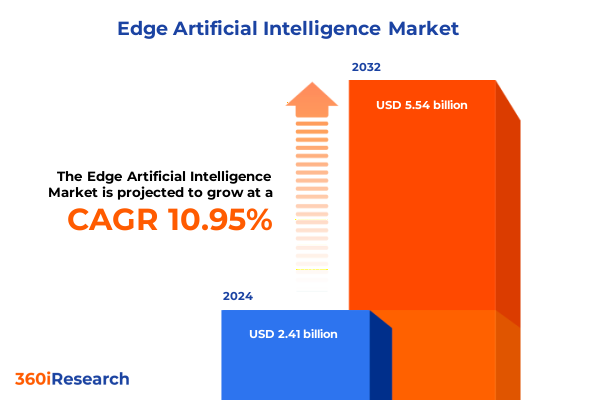

The Edge Artificial Intelligence Market size was estimated at USD 2.64 billion in 2025 and expected to reach USD 2.90 billion in 2026, at a CAGR of 11.15% to reach USD 5.54 billion by 2032.

Captivating overview framing how decentralized intelligence at the network edge transforms real-time data processing and user experiences

The proliferation of Internet of Things devices, coupled with advancements in wireless networks and miniaturized computing, is redefining where and how artificial intelligence processes data. Traditional cloud-based architectures are increasingly strained by the sheer volume of sensor data, leading to latency and bandwidth bottlenecks. Edge Artificial Intelligence shifts compute and inference workloads from centralized servers to distributed edge nodes, enabling real-time analytics and decision-making directly at the source of data generation. This paradigm not only alleviates network congestion but also enhances user experiences by delivering millisecond-level responsiveness, a threshold essential for applications such as autonomous vehicles and industrial automation.

Beyond latency improvements, Edge AI fosters greater data privacy by keeping sensitive information on local devices rather than transmitting raw data to remote data centers. This localized approach aligns with growing regulatory scrutiny and consumer demand for data protection, positioning Edge AI as a strategic enabler for compliance-driven industries. As organizations navigate the complexities of decentralizing AI workloads, the introduction of heterogeneous hardware accelerators, specialized inference chips, and optimized software stacks is accelerating innovation at the network edge. Together, these technological advancements mark the dawn of a new era where intelligence is embedded directly into the fabric of connected devices, unlocking unprecedented opportunities for automation and contextual awareness.

Compelling narrative illustrating how AI models, next-gen networks, and collaborative ecosystems converge to reshape Edge AI deployments

The landscape of Edge Artificial Intelligence is being reshaped by three interconnected forces: the rapid evolution of AI algorithms toward lightweight architectures, the deployment of 5G and private networking solutions at unprecedented scale, and the maturation of edge-native platforms that bridge hardware and software seamlessly. Lightweight neural network models, driven by research into model compression and pruning, now deliver high accuracy with a fraction of the computational footprint, making on-device inference feasible for a wide array of use cases from visual inspection on factory floors to voice assistants in smart homes.

Concurrently, the global rollout of 5G has spurred the adoption of private wireless networks in industrial complexes and campuses, offering the deterministic performance and security required for mission-critical Edge AI deployments. These connectivity breakthroughs, together with containerized edge platforms and orchestration frameworks, are enabling enterprises to manage distributed AI workloads with the same operational rigor as cloud-native environments. Ecosystem partnerships are proliferating, uniting chipmakers, software vendors, and systems integrators to deliver turnkey solutions that abstract the underlying complexity. This convergence of algorithmic innovation, network transformation, and collaborative ecosystems is charting a new frontier where Edge AI becomes an integral component of digital transformation initiatives across industries.

Comprehensive assessment of how evolving U.S. tariff policies in 2025 are reshaping supply chains, costs, and strategic responses across Edge AI

The introduction of broad reciprocal tariffs by the United States in early April 2025 has created a ripple effect across the hardware-dependent ecosystem of Edge AI. The baseline 10% tariff on nearly all imports, coupled with elevated duties on goods from trading partners with persistent deficits, has raised the cost of processors, memory modules, and assembled edge servers. Meanwhile, a targeted levy of 25% or more on all imported semiconductors announced by the administration threatens to significantly increase the expenses associated with AI accelerators and inference chips, as the U.S. imported $139 billion of semiconductors in 2024 alone, 27% of which originated from Taiwan. Despite temporary exemptions for certain electronics, emerging guidance indicates that these relief measures may be short-lived as policymakers seek to bolster domestic manufacturing capacity and reduce foreign dependencies.

The cumulative impact of these policies has extended beyond raw hardware costs. Edge AI software providers are recalibrating pricing models to offset increased infrastructure expenses, with reported adjustments in subscription fees by up to 20%. Supply chain timelines have lengthened, prompting many organizations to diversify sourcing strategies to include alternative manufacturing hubs in South Korea, India, and Vietnam. Simultaneously, federal incentives and public-private partnerships under the CHIPS and Science Act are accelerating investment into U.S.-based fabrication facilities, driving a longer-term shift toward reshoring critical semiconductor value chains. Collectively, these developments underscore the imperative for Edge AI stakeholders to adopt agile procurement practices and to anticipate policy-driven cost fluctuations in their strategic planning.

