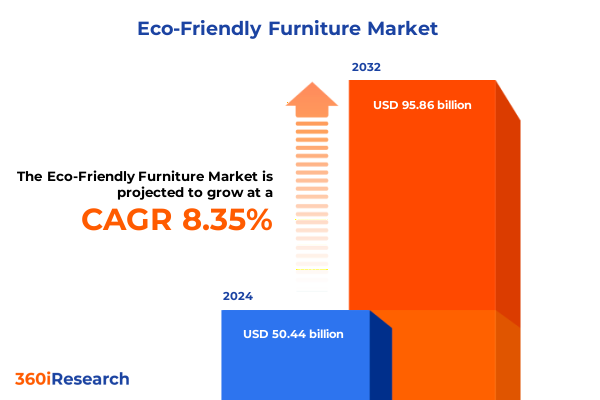

The Eco-Friendly Furniture Market size was estimated at USD 54.57 billion in 2025 and expected to reach USD 59.03 billion in 2026, at a CAGR of 8.38% to reach USD 95.86 billion by 2032.

Increasing consumer demand and innovative design are driving unprecedented growth in the eco-friendly furniture sector while sustainability shapes modern homes

The eco-friendly furniture sector is experiencing an unprecedented surge in consumer engagement driven by heightened environmental consciousness and a demand for sustainable living solutions. Across North America and beyond, homeowners are increasingly prioritizing products that reduce ecological footprints while offering aesthetic appeal and functional innovation. This shift extends beyond mere preference, reflecting a broader societal movement toward responsible consumption and circular economy principles.

Industry leaders are responding by embedding sustainability into every stage of the product lifecycle. Major retailers have committed to ambitious emissions targets and circular initiatives, leveraging renewable materials and extending product lifespans through modular designs and buyback programs. Under the leadership of Jesper Brodin, Ingka Group-which operates the majority of IKEA stores-has set a goal to cut carbon emissions by 50% by 2030, emphasizing collaboration with governments and stakeholders to secure sustainable raw materials and expanding peer-to-peer marketplaces for secondhand furniture to support reuse and recycling efforts.

Moreover, circular design concepts are reshaping traditional supply chains. Initiatives like closed-loop flat-pack furniture aim to decouple resource use from environmental impact, fostering products designed for disassembly and remanufacture. By prioritizing renewable inputs such as responsibly sourced wood and recycled textiles, manufacturers are charting a course toward eco-innovation that addresses both consumer demand and planetary stewardship.

Evaluating how sustainability regulations, circular design innovations, and consumer behavior shifts are revolutionizing eco-friendly furniture industry standards

Regulatory momentum is propelling the eco-friendly furniture landscape into a new era. Governments worldwide are enacting policies to support carbon neutrality and resource conservation, aligning with global climate commitments. The European Green Deal, for example, mandates a 55% reduction in greenhouse gas emissions by 2030 and introduces measures such as the Carbon Border Adjustment Mechanism to level the playing field for sustainable imports. These regulatory frameworks incentivize manufacturers to adopt cleaner production processes and transparent supply chains.

Simultaneously, corporate sustainability strategies are evolving from aspirational goals to operational imperatives. Companies are integrating circular economy principles-designing for disassembly, implementing buyback schemes, and increasing the use of recycled and rapidly renewable materials like bamboo. MillerKnoll’s commitment to eliminate PFAS across its North American portfolio by 2027 exemplifies this trend, underscoring the industry’s shift toward chemical-free and high-performance materials that align with health and environmental standards.

Technological advancements are also reshaping the market, with digital platforms enhancing transparency and consumer engagement. Tools like environmental product calculators enable buyers to compare carbon footprints, while blockchain-based traceability solutions verify the provenance of sustainable materials. These innovations not only bolster consumer trust but also streamline compliance with increasingly stringent environmental and social governance criteria.

