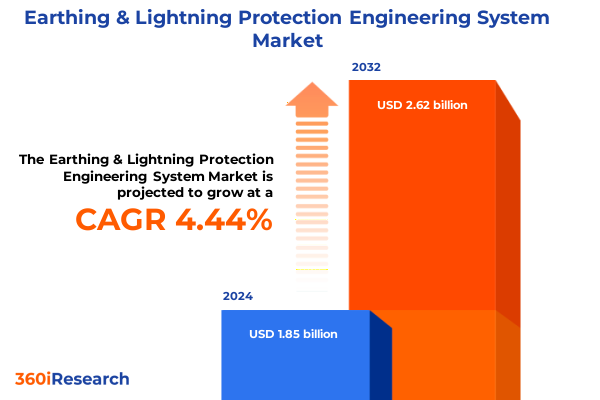

The Earthing & Lightning Protection Engineering System Market size was estimated at USD 1.88 billion in 2025 and expected to reach USD 1.97 billion in 2026, at a CAGR of 4.85% to reach USD 2.62 billion by 2032.

Unveiling the Critical Role of Integrated Earthing and Lightning Protection Frameworks in Ensuring Infrastructure Resilience and Operational Continuity

A robust earthing and lightning protection engineering framework serves as the foundation for safeguarding critical infrastructure, mitigating operational risks, and ensuring continuity across industrial, commercial, and utility applications. At its core, an integrated system of ground conductors, electrodes, enhancement materials, and grids functions in tandem with air termination networks, surge arresters, and maintenance protocols to neutralize electrical surges and provide safe dissipation of fault currents. Growing threats from intensifying weather events, heightened regulatory scrutiny, and the imperative for uninterruptible power in data centers and smart grid deployments underscore the urgency of adopting advanced protection solutions.

Against this backdrop, engineering leaders are compelled to refine design methodologies, embrace material innovations, and establish proactive service models that can preempt system failures. By consolidating best practices in installation, performance monitoring, and standards compliance, stakeholders can elevate resilience while managing total lifecycle costs. Considering the vast array of components-from copper and aluminum conductors to graphite-enhanced backfills and sophisticated surge protection devices-decision-makers must navigate intricate technical and supply-chain variables to deliver high-integrity protection architectures.

Charting Technological Paradigm Shifts and Materials Innovations Redefining Protection Systems from Conductor Alloys to Predictive Monitoring

The landscape of earthing and lightning protection engineering is undergoing transformative shifts driven by materials science breakthroughs, digital innovation, and evolving compliance requirements. Novel conductor alloys that blend conductivity with corrosion resistance are enabling slimmer, more durable grounding networks, while advanced enhancement compounds-including polymer-modified bentonite and conductive cement composites-are redefining electrode performance in challenging soils. Meanwhile, the integration of IoT-enabled sensors within grounding grids and surge protection modules facilitates real-time impedance measurement, predictive analytics, and remote diagnostics, thus reducing the need for manual intervention and minimizing downtime.

Standards bodies have responded in kind, issuing updated guidelines that stress lifecycle traceability, risk-based maintenance schedules, and interoperability protocols across protection subsystems. This shift toward modular architectures empowers engineering teams to deploy incremental upgrades, swapping legacy arresters or conductors without disrupting the overall earthing topology. Additionally, emerging practices around digital twins for protection systems enable scenario modeling of fault events, guiding optimized placement of rods, meshes, and surge arresters. As organizations navigate these converging technological currents, the focus increasingly pivots from reactive repairs to resilience-centered design, ensuring that future infrastructure can endure both electrical and environmental stressors.

Analyzing the Cumulative Impact of 2025 United States Tariff Actions on Material Sourcing, Cost Structures, and Supply Chain Resilience

Recent United States tariff measures enacted in early 2025 have introduced a complex dynamic into the procurement and supply of raw materials central to earthing and lightning protection systems. Tariffs targeting aluminum, copper, and steel imports have elevated landed costs for conductors, grids, and electrodes, prompting stakeholders to reassess sourcing strategies. In response, many engineering firms are forging stronger alliances with domestic manufacturers to secure priority allocations of specialized aluminum conductor rod and copper grounding strips, thereby insulating project timelines from international shipping disruptions.

Concurrently, these trade actions have catalyzed research into alternative materials and composite solutions, with a focus on polymer-encapsulated electrodes and carbon-based backfill supplements that can deliver comparable performance at competitive price points. Organizations are also exploring joint-venture frameworks with suppliers in tariff-exempt regions to establish secondary production hubs, diversifying risk while maintaining compliance with local content requirements. On the project planning front, engineers now incorporate tariff-adjusted cost indices into bid submissions and life-cycle analyses, anticipating potential duty fluctuations. These adaptive strategies underscore the imperative for integrated risk management across global supply chains, ensuring that critical protection initiatives remain both technically sound and financially viable.

