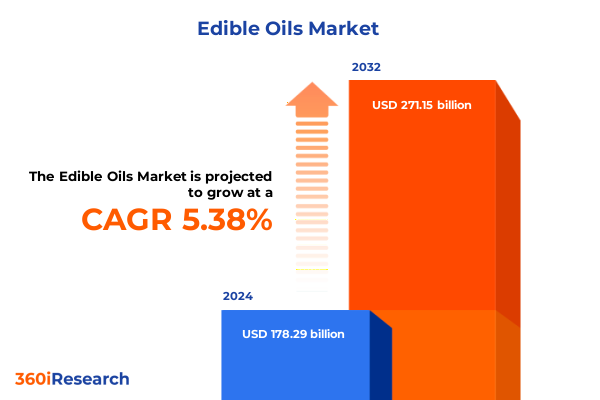

The Edible Oils Market size was estimated at USD 187.34 billion in 2025 and expected to reach USD 197.01 billion in 2026, at a CAGR of 5.42% to reach USD 271.15 billion by 2032.

Understanding the Evolving Dynamics of the Global Edible Oils Landscape and Its Implications for Long Term Strategic Growth and Innovation

The edible oils market has undergone profound evolution over recent years, driven by shifting consumer preferences, sustainability imperatives, and technological advancements. Consumers increasingly prioritize health and wellness, favoring oils with beneficial fatty acid profiles and clean-label credentials. This has accelerated demand for plant-derived oils such as avocado, coconut, and olive oil, while also prompting innovation in cold-pressed and solvent-free extraction techniques. At the same time, environmental and ethical considerations are exerting pressure on producers to adopt traceable, sustainable practices that minimize deforestation, reduce carbon footprints, and enhance supply chain transparency.

Against this backdrop, industry participants-from agricultural cooperatives to multinational refiners-are reconfiguring their strategies to capture emerging opportunities. Investment in specialized product lines and advanced processing technologies is on the rise, as is the integration of digital tools for quality assurance and provenance tracking. Moreover, trade policies and tariff adjustments are reshaping global supply chains, compelling stakeholders to diversify sourcing and streamline logistics. This introduction lays the groundwork for a detailed exploration of the transformative shifts, segmentation insights, regional dynamics, and strategic imperatives that define today’s edible oils landscape.

Exploring the Pivotal Transformative Shifts Reshaping Production, Consumption Patterns and Value Chains across the Global Edible Oils Industry

Over the past decade, the edible oils industry has witnessed seismic transformations that extend far beyond incremental product launches. On the production side, there has been a marked shift away from traditional solvent extraction toward greener enzymatic and cold-pressed techniques. These methods not only preserve nutritional integrity but also resonate with consumer demand for minimally processed ingredients. Concurrently, investments in biotechnology and precision agriculture are optimizing crop yields and improving oilseed resilience in the face of climate volatility.

On the consumption front, the rise of plant-based diets and functional foods has elevated certain oils into mainstream culinary and nutraceutical applications. Olive oil’s heart-healthy reputation has been complemented by the emergence of specialty oils like avocado and tea seed for their unique flavor profiles and performance in high-heat cooking. Digital traceability and blockchain-enabled supply chain solutions are becoming critical differentiators as retailers and regulators intensify focus on authenticity and sustainability. Taken together, these transformative shifts are redefining value chains and unlocking new avenues for innovation across the edible oils ecosystem.

Analyzing the Cumulative Impact of United States Tariffs on Edible Oils Supply, Pricing Structures and Trade Relationships in 2025

In 2025, the United States implemented a series of targeted tariffs on imported edible oils, with levies spanning palm, soybean, and sunflower oil imports from key producing regions. These duties were introduced amid broader trade negotiations aimed at bolstering domestic agriculture while responding to supply chain vulnerabilities exposed during the pandemic era. As a result, U.S. refiners and distributors have faced increased input costs, triggering a cascade of adjustments in pricing structures downstream.

To mitigate these pressures, many industry players have redirected procurement toward alternative suppliers and invested in local oilseed processing capacity. Domestic crush facilities saw renewed investment as processors aimed to secure stable feedstock under the new tariff regime. At the same time, strategic partnerships and export alliances with non-tariffed regions gained prominence, ensuring continuity of supply for industrial and retail markets. Despite short-term price volatility, these adaptations have fostered greater supply chain resilience and stimulated long-term capacity expansion within the United States edible oils sector.

