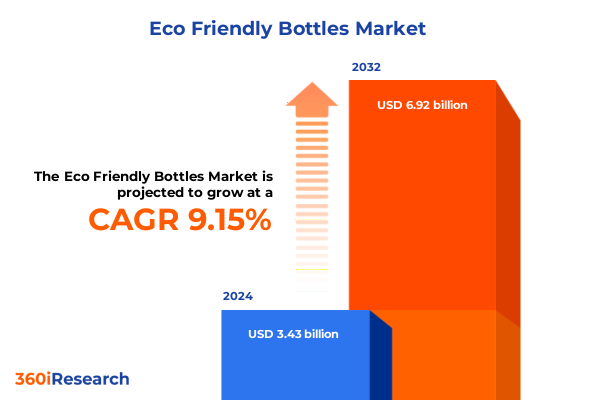

The Eco Friendly Bottles Market size was estimated at USD 3.69 billion in 2025 and expected to reach USD 3.98 billion in 2026, at a CAGR of 9.37% to reach USD 6.92 billion by 2032.

A concise orientation to the intersecting forces of sustainability, material science, trade policy, and retail dynamics reshaping reusable bottle strategies

The reusable and eco-friendly bottle market sits at the intersection of consumer values, materials innovation, and global supply-chain dynamics, creating both strategic opportunity and operational complexity for product and procurement leaders.

Sustainability narratives and consumer expectations for circularity have elevated the bottle from commodity to brand signal, while performance requirements-insulation, durability, and safety-continue to drive engineering choices and materials trade-offs. Meanwhile, trade policy and raw material availability are reintroducing cost and sourcing volatility into product roadmaps, making it essential for stakeholders to align design, channel, and sourcing strategies.

This executive summary distills the most consequential forces shaping product roadmaps today, focusing on how shifts in regulation, distribution, consumer preference, and tariff policy materially change the decisions that brands, suppliers, and retailers must make over the next planning cycle. It is intended to support strategic discussions among R&D, procurement, and commercial teams as they balance product differentiation, sustainability goals, and supply resilience.

How rapid consumer expectations, materials breakthroughs, and channel innovation have collectively redefined competitive priorities for eco-friendly bottle makers

Over the last three years the landscape for eco-friendly bottles has undergone a rapid realignment driven by technological upgrades, shifting consumer priorities, and channel evolution that together rewrite competitive advantage.

Design and materials innovation have accelerated beyond conventional metal and glass: antibacterial and self‑purifying caps, advanced polymers engineered for durability, and novel bamboo treatments have expanded the functional and storytelling possibilities for brands. Simultaneously, consumers-particularly younger cohorts-expect products that demonstrate credibility on recyclability, reusability, and transparent lifecycle claims, so product teams must marry technical performance with verifiable circularity to earn premium positioning. McKinsey’s recent findings underscore that recyclability and reusability remain top sustainability attributes for consumers, even as quality, price, and convenience continue to guide buying decisions.

Distribution and product formatting have also transformed: digital-first launches, limited-edition color drops, and DTC experiences now amplify brand narratives and accelerate product lifecycles, while retailers and specialty channels focus on curated assortments that prioritize differentiation. These shifts, combined with continued premiumization and tech-enabled product features, mean that product roadmaps must be faster, more modular, and more defensible with respect to supply and regulatory risk. Finally, supplier networks and manufacturing footprints are being re-evaluated in response to tariffs, national security‑driven trade actions, and the rising cost of key feedstocks, making integrated sourcing strategies a critical enabler of durable margin and consistent brand experience.

Detailed implications of the 2025 United States trade measures on metal-containing bottle lines and the supply chain actions required to mitigate duty exposure

Tariff policy enacted in 2025 represents a clear inflection point for materials that are central to reusable bottles, and the practical implication for product teams is that duty exposure is now a design and sourcing consideration rather than an after-the-fact cost line.

Executive actions and proclamations issued in 2025 adjusted Section 232 coverage and clarified that steel and aluminum articles, as well as many of their derivative products, are subject to additional ad valorem duties effective in March 2025, with detailed HTS code listings and derivative-product provisions published in the Federal Register. These actions expanded the tariff footprint to derivative articles that contain steel or aluminum content, and they end previous country exemptions for a number of trading partners, creating a uniform ad valorem treatment that must now be incorporated into landed-cost models. The White House materials and subsequent trade-operations updates set the effective administration dates and listed Annex classifications that importers and product designers should review when classifying components.

