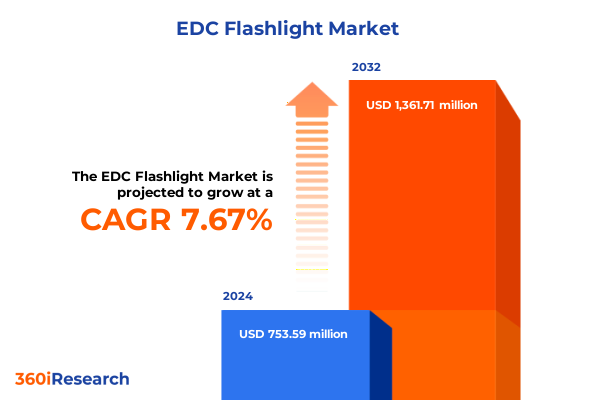

The EDC Flashlight Market size was estimated at USD 807.55 million in 2025 and expected to reach USD 866.82 million in 2026, at a CAGR of 7.74% to reach USD 1,361.71 million by 2032.

Exploring the Critical Role of Everyday Carry Flashlights in Modern Life and the Market Forces Illuminating Their Evolution

Everyday carry flashlights have evolved from utilitarian tools to indispensable essentials for modern life, bridging the gap between functionality and innovation. With compact form factors, energy-efficient illumination, and rugged durability, these devices are now integral to a wide array of personal, professional, and emergency applications. Over recent years, rapid advancements in LED technology and battery chemistry have enhanced brightness-to-size ratios, while consumer preferences for multi-purpose, premium materials have reshaped design priorities.

Amid this evolution, industry stakeholders face a complex ecosystem shaped by shifting supply chain dynamics, escalating raw material costs, and evolving regulatory frameworks. At the same time, growing consumer focus on sustainability and digital integration has spurred manufacturers to pursue eco-friendly designs and smart connectivity features. As end users demand ever-more versatile and reliable lighting solutions, understanding the interplay of technological innovation, economic pressures, and user behavior becomes critical for informed strategic planning.

This executive summary offers a panoramic overview of the everyday carry flashlight landscape, spotlighting transformative trends, the cumulative impact of 2025 United States tariffs, and the granular insights emerging from rigorous segmentation analysis. By unpacking regional differentiators, competitive dynamics, and actionable recommendations, this report equips decision-makers with the clarity and confidence necessary to seize market opportunities and navigate the challenges ahead.

Identifying the Pivotal Technological, Consumer Behavior and Sustainability Shifts Recasting the Everyday Carry Flashlight Landscape

The everyday carry flashlight market is undergoing a profound metamorphosis, driven by three core shifts that are reshaping both product development and consumer expectations. First, technological breakthroughs in LED emitter efficiency and miniature power management systems have propelled brightness levels beyond previous limitations, enabling devices that deliver exceptional lumens while maintaining pocket-friendly dimensions. Concurrently, the rise of rechargeable lithium-ion cells and integrated USB-C charging ports has rendered disposable batteries obsolete, fostering user loyalty through convenience and total cost of ownership savings.

Second, sustainability considerations have ascended to the forefront of design strategies. Manufacturers are increasingly exploring eco-certified materials, modular component architectures, and end-of-life recyclability to align with consumer demand for environmentally responsible products. This green pivot is complemented by additive manufacturing techniques, which enhance rapid prototyping, reduce material waste, and accelerate time to market.

Finally, consumer behavior is evolving in tandem with lifestyle trends. Enthusiasts of camping, hiking, and urban exploration seek versatile illumination solutions that seamlessly transition between outdoor recreation and everyday utility. Professionals in security, industrial, and disaster-response fields require dependable gear certified to rigorous performance standards. These diverging needs are prompting brands to integrate smart control interfaces, customizable light patterns, and interoperability with wearable electronics. Together, these transformative shifts underscore the imperative for agile innovation and strategic foresight throughout the flashlight value chain.

