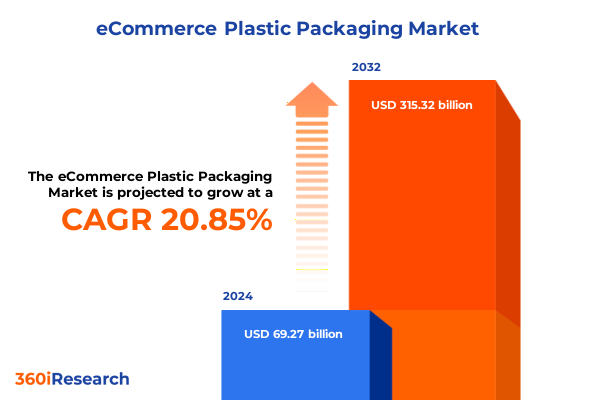

The eCommerce Plastic Packaging Market size was estimated at USD 84.03 billion in 2025 and expected to reach USD 101.09 billion in 2026, at a CAGR of 20.79% to reach USD 315.32 billion by 2032.

Compelling Opening Overview of eCommerce Plastic Packaging Dynamics Driven by Sustainability Imperatives and Digital Consumer Expectations

The landscape of eCommerce plastic packaging is undergoing rapid transformation as consumer preferences, technological innovation, and sustainability imperatives converge to redefine market expectations. Online shoppers now demand packaging that not only protects products during transit but also aligns with environmental and convenience priorities. As a result, packaging designers are challenged to balance lightweight materials, durability, and branding opportunities while minimizing carbon footprints.

Against this backdrop, eCommerce retailers and brand owners are investing in novel materials, processes, and supply chain strategies to meet these heightened requirements. Demand for optimized dimensional weight metrics and reduced packaging waste has spurred the adoption of multi-layer films and high-performance resins, driving manufacturers to enhance barrier properties without compromising recyclability. Consequently, stakeholders across the value chain are forging partnerships to innovate and scale solutions that address both logistical and ecological considerations.

Building on these trends, decision-makers must align product design, procurement, and fulfillment strategies with evolving regulatory frameworks and consumer attitudes. By anticipating shifts in digital commerce models and sustainability standards, market participants can position themselves for long-term resilience. This report provides a comprehensive executive summary of the transformative forces reshaping eCommerce plastic packaging, equipping industry leaders with the insights needed to navigate complexity and capture emerging opportunities.

Unveiling the Major Transformations Reshaping eCommerce Plastic Packaging Through Technological Innovation and Regulatory Evolution

The eCommerce plastic packaging sector is experiencing a series of seismic shifts driven by technological breakthroughs and regulatory evolution. Digitally enabled manufacturing techniques, such as on-demand printing and digital prototyping, are streamlining production cycles and enabling rapid customization for direct-to-consumer channels. Simultaneously, the rise of smart packaging solutions-integrating QR codes, RFID tags, and sensors-is enhancing consumer engagement and traceability across the supply chain.

In parallel, regulatory authorities are introducing more stringent requirements to curb plastic waste and promote circularity. Extended producer responsibility mandates and pledges to reduce single-use plastics have compelled brands to adopt recycled and bio-based resins, driving significant research and development investments. Moreover, the acceleration of carbon disclosure frameworks and producer tax schemes has elevated environmental performance to a board-level priority.

Furthermore, consumer education and activation campaigns are reshaping purchasing behavior, leading to rising demand for minimalistic packaging designs and take-back schemes. As sustainability credentials become critical differentiators, companies are leveraging life-cycle analysis tools to quantify environmental footprints and inform material selection. These convergent trends underscore the imperative for agile innovation and collaborative ecosystems to thrive in the redefined eCommerce plastic packaging landscape.