Understanding the cumulative effects of sweeping United States tariff policies implemented in 2025 on materials, production costs, and supply chain dynamics

In 2025, United States tariff policy underwent a dramatic transformation, with average effective rates escalating from approximately 2.5% to 16.6% and proposals targeting a further increase to 20.6%. This marked the highest tariff levels since 1910, exerting significant upward pressure on the cost of imported furniture and related raw materials, ultimately contributing to broader inflationary trends.

A universal 10% tariff on all imports took effect on April 5, 2025, encompassing a broad spectrum of goods, from textiles to finished furniture pieces. Concurrently, the government introduced higher, country-specific reciprocal duties, including a 20% levy on European Union products and tariffs ranging between 24% and 49% on key Asian suppliers. These measures intended to strengthen domestic manufacturing have instead disrupted established supply chains and triggered uncertainty among importers and retailers.

Further complicating the landscape, on March 12, 2025, the administration imposed a 25% tariff on all steel and aluminum imports. While aimed at safeguarding the domestic metals industry, this policy significantly increased the cost of hardware components vital to cabinetry and furniture assembly. Industry commentators predict that hardware cost inflation may ripple through pricing structures, eroding profit margins and challenging manufacturers to identify alternative sourcing strategies.

Meanwhile, a temporary 90-day suspension of the additional 24% Section 301 duties on Chinese furniture imports reduced the effective tariff rate to 10% from May through July 2025. Though short-lived, this reprieve provided a narrow window for importers to restock at lower landed costs, offering temporary relief amid a volatile trade environment.

The industry response has been swift and multifaceted. U.S. musical instrument manufacturer D’Addario & Company established a dedicated trade war task force to navigate the tariff landscape, shifting production strategies and exploring free trade zone designations. Meanwhile, BIFMA has publicly urged policymakers to reconsider new tariffs that could undermine the North American furniture sector’s USMCA-driven gains, highlighting the industry’s contribution of nearly $15 billion in annual output and $1.75 billion in exports. North American commercial furniture trade associations warn that increased duties threaten supply chain stability and could lead to higher consumer prices, reduced demand, and potential job losses across 48 states.

Analyzing the pivotal roles of product, material, channel, user, and price segmentation in shaping the eco-friendly furniture market landscape

The eco-friendly furniture market can be dissected through multiple segmentation lenses, each revealing distinct trends and opportunities. Product type analysis shows that beds, cabinets, chairs, sofas, and tables each serve unique consumer needs and design preferences. Within these categories, subsegments like upholstered beds and sectional sofas are gaining traction for their ability to combine comfort with sustainable materials, while modular storage beds and console tables exemplify adaptive design.

Material segmentation underscores the growing prominence of renewable and recycled inputs such as bamboo, metal, rattan, and reclaimed wood. Bamboo’s rapid renewability and strength make it a favored alternative to traditional hardwoods, whereas recycled wood appeals to eco-conscious buyers seeking authenticity and a lower carbon footprint.

Sales channel dynamics highlight the interplay between offline and online avenues. Physical furniture stores and specialty retailers continue to emphasize tactile experiences and personalized consultations, while e-commerce platforms and brand websites leverage augmented reality tools that allow customers to visualize eco-friendly pieces in their own spaces. End-user segmentation reveals distinct commercial and residential imperatives, from hospitality projects demanding robust, sustainable fixtures to home consumers prioritizing low-VOC finishes and recycled upholstery.

Distribution channel analysis illustrates the roles of direct sales, distributors, retailers, and wholesalers in ensuring product availability and service quality. Pricing segmentation demonstrates a spectrum ranging from economy to premium offerings, reflecting divergent consumer willingness to pay for sustainable credentials. Finally, application and style segmentation captures indoor comforts in living rooms and offices alongside outdoor furnishings for patios and gardens, with contemporary, modern, rustic, and traditional aesthetics accommodating evolving tastes.