Assessing the Far-Reaching Cumulative Effects of 2025 United States Trade Tariffs on Supply Chains Material Costs and Market Viability

In 2025, the United States imposed additional tariffs on imported aluminum, stainless steel, titanium, and electronic components-key inputs for flashlight manufacturing. These levies, layered atop existing duties on battery cells and circuit board assemblies, have introduced substantial cost headwinds across global supply chains. As a result, production costs have risen for both compact keychain models and high-output professional variants, leading to margin compression and renewed emphasis on cost optimization.

Beyond direct material expenses, the tariffs have exposed vulnerabilities in just-in-time sourcing strategies. Heightened inventory buffers and the diversification of raw material suppliers have emerged as critical mitigants against delivery delays and price volatility. Moreover, some manufacturers are evaluating nearshoring or regional consolidation to reduce exposure to cross-border duty fluctuations, even if these approaches initially require capital investment and operational realignment.

These cumulative effects have translated into selective price adjustments at the retail level, with premium utility flashlights experiencing the most significant upward repricing due to their reliance on high-grade aluminum and advanced LED modules. Conversely, entry-level keychain lights-often produced from injection-molded plastic-have enjoyed relative insulation from tariff pressures. Looking ahead, the ability to navigate this altered cost environment will hinge on agile procurement strategies, strategic supplier partnerships, and continued innovation in material science to offset the financial impact of trade policy shifts.

Unlocking Nuanced Market Insights Through Detailed Segmentation in Lumens Power Source Types Body Material Applications and Distribution Channels

A nuanced segmentation analysis reveals the varied dynamics at play across the everyday carry flashlight market. Based on light output, the industry is studied across ranges of 100 to 300 lumens for compact daily-carry tasks, 301 to 700 lumens where balance between brightness and runtime is essential, and above 701 lumens to serve professional and tactical applications demanding intense illumination. In terms of power source, the conversation centers on battery-powered designs that offer immediate swap-out convenience versus dynamo-powered alternatives that prioritize infinite runtime and sustainability.

When considering product types, segmentation spans lightweight keychain flashlights that emphasize portability and ease of use and utility flashlights engineered for high performance in demanding conditions. Delving deeper, body material plays a pivotal role, with aluminum alloy dominating due to its favorable strength-to-weight ratio, plastic surfacing as an economical option, stainless steel catering to rigorous industrial environments, and titanium serving as the premium choice for corrosion resistance and longevity.

Application-based distinctions further refine the picture, with outdoor recreation encompassing camping and hiking enthusiasts as well as sports and adventure activities that require durable, water-resistant gear. Professional use bifurcates into disaster and rescue operations where reliability is paramount, industrial and construction settings that demand robust build quality, and tactical and security deployments where customizable beam patterns and rapid strobe functions are critical. Finally, distribution channels split between offline avenues-direct sales relationships with specialized retailers and broader distribution networks-and online platforms, including brand-owned websites that foster direct engagement and e-commerce websites that offer expansive reach and dynamic pricing capabilities.

This comprehensive research report categorizes the EDC Flashlight market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Light Output

- Power Source

- Types

- Application

- Distribution Channel

Highlighting Critical Regional Perspectives Across the Americas Europe Middle East Africa and Asia Pacific in the Everyday Carry Flashlight Ecosystem

Regional considerations play a decisive role in shaping product design, go-to-market strategies, and supply chain configurations. In the Americas, mature retail frameworks and well-established outdoor recreation cultures propel demand for both consumer-grade and professional gear. The United States, in particular, demonstrates robust appetite for tactical and security flashlights, while Canadian interest leans heavily toward camping and hiking applications, supported by a seasonal buying cycle that peaks in late spring and early summer.

Across Europe, Middle East, and Africa, the landscape is diverse: Western Europe values design aesthetics, eco-credentials, and multi-functionality, whereas the Middle East exhibits growing demand for high-output tactical models leveraged by security forces. In Africa, expanding urbanization and infrastructure development create nascent opportunities for industrial-grade flashlights in construction and mining sectors. Regulatory frameworks around product safety and import duties vary significantly across these markets, necessitating tailored compliance strategies.