Assessing the Cumulative Effects of United States Tariff Measures on eCommerce Plastic Packaging Costs and Supply Chain Viability in 2025

Assessing the cumulative impact of new United States tariff measures in 2025 reveals a pronounced effect on raw material costs and supply chain configurations for eCommerce plastic packaging stakeholders. The continuation of Section 301 duties on selected polymer imports, alongside additional levies on specialized films and barrier coatings, has elevated landed costs for plastic resin and finished packaging products. This has prompted many brand owners to revisit sourcing strategies and explore alternative regional suppliers to mitigate cost increases.

In response to higher import duties, several packaging converters have accelerated reshoring initiatives, establishing or expanding domestic extrusion and molding facilities. By investing in North American production capacities, companies aim to maintain competitive lead times and reduce exposure to fluctuating tariff rates. However, this regionalization trend carries its own challenges, including labor availability, capital expenditure intensity, and potential capacity constraints during peak eCommerce seasons.

Consequently, organizations are deploying advanced analytics to optimize inventory positioning and dynamic replenishment, thereby buffering against tariff-induced price volatility. Collaborative contracts, multi-tier supplier networks, and strategic hedging approaches have emerged as critical mechanisms to distribute risk and preserve margin integrity. As these policies continue into 2025, companies that proactively adjust procurement, manufacturing, and distribution modalities are better positioned to sustain growth and profitability under shifting trade regimes.

Deriving Strategic Clarity from Multi-Dimensional Segmentation of Packaging Type Material Composition End-Use Industries Product Form and Channel Dynamics

Insight into the packaging type dimension reveals that flexible packaging solutions have gained prominence, driven by their lightweight characteristics and cost efficiencies in eCommerce logistics. Within this category, bags, films, pouches, and sheets have each carved out specialized applications-from protective mailers to high-barrier pouches for perishables. In tandem, rigid packaging formats, encompassing bottles, containers, jars, and trays, continue to serve markets requiring structural integrity and reusability, notably in premium personal care and healthcare applications.

Material composition represents another critical axis of differentiation, with high-density polyethylene and low-density polyethylene underpinning many base films, while polyethylene terephthalate and polypropylene are favored for their strength, clarity, and recyclability. Polystyrene and polyvinyl chloride maintain niche applications where rigidity, barrier performance, or transparency are paramount. As brand stewardship intensifies, sustainable variants of these polymers, including post-consumer recycled resins and chemically recycled feedstocks, are achieving greater adoption across the value chain.

The end-use industry segmentation underscores the dominant role of food and beverage in eCommerce plastic packaging demand, with bottled water, carbonated drinks, dairy products, and frozen foods requiring specialized barrier and thermal properties. Healthcare applications, spanning diagnostics, medical devices, pharmaceuticals, and supplies, demand strict regulatory compliance and material traceability. Adjacent sectors such as cosmetics and personal care, electronics, automotive, and agriculture contribute to diversified demand profiles.

Product form segmentation mirrors packaging type categories, reaffirming the primacy of flexible formats for lightweight, form-fitting solutions and the consistent relevance of rigid vessels for user convenience and product protection. Meanwhile, sales channel analysis highlights the importance of platforms facilitating bulk transactions as well as consumer-facing channels. B2B portals provide efficient procurement for enterprise buyers, while brand websites and leading online retailers-including national chains-emphasize consumer reach. Platform merchants, from global marketplaces to niche eCommerce aggregators, extend market access and drive volume through integrated logistics and promotional tools.

This comprehensive research report categorizes the eCommerce Plastic Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Material Type

- Product Form

- End-Use Industry

Uncovering Regional Growth Dynamics from the Americas through Europe Middle East Africa and into Asia Pacific for Informed Packaging Strategy Alignment

Regional dynamics in the eCommerce plastic packaging sphere are shaped by diverse market drivers across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, North American demand is propelled by high eCommerce penetration and extensive distribution networks, prompting innovations in lightweight mailers and hybrid cushioning systems to optimize last-mile delivery.