Practically, stainless steel and aluminum bottle families are directly affected because customs and tariff guidance treat derivative articles as potentially subject to the Section 232 duties; where a bottle or part is classified as a steel or aluminum derivative, additional duty is applied on the value or percentage of metal content unless specific domestic-melted or domestic-smelted exceptions apply. Logistics and customs specialists have emphasized the need to revise HTS classifications, document melt/pour or smelt/cast country of origin, and prepare for new entry-line reporting requirements that break out metal content. Trade and freight advisors published operational guidance noting that the tariffs not only raise cost but also introduce new documentation, FTZ designation rules, and potential exposure for derivative classifications, which can affect product-level margins and shelf pricing.

Because aluminum and steel duties are applied to derivative products in many cases, product teams should treat material selection, component design, and assembly processes as levers to mitigate tariff exposure. Options to reduce immediate duty impact include reformulating non-metallic components where performance permits, repatriating melt and smelt processes, qualifying alternative suppliers in low-duty jurisdictions, exploiting legitimate domestic-melt or domestic-smelt proofs of origin, and redesigning multi-material assemblies to minimize the value-attributable metal content that is subject to additional duties. Trade teams should also track ongoing legal and administrative changes closely: proclamations and litigation around tariff authorities may alter enforcement timelines or create refund and exclusion opportunities, so maintaining proactive engagement with customs counsel and trade advisors is essential to avoid misclassification and to pursue mitigation pathways. Reuters and several major logistics advisors published contemporaneous coverage and operational briefs as these measures took effect; practitioners should review official annex lists and consult customs guidance when preparing entries and contracts.

Actionable segmentation intelligence linking material choices, product formats, distribution models, end-uses, pricing tiers, capacities, and age cohorts to strategic product decisions

Segmentation analysis reveals the product- and channel-level decisions that determine which materials, product types, and price bands will outperform in different commercial contexts, and translating these segments into strategy requires mapping technical attributes to consumer expectations and sourcing realities.

Across material choices, the market categorization spans aluminum, bamboo, glass, silicone, stainless steel, and Tritan, with sub-types that carry distinct supply and processing implications: bamboo’s Moso and Phyllostachys variants demand different harvesting and treatment workflows; glass choices between borosilicate and soda lime affect fragility, weight, and perceived sustainability; and stainless steel grades such as 18/10 and 18/8 create varying corrosion resistance, finish quality, and cost profiles. Material selection therefore informs production footprints, supplier qualification criteria, and duty exposure when metal content is present. At the product-type layer, formats include collapsible, filtered, insulated, and non-insulated variations, with the insulated portfolio further differentiated by double-wall and vacuum constructions that materially change manufacturing complexity and weight profiles, and thus logistics costs. Distribution models range from online retail to specialty stores and supermarkets/hypermarkets, each channel carrying different expectations for assortment, pricing cadence, and promotional mechanics. End-use segmentation-commercial, personal, promotional, and sports-shapes design trade-offs from brand imprinting to ruggedness, while price tiers of economy, mid-range, and premium determine allowable cost structures, marketing investments, and warranty commitments. Capacity bands under 500 milliliters, 500–1000 milliliters, and above 1000 milliliters reflect usage patterns that vary by age group-adult and kids adoption-and intersect with product type where sports and insulated variants skew larger. Integrating these segment layers reveals which product architectures are feasible under current trade conditions and which will require design or sourcing changes to preserve margin and performance.

The segmentation lens also surfaces where R&D and commercial efforts should focus. For example, premium insulated vacuum bottles aimed at adult consumers in specialty retail have different tolerances for weight, finish, and price than economy collapsible bottles targeted at kids or promotional channels. Glass-especially borosilicate-retains strength in perceived sustainability but demands different protective packaging strategies for supermarket and mass channels. Bamboo presents a high‑storytelling, brand-differentiated option but requires careful supplier audits and treatment standards to ensure durability and hygiene. Tritan and advanced silicone variants provide lower-weight, shatter-resistant solutions that perform well in economy and sports segments and reduce metal-related tariff exposure. These segmentation-derived trade-offs should guide cross-functional roadmaps that align design, sourcing, and channel strategies without relying on a single, one-size-fits-all approach.

This comprehensive research report categorizes the Eco Friendly Bottles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Capacity

- Age Group

- End Use

- Distribution Channel

Region-specific commercial and sourcing implications for the Americas, Europe Middle East and Africa, and Asia-Pacific that determine product mix and compliance choices

Regional dynamics continue to shape both demand profiles and supply responses, and a region-by-region perspective clarifies where brands must adapt product mixes, marketing claims, and sourcing footprints.