In-depth exploration of Edge AI market drivers based on hardware, software, services, use cases, and deployment scenarios unveiling hidden opportunities

An effective understanding of Edge AI demands a multifaceted segmentation lens that traces the market across interconnected dimensions of technology offerings, industry applications, deployment modalities, and ecosystem attributes. From a component standpoint, solutions span hardware that incorporates accelerators, memory modules, processors, and storage arrays, services that range from managed to professional consulting, and software that encompasses application suites, middleware frameworks, and platform ecosystems. In terms of industry verticals, Edge AI addresses use cases in automotive fleets-from commercial to passenger vehicles-consumer electronics including smart home devices, smartphones, and wearables, energy and utilities for oil and gas monitoring and smart grid initiatives, healthcare through medical imaging and patient monitoring, manufacturing across automotive, electronics, and food and beverage plants, and retail environments focused on in-store analytics and online personalization.

Application-level segmentation reveals distinct classes of AI workloads driving edge deployments. Anomaly detection spans fraud and intrusion detection for cybersecurity and financial monitoring. Computer vision unlocks facial recognition, object detection, and visual inspection within manufacturing, security, and logistics. Natural language processing powers speech recognition and text analysis capabilities in customer service and voice-activated systems. Predictive analytics delivers demand forecasting and maintenance planning to optimise asset availability. Deployment modalities further differentiate the market across cloud-based services, hybrid architectures, and on-device inference that runs on microcontrollers, mobile devices, and single board computers. Processor types range from ASICs and CPUs-both Arm and x86 architectures-to DSPs, FPGAs, and GPUs, whether discrete or integrated, while node typologies extend from device edge nodes such as IoT, mobile, and wearable devices to fog nodes composed of gateways and routers, and network edge sites like base stations and distributed nodes. Connectivity options include high-speed 5G-public and private-Ethernet, LPWAN, and Wi-Fi standards including Wi-Fi 5 and Wi-Fi 6. Finally, AI model architectures bifurcate into deep learning approaches, including convolutional, recurrent, and transformer networks, and traditional machine learning methods such as decision trees and support vector machines, each tailored for specific latency, accuracy, and resource constraints.

This comprehensive research report categorizes the Edge Artificial Intelligence market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Processor Type

- Node Type

- Connectivity Type

- AI Model Type

- End Use Industry

- Application

- Deployment Mode

Detailed comparative view of regional Edge AI adoption, investment trends, and infrastructural strengths across Americas, EMEA, and Asia-Pacific regions

Regionally, the Americas lead in early adoption of Edge AI, driven by robust investment in North American chip fabrication, extensive private 5G rollouts, and a mature industrial automation ecosystem. Major U.S. technology hubs are piloting applications in manufacturing execution systems and smart city infrastructure, while Latin American markets are experimenting with Edge AI to enhance agricultural yield forecasting and remote education services. Meanwhile, Europe, the Middle East, and Africa demonstrate a mixed landscape: Western Europe benefits from stringent data privacy regulations that bolster local processing, and the Middle East is accelerating smart city projects, notably in Gulf Cooperation Council states, underpinned by sovereign investment funds. Contrastingly, certain African regions face challenges in connectivity and infrastructure, forging a need for solutions optimized for intermittent networks.

Asia-Pacific presents the fastest growth trajectory, with China advancing toward its 2030 AI leadership goals through state-sponsored edge computing initiatives and domestic semiconductor development. Japan, South Korea, and Taiwan continue to foster advanced semiconductor R&D, supporting edge inference accelerators, while Southeast Asian nations leverage Edge AI for logistics optimization in burgeoning e-commerce markets. Across these regions, varied regulatory frameworks, differing infrastructure readiness, and unique industry priorities create a complex mosaic for solution providers, underscoring the importance of regional go-to-market strategies tailored to local technology ecosystems and policy environments.

This comprehensive research report examines key regions that drive the evolution of the Edge Artificial Intelligence market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analytical review of leading industry players steering the evolution of Edge AI through technological innovation, strategic alliances, and ecosystem growth

Leading technology firms are shaping the Edge AI narrative through investments in specialized hardware, software platforms, and ecosystem alliances. Semiconductor innovators are introducing next-generation inference chips designed for low-power edge environments, while cloud providers extend distributed computing stacks and AI services across edge nodes. Systems integrators and managed service vendors are bundling end-to-end solutions that combine network connectivity, security frameworks, and industry-specific algorithms. Collaborative alliances between telecom operators and equipment manufacturers are enabling private network deployments with built-in AI orchestration, and research consortia are standardizing interoperability protocols to reduce integration friction.