Decoding Comprehensive Segmentation Insights Spanning Earthing Networks, Lightning Termination Assemblies, Surge Arresters and Lifecycle Services

Segmented analysis reveals nuanced adoption patterns across the core elements of protection engineering, reflecting both functional requirements and localized environmental factors. Within earthing systems, grounding networks built from aluminum conductors often find favor in applications prioritizing weight economy, while copper conductors remain the gold standard for high-reliability installations. Steel options serve as cost-effective alternatives where mechanical robustnes is paramount. Electrode choices range from driven rods in sandy soils to plate and strip configurations in rocky substrates, and specialized meshes deliver uniform grounding potentials in large-scale industrial pads. Furthermore, the use of bentonite and cement-based enhancement agents predominates in regions with high soil resistivity, whereas graphite and salt-based blends cater to arid or saline environments. Grid assemblies bifurcate between copper-based meshes for premium performance and galvanized steel networks for budget-conscious builds.

On the lightning protection side, mesh air terminals are deployed to create protective zones over broad roof footprints, while rod air terminals excel in pinpoint surge interception. Mechanical connectors streamline on-site installation, contrasting with welded joints that emphasize long-term conductor continuity. Cable conductors offer flexibility for retrofit applications, whereas rigid strips provide enhanced lightning current capacity. Grounding electrodes under this system segment comprise driven rods, circumferential ground rings, and plate electrodes tailored to foundation geometries. Surge protection devices classified as Type 1, Type 2, and Type 3 cover the spectrum of transient voltage suppression needs in four-pole and single-pole configurations alike, ensuring layered defense for utility, commercial, and residential circuits. Maintenance services encompass in-situ earth resistance testing and soil resistivity assessments to validate installation integrity, alongside ultrasonic and visual inspections, conductor repairs, electrode replacements, and component upgrades, ensuring that protective architectures perform reliably over their service lives.

This comprehensive research report categorizes the Earthing & Lightning Protection Engineering System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Earthing System

- Lightning Protection System

- Surge Protection Device

- Maintenance Service

Examining Regional Dynamics Driving Infrastructure Protection Strategies Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics manifest distinct drivers and adoption velocities across the Americas, Europe Middle East and Africa, and Asia-Pacific geographies, each presenting both challenges and opportunities for protection engineering stakeholders. In the Americas, a surge in grid modernization projects and stringent utility regulations have spurred demand for high-performance grounding networks in North America, while infrastructure development in Latin American markets focuses on pragmatic solutions that balance cost efficiency with reliability. The regulatory landscape in the United States and Canada emphasizes quarterly testing protocols and compliance transparency, shaping procurement cycles and service provider partnerships.

Within Europe Middle East and Africa, harmonized standards across the European Union foster cross-border collaboration, driving innovation in composite enhancement materials and advanced surge modules. Gulf states and North African economies are investing heavily in renewable energy integration, necessitating robust earthing grids for solar farms and wind installations, whereas sub-Saharan markets prioritize modular kits that can be deployed rapidly in rural electrification projects. In Asia-Pacific, rapid urban expansion in China and India underpins large-scale commercial and residential constructions, elevating the need for integrated lightning protection systems. Meanwhile, mature markets in Japan and Australia push for smart-grid compatibility, emphasizing embedded monitoring and remote servicing capabilities. These regional nuances inform strategic entry plans, product customization mandates, and long-term partnership models across the protection engineering ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Earthing & Lightning Protection Engineering System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Initiatives and Collaborative Innovations Among Industry Leaders Shaping the Competitive Protection Engineering Landscape

A constellation of global and regional players drives innovation, service excellence, and competitive differentiation within the engineering protection ecosystem. Leading multinational corporations leverage expansive R&D budgets to introduce proprietary conductor coatings, adaptive surge arrestor topologies, and digital monitoring platforms, while midsize specialists focus on niche segments such as low-resistance electrode optimization or ultrafast surge suppression modules. Partnerships between component manufacturers and system integrators are increasingly common, facilitating turnkey solutions that bundle design, installation, and ongoing service under unified performance guarantees.

On the innovation front, entrants are collaborating with academic institutions to validate novel ground enhancement chemistries and conduct accelerated life-cycle testing of arresters using climate-simulated chambers. At the same time, several companies are establishing regional production footprints to circumvent trade barriers and reduce lead times, particularly for custom-engineered grounding meshes and salt-based backfill blends. Service firms are differentiating through digital dashboards that track impedance trends and automate maintenance scheduling, effectively transitioning from transactional repair models to subscription-based resilience programs. Collectively, these industry dynamics underscore a marketplace in which technological prowess, strategic alliances, and customer-centric service delivery converge to shape long-term competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Earthing & Lightning Protection Engineering System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- AN Wallis & Co. Ltd

- DEHN + SÖHNE GmbH + Co. KG

- Eaton Corporation plc

- Eaton Corporation plc

- Harger Lightning & Grounding, Inc.