This comprehensive research report categorizes the Eco-Friendly Furniture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Price Range

- Style

- Application

- End User

- Sales Channel

Exploring regional dynamics across the Americas, Europe Middle East Africa, and Asia-Pacific that influence demand, supply chains, and sustainability priorities

In the Americas, the eco-friendly furniture sector is deeply influenced by shifting consumer values and policy frameworks. U.S. stakeholders face a balancing act between supportive state-level incentives and the challenges posed by federal tariff variations. Industry associations report that North American furniture manufacturing contributes nearly $15 billion to the economy and targets specialized exports worth $1.75 billion annually, underscoring the region’s economic significance and its vulnerability to trade policy shifts.

Europe, the Middle East, and Africa (EMEA) are characterized by rigorous climate policies and ambitious sustainability targets. The European Union’s commitment to cut net greenhouse gas emissions by at least 55% by 2030 and to become climate neutral by 2050 drives demand for certified sustainable products. Regulatory tools such as the circular economy action plan and the Carbon Border Adjustment Mechanism ensure that imported furnishings meet strict environmental standards, creating a competitive edge for compliant manufacturers.

Asia-Pacific markets are experiencing rapid urbanization and increasing disposable incomes, fueling demand for eco-friendly furniture innovations. Notably, recent U.S. tariff adjustments have reduced duties on Chinese furniture imports to a 10% base rate, temporarily easing cost pressures for importers seeking to incorporate bamboo, rattan, and recycled wood designs into their offerings. This tariff reprieve, combined with regional sustainability initiatives in countries such as Australia and Japan, supports growth in circular product lines and green manufacturing practices.

This comprehensive research report examines key regions that drive the evolution of the Eco-Friendly Furniture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering how leading brands and manufacturers are leveraging sustainability, innovation, and circular economy principles to drive competitiveness

Leading market participants exemplify the integration of sustainability, innovation, and circularity. IKEA has advanced its climate agenda with a 5% reduction in its total climate footprint year-on-year and a 28% decrease compared to its 2016 baseline, driven by renewable energy investments and material efficiency measures. Its strengthened climate targets, validated by the Science-based Targets initiative, aim for a 50% emissions cut by 2030 while scaling buyback services and modular designs to promote product longevity.

MillerKnoll, encompassing Herman Miller and Knoll brands, is pioneering chemical-free furniture by eliminating PFAS from its North American portfolio by 2027. Collaborations with designers such as John Pawson on the Drift Sofa illustrate how plant-derived latex foam and responsibly sourced timber blends can merge minimalist aesthetics with ecological principles. The company’s Em-brace of circular programs and material transparency tools further cements its leadership in sustainable office and home furnishings.

Steelcase has made audacious commitments, publishing an industry-first net-zero transition plan that targets a 90% reduction in carbon emissions across its value chain by 2050. Its 2024 Impact Report highlights a 30% cut in operational emissions since 2020, expanded availability of CarbonNeutral® certified products, and an average of 40% recycled content in packaging. By engaging suppliers in science-based targets and pursuing BIFMA LEVEL® certifications, Steelcase demonstrates how rigorous environmental standards can drive competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Eco-Friendly Furniture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashley Furniture Industries, LLC

- Bassett Furniture Industries, Inc.

- Crate & Barrel

- Dare Studio Ltd.

- DEDON GmbH

- EcoBalanza

- Ethan Allen Interiors Inc.

- Flexsteel Industries, Inc.

- Haworth, Inc.

- Ingka Holding B.V.

- MillerKnoll, Inc.

- Steelcase Inc.

- Teknion Corporation

Delivering strategic recommendations for industry leaders to optimize sustainable practices, streamline supply chains, and capitalize on emerging trends

Industry leaders should prioritize the adoption of circular design frameworks that enable product disassembly, refurbishment, and material recovery. By integrating modularity and standardized components, manufacturers can reduce waste and lower end-of-use processing costs. Strategic partnerships with certified recycling facilities and take-back initiatives will enhance brand reputation and contribute to a closed-loop ecosystem.

