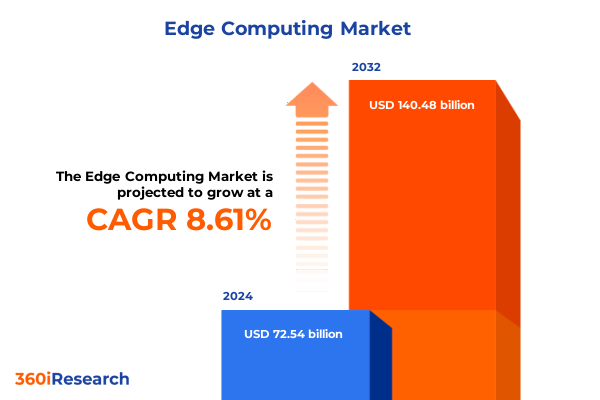

The Edge Computing Market size was estimated at USD 78.46 billion in 2025 and expected to reach USD 84.95 billion in 2026, at a CAGR of 8.67% to reach USD 140.48 billion by 2032.

Pioneering the Edge Computing Frontier: Unlocking Real-Time Data Processing, Latency Reduction, and Scalability at the Network Edge

Edge computing is a distributed computing paradigm that relocates data processing and storage closer to the source of data generation rather than in centralized cloud data centers. By pushing compute resources to network peripheries-on devices, gateways, or localized micro data centers-edge computing minimizes the latency associated with transmitting data over long distances and reduces the bandwidth demands on core networks. This approach evolved from early content delivery networks in the late 1990s to support real-time application needs across diverse industries. In essence, edge computing redefines the traditional cloud model by delivering computational power where it is most immediately needed.

Navigating the New Edge Era: How Advances in Network Fabric, 5G Integration, and AI Workloads Are Revolutionizing Distributed Computing Architectures

Recent technological breakthroughs have converged to reshape the edge computing landscape and accelerate its adoption. High-speed 5G connectivity now extends network bandwidth and reduces latency to levels that enable truly distributed processing, triggering pilot deployments in autonomous vehicles and smart manufacturing environments. At the same time, optimized neural network libraries and specialized edge-native AI models allow sophisticated machine learning workloads to execute directly on edge devices, obviating the need to send raw data to remote servers. Moreover, emerging network fabrics that integrate programmable data-plane accelerators within edge nodes are enabling operators to dynamically allocate compute and networking resources based on real-time application demands. As a result, distributed architectures are shifting from siloed compute islands toward converged systems that seamlessly orchestrate resources from the core to the edge.

Assessing the Comprehensive Impact of United States 2025 Tariffs on Edge Computing Supply Chains, Costs, and Strategic IT Planning Across Industries

The United States government’s tariff policies throughout 2025 have introduced elevated duties on a wide array of imported hardware components crucial to edge computing, including semiconductors, network interface cards, and ruggedized servers. Industry associations have warned that proposed levies of up to 32% on devices containing advanced integrated circuits could significantly inflate procurement costs for enterprises pursuing edge rollouts. Tech leaders who previously optimized global supply chains for cost efficiency now face a complex environment where tariffs disrupt long-standing sourcing strategies. Consequently, many organizations are exploring vendor diversification and nearshoring options to mitigate exposure to volatile trade measures.

Uncovering Critical Edge Computing Market Dynamics Through Deep Component, End-User, Application, Deployment Mode, and Organization Size Segmentation Analysis

