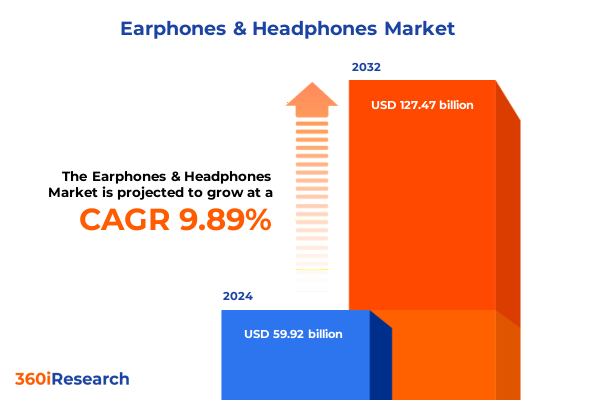

The Earphones & Headphones Market size was estimated at USD 65.37 billion in 2025 and expected to reach USD 71.33 billion in 2026, at a CAGR of 10.00% to reach USD 127.47 billion by 2032.

Explore shifting consumer preferences, wireless audio innovations, and regulatory changes transforming the dynamic market for earphones and headphones

In recent years, the earphones and headphones sector has emerged as a dynamic hub of technological innovation and shifting consumer priorities. As audio experiences have become integral to daily life-whether facilitating immersive entertainment, enabling remote work, or supporting fitness activities-manufacturers have responded with a diversity of device formats and feature sets. The delineation between compact in-ear earphones and full-featured over-ear headphones reflects a spectrum of consumer demands, with each category vying for attention through distinct value propositions.

Moreover, the proliferation of streaming services and high-resolution audio standards has elevated expectations around sound quality, driving advancements in codec support and driver design. This evolution has paralleled the increasing ubiquity of wireless interfaces; Bluetooth Low Energy and next-generation protocols have become essential, reducing reliance on legacy wired connections. Simultaneously, active noise cancellation and adaptive sound processing have transitioned from premium differentiators into mainstream features, reshaping what users anticipate from audio accessories.

Furthermore, sustainability and ergonomic considerations now permeate product development, with manufacturers adopting recyclable materials and ergonomic fit designs to address environmental concerns and comfort during prolonged use. In this context, understanding the interplay between consumer preferences, technological capabilities, and regulatory environments is critical for stakeholders aiming to navigate the competitive landscape and drive the next wave of growth.

Unveil the latest breakthroughs in immersive audio technologies, shifting consumer behavior, and sustainability trends redefining the audio accessories landscape

The audio accessories arena is experiencing a profound metamorphosis driven by several transformative shifts in technology, design, and consumer engagement. First, connectivity standards have advanced beyond basic Bluetooth, with the adoption of high-bandwidth codecs and multi-device pairing facilitating seamless transitions between smartphones, tablets, and laptops. These improvements have set the stage for a truly untethered experience, eliminating the compromise between convenience and audio fidelity.

In addition, noise cancellation techniques have grown more sophisticated, leveraging artificial intelligence and adaptive algorithms to differentiate between ambient environments-whether commuting in urban centers or focusing in quiet office settings. This evolution has heightened competition as brands race to enhance sound isolation while maintaining natural audio reproduction. Meanwhile, the integration of sensors for biometric monitoring has positioned certain headsets at the convergence of consumer electronics and health-tech, offering insights into metrics such as heart rate and activity levels.

Simultaneously, consumer sentiment has shifted toward ethical and environmental accountability. Manufacturers are increasingly exploring sustainable materials, modular designs for extended product life cycles, and carbon-neutral packaging to align with global sustainability goals. These developments have been further accelerated by strategic collaborations with software platforms, enabling personalized sound tuning and firmware updates that prolong device relevance. Taken together, these transformative shifts are redefining competitive parameters, compelling companies to innovate holistically across hardware, software, and customer experience strategies.