In the Americas, consumer familiarity with reusable bottles is high and premiumization-driven by outdoor and lifestyle brands-remains an important growth vector; meanwhile, recent tariff adjustments and administrative requirements have made near-shore sourcing and domestic melt/smelt proofs of origin more attractive options for margin protection. North American channels emphasize omnichannel execution and DTC storytelling, and procurement teams are actively re-evaluating supplier contracts in response to tariff-driven landed-cost volatility. In Europe, Middle East & Africa, regulatory pressure on single-use plastics, stronger deposit-return schemes in parts of Europe, and higher consumer expectations for circularity elevate glass, metal, and easily recyclable solutions; meanwhile, varied national recycling infrastructures require nuanced material choices and localized packaging strategies. In Asia-Pacific, diverse demand patterns include strong acceptance of compact formats, rapid product innovation adoption, and deeply integrated local manufacturing that can provide cost-effective supply but requires careful due diligence around labor, environmental compliance, and component traceability. These regional distinctions demonstrate why a one-size-fits-all go-to-market or sourcing approach is unlikely to succeed and why portfolio localization-both in product specification and in trade-compliance posture-should be a priority for global brands. McKinsey’s regional consumer packaging insights and contemporaneous trade advisories underline the importance of tailoring product attributes to both local circularity perceptions and channel mechanics.

This comprehensive research report examines key regions that drive the evolution of the Eco Friendly Bottles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How differentiated strategies from premium branding, smart-feature integration, and supply-chain resilience are shaping competitive advantage among leading bottle manufacturers

Leading companies in the reusable bottle space are pursuing differentiated routes to value capture: some prioritize brand-led premiumization and collaborations, others double down on technological differentiation, and a distinct cohort focuses on operational resilience through supply diversification and vertical integration.

Brands with strong direct-to-consumer engines have used online drops and limited-edition colorways to create scarcity and cultural relevance while leveraging durable warranties and brand narratives to justify premium pricing. Technology-focused entrants have introduced smart and self-cleaning features that create adjacent serviceability and add-on revenue possibilities; acquisition activity in this space reinforced the strategic value of technology-enabled differentiation, with at least one high-profile smart-bottle maker integrating with a global filtration brand to scale distribution and R&D synergies. Meanwhile, established outdoor and performance brands have leaned into omnichannel distribution and international expansion, investing in product line extensions and technology that preserve thermal performance and ruggedness while managing cost pressures. Public filings and industry coverage illustrate how firms are balancing product innovation, channel expansion, and trade exposure in their capital allocation and go-to-market choices.

Across the supplier base, material producers and component specialists are emphasizing traceability and documentation to support customs classification and to help brand customers meet evolving tariff and regulatory requirements. In parallel, retailers and specialty chains are curating assortments with stronger sustainability claims and more granular warranty and repair propositions, recognizing that consumers increasingly treat the bottle as a branded, durable good that should deliver years of service rather than an expendable accessory. These dynamics create distinct opportunities for companies that can both innovate on product features and demonstrate operational rigor on supply-chain transparency and trade compliance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Eco Friendly Bottles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALPLA Group GmbH & Co KG

- Deltora Biopolymers Private Limited

- Earthware Products Pvt Ltd

- Ecolife Recycling Private Limited

- Ecologic Brands, Inc.

- EcoVessel India

- Guangzhou Gaopin Plastic Products Co., Ltd.

- Hydro Flask, LLC

- Klean Kanteen, Inc.

- Metal Group Co., Ltd.

- Nelcon Industries India Private Limited

- Newell Brands Inc.

- Shanghai Fengqi Industrial Co., Ltd.

- SIGG Switzerland AG

- S’well LLC

- Thermos LLC

- Tuffplus – Krypton Stainless Pvt Ltd

- Xiamen Sikma Intelligent Technology Co., Ltd.

Practical cross-functional actions leaders must implement to protect margin, ensure compliance, and accelerate differentiated product innovation in a tariff-sensitive environment

Industry leaders should act now to convert structural change into durable advantage by adopting integrated product, sourcing, and compliance strategies that preserve margin while meeting evolving consumer and regulatory expectations.