Open-source initiatives and developer communities are accelerating edge-native software development kits and reference architectures, lowering the barrier to entry for emerging players. Strategic acquisitions and partnerships among hyperscalers, semiconductor houses, and industrial OT specialists are expanding the addressable market, while flexible licensing models and usage-based pricing are gaining traction. Together, these competitive dynamics reflect a maturing Edge AI landscape where differentiated technology offerings, strategic collaborations, and developer enablement converge to define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Edge Artificial Intelligence market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- Amazon.com, Inc.

- Apple Inc.

- Baidu, Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Lattice Semiconductor Corporation

- MediaTek Inc.

- Microchip Technology Incorporated

- Microsoft Corporation

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Texas Instruments Incorporated

Actionable strategic roadmap enabling industry leaders to navigate disruptive market shifts, supply chain challenges, and regulatory landscapes in Edge AI

Organizations aiming to harness the full potential of Edge AI should prioritize a multifaceted strategy that addresses technology, talent, and governance. First, accelerating investments in on-device inference engines and lightweight model architectures will reduce dependency on high-cost network connectivity and mitigate tariff exposure by enabling local processing. Second, establishing diversified supply chains that encompass alternative semiconductor sources and engaging in public-private partnerships for domestic fabrication can safeguard against policy-driven cost fluctuations.

Third, building cross-functional teams that merge AI research, network engineering, and cybersecurity expertise will ensure seamless integration of edge solutions with existing infrastructures. Fourth, collaborating with telecom and system integration partners on private 5G and hybrid cloud deployments can deliver tailored performance SLAs for critical use cases. Fifth, implementing robust data governance frameworks that enforce encryption, anonymization, and compliance with regional privacy regulations will foster trust and regulatory alignment. Finally, adopting an experimental mindset-through pilot programs and digital twins-will enable rapid validation of new use cases and facilitate scalable roll-outs while controlling risk.

Transparent overview of our rigorous research methodology integrating qualitative insights, quantitative analysis, and expert validation to ensure comprehensive accuracy

This research synthesizes insights from primary interviews with senior technology executives, infrastructure architects, and industry analysts, complemented by secondary research across public filings, technical white papers, and regulatory disclosures. Quantitative data was triangulated through proprietary surveys of end users and vendor performance benchmarks, ensuring both depth and breadth in our analyses. Segmentation frameworks were validated against publicly available product roadmaps and real-world deployment case studies to confirm applicability.

Our study incorporates expert workshops to refine scenario planning around tariff impacts and geopolitical risks, while our thesis on hardware-software co-optimization draws upon peer-reviewed research in edge intelligence. Connectivity trends were informed by telecommunications regulatory filings and operator network expansion reports. All findings underwent rigorous internal peer review, ensuring methodological transparency and actionable clarity for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Edge Artificial Intelligence market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Edge Artificial Intelligence Market, by Component

- Edge Artificial Intelligence Market, by Processor Type

- Edge Artificial Intelligence Market, by Node Type

- Edge Artificial Intelligence Market, by Connectivity Type

- Edge Artificial Intelligence Market, by AI Model Type

- Edge Artificial Intelligence Market, by End Use Industry

- Edge Artificial Intelligence Market, by Application

- Edge Artificial Intelligence Market, by Deployment Mode

- Edge Artificial Intelligence Market, by Region

- Edge Artificial Intelligence Market, by Group

- Edge Artificial Intelligence Market, by Country

- United States Edge Artificial Intelligence Market

- China Edge Artificial Intelligence Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 5088 ]

Final synthesis underscoring critical takeaways from market shifts, tariff impacts, segmentation insights, and regional trends driving the future of Edge AI

Edge Artificial Intelligence stands at a pivotal juncture, driven by the convergence of algorithmic efficiency, advanced network architectures, and evolving policy landscapes. The transformative shifts in hardware miniaturization, service orchestration, and deployment models are enabling a new generation of real-time, privacy-preserving AI applications across industries. However, the ripple effects of U.S. tariff policies in 2025 underscore the need for agile supply chain strategies and cost-management frameworks. Balanced against these challenges, the diverse segmentation insights reveal a wealth of opportunities-from healthcare diagnostics at the point of care to predictive maintenance on factory lines and contextual analytics in smart retail.

Regional nuances further highlight the importance of tailored go-to-market approaches, whether leveraging regulatory incentives in North America, forging public-private collaborations in EMEA, or tapping state-led initiatives in Asia-Pacific. With leading companies advancing novel inference chips, hybrid cloud-edge platforms, and developer ecosystems, the path forward is defined by strategic partnerships and continuous innovation. By aligning action plans with the insights and recommendations presented here, stakeholders can confidently navigate this dynamic market and drive lasting value through Edge AI.

Engaging invitation urging decision makers to partner with Associate Director Sales & Marketing for exclusive Edge AI research access

Mobilize your strategic vision and capitalize on the most comprehensive Edge AI analysis available. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your exclusive access to the full research report. Engage with an expert dedicated to tailoring the insights you need to drive innovation and competitive advantage in Edge Artificial Intelligence. Reach out via our corporate website to schedule a personalized briefing and unlock the transformative potential of this market research.

- How big is the Edge Artificial Intelligence Market?

- What is the Edge Artificial Intelligence Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?