Evaluate the wide-ranging effects of 2025 U.S. tariffs on import costs, supply chain adjustments, and strategic pricing in the audio accessories sector

In 2025, newly enacted U.S. tariffs targeting select audio imports have exerted tangible pressure on cost structures, compelling manufacturers and distributors to reassess their sourcing strategies. As duties on components and finished devices increased, many suppliers confronted the choice between absorbing higher costs, which would compress margins, or passing expenses directly to consumers, risking price-sensitive demand.

Consequently, supply chain realignment emerged as a strategic imperative. Companies with flexible production footprints accelerated their shift toward Southeast Asian facilities or explored nearshoring options in Mexico to mitigate exposure to punitive tariffs. This pivot not only reduced duty burdens but also shortened lead times, enhancing responsiveness in a market characterized by rapid product cycles.

Moreover, retail partners adapted pricing and promotional tactics to maintain competitiveness, incorporating bundle incentives and financing options that offset perceived cost hikes. In parallel, premium brands emphasized feature-led differentiation-such as advanced noise cancellation and spatial audio support-to underpin price justifications. Meanwhile, entry-level offerings increasingly leveraged cost-effective manufacturing partnerships to preserve affordability.

As a result, industry participants navigated a complex equilibrium of supply chain optimization, value communication, and portfolio calibration. These cumulative impacts underscore the imperative for agile procurement, dynamic pricing strategies, and strategic geographic diversification to thrive under evolving tariff regimes.

Gain insights into product types, connectivity, noise cancellation, battery life, and distribution to shape effective audio device market strategies

Analyzing the market through multiple segmentation lenses reveals nuanced strategic opportunities. Within product type, the earphones segment divides into truly wireless earbuds and corded in-ear models, each serving distinct use cases from sport-focused designs to everyday mobility. At the same time, on-ear and over-ear headphones cater to preferences for portability versus immersive soundstage, with over-ear configurations often commanding premium resonance among audiophiles.

Connectivity serves as another pivotal axis; wired solutions maintain relevance for professional environments emphasizing zero-latency monitoring, whereas wireless devices dominate consumer segments seeking frictionless integration with mobile ecosystems. Noise cancellation further bifurcates consumer choice into active systems that employ real-time adaptive processing and passive designs featuring acoustic isolation and ergonomic sealing. Battery life differentiators also play a critical role, spanning compact devices offering up to five hours of playback, midsize designs delivering between five and ten hours, and extended-life units exceeding ten hours for prolonged uninterrupted use.

Distribution channels complete the panorama, with offline retail encompassing consumer electronics outlets alongside hypermarket and supermarket placements, and online stores spanning direct company portals as well as third-party e-commerce platforms. Finally, application insights illuminate diverse usage scenarios: gaming headsets with low-latency features, music and entertainment devices optimized for sonic fidelity, professional headsets designed for critical listening or broadcast use, and sports and fitness accessories engineered for sweat proof or water resistant performance. Integrating these segmentation dimensions equips decision-makers to tailor offerings precisely to target user cohorts and use cases.

This comprehensive research report categorizes the Earphones & Headphones market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity

- Noise Cancellation

- Battery Life

- Application

- Distribution Channel

Explore how consumer demands, retail channels, and regulatory frameworks vary across Americas, EMEA, and Asia-Pacific to inform growth strategies

Regional dynamics play an instrumental role in shaping market trajectories. In the Americas, demand trends gravitate toward premium wireless models equipped with advanced noise cancellation and spatial audio features, reflecting high consumer willingness to invest in superior listening experiences. This region benefits from a mature retail infrastructure that combines specialist electronics stores with robust e-commerce penetration, enabling both omnichannel engagement and direct-to-consumer launches.

Across EMEA, value consciousness exerts greater influence. Consumers seek a balance between feature sets and price, prompting brands to introduce tiered portfolios that combine entry-level wired products with mid-range wireless options. Regulatory frameworks within the European Union have also mandated stricter environmental and recycling standards, incentivizing the adoption of sustainable materials and modular repairable designs. Meanwhile, distribution networks in emerging EMEA markets often involve partnerships with regional distributors to navigate diverse import regulations and retail preferences.