This analysis examines market dynamics across multiple segmentation dimensions to reveal where edge computing value is being captured and where growth pockets are emerging. When evaluating by component, hardware solutions span gateways & routers that aggregate local data, networking equipment that manages communication pathways, edge servers that host compute workloads and local storage units that buffer and secure data. Complementing these are managed and professional services that guide deployment and ongoing operations, while software portfolios cover management & orchestration platforms, specialized edge compute platforms and security frameworks tailored for distributed environments. From an end-user perspective, adoption varies significantly between energy & utilities operations requiring real-time grid management, defense agencies enforcing mission-critical insights at forward deployments, healthcare organizations processing patient data on medical devices, discrete and process manufacturers orchestrating automated production lines, retailers and e-commerce firms personalizing in-store experiences, telecommunication and IT providers enhancing network services and logistics operators optimizing last-mile deliveries. Each application-spanning artificial intelligence and machine learning inference, augmented and virtual reality experiences, content delivery and optimization for streaming, advanced data analytics pipelines, diverse Internet of Things deployments and security & monitoring frameworks-drives specific performance and architectural requirements. The Internet of Things sector alone bifurcates into consumer-oriented devices managing home automation or wearables and industrial IoT solutions embedded in heavy machinery or manufacturing lines. Deployment strategies further diverge into cloud-based edge services hosted within regional cloud zones and on-premises edge nodes deployed in controlled environments. Organizational adoption also correlates with company size, where large enterprises leverage edge computing to optimize global operations at scale, while small and medium enterprises prioritize agility and cost efficiency in targeted pilot initiatives.

This comprehensive research report categorizes the Edge Computing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Network Connectivity

- Deployment Mode

- Application

- End-User

- Organization Size

Deciphering Regional Variations in Edge Computing Adoption, Infrastructure Readiness, and Strategic Priorities Across the Americas, EMEA, and Asia-Pacific

Regional adoption patterns underscore distinct priorities and maturity levels across the Americas, Europe, Middle East & Africa and Asia-Pacific. In the Americas, robust investments in telco operator edge platforms and hyperscale cloud expansions are driving mainstream deployments in metropolitan and suburban contexts. European markets emphasize stringent data sovereignty and privacy controls, propelling hybrid edge-cloud architectures that interoperate with regional regulatory frameworks. The Middle East and Africa region is witnessing accelerated edge deployment in energy and mining sectors, where latency-sensitive analytics and autonomous operations unlock new efficiencies. Meanwhile, Asia-Pacific exhibits a diverse edge ecosystem: advanced manufacturing hubs in East Asia champion full-stack edge solutions, while emerging Southeast Asian markets adopt low-cost gateways and localized AI inference to support smart city and retail initiatives. Across all these geographies, the interplay between infrastructure readiness, regulatory stance and end-user maturity defines the pace and scale of edge uptake.

This comprehensive research report examines key regions that drive the evolution of the Edge Computing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Pioneers Shaping the Edge Computing Ecosystem with Game-Changing Technologies and Strategic Collaborations

Leading technology companies are driving the evolution of edge computing through strategic product portfolios and ecosystem partnerships. Amazon Web Services has expanded its edge footprint with AWS Wavelength Zones, embedding compute and storage services into telco data centers to enable ultra-low latency applications in collaboration with major carriers. Microsoft’s Azure IoT Edge platform has reached general availability, empowering enterprises to deploy AI workloads and Azure services on on-premises IoT devices through an open-source runtime and integrated device management capabilities. Google Cloud continues to scale its edge capabilities, leveraging AI-optimized servers and expanded on-prem deployments to host inference workloads closer to end users, supported by a 32% increase in cloud revenue driven by AI demand. In network infrastructure, Cisco Systems is bolstering its edge solutions with Edge Intelligence and secure networking stacks to streamline data processing at access points. Dell Technologies remains a prominent hardware provider with PowerEdge servers and Edge Gateway appliances purpose-built for industrial and retail edge environments. Hewlett Packard Enterprise’s GreenLake and Edgeline offerings deliver converged compute, storage and management services for hybrid and on-premise use cases. NVIDIA leads in edge AI by offering the Jetson platform, which integrates GPU-accelerated inference engines for autonomous machines and smart cameras. IBM’s Edge Application Manager and hybrid cloud extensions facilitate secure workload management across distributed infrastructures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Edge Computing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Advanced Micro Devices, Inc.

- Amazon Web Services, Inc.

- Arm Holdings plc

- C3.ai, Inc.

- Capgemini SE

- Cisco Systems, Inc.

- Cognizant Technology Solutions Corporation

- Dell Technologies Inc.

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- MediaTek Inc.

- Microsoft Corporation

- NIPPON TELEGRAPH AND TELEPHONE CORPORATION

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Oracle Corporation

- Palantir Technologies Inc.