- Kumwell Corporation Public Company Limited

- Legrand SA

- nVent Electric plc

- OBO Bettermann GmbH & Co. KG

- Phoenix Contact GmbH & Co. KG

- Schneider Electric SE

- Siemens AG

Implementing Strategic Actions Emphasizing Material Innovation, Digital Integration, and Localized Partnerships to Drive Sustainable Growth

Industry leaders are advised to adopt a multifaceted approach that integrates material diversification, digital transformation, and strategic partnerships to strengthen both technical capability and market positioning. First, evaluating alternative conductor alloys and composite electrode materials can mitigate exposure to tariff volatility, while concerted investments in R&D partnerships support the co-development of next-generation backfill and coating solutions designed for extreme environmental conditions. Concurrently, embedding IoT sensors and remote monitoring platforms within protective assemblies will facilitate condition-based maintenance, reduce unplanned outages, and optimize service resource allocation.

Leaders should also pursue localized manufacturing or joint-venture frameworks in key regions to enhance supply-chain resilience and align with regional content regulations. Engaging early with standards committees can position organizations to influence evolving compliance mandates and promote interoperability protocols that favor modular, upgradeable system architectures. Additionally, cultivating workforce expertise through targeted training programs on advanced diagnostic tools and installation best practices will reinforce quality execution and foster a culture of continuous improvement. By orchestrating these strategic initiatives, companies can deliver differentiated value propositions, bolster customer loyalty, and unlock new service-based revenue streams.

Outlining a Structured Research Approach Incorporating Primary Interviews, Secondary Analysis, and Robust Validation Frameworks

The insights presented in this analysis derive from a structured research methodology designed to ensure comprehensiveness, accuracy, and practical relevance. Primary data was gathered through in-depth interviews with engineering managers at utilities, construction firms, and EPC contractors, supplemented by workshops conducted with leading component manufacturers and maintenance service providers. These qualitative engagements were triangulated with insights from end-user surveys capturing project priorities, pain points, and long-term resilience objectives.

Complementing primary research, secondary sources including technical whitepapers, international standards publications, and patent filings were systematically canvassed to identify emerging materials, digital monitoring protocols, and evolving compliance frameworks. Data validation protocols included cross-referencing project case studies and performance benchmarks, while analytical frameworks such as SWOT and Porter’s Five Forces were applied to distill competitive dynamics and strategic imperatives. Segmentation mapping techniques ensured that product, service, and regional subdivisions were examined holistically, fostering an integrated view of the protection engineering landscape. This methodological rigor underpins the actionable recommendations and offers decision-makers a clear line of sight into critical adoption vectors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Earthing & Lightning Protection Engineering System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Earthing & Lightning Protection Engineering System Market, by Earthing System

- Earthing & Lightning Protection Engineering System Market, by Lightning Protection System

- Earthing & Lightning Protection Engineering System Market, by Surge Protection Device

- Earthing & Lightning Protection Engineering System Market, by Maintenance Service

- Earthing & Lightning Protection Engineering System Market, by Region

- Earthing & Lightning Protection Engineering System Market, by Group

- Earthing & Lightning Protection Engineering System Market, by Country

- United States Earthing & Lightning Protection Engineering System Market

- China Earthing & Lightning Protection Engineering System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Key Drivers, Challenges, and Opportunities Shaping the Future of Earthing and Lightning Protection Engineering Systems

As infrastructure systems worldwide grapple with heightened electrical and environmental risks, the imperative for resilient earthing and lightning protection engineering has never been greater. The confluence of material innovations, digital monitoring capabilities, and adaptive service models offers a roadmap for crafting robust defense mechanisms that can withstand evolving hazard profiles. At the same time, trade policy shifts underscore the necessity for agile supply-chain strategies and collaborative manufacturing alliances to mitigate cost pressures and delivery uncertainties.

Moreover, region-specific drivers-from grid modernization mandates in North America to renewable integration in EMEA and urban expansion in Asia-Pacific-highlight the importance of tailored solutions that reflect localized regulatory and environmental contexts. Industry stalwarts and emerging players alike must navigate these complexities with a balanced approach that aligns technical performance, lifecycle cost management, and customer service excellence. As the protection engineering ecosystem continues to evolve, organizations that proactively embrace innovation, standard harmonization, and workforce development will be best positioned to deliver superior reliability and capture long-term value.

Secure Unmatched Strategic Insights with a Direct Invitation to Engage Ketan Rohom for In-Depth Earthing and Lightning Protection Expertise

Unlock unparalleled strategic insights by securing this comprehensive analysis directly from Ketan Rohom, enabling your organization to anticipate emerging challenges and capitalize on opportunity areas across earthing and lightning protection engineering systems. By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you will gain privileged access to in-depth qualitative and quantitative assessments, nuanced regional breakdowns, and rigorous company profiles that can inform procurement strategies, innovation roadmaps, and competitive positioning. Engage now to obtain bespoke guidance on navigating evolving tariff landscapes, optimizing segmentation strategies, and leveraging actionable recommendations tailored to your business objectives. Don’t miss the chance to differentiate your solutions with data-driven expertise and stay ahead of disruptive trends. Reach out today to Ketan Rohom and elevate your decision-making with specialized research insights.

- How big is the Earthing & Lightning Protection Engineering System Market?

- What is the Earthing & Lightning Protection Engineering System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?