In Asia-Pacific, growth is fueled by both established tech hubs and rapidly expanding emerging economies. Price-competitive manufacturers headquartered in China and Southeast Asia drive volume, while brand-driven markets in Japan and South Korea emphasize premium craftsmanship and integration with domestic streaming ecosystems. Regional policies affecting cross-border e-commerce, alongside varying radio frequency requirements, create a complex operating environment. By aligning product roadmaps and go-to-market strategies with these regional characteristics, stakeholders can harness localized demand drivers and regulatory incentives.

This comprehensive research report examines key regions that drive the evolution of the Earphones & Headphones market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover how leading audio brands leverage innovation, partnerships, and strategic positioning to strengthen their competitive edge in the audio accessories space

Major players continue to differentiate through innovation intensity and strategic alliances. One leading technology pioneer has deepened its spatial audio ecosystem, leveraging proprietary chipsets and immersive audio codecs to lock in a loyal user base. Meanwhile, a heritage audio brand has focused on refining active noise cancellation algorithms and premium materials, reinforcing its reputation for luxury performance.

Concurrently, global electronics conglomerates have expanded their presence by integrating smart assistants and health-monitoring features, collaborating with software developers to deliver ecosystem lock-in. In the mid-tier segment, emerging manufacturers from Asia have captured market share through aggressive pricing and rapid new-model introductions, often co-developed with component suppliers to optimize cost structures. Partnerships between gaming platform providers and headphone manufacturers have also produced specialized peripherals that align audio performance with low-latency requirements and brand affinities.

Additionally, acquisitive activity has reshaped competitive boundaries, as established audio companies acquire startups specializing in sensor-based analytics or advanced acoustic materials. This consolidation underscores a strategic pursuit of complementary capabilities, from battery innovation to modular design expertise. By observing these competitive moves-ranging from vertical integration to collaborative product ecosystems-industry leaders can benchmark best practices and identify potential partnership or acquisition targets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Earphones & Headphones market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1MORE USA, Inc.

- 3M Company

- Anker Innovations Technology Co., Ltd

- Apple Inc.

- ASUSTek Computer Inc.

- Bang & Olufsen A/S

- Belkin

- Beyerdynamic GmbH & Co. KG

- Boat by Imagine Marketing Limited

- Bose Corporation

- Boult Audio

- Bowers & Wilkins Group Ltd.

- Campfire Audio LLC

- EPOS Group A/S

- FOCAL-JMLAB Company

- GN Store Nord A/S

- Grado Labs, Inc.

- HIFIMAN Corporation

- HP Inc.

- Huawei Device Co., Ltd.

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Logitech Inc.

- Noise by Nexxbase Marketing Pvt Ltd.

- OnePlus Technology (Shenzhen) Co., Ltd.

- Panasonic Holdings Corporation

- PEAG LLC DBA JLab

- pTron by Palred Electronics Pvt. Ltd.

- Samsung Electronics Co., Ltd.

- Sennheiser electronic GmbH & Co. KG

- Shokz Technology Inc.

- Shure Incorporated

- Skullcandy, Inc.

- Sony Corporation

- Suunto Oy

- Truke

Implement targeted market strategies and operational enhancements to capitalize on evolving trends and drive sustainable growth in the audio sector

To capitalize on evolving market dynamics, companies should prioritize diversification of their manufacturing and procurement networks, thereby reducing exposure to tariff fluctuations and supply disruptions. Operational enhancements, such as adopting lean production methodologies and implementing real-time inventory tracking, will further bolster resilience against unforeseen shocks.

Furthermore, accelerating research and development in adaptive noise cancellation, high-efficiency battery chemistries, and integrated biometric sensing will unlock new application segments-particularly within health-tech and professional audio domains. Concurrently, expanding direct-to-consumer channels through upgraded digital storefronts and immersive virtual product demos can strengthen brand loyalty and enhance margins by bypassing intermediaries.