First, design-to-cost must be retooled to include tariff sensitivity as a core parameter: engineering teams should model landed cost impacts of metal content early in the design cycle and test non-metallic or alternative-grade substitutions where performance and safety permit. Second, establish a prioritized supplier diversification program that includes near-shore options, certified domestic melt/smelt partners, and alternative low-duty jurisdictions, and pair that program with supply‑chain visibility tools that can produce melt/smelt and smelt/cast certificates on demand for customs authorities. Third, elevate product claims and circularity proof points: invest in third-party testing and recyclability disclosures that align with regional recycling realities, and prepare customer-facing narratives that translate technical attributes-such as borosilicate glass durability or 18/10 stainless corrosion resistance-into clear consumer benefits.

Fourth, adapt channel strategies by tailoring assortments and price positioning to the needs of online retail, specialty stores, and supermarket/hypermarket formats; use DTC drops and limited runs to test premium innovations while ensuring mass channels have robust economy and mid-range SKUs optimized for logistics and shrinkage. Fifth, prioritize modular product architectures that allow manufacturers to shift components or finishes without a full redesign, reducing lead times and requalification costs. Finally, embed trade compliance into commercial KPIs: require HTS classification audits before product launches, set up a tariff risk register, and maintain ongoing engagement with customs counsel to seek exclusions or refund opportunities where appropriate. Taken together, these actions will improve agility, protect margins, and enable differentiated customer propositions in an increasingly contested landscape.

Transparent explanation of the multi-method research approach combining primary interviews, trade-code analysis, and segmentation mapping to validate findings and recommendations

The research approach behind this executive summary combined document-level trade analysis, primary stakeholder interviews, and cross-functional product segmentation mapping to produce actionable and verifiable insights.

Primary inputs included structured interviews with supply-chain leaders, product managers, and channel executives who run portfolio decisions and vendor qualification programs, supplemented by direct review of public proclamations, HTS annex lists, and customs-advisory materials to validate tariff treatment and implementation dates. Secondary inputs consisted of authoritative commentary from packaging and trade advisors and contemporary business coverage that contextualized consumer and competitive behavior. Segmentation mapping translated material science, product format, distribution requirements, end-use archetypes, price tiers, capacity choices, and age cohorts into a decision framework that informs product architecture and go-to-market choices. Cross-validation used a combination of legal-advisory checks and procurement scenarios to ensure recommendations are operationally feasible and aligned with prevailing customs guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Eco Friendly Bottles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Eco Friendly Bottles Market, by Product Type

- Eco Friendly Bottles Market, by Material

- Eco Friendly Bottles Market, by Capacity

- Eco Friendly Bottles Market, by Age Group

- Eco Friendly Bottles Market, by End Use

- Eco Friendly Bottles Market, by Distribution Channel

- Eco Friendly Bottles Market, by Region

- Eco Friendly Bottles Market, by Group

- Eco Friendly Bottles Market, by Country

- United States Eco Friendly Bottles Market

- China Eco Friendly Bottles Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

A forward-looking synthesis explaining why integrated product design, tariff-aware sourcing, and credible sustainability credentials will decide competitive outcomes

The eco-friendly bottle landscape has entered a phase where product differentiation, compliance acuity, and supply resilience determine which firms will convert demand into lasting commercial advantage.

Consumer interest in sustainability and functional performance continues to reward brands that can both tell credible circularity stories and deliver best-in-class user experiences. At the same time, 2025 trade measures have reframed material choices as strategic levers rather than tactical decisions; the cost, documentation, and classification challenges introduced by new tariff treatments mean teams must move beyond siloed sourcing and design decisions and toward integrated roadmaps that account for trade, logistics, and channel realities. Brands and suppliers that act decisively-aligning early product engineering with tariff-aware sourcing, investing in circularity credentials, and tailoring regional assortments-will be better positioned to retain margin, reduce supply disruption, and capture premium consumer demand. In short, the next wave of competitive advantage will accrue to organizations that turn regulatory and supply complexity into deliberate product and commercial differentiation.

Direct next steps for procurement and commercial leaders to access a tailored market report and translate insights into purchase-ready action plans

For decision-makers who want a single definitive source that synthesizes regulatory, supply chain, and product intelligence into a practical purchasing pathway, contact Ketan Rohom, Associate Director, Sales & Marketing, to request the full market research report and learn how tailored insights can be integrated with your commercial roadmap.

The full report provides a structured dossier of primary interviews, trade‑level tariff analysis, material supply maps, retailer channel evaluations, and scenario-ready playbooks that help procurement, product, and commercial leaders convert insight into immediate action. Reach out to arrange a briefing or an executive summary delivery designed to the needs of your team.

- How big is the Eco Friendly Bottles Market?

- What is the Eco Friendly Bottles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?