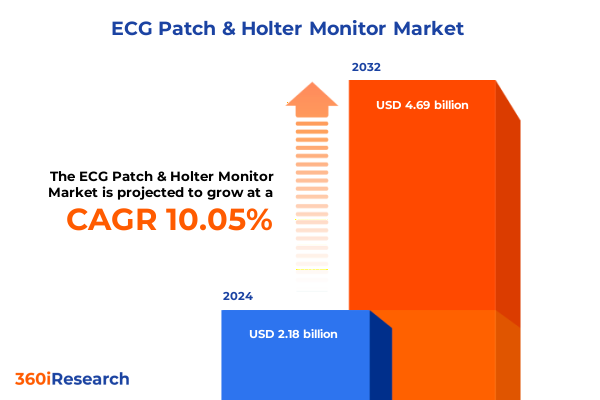

The ECG Patch & Holter Monitor Market size was estimated at USD 2.40 billion in 2025 and expected to reach USD 2.65 billion in 2026, at a CAGR of 11.01% to reach USD 4.99 billion by 2032.

Setting the Stage for Next-Generation Ambulatory Cardiac Monitoring with Revolutionized ECG Patch and Holter Device Solutions

In an era where cardiac monitoring is rapidly evolving, the convergence of miniaturized sensors, wireless connectivity, and telehealth infrastructure has propelled ambulatory cardiac surveillance into a new frontier. Traditional diagnostic pathways, once reliant on cumbersome Holter monitors, are yielding ground to versatile ECG patches that offer patient-friendly wearability and seamless data capture. This transformation is underpinned by growing clinician and patient demands for continuous, real-time heart rate and rhythm tracking that extends beyond clinical settings.

At the core of this shift is the integration of multi-day ECG patches that range from two-day and seven-day durations to more extended fourteen-day monitoring, complemented by Holter monitors capable of 24-hour through beyond seven-day deployments. These advancements not only enhance diagnostic sensitivity for transient arrhythmias but also elevate patient adherence by minimizing lifestyle disruption. Coupled with wireless patch innovations and Bluetooth 4.0 and 5.0 enabled platforms, the landscape is primed for scalable remote patient monitoring models. This introduction sets the stage for an in-depth exploration of the transformative forces reshaping the ECG patch and Holter monitor ecosystem, highlighting critical developments that will guide industry stakeholders through the next wave of growth and innovation.

Uncovering the Paradigm Shifts Redefining Ambulatory Cardiac Surveillance with AI Empowerment and Wearable Technology Integration

The cardiac surveillance market is experiencing a seismic shift driven by the adoption of cloud-enabled analytics, artificial intelligence–powered arrhythmia detection algorithms, and the proliferation of wireless patch designs. Innovations in machine learning are refining the accuracy of atrial fibrillation and sleep apnea monitoring, while enabling triage systems that flag critical events in near real time. These technological leaps are redefining clinical workflows, shifting the diagnostic paradigm from reactive, symptom-driven testing to proactive, continuous surveillance.

Moreover, healthcare systems are embracing remote patient monitoring as a cornerstone of value-based care initiatives. Integration of real-time data transmission capabilities with electronic health record platforms is streamlining clinician access to patient metrics, reducing the need for in-person follow-up visits, and mitigating readmission risks. Additionally, the rise of home-based diagnostic solutions is decentralizing care and empowering patients to manage chronic cardiovascular conditions outside traditional hospital environments. Collectively, these transformative shifts underscore a broader transition toward patient-centric, technology-enabled models that promise to improve outcomes and lower overall costs of cardiac care.

Evaluating the Cumulative Impact of 2025 United States Tariff Changes on ECG Patch and Holter Monitor Manufacturing and Distribution Landscape

In early 2025, the United States government implemented new tariff measures that have introduced complexity across the supply chain for cardiac monitoring devices. These tariffs, targeted at imported electronic components and sensor materials, have elevated production costs for manufacturers of ECG patches and Holter monitors. As a consequence, device pricing strategies are under pressure to maintain margins while ensuring continued investment in research and development.

The cumulative effect of these tariff changes has manifested in a ripple across distribution networks, prompting companies to reassess sourcing strategies, explore alternative materials, and consider nearshoring as a hedge against future trade uncertainties. Despite these headwinds, many stakeholders are leveraging economies of scale in high-volume production and seeking cost efficiencies through streamlined manufacturing processes. Transitional pricing structures and targeted rebate programs for end users such as ambulatory care centers and home care providers are emerging to offset immediate cost impacts. Going forward, a nuanced understanding of tariff escalation and its interplay with global component availability will be essential for industry players aiming to sustain competitive positioning.