Unveiling Key Segmentation Insights Across Diverse Product Types, Advanced Processing Techniques, Varied Packaging Formats and Distribution Channels

The edible oils market can be comprehensively understood by examining the intricate interplay of its core segments. Based on product type, offerings span animal-derived oils and a broad spectrum of plant-derived oils, including avocado, canola, coconut, corn, cottonseed, linseed, olive, palm, peanut, rice, sesame, soybean, and sunflower varieties. Each subtype brings its own nutritional profile, flavor characteristics, and price point, catering to diverse consumer and industrial applications. In parallel, the processing technique dimension encompasses enzymatic extraction, mechanical extraction-including both cold-pressed and hot-pressed methods-and traditional solvent extraction, each method impacting yield, quality, and cost structure.

Further differentiation arises through packaging formats ranging from bottles and cans or jars to drums, pouches, and tins, which align with varying end-user requirements from retail kitchens to large-scale food processors. Application-based insights reveal that culinary uses such as baking and grilling, cooking and frying, salad dressings, and sauces and marinades form a significant demand pillar, while food processing and preservation, personal care and cosmetics, and pharmaceuticals represent growing specialty segments. Lastly, distribution channels bifurcate into offline retail-spanning convenience stores, specialty stores, and supermarkets or hypermarkets-and online retail platforms, the latter experiencing robust growth due to digital penetration and shifting shopping behaviors. Together, these segmentation lenses illuminate critical areas for targeted innovation, portfolio optimization, and channel-specific strategies within the edible oils arena.

This comprehensive research report categorizes the Edible Oils market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Processing Technique

- Packaging

- Application

- Distribution Channel

Revealing Distinct Regional Insights Highlighting Demand Drivers and Market Dynamics across Americas, Europe, Middle East & Africa and Asia-Pacific

Regional dynamics play a pivotal role in shaping edible oils demand and supply patterns. In the Americas, producers benefit from vast oilseed cultivation zones in North and South America, driving dominance in soybean and canola oil exports. North American consumers exhibit growing preference for specialty and high-oleic oils, while South American exporters leverage scale and cost-efficiency to serve global commodity markets. Transitioning climates and sustainability commitments are prompting investments in regenerative agricultural practices across key oilseed regions.

Across Europe, the Middle East, and Africa, consumption is heavily influenced by culinary traditions and regulatory frameworks. Mediterranean nations maintain strong olive oil consumption, supported by appellation systems and health claims, while North African markets rely significantly on imported vegetable oils for staple foods. Stricter environmental policies in the European Union are accelerating adoption of certified sustainable palm oil and incentivizing industry shifts toward low-carbon footprints. Meanwhile, the Asia-Pacific region presents a dual narrative: established producers like Indonesia and Malaysia continue to expand palm oil capacity, whereas emerging economies in South and Southeast Asia are witnessing rapid growth in coconut and rice bran oil production. Urbanization and rising per capita income further fuel demand for branded and premium oils, creating opportunities for both global and local players to capture value.

This comprehensive research report examines key regions that drive the evolution of the Edible Oils market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Driving Competitive Advantage in the Edible Oils Market

Leading participants in the edible oils market distinguish themselves through a blend of scale, supply chain integration, and innovation. Multinational agribusiness corporations have leveraged upstream operations in oilseed cultivation and downstream refinery networks to optimize margins and ensure raw material security. These players frequently pursue strategic acquisitions to bolster specialty oil portfolios and enter high-growth geographies. Concurrently, regional refiners and independent producers capitalize on niche positioning, offering certified organic or single-origin oils tailored to discerning consumer segments.

Research and development efforts are increasingly focused on enhancing oil stability, nutritional value, and functionality. Collaborations with biotechnology firms and academic institutions have yielded novel high-oleic and omega-3 enriched variants. On the sustainability front, traceability platforms powered by blockchain are being piloted to authenticate palm oil sourcing and prevent deforestation. Packaging innovations, including lightweight and recyclable materials, align with circular economy goals and regulatory mandates. Collectively, these strategic initiatives underscore an industry-wide commitment to balancing competitive advantage with environmental and social stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Edible Oils market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3F Industries Ltd.

- AJWA Group

- American Vegetable Oils, Inc.

- Archer-Daniels-Midland Company

- Associated British Foods PLC

- Borges International Group, S.L.

- Bunge Global SA

- Canada Pride Foods Inc.

- Cargill, Incorporated

- CHS Inc.

- Data Group

- DEOLEO S.A.

- FUJI OIL CO., LTD.

- GrainCorp Limited

- IOI Corporation Berhad

- J-OIL MILLS , INC.

- Kaneka Corporation

- Louis Dreyfus Company B.V.

- Marico Limited

- Musim Mas Group

- Ngo Chew Hong Edible Oil Pte Ltd by Mewah International Inc.

- Olam Group

- Patanjali Foods Ltd.

- Peerless Holdings Pty Ltd.