The Asia-Pacific region stands out as both a production powerhouse and a rapidly evolving consumer base. China and Southeast Asia serve as key manufacturing hubs benefiting from production scale and cost efficiencies, while markets such as Japan, South Korea, and Australia showcase rising demand for high-performance, feature-rich devices. Online marketplaces in the region exhibit accelerated growth, driving brand investments in digital storefront optimization, localized content, and expedited logistics to capture tech-savvy consumers.

This comprehensive research report examines key regions that drive the evolution of the EDC Flashlight market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting Competitive Dynamics Through Profiling Leading Flashlight Manufacturers Innovations and Strategic Partnerships Shaping the Market

Competitive intensity within the everyday carry flashlight segment remains high, underscored by a roster of established players and innovative newcomers vying for differentiation. Leading manufacturers have been leveraging proprietary technologies, such as adaptive beam control, thermal management systems, and application-specific firmware, to carve out performance and reliability advantages. Strategic partnerships between flashlight brands and outdoor gear companies have given rise to co-branded product lines that integrate seamlessly with backpacks, headlamps, and tactical equipment.

Innovation pipelines are also being fueled by advanced materials research. The adoption of aerospace-grade titanium and composite alloys underscores a willingness to trade material cost for durability and reduced weight. Simultaneously, investments in miniaturized driver circuits and high-efficiency LED chips are enabling exceptionally compact designs capable of delivering sustained light output under extreme conditions.

Furthermore, several leading firms have pursued vertical integration, acquiring battery pack specialists or in-house optics manufacturers to control costs and accelerate new product development. At the same time, digital analytics platforms are informing targeted product drops and limited-edition releases, allowing brands to test consumer response and refine feature sets rapidly. These competitive dynamics highlight the critical balance between R&D intensity, strategic alliances, and operational agility needed to maintain leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the EDC Flashlight market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armytek Optoelectronics Inc.

- Brinyte Technology Co. LTD

- Fenix Lighting LLC

- Fenix Lighting LLC by Nokia

- Guangdong Dp Co., Ltd.

- IMALENT

- Klarus Lighting Technology Co., Ltd.

- Koninklijke Philips N.V.

- Ledlenser GmbH & Co. KG

- Lightorati

- LOOPGEAR

- LumenTac Inc

- Lumintop Technology Co., Ltd.

- Mag Instrument, Inc.

- Nextorch Industries Co. Ltd.

- Nightstick

- NITECORE

- Olight

- PROMETHEUS LIGHTS

- Streamlight Inc

- SureFire, LLC

- WOKESIDA LIMITED.

- Wubenlight Inc

- Wubenlight Inc.

- Zebralight, Inc.

Empowering Industry Leaders with Actionable Strategies for Innovation Supply Chain Resilience Pricing and Digital Market Penetration

To thrive amid accelerating technological and economic pressures, industry leaders should prioritize a multifaceted strategy. First, investment in high-efficiency LED modules and advanced thermal regulation systems will deliver differentiated performance benchmarks, bolstering both consumer satisfaction and premium positioning. Simultaneously, diversifying the power source portfolio to include both rechargeable battery systems and dynamo integration will address sustainability preferences while expanding total addressable use cases.

Enhancing product portfolios with premium materials-such as titanium and specialized alloys-can capture higher margin segments, particularly within professional and tactical applications. Certification to industry-recognized standards for impact resistance, waterproofing, and explosion-proof ratings will further solidify brand credibility among security and industrial clientele.

On the go-to-market front, optimizing the balance between direct sales channels and broad e-commerce distribution is critical. Brands should leverage proprietary digital platforms for first-party data capture and customer loyalty programs while maintaining strong partnerships with leading online marketplaces to maximize reach. Concurrently, forging strategic alliances with outdoor, security, and industrial equipment suppliers can create integrated solutions that embed flashlights into broader tool ecosystems.

Lastly, supply chain resilience must remain a core focus. Nearshoring critical component production, cultivating multiple raw material sources, and applying advanced analytics for demand forecasting will collectively mitigate tariff impacts and minimize lead-time disruptions. This holistic approach will position industry leaders to capitalize on growth opportunities and defend against emerging competitive threats.