Deep Dive into Product End User Application Technology and Sales Channel Segmentation Driving Strategic Insights in Cardiac Monitoring

Market dynamics reveal distinct performance profiles across product formats, with multi-day ECG patches gaining traction among providers seeking extended monitoring without patient inconvenience. Two-day and seven-day patches are particularly favored for capturing intermittent arrhythmias, while fourteen-day formats cater to complex diagnostic cases requiring prolonged data acquisition. Conversely, Holter monitors remain entrenched in protocols demanding high-fidelity signal capture over periods ranging from twenty-four to beyond seven days, often for inpatient and ambulatory care center applications.

End-user segmentation shows that hospitals and diagnostic centers continue to anchor demand for longer-duration Holter systems, while home care and ambulatory care centers increasingly adopt wireless patch solutions for remote monitoring. In terms of application, arrhythmia monitoring leads uptake, but growth in remote patient monitoring and sleep apnea tracking is accelerating, driven by digital health reimbursement frameworks. Technologically, Bluetooth-enabled devices-spanning Bluetooth 4.0 and 5.0-are redefining connectivity benchmarks, whereas real-time data transmission and wireless patches are facilitating seamless clinician feedback loops. Across sales channels, direct tender agreements dominate institutional procurement, while online sales are burgeoning among consumer-facing home monitoring offerings.

This comprehensive research report categorizes the ECG Patch & Holter Monitor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

- Sales Channel

Illuminating Regional Nuances in Cardiac Monitoring Markets across Americas Europe Middle East Africa and Asia Pacific Geographies

Regional demand patterns exhibit notable differentiation, with the Americas maintaining strong adoption of integrated remote patient monitoring systems underpinned by widespread reimbursement coverage. In North America, health insurers are expanding telehealth benefits, fueling uptake of both ECG patches and advanced Holter monitors. Latin America, meanwhile, is witnessing incremental deployment in diagnostic centers as government initiatives boost cardiovascular screening programs.

In Europe, Middle East, and Africa, fragmented healthcare ecosystems are driving a two-tiered landscape: mature Western European markets favor wireless patch innovations within well-funded ambulatory care networks, whereas Middle Eastern and African regions rely on cost-effective Holter systems to extend basic arrhythmia surveillance. Meanwhile, Asia-Pacific markets are characterized by rapid digital health adoption across home care channels, especially in China, Japan, and Australia, with online sales channels emerging as key conduits for direct-to-consumer devices. Overall, regional drivers span reimbursement policies, healthcare infrastructure maturity, and digital connectivity penetration, shaping a heterogeneous but opportunity-rich global marketplace.

This comprehensive research report examines key regions that drive the evolution of the ECG Patch & Holter Monitor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Dynamics and Innovation Strategies of Leading ECG Patch and Holter Monitor Manufacturers Shaping the Industry

Competitive analysis highlights several leading innovators driving the ECG patch and Holter monitor space. Key players are investing heavily in R&D to integrate advanced analytics, enhance sensor accuracy, and improve user comfort. Partnerships between device manufacturers and software platform providers are accelerating the delivery of end-to-end solutions that tie patient-generated data to clinical decision support tools.

Moreover, a wave of strategic acquisitions and collaborations is underway, as technology firms with AI capabilities seek to bolster their offerings through established cardiovascular device portfolios. Manufacturers are also diversifying product lines to address the growing demand for hybrid monitoring solutions that combine arrhythmia detection with sleep apnea and remote patient monitoring functionalities. To maintain a competitive edge, companies are optimizing production workflows, securing long-term component supply agreements, and expanding direct distribution networks in both institutional and consumer markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the ECG Patch & Holter Monitor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AliveCor, Inc.

- Bardy Diagnostics, Inc.

- BPL Medical technologies Pvt. Ltd.

- Canadian Cardiac Care

- Cardiac Insight Inc.

- Cortrium ApS

- First Call Medical, Inc.

- Hillrom Holdings, Inc.

- iRhythm Technologies, Inc.

- Koninklijke Philips N.V.

- Lief Therapeutics

- LifeSignals Group Inc.

- Medtronic PLC

- MidMark Corporation

- Monitra Healthcare Private Limited

- Nasiff Associates Inc.

- Nihon Kohden Corporation

- Nissha Medical Technologies

- OSI Systems, Inc.

- ReactDx

- ScottCare Corporation

- SmartCardia SA

- Stratus

- Viatom Technology Co., Ltd. by Lepu Medical Group

- VitalConnect

- VivaLNK, Inc.

