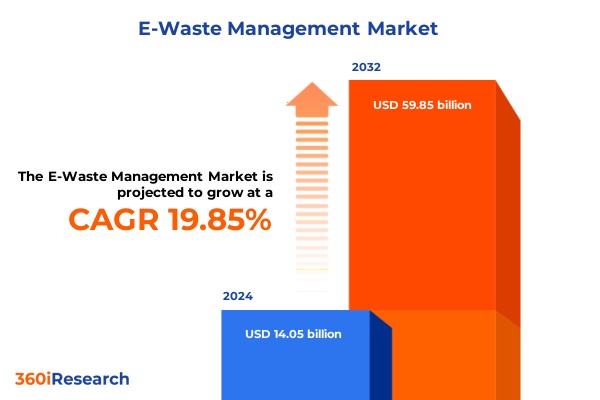

The E-Waste Management Market size was estimated at USD 16.63 billion in 2025 and expected to reach USD 19.69 billion in 2026, at a CAGR of 20.07% to reach USD 59.85 billion by 2032.

Setting the Stage for Sustainable Electronics Disposal Amidst Escalating Global E-Waste Challenges and Emerging Circular Economy Demands

The proliferation of electronic devices has ushered in an era of unprecedented convenience and connectivity, yet it has simultaneously created a mounting global challenge: the exponential accumulation of e-waste. In 2022 alone, a record 62 million tonnes of electronic waste were generated worldwide, marking an 82% increase since 2010 and outpacing documented recycling efforts by a factor of nearly five. This surge threatens to inundate existing collection and recovery infrastructures, while leaving hazardous materials such as mercury and lead to pollute ecosystems and jeopardize human health.

Against this backdrop, stakeholders across supply chains, policy-making bodies, and recycling networks face urgent pressure to innovate. The shortfall in formal collection, which amounted to just 22.3% of total e-waste in 2022, underscores systemic gaps in regulatory frameworks, public awareness, and technical capacity for safe disposal. Compounding the challenge is the burgeoning demand for new electronic products, driven by technological advancement and shortening product lifecycles, which perpetuates a cycle of rapid obsolescence.

In response, industry participants are increasingly embracing circular economy principles, advocating for extended producer responsibility, and investing in advanced material recovery technologies. This introduction sets the stage for a comprehensive examination of how market dynamics, policy shifts, and emerging technologies converge to redefine sustainable e-waste management.

Unveiling the Pivotal Transformations Reshaping E-Waste Management Through Cutting-Edge Technology, Regulatory Evolution, and Circular Economy Integration

Over the past decade, the e-waste management landscape has undergone pivotal transformations accelerating the transition toward more sustainable practices. Technological innovation has been a driving force, with automated sorting systems and artificial intelligence–enabled robotics enhancing material recovery rates and reducing manual hazards. Advanced sensors and machine learning algorithms facilitate precise separation of metals, plastics, and rare earth elements, unlocking new efficiencies in recycling processes.

Concurrently, policy evolution at global and national levels has introduced stringent requirements for waste handling and cross-border shipments. The Basel Convention’s e-waste amendments, effective January 1, 2025, mandate prior informed consent for the trade of both hazardous and non-hazardous electronic waste, reshaping transboundary logistics and prompting major exporters to secure new bilateral agreements to maintain market access. Simultaneously, a growing number of jurisdictions have embedded Extended Producer Responsibility (EPR) frameworks into law, compelling manufacturers to bear lifecycle accountability and invest in end-of-life collection networks.

On the corporate front, strategic investments by key players in circular design and reverse logistics capabilities have become a hallmark of competitive advantage. Collaboration among technology providers, recyclers, and material off-takers is catalyzing closed-loop supply chains for critical minerals, thereby mitigating supply risks and promoting resource security. These synergistic shifts in technology adoption, regulation, and stakeholder collaboration have collectively redefined how e-waste is managed, underscoring a sector in the midst of profound transformation.