To mitigate tariff-driven cost fluctuations, companies must diversify supply chains across multiple regions and explore free trade zones or nearshoring opportunities. Leveraging trade agreements such as the USMCA and pursuing tariff exemptions for sustainable materials can safeguard margins while supporting domestic manufacturing resurgence.

Investing in digital traceability platforms will enhance transparency, enabling consumers and B2B buyers to verify the provenance, carbon footprint, and chemical composition of furniture products. Such tools not only fulfill regulatory compliance but also reinforce consumer trust amid growing demands for product authenticity and environmental accountability.

Finally, brands can strengthen their market position through value-based storytelling and certification labels. Demonstrating alignment with recognized standards-such as Forest Stewardship Council, Cradle to Cradle, or CarbonNeutral®-will allow companies to differentiate offerings, command premium price ranges, and solidify long-term customer loyalty.

Detailing the robust research methodology integrating primary interviews, extensive secondary sources, and rigorous data analysis techniques

The research methodology underpinning this report combines qualitative and quantitative approaches to ensure comprehensive market perspectives and actionable insights. Primary research consisted of structured interviews with executives from leading furniture manufacturers, distributors, and sustainability experts. These dialogues provided first-hand accounts of strategic priorities, operational challenges, and emerging product innovations.

Secondary research incorporated analysis of public company disclosures, government policy documents, and industry association reports. Key sources included corporate sustainability and climate reports, official tariff announcements, and regulatory filings. This phase also involved reviewing academic papers, market journals, and reputable news outlets to validate trends and legislative impacts.

Data triangulation techniques ensured robustness and reliability, cross-referencing figures and qualitative inputs from multiple stakeholder groups. Desk research was supplemented by trade show observations and supplier audits to capture the latest material technologies and circular design practices. Insights were synthesized using application-specific frameworks, including SWOT analyses, Porter’s Five Forces, and segmentation matrices, to structure findings and recommendations systematically.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Eco-Friendly Furniture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Eco-Friendly Furniture Market, by Product Type

- Eco-Friendly Furniture Market, by Material

- Eco-Friendly Furniture Market, by Price Range

- Eco-Friendly Furniture Market, by Style

- Eco-Friendly Furniture Market, by Application

- Eco-Friendly Furniture Market, by End User

- Eco-Friendly Furniture Market, by Sales Channel

- Eco-Friendly Furniture Market, by Region

- Eco-Friendly Furniture Market, by Group

- Eco-Friendly Furniture Market, by Country

- United States Eco-Friendly Furniture Market

- China Eco-Friendly Furniture Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2862 ]

Summarizing key findings and emphasizing the strategic importance of sustainability and circularity in the future of eco-friendly furniture markets

The eco-friendly furniture sector stands at the intersection of evolving consumer preferences, regulatory imperatives, and technological breakthroughs. Market participants who embrace circular economy models and align with stringent environmental standards will capture new growth opportunities and build resilient supply chains. While tariff uncertainties raise cost pressures, strategic diversification and trade agreement leverage can mitigate headwinds and maintain competitive edge.

Key market segments-from platform beds to modular seating and console tables-are experiencing renewed innovation as designers experiment with fast-growing materials like bamboo and recycled composites. Regional nuances, such as North American manufacturing capabilities and EMEA’s rigorous climate policies, will require tailored strategies that reflect local market dynamics and policy frameworks.

Ultimately, collaboration across the value chain-spanning raw material suppliers, product designers, logistics partners, and end customers-will define the next phase of sustainable transformation. By prioritizing transparency, chemical safety, and closed-loop practices, industry leaders can secure long-term value creation for stakeholders and contribute to a healthier planet.

Engage with Ketan Rohom to unlock comprehensive market research insights and empower strategic decision-making in eco-friendly furniture industry investments

Ready to elevate your strategic planning with in-depth market intelligence, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to purchase the comprehensive market research report and gain a competitive advantage in the eco-friendly furniture sector.

- How big is the Eco-Friendly Furniture Market?

- What is the Eco-Friendly Furniture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?