- Panasonic Holdings Corporation

- QUALCOMM Incorporated

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- SAP SE

- Siemens AG

- Tata Consultancy Services Limited

- Texas Instruments Incorporated

- Wipro Limited

Empowering Industry Leaders with Tactical Strategies for Supply Chain Resilience, Cost Optimization, and Scalable Edge Computing Deployments

Industry leaders must act decisively to capitalize on the transformative potential of edge computing. To begin, organizations should diversify their hardware supplier base to ensure resilience against trade-driven cost volatility and supply chain disruptions. Simultaneously, they can establish partnerships with network operators and cloud providers to deploy managed edge zones in key markets, thereby accelerating time to value and simplifying operational complexity. It is also essential to integrate security by design-leveraging zero trust principles and hardware-rooted trust modules-to protect data across edge nodes and communication channels. Furthermore, businesses should adopt containerized workloads and serverless patterns at the edge to streamline application delivery and support dynamic scaling. Investing in developer enablement, through standardized SDKs and telemetry frameworks, will foster innovation while reducing integration overhead. Lastly, executive teams should align edge initiatives with broader digital transformation strategies and sustainability goals, prioritizing pilot programs in high-impact use cases such as predictive maintenance, immersive customer experiences and adaptive network services.

Implementing a Robust and Rigorous Research Methodology Integrating Qualitative and Quantitative Approaches for Comprehensive Edge Computing Insights

This report synthesizes insights from a rigorous research methodology that integrates both qualitative and quantitative approaches. Primary research consisted of in-depth interviews with C-level executives, technology architects and operations managers across key verticals, complemented by structured surveys of over 150 edge computing practitioners worldwide. Secondary research involved a thorough review of corporate filings, public announcements, technical whitepapers and patent data to validate vendor capabilities and solution roadmaps. Data triangulation ensured consistency by cross-referencing quantitative survey results with documented industry benchmarks, while expert panels in networking, AI and IoT provided critical context on emerging trends and adoption challenges. All findings were subjected to peer review by independent analysts specializing in distributed computing architectures to ensure accuracy, relevance and actionable value.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Edge Computing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Edge Computing Market, by Component

- Edge Computing Market, by Network Connectivity

- Edge Computing Market, by Deployment Mode

- Edge Computing Market, by Application

- Edge Computing Market, by End-User

- Edge Computing Market, by Organization Size

- Edge Computing Market, by Region

- Edge Computing Market, by Group

- Edge Computing Market, by Country

- United States Edge Computing Market

- China Edge Computing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding the Edge Computing Journey by Synthesizing Strategic Imperatives, Key Takeaways, and Outlook for Technological and Operational Excellence

Edge computing is rapidly shifting from proof-of-concept trials to strategic imperatives for organizations seeking real-time decision-making, enhanced security and operational efficiency. The convergence of high-speed connectivity, distributed AI workloads and programmable infrastructure has unlocked novel architectures that process data precisely where it is generated. Yet, as trade policies introduce cost pressures and regional priorities diversify deployment models, market participants must stay agile, embracing modular solutions and collaborative ecosystems. By segmenting the market across components, applications and geography, decision-makers gain clarity on where to focus investments and how to navigate evolving regulatory and technological landscapes. Ultimately, the organizations that master the orchestration of compute, network and analytics at the edge will secure a lasting competitive advantage in the digital economy.

Next Steps to Secure Your Competitive Advantage with a Tailored Edge Computing Market Research Report Available Through Associate Director Sales & Marketing

Don’t let uncertainty slow your strategic momentum in edge computing. Reach out today to secure a customized market research report tailored to your organization’s needs. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how in-depth insights on edge computing infrastructure, deployment strategies, and emerging opportunities can empower your decision-making. Ketan’s expertise in decoding complex technological landscapes ensures you receive a targeted analysis that aligns with your growth objectives. Contact him now to discuss your specific requirements, unlock exclusive data, and accelerate your competitive advantage in the rapidly evolving edge computing arena.

- How big is the Edge Computing Market?

- What is the Edge Computing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?