Assessing the Widespread Implications of 2025 United States Tariff Measures on the E-Waste Value Chain and Recycling Ecosystem

The introduction of new United States tariff measures in 2025 has exerted multifaceted pressures on the domestic e-waste ecosystem. Broad tariffs, including an across-the-board 10% duty on Chinese imports and additional levies up to 79% on specific categories such as e-bikes, have reverberated through supply chains. Many specialized recycling equipment components, particularly shredder wear parts and advanced separation technologies sourced from China and Europe, now face elevated costs and delivery uncertainties.

Industry associations have vocalized concerns regarding the disruptive potential of these duties. The Recycled Materials Association cautioned that escalating tariffs threaten to undermine U.S. competitiveness by raising input costs for recycling facilities that rely on imported machinery, thereby imperiling investments in modernization and expansion initiatives. Likewise, the National Waste & Recycling Association highlighted how abrupt tariff shifts could dampen job creation and inflate operating expenses, ultimately driving up consumer prices for recycled-content products.

Adding complexity to the trade environment is the United States’ non-participation in the Basel Convention, which diverges from most of its trading partners. This status has prompted uncertainty over the treatment of e-waste shipments requiring prior informed consent under international agreements, potentially lengthening approval cycles and increasing administrative overhead for exporters and importers alike. Collectively, these tariff and regulatory headwinds demand strategic recalibration by industry stakeholders to safeguard supply continuity and sustain the momentum of domestic recycling growth.

Decoding the Multifaceted E-Waste Landscape Through Comprehensive Segmentation Insights Encompassing Product Types, Processes, and End Users

Segmentation by product type reveals the intricate array of electronic waste streams, beginning with consumer electronics that encompass audio devices, cameras, and televisions, each presenting distinct material compositions and recovery challenges. IT and telecommunications equipment, inclusive of computers, mobile phones, and networking hardware, generate complex mixtures of precious and base metals, necessitating specialized separation technologies. Large household appliances such as dishwashers, refrigerators, and washing machines introduce bulkier form factors, driving the development of heavy-duty shredding and crushing solutions. Lighting equipment, from fluorescent to LED lamps, requires delicate handling of mercury and phosphor compounds. Meanwhile, small household appliances including microwave ovens, toasters, and vacuum cleaners present diverse plastic and metal blends that test material purity thresholds.

Processing stages encompass collection networks, both curbside services and drop-off centers, which form the backbone of formal recovery channels. Dismantling operations, whether automated or manual, set the stage for material recovery endeavors. Glass, metal, and plastic recovery streams capture value across different substrate categories, while shredding techniques, whether single-stream for coarse separation or multi-stream for higher purity outputs, enable downstream refinement.

End-use pathways-from energy recovery via gasification and incineration to recycling through hydrometallurgical, mechanical, and pyrometallurgical routes-offer depending on material characteristics and economic viability. Complementing these are refurbishment and repair services that extend product lifecycles and extract residual value. Across end-user segments, commercial entities in healthcare, IT and retail sectors, industrial operations in construction and manufacturing, and residential households collectively shape demand dynamics and investment priorities in e-waste management.

This comprehensive research report categorizes the E-Waste Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Process

- End Use

Navigating Regional Divergences in E-Waste Generation and Management Across the Americas, Europe Middle East Africa, and Asia-Pacific

The Americas region demonstrated significant per-capita e-waste generation in 2022, averaging 14.1 kilograms, with formal recycling networks recovering just 4.2 kilograms per person, equating to a 30% documented collection rate. North American e-waste regulation is predominantly administered at state and provincial levels, yielding a mosaic of policies that affect cross-border trade and domestic processing capabilities. Latin American nations, while grappling with infrastructure gaps, are pursuing EPR frameworks to bolster material flows and encourage investment in dedicated recycling facilities.

Europe, Middle East, and Africa (EMEA) present divergent realities. Europe leads global recycling performance, formalizing the collection and processing of 42.8% of generated e-waste at an average of 7.5 kilograms per capita in 2022. A mature legislative environment underpinned by the EU’s Waste Electrical and Electronic Equipment (WEEE) Directive has driven standardization and infrastructure build-out, whereas Middle Eastern and African markets contend with nascent policy regimes and limited state capacity, resulting in sub-1% recovery rates in many African locales.