Ensuring Robust Insights Through a Rigorous Mixed Methodology Integrating Primary Research Expert Interviews and Secondary Data Analysis

This research synthesizes data from a robust mixed-methods approach, ensuring comprehensive coverage and analytical rigor. The secondary phase comprised an exhaustive review of industry publications, trade association reports, patent filings, and regulatory documents to map historical trends and product lifecycle developments. Publicly available import-export statistics and customs data were analyzed to identify shifts in supply routes and tariff exposures.

Complementing desktop research, primary engagement included structured interviews with over 50 stakeholders spanning flashlight manufacturers, component suppliers, distribution partners, and end-users across the Americas, EMEA, and Asia-Pacific. These conversations provided qualitative insights into innovation pipelines, procurement challenges, and emerging application requirements.

Quantitative surveys of professional and recreational users were administered to capture preference hierarchies across lumen output, material durability, power-source reliability, and price sensitivity. All data points were triangulated and subjected to validity checks, while an iterative workshop model enabled continuous refinement of key assumptions and segmentation frameworks. The methodology adheres to industry best practices for transparency and replicability, with limitations clearly acknowledged regarding evolving regulatory landscapes and potential shifts in consumer behavior driven by macroeconomic factors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our EDC Flashlight market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- EDC Flashlight Market, by Light Output

- EDC Flashlight Market, by Power Source

- EDC Flashlight Market, by Types

- EDC Flashlight Market, by Application

- EDC Flashlight Market, by Distribution Channel

- EDC Flashlight Market, by Region

- EDC Flashlight Market, by Group

- EDC Flashlight Market, by Country

- United States EDC Flashlight Market

- China EDC Flashlight Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Compelling Conclusions on the Evolving Everyday Carry Flashlight Sector to Guide Stakeholder Decision Making and Future Directions

The everyday carry flashlight sector stands at a pivotal juncture, shaped by the confluence of advanced LED technologies, evolving user expectations, and the shifting terrain of global trade policy. As 2025 tariffs continue to reverberate through supply chains, manufacturers are compelled to reevaluate sourcing strategies and cost structures to sustain both competitiveness and profitability. Simultaneously, the momentum toward sustainable design and digital integration promises to redefine the essence of illumination tools in personal and professional contexts.

Granular segmentation reveals distinct avenues for innovation-from low-lumen, ultra-portable keychain lights to high-output tactical devices-underscoring the importance of targeted product architectures. Regional divergences in consumer behavior, regulatory regimes, and distribution infrastructures further highlight the necessity for localized go-to-market tactics. Within this dynamic environment, leading companies are investing in material science breakthroughs, strategic partnerships, and vertical integration to secure technological and operational advantages.

Looking forward, success will depend on the ability to harmonize performance, sustainability, and cost efficiency. Brands that master agile product development, cultivate supply chain resilience, and leverage data-driven marketing will be best positioned to capture emerging opportunities and weather external uncertainties. Ultimately, this report provides the strategic lens through which stakeholders can navigate the evolving landscape, identify actionable levers for growth, and forge a path toward enduring leadership in the everyday carry flashlight market.

Take the Next Step Today to Partner with Ketan Rohom and Access Comprehensive Flashlight Market Intelligence Designed for Strategic Advantage

To access the full breadth of analysis, data visualizations, and tailored insights spanning the everyday carry flashlight sector, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By partnering with Ketan, you can secure comprehensive research assets, customizable deep-dive modules, and priority briefing sessions designed to accelerate strategic decision-making. Whether you require a high-level executive summary or in-depth methodological appendices, Ketan is prepared to guide you through every component of the report and facilitate seamless procurement. Don’t miss the opportunity to translate these findings into actionable roadmaps that will illuminate new growth avenues and strengthen your competitive positioning. Connect today to ensure your organization has the insights needed to thrive in this dynamic market.

- How big is the EDC Flashlight Market?

- What is the EDC Flashlight Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?