- ZOLL Medical Corporation

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Disruption and Capitalize on Growth Opportunities in Cardiac Monitoring

Industry leaders should prioritize the integration of artificial intelligence–driven diagnostic algorithms into wearable platforms to enhance early detection of silent arrhythmias and sleep-disordered breathing events. By embedding machine learning models that continuously learn from large datasets, organizations can deliver predictive insights directly to clinicians, improving patient outcomes and reducing hospital readmissions.

Simultaneously, alignment with evolving reimbursement frameworks is critical; proactive engagement with payers and regulatory bodies can secure favorable coding pathways for advanced monitoring services. In response to tariff challenges, companies should diversify component sourcing, invest in scalable manufacturing processes close to end markets, and explore public-private partnerships to offset cost pressures. Finally, expansion into underserved regions via digital sales channels can unlock new revenue streams, while alliances with telehealth providers will ensure comprehensive care pathways that resonate with both patients and healthcare systems.

Comprehensive Research Methodology Incorporating Robust Data Collection Multisource Triangulation and Expert Validation for Reliable Market Insights

This analysis is founded on a multi-pronged research methodology combining primary interviews with cardiologists, electrophysiologists, and health system executives alongside secondary data from regulatory filings, published clinical studies, and technology white papers. Quantitative insights were corroborated using anonymized usage data from leading device manufacturers and telehealth platform providers.

In addition, rigorous triangulation techniques ensured consistency across disparate information sources, while expert validation workshops with clinical thought leaders refined key assumptions. The segmentation framework was developed through iterative consultations with market participants across product, end-user, application, technology, and sales channel dimensions. Regional analyses drew on localized data, reimbursement codes, and digital connectivity metrics to capture nuanced market variations. This robust approach guarantees a comprehensive, reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our ECG Patch & Holter Monitor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- ECG Patch & Holter Monitor Market, by Product

- ECG Patch & Holter Monitor Market, by Technology

- ECG Patch & Holter Monitor Market, by Application

- ECG Patch & Holter Monitor Market, by End User

- ECG Patch & Holter Monitor Market, by Sales Channel

- ECG Patch & Holter Monitor Market, by Region

- ECG Patch & Holter Monitor Market, by Group

- ECG Patch & Holter Monitor Market, by Country

- United States ECG Patch & Holter Monitor Market

- China ECG Patch & Holter Monitor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Illuminate the Future Trajectory of ECG Patch and Holter Monitor Markets in a Rapidly Evolving Healthcare Ecosystem

In summary, the ECG patch and Holter monitor market is at a critical juncture, driven by technological innovation, regulatory evolution, and shifting care delivery models. The emergence of wireless patch platforms, combined with Bluetooth 4.0 and 5.0 enhancements, is reshaping how clinicians and patients engage with cardiac monitoring. Tariff-induced cost challenges underscore the need for agile supply chain strategies, while regional variations offer a tapestry of high-growth opportunities across the Americas, Europe Middle East Africa, and Asia-Pacific.

As competition intensifies, differentiation through integrated AI analytics, real-time data transmission, and seamless telehealth integration will define the next generation of market leaders. For stakeholders seeking to thrive, an informed, proactive approach that blends technical innovation with strategic partnerships will be imperative. The insights presented here provide the blueprint for navigating this dynamic landscape and capturing value in an increasingly patient-centric world.

Engage Directly with Ketan Rohom Associate Director Of Sales And Marketing to Access Exclusive ECG Patch and Holter Monitor Market Intelligence and Propel Strategic Growth

If your organization seeks to stay ahead in the fast-paced realm of ambulatory cardiac monitoring, there is an opportunity to access unparalleled depth of market intelligence. Reach out directly to Ketan Rohom, Associate Director of Sales and Marketing, to explore how detailed insights on ECG patch and Holter monitor trends can support your strategic planning. Taking this step will enable you to refine investment decisions, identify high-potential segments-whether in advanced Bluetooth-enabled real-time data transmission technologies or emerging applications such as sleep apnea monitoring-and craft differentiated product offerings that resonate across ambulatory care centers, diagnostic networks, home care providers, and hospital systems. By leveraging our rigorous analysis, you will gain a nuanced understanding of tariff impacts on supply chains, regional demand drivers from the Americas to Asia-Pacific, and competitive positioning of leading device manufacturers. Contact Ketan today, unlock the full research report, and transform your organization’s ability to innovate and lead within the evolving landscape of remote cardiac surveillance.

- How big is the ECG Patch & Holter Monitor Market?

- What is the ECG Patch & Holter Monitor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?