Asia-Pacific stands as the largest e-waste contributor by volume, accounting for nearly half of global generation, propelled by rapid digitization and consumer electronics adoption. Despite producing 30 billion kilograms of e-waste, the region’s formal recycling rates remain constrained by uneven regulatory frameworks and under-resourced collection systems, though leading economies like Japan and South Korea are piloting advanced recovery technologies to close the gap.

This comprehensive research report examines key regions that drive the evolution of the E-Waste Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation and Collaboration Across the E-Waste Recovery and Recycling Value Chain Worldwide

A cohort of global enterprises is driving the e-waste recovery sector through strategic investments in advanced infrastructure and cross-sector partnerships. Sims Recycling Solutions, the world’s largest electrical and electronics recycler, operates over 230 facilities across five continents and processes more than 475,000 tonnes of e-waste annually, recovering critical metals and plastics for reuse in manufacturing. Umicore has positioned itself at the forefront of materials innovation, leveraging hydrometallurgical and mechanical processes to extract gold and copper at scale from high-grade electronic scrap streams processed through its European centers.

Regional leaders such as Waste Management Inc. in North America and Veolia in Europe complement these global players with integrated waste collection and resource recovery networks, while Electronic Recyclers International advances best practices in data-sanitized asset disposition for corporate clients. Stena Metall Group and Kuusakoski mark the Nordic contribution by pioneering circular business models centered on closed-loop alloy streams. Emerging players like MiNI, focused on modular dismantling technologies, and Li-Cycle, specializing in lithium-ion battery recycling, further diversify the competitive ecosystem.

Collaboration between these entities and raw material end-users has fostered innovation consortia focused on refining separation processes and standardizing material specifications. As capital flows increasingly target recycling tech and digital traceability platforms, these companies are expanding their geographic footprints, forming joint ventures, and reinforcing supply chain resilience in response to evolving regulatory and market pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the E-Waste Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ATRenew Inc.

- Attero Recycling Private Limited

- Boliden AB

- Capital Environment Holdings Limited

- Desco Electronic Recyclers (Pty) Ltd.

- DOWA ECO‑SYSTEM Co., Ltd.

- EcoCentric Environmental Solutions Ltd.

- Ecoreco

- Electronic Recyclers International, Inc.

- Enviro‑Hub Holdings Ltd.

- Kuusakoski Oy

- Landbell Group AG

- MBA Polymers, Inc.

- Namo E‑Waste Pvt Ltd.

- Recykal Private Limited

- Remondis SE & Co. KG

- Sembcorp Environmental Management Pte Ltd.

- Sims Lifecycle Services, Inc.

- Stena Metall Group AB

- TES‑AMM Co., Ltd.

- Tetronics International Ltd.

- Umicore S.A.

- Veolia Environnement S.A.

Empowering Industry Leadership with Actionable Strategies to Accelerate Circularity, Policy Advocacy, and Operational Excellence in E-Waste Management

Leaders in the e-waste management sector must embark on a strategic roadmap emphasizing both immediate actions and long-term commitments. Key among these is the adoption of advanced digital tracking systems that enable full lifecycle visibility of electronic products, ensuring transparency in material flows and bolstering compliance with emerging international trade controls.

Concurrently, forging multi-stakeholder alliances with original equipment manufacturers, logistics providers, and government bodies can accelerate deployment of standardized take-back and collection networks, reducing fragmentation across jurisdictions. By championing extended producer responsibility provisions and co-investing in material recovery facilities, industry leaders can leverage scale economics to lower per-unit processing costs and unlock new revenue streams from secondary raw materials.

Operational excellence demands targeted investment in automation and robotics to enhance throughput and purity in sorting operations, while simultaneously upskilling the workforce to manage sophisticated recycling equipment. Equally important is proactive engagement in policy advocacy to shape pragmatic regulations that balance environmental goals with economic feasibility.