Sustainability must also be elevated from compliance to competitive differentiator. Initiatives such as modular repair programs, post-consumer recycling partnerships, and transparent sustainability reporting will resonate with environmentally conscious consumers and regulators alike. Finally, tailoring offerings to regional preferences-whether through localized firmware features, strategic distribution alliances, or targeted marketing campaigns-will ensure relevance across diverse market environments.

Detail the research framework, data gathering methodologies, and analytical processes employed to generate robust insights into the earphones and headphones market

This research project employed a rigorous mixed-methodology approach, combining comprehensive secondary research with targeted primary data collection. Secondary sources included public company filings, trade association reports, academic publications, and customs data, enabling a robust understanding of historical market dynamics and regulatory shifts.

Primary research involved structured interviews with key industry stakeholders-such as product managers, supply chain executives, and retail buyers-to validate market drivers and capture qualitative insights. An online consumer survey supplemented executive perspectives, uncovering end-user preferences across device attributes and purchase channels. Detailed segmentation matrices were then constructed to map features, price tiers, and application use cases against consumer cohorts.

Data triangulation ensured consistency across information streams, with quantitative findings cross-checked against company-reported sales and import-export statistics. Analytical frameworks-such as SWOT and Porter’s Five Forces-guided competitive assessments and strategic scenario planning. Quality assurance protocols included peer reviews, expert panel validations, and iterative refinements to the research scope, guaranteeing the final deliverable presents accurate, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Earphones & Headphones market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Earphones & Headphones Market, by Product Type

- Earphones & Headphones Market, by Connectivity

- Earphones & Headphones Market, by Noise Cancellation

- Earphones & Headphones Market, by Battery Life

- Earphones & Headphones Market, by Application

- Earphones & Headphones Market, by Distribution Channel

- Earphones & Headphones Market, by Region

- Earphones & Headphones Market, by Group

- Earphones & Headphones Market, by Country

- United States Earphones & Headphones Market

- China Earphones & Headphones Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarize the key findings, strategic implications, and future outlook to guide stakeholders as they navigate the evolving earphones and headphones landscape

In summary, the earphones and headphones market stands at a pivotal juncture, shaped by advanced connectivity standards, adaptive noise cancellation systems, and heightened sustainability expectations. The interplay of segmentation dimensions-ranging from product form factors to distribution channels-offers multiple avenues for differentiation, while regional variances underscore the need for localized strategies. Competitive dynamics continue to evolve through innovation partnerships, targeted acquisitions, and ecosystem integrations that span hardware and software domains.

The introduction of U.S. tariffs in 2025 has reinforced the importance of supply chain agility and strategic procurement diversification. Companies that proactively realign manufacturing footprints and refine pricing architectures will maintain cost competitiveness and preserve margin integrity. Meanwhile, actionable recommendations emphasize the integration of advanced audio technologies, expanded direct-to-consumer engagement, and sustainability leadership as cornerstones of future success.

Ultimately, stakeholders equipped with a nuanced understanding of market shifts, segmentation intricacies, and regional characteristics will be best positioned to navigate the challenges ahead and capitalize on emerging opportunities. This comprehensive analysis provides the strategic foundation required to make informed decisions and drive growth in the rapidly evolving audio accessories landscape.

Connect with Ketan Rohom to secure exclusive market research insights, tailored strategic guidance, and support in advancing your audio accessories objectives

We appreciate your interest in unlocking advanced market analysis and strategic insights in the rapidly evolving world of earphones and headphones. To gain exclusive access to an in-depth research report tailored to your organization’s objectives, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. By engaging with Ketan, you will receive personalized guidance on how the latest technological developments, regulatory shifts, and consumer trends intersect to shape future opportunities. Whether you seek granular segmentation analysis, competitive benchmarking, or actionable growth strategies, Ketan will ensure the report aligns with your decision-making needs. Reach out to schedule a comprehensive consultation, explore bespoke research packages, and secure the critical intelligence that will position your business at the forefront of the audio accessories market.

- How big is the Earphones & Headphones Market?

- What is the Earphones & Headphones Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?