Europe, the Middle East, and Africa collectively exhibit a dual focus on regulatory compliance and emerging market expansion. The European Union’s single-use plastic directives and advanced recycling infrastructure have spurred closed-loop initiatives, while Middle Eastern markets leverage free-zone logistics to serve both regional and global eCommerce channels. Across Africa, growing digital adoption is creating nascent opportunities for cost-effective packaging tailored for infrastructure constraints.

In Asia-Pacific, rapid growth in online retail across China, India, and Southeast Asia has driven unprecedented demand for both standard and customized packaging formats. Regional manufacturers are scaling capacity for films and rigid containers to meet local brand requirements, while cross-border eCommerce flows intensify trade between markets. Strategic partnerships between global converters and local players are enabling faster market entry and product localization.

Altogether, these regional insights highlight the necessity for adaptable supply chains that can reconcile regulatory frameworks, distribution complexities, and consumer preferences. Stakeholders must leverage local expertise while maintaining global consistency to capture opportunities across varied economic and cultural landscapes.

This comprehensive research report examines key regions that drive the evolution of the eCommerce Plastic Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Advantages and Strategic Moves of Leading Enterprises Shaping the eCommerce Plastic Packaging Market Landscape

Leading enterprises in the eCommerce plastic packaging sector are differentiating through a blend of technology investments, sustainable product development, and strategic partnerships. Global resin producers and converters are channeling R&D budgets into bio-based and mechanically recycled resins, positioning themselves ahead of regulatory mandates and consumer expectations for circular materials.

Simultaneously, packaging specialists are expanding digital manufacturing capabilities. Advanced engraving and inkjet printing solutions enable high-resolution graphics on films and rigid substrates, facilitating personalized packaging and agile assortment management. These capabilities reduce lead times for new product introductions while minimizing tooling costs and material waste.

Mergers and acquisitions have also reshaped the competitive arena, with larger entities integrating niche players to broaden their product portfolios and geographic footprint. Collaborative alliances between packaging firms and waste-management providers are creating streamlined take-back programs, reinforcing brand commitments to extended producer responsibility.

Furthermore, select companies are deploying data analytics platforms to provide clients with real-time dashboards on order velocity, return rates, and packaging performance metrics. By leveraging these insights, brand owners can fine-tune packaging specifications, negotiate better logistics rates, and enhance the overall customer experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the eCommerce Plastic Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Berry Global Group, Inc.

- CCL Industries Inc.

- Cosmo Films Limited

- DS Smith Plc

- EPL Limited

- Huhtamaki Oyj

- Jindal Poly Films Limited

- Manjushree Technopack Limited

- Mondi plc

- Polyplex Corporation Limited

- Pregis LLC

- ProAmpac LLC

- Pyramid Technoplast Private Limited

- Sealed Air Corporation

- Shiprocket Packaging Private Limited

- Sonoco Products Company

- Storopack Hans Reichenecker GmbH

- Time Technoplast Limited

- Uflex Limited

Delivering Tactical Recommendations to Propel Industry Leadership and Foster Innovation in eCommerce Plastic Packaging Amid Rising Market Challenges

To navigate the complexities of eCommerce plastic packaging, industry leaders should prioritize investments in sustainable materials and closed-loop recycling partnerships. Collaborating with recycling specialists and integrating post-consumer content into film and container production not only meets regulatory thresholds but also resonates with eco-conscious consumers.

In parallel, brands and converters must embrace digital finishing technologies to streamline customization and reduce minimum order requirements. Implementing on-demand printing infrastructures allows for rapid design iterations, tailored promotions, and localized campaigns, driving consumer engagement without inflating inventory risk.

Supply chain diversification is equally crucial. Establishing multi-region sourcing frameworks and near-shore production sites can cushion against tariff volatility and logistical disruptions. Companies should also leverage predictive analytics to optimize inventory allocation and dynamically rebalance stock in response to demand fluctuations.