- Presco PLC

- PT Sinar Mas Agro Resources and Technology Tbk

- Purti Vanaspati Pvt. Ltd.

- Salad Oils International Corporation

- Sunora Foods Inc.

- The Nisshin OilliO Group, Ltd.

- Titan Oils Inc.

- UEDA OILS & FATS MFG. CO.,LTD.

- Vicentin S.A.I.C

- Wilmar International Ltd.

Formulating Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Emerging Challenges and Opportunities

To thrive amid intensifying competition and evolving consumer expectations, industry leaders should prioritize sustainable sourcing strategies that encompass both environmental and social dimensions. Building traceable supply chains through validated certifications and digital monitoring will not only meet regulatory requirements but also resonate with ethically conscious end users. Moreover, diversifying supplier portfolios and investing in domestic processing capacity can mitigate the risks associated with tariff fluctuations and global supply disruptions.

Innovation should be pursued in both product development and delivery channels. Expanding high-margin specialty oil offerings by leveraging advanced extraction techniques and targeted R&D can capture growing interest in functional and premium segments. Simultaneously, enhancing omnichannel presence-by optimizing e-commerce platforms and forging partnerships with foodservice and retail players-will unlock additional growth avenues. Collaborative ventures with technology providers, start-ups, and research institutions can accelerate time to market for sustainable packaging and novel oil blends. By adopting a proactive, integrated approach to sustainability, consumer engagement, and operational resilience, industry leaders can position their organizations for long-term success in the evolving edible oils landscape.

Outlining a Rigorous Research Methodology Combining Primary Expert Interviews and Robust Secondary Data Analysis

This market analysis is underpinned by a structured research methodology that combines primary insights with rigorous secondary validation. Primary research comprised in-depth interviews with key stakeholders, including leading producers, distributors, retail buyers, regulatory bodies, and technical experts specializing in extraction and sustainability. These conversations provided real-world perspectives on operational challenges, innovation priorities, and emerging market trends.

Secondary research drew upon a comprehensive review of publicly available documentation, including trade association reports, government publications, industry white papers, and academic studies. Data points were triangulated across multiple sources to ensure accuracy and mitigate bias. Furthermore, proprietary databases tracking global oilseed production, trade flows, and consumption patterns were leveraged to enrich qualitative findings. Throughout the research process, strict quality controls and validation protocols were maintained to deliver dependable, actionable insights for stakeholders across the edible oils value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Edible Oils market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Edible Oils Market, by Product Type

- Edible Oils Market, by Processing Technique

- Edible Oils Market, by Packaging

- Edible Oils Market, by Application

- Edible Oils Market, by Distribution Channel

- Edible Oils Market, by Region

- Edible Oils Market, by Group

- Edible Oils Market, by Country

- United States Edible Oils Market

- China Edible Oils Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Future Trajectory of the Edible Oils Market Emphasizing Sustainable Innovation and Growth Strategies

As the edible oils market continues its trajectory toward greater complexity, stakeholders must embrace sustainable innovation, operational agility, and consumer-centricity to maintain a competitive edge. The convergence of health-conscious consumption, environmental stewardship, and digital transformation will define the industry’s next chapter. Organizations that strategically invest in advanced extraction methods, traceable supply chains, and diversified portfolios will be best positioned to capitalize on shifting preferences and regulatory landscapes.

Looking ahead, collaboration across the value chain will be pivotal in driving collective progress. Partnerships with agricultural producers, technology providers, and end-user brands can spark breakthrough developments in product performance and sustainability outcomes. By keeping a pulse on regional nuances and tariff developments and by proactively adapting to emerging market signals, stakeholders can navigate uncertainties and secure sustainable growth. This comprehensive analysis serves as a roadmap for those seeking to harness the full potential of the global edible oils ecosystem.

Connect with Associate Director of Sales and Marketing to Secure Comprehensive Edible Oils Market Intelligence and Drive Strategic Decisions

To secure the full depth of strategic insights contained within this comprehensive study, engage directly with Ketan Rohom, Associate Director of Sales and Marketing. His expertise will guide you to the report sections most relevant to your organization’s needs, ensuring you obtain actionable intelligence tailored to your growth objectives and competitive landscape. Reach out to schedule a consultation that will illuminate the nuanced dynamics of the edible oils market and position your business at the forefront of industry innovation.

Don’t miss the opportunity to leverage these rigorous findings and strategic analyses. Connect with Ketan Rohom to access the complete research report, gain unrivaled visibility into emerging trends, and drive impactful decisions that will propel your organization toward sustainable success in the global edible oils market.

- How big is the Edible Oils Market?

- What is the Edible Oils Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?