By integrating circular design principles at the product development stage, companies can minimize end-of-life complexity and streamline material reclamation. Finally, cultivating consumer awareness through targeted outreach and incentive programs will drive higher participation rates in formal e-waste channels, ensuring that the benefits of advanced recycling technologies are fully realized.

Outlining a Robust Research Framework Integrating Quantitative Analysis, Stakeholder Engagement, and Industry Benchmarking for E-Waste Insights

This analysis leverages a multi-pronged methodology combining quantitative data collection, qualitative expert interviews, and comprehensive secondary research. Global e-waste generation and recycling metrics are drawn from internationally recognized sources, including the United Nations Global E-waste Monitor and trade association publications, to establish a robust baseline of industry performance.

Primary insights were obtained through structured discussions with key stakeholders across OEMs, recycling operators, and regulatory agencies, ensuring a nuanced understanding of operational constraints and emerging best practices. These interviews informed thematic deep dives into technology adoption, policy impacts, and investment drivers.

A rigorous segmentation framework was applied to dissect market dynamics by type, process, end use, and end user dimensions, facilitating targeted analysis and highlighting growth pockets. Regional evaluations incorporate both macroeconomic indicators and legislative landscapes to assess strategic opportunities and barriers across the Americas, EMEA, and Asia-Pacific.

Supplementary research included desk reviews of corporate disclosures, case studies of leading recycling facilities, and scrutiny of relevant legislation such as Basel Convention amendments and United States tariff orders. Cross-validation techniques were employed to reconcile disparate data points, ensuring accuracy and consistency throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our E-Waste Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- E-Waste Management Market, by Type

- E-Waste Management Market, by Process

- E-Waste Management Market, by End Use

- E-Waste Management Market, by Region

- E-Waste Management Market, by Group

- E-Waste Management Market, by Country

- United States E-Waste Management Market

- China E-Waste Management Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2544 ]

Synthesis of Strategic Insights Highlighting Opportunities and Imperatives for Effectively Tackling the E-Waste Crisis in a Dynamic Market Landscape

The convergence of technological innovation, policy evolution, and shifting market dynamics presents a compelling inflection point in the global effort to manage electronic waste effectively. While e-waste volumes continue to surge, the maturation of advanced recovery technologies and the proliferation of circular economy mandates offer tangible pathways to recapture valuable materials and mitigate environmental harm.

Regional disparities highlight both the successes of jurisdictions with mature infrastructure and the untapped potential in emerging markets. The imposition of diverse tariff regimes and international trade controls underscores the imperative for agile supply chain strategies and cross-border collaboration.

Leading companies have demonstrated that strategic investments in automation, material science, and digital traceability can yield significant gains in efficiency and resource recovery rates. However, systemic challenges persist, including policy fragmentation, infrastructure gaps, and public participation shortfalls, which require concerted action from industry stakeholders, policymakers, and consumers alike.

Ultimately, the path forward hinges on an integrated approach that aligns product design, regulatory frameworks, and operational capabilities within a cohesive circular economy vision. By harnessing data-driven insights and forging collaborative alliances, the e-waste ecosystem can transform a growing crisis into a sustainable opportunity.

Take the Next Step: Partner with Ketan Rohom to Unlock In-Depth E-Waste Market Insights and Drive Strategic Decision-Making Today

Engage directly with Ketan Rohom to explore how our rigorous analysis and strategic insights can drive impactful decisions in your organization’s approach to electronic waste management. His expertise in orchestrating tailored market intelligence will empower your team to navigate regulatory complexities, identify high-impact investment areas, and optimize circular economy strategies.

Reach out to schedule a personalized briefing and gain exclusive access to our comprehensive market research report. Partnering with an associate director committed to your success ensures that you receive actionable, data-driven guidance precisely aligned with your strategic objectives.

- How big is the E-Waste Management Market?

- What is the E-Waste Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?