Finally, fostering cross-sector collaborations-between packaging, logistics, and consumer goods partners-can uncover innovative delivery models and reusable packaging pilots. By sharing learnings and aggregating volumes, participants can lower costs, accelerate adoption of sustainable practices, and reinforce brand differentiation in a crowded eCommerce marketplace.

Describing Rigorous Research Methodology Employed to Ensure Comprehensive Analysis of eCommerce Plastic Packaging Market Variables and Qualitative Insights

This study employs a rigorous, mixed-methodology framework to ensure comprehensive coverage of market variables and qualitative insights. Primary research includes in-depth interviews with executive stakeholders across packaging, retail, and logistics, as well as structured surveys of procurement professionals and packaging engineers. These engagements probe strategic priorities, material selection criteria, and operational challenges in eCommerce contexts.

Secondary research sources encompass publicly available regulatory documentation, trade association reports, patent filings, and corporate sustainability disclosures to triangulate market trends. A detailed segmentation framework was developed to categorize data across packaging type, material composition, end-use application, product form, and sales channel dimensions.

Quantitative analysis involves synthesizing shipment volumes, import/export statistics, and trade data to gauge supply trends and tariff impacts. Concurrently, qualitative expert panels validate findings, identify emerging technologies, and assess regional nuances in adoption and compliance.

Throughout the research process, data integrity is maintained through cross-validation techniques and continuous review by subject-matter specialists. This methodological rigor underpins the strategic perspectives presented in this report, ensuring both depth and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our eCommerce Plastic Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- eCommerce Plastic Packaging Market, by Packaging Type

- eCommerce Plastic Packaging Market, by Material Type

- eCommerce Plastic Packaging Market, by Product Form

- eCommerce Plastic Packaging Market, by End-Use Industry

- eCommerce Plastic Packaging Market, by Region

- eCommerce Plastic Packaging Market, by Group

- eCommerce Plastic Packaging Market, by Country

- United States eCommerce Plastic Packaging Market

- China eCommerce Plastic Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Presenting a Comprehensive Conclusion That Synthesizes Critical Findings and Reinforces Strategic Imperatives for eCommerce Plastic Packaging Stakeholders

Through this executive summary, key findings around sustainability drivers, technological innovation, segmentation nuances, regional dynamics, and corporate strategies have been synthesized to illuminate the evolving eCommerce plastic packaging landscape. Stakeholders are advised to integrate sustainability goals with digital customization capabilities to meet consumer expectations and regulatory demands.

The cumulative impact of 2025 tariff measures underscores the importance of supply chain agility and cost mitigation tactics, while segmentation insights reveal distinct growth pockets across flexible and rigid formats, material types, and end-use industries. Regional analyses spotlight unique market drivers and compliance considerations spanning the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Leading organizations are forging competitive advantages through R&D investments, M&A activities, and data-driven performance management, setting a high bar for innovation and operational excellence. As market participants refine strategies, the strategic imperative lies in balancing efficiency, sustainability, and consumer engagement in an increasingly complex eCommerce ecosystem.

Ultimately, the ability to adapt packaging designs, diversify sourcing, and collaborate across the value chain will determine success in capturing the next phase of growth in eCommerce plastic packaging.

Encouraging Immediate Engagement with Ketan Rohom Associate Director Sales & Marketing to Secure the Comprehensive eCommerce Plastic Packaging Research Report

For personalized guidance and to secure immediate access to the comprehensive eCommerce plastic packaging market research report, contact Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to explore exclusive insights tailored to your organization’s strategic goals, and leverage in-depth analysis on segmentation, regional dynamics, and competitive benchmarking to stay ahead of industry trends. Reach out today to discuss custom packages, licensing options, and value-added services that align with your growth objectives and decision-making timelines. Empower your team with the intelligence needed to optimize supply chains, accelerate product innovation, and drive sustainable practices within the evolving eCommerce plastic packaging space.

- How big is the eCommerce Plastic Packaging Market?

- What is the eCommerce Plastic Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?