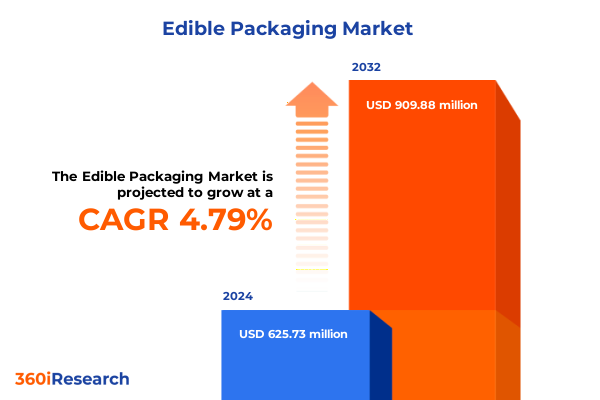

The Edible Packaging Market size was estimated at USD 651.20 million in 2025 and expected to reach USD 678.60 million in 2026, at a CAGR of 4.89% to reach USD 909.88 million by 2032.

Setting the Stage for the Rise of Edible Packaging Solutions and Their Transformative Implications for Sustainable Food and Beverage Ecosystems

The quest for sustainable packaging solutions has reached a pivotal juncture as stakeholders across the food and beverage value chain grapple with the environmental consequences of single-use materials. Edible packaging is emerging as a compelling alternative, promising to minimize plastic waste, optimize resource utilization, and enhance the consumer experience. By integrating food-grade constituents into packaging designs, manufacturers can create entirely compostable or consumable materials that seamlessly blend with existing supply chains. This introduction sets the context for a deeper exploration of how edible packaging innovations are reshaping the industry’s approach to circularity, resource efficiency, and brand differentiation. As we delve into subsequent sections, the narrative will build upon this foundation, illustrating the interplay of regulatory pressures, consumer preferences, and technological breakthroughs that are driving adoption. We begin by outlining the macro-level trends that catalyze this transformation and prepare the ground for a holistic examination of market segmentation, regional dynamics, and strategic imperatives.

Examining the Converging Forces of Sustainability Regulation Consumer Demand and Technological Innovation Redefining the Edible Packaging Landscape

The push toward edible packaging is underpinned by a confluence of forces that are fundamentally altering the traditional packaging paradigm. First, tightening regulations on single-use plastics at both federal and state levels in the United States have heightened demand for viable alternatives. In parallel, consumer awareness of ecological impact has given rise to heightened expectations for sustainable product attributes and transparent supply chains. Coupled with this consumer momentum, advancements in biomaterials science have unlocked new possibilities for formulating robust, food-safe films, coatings, and capsules derived from polysaccharides, lipids, and proteins.

Moreover, the cost curve of bio-based raw materials has begun to intersect with that of conventional plastics, thanks to improvements in extraction and processing efficiency. This cost dynamic has been further shaped by investment from leading consumer goods companies seeking to differentiate their products and reduce environmental footprints. As a result, the edible packaging landscape has evolved from niche laboratory prototypes into scalable commercial solutions. In the following section, we explore how U.S. tariff changes in 2025 are poised to add another layer of complexity to these transformative shifts.

Understanding the Full Spectrum of 2025 United States Tariff Adjustments and Their Reverberating Effects on Edible Packaging Supply Chains

The United States’ implementation of revised tariffs on imported biomaterials and packaging components in early 2025 represents a critical inflection point for edible packaging stakeholders. These policy adjustments, which affect multiple categories of polysaccharide and protein-based inputs, have reverberated across the supply chain, prompting manufacturers to reassess sourcing strategies. Faced with elevated duties on certain marine-derived alginates and specialty protein isolates, companies are diversifying their supplier base to mitigate cost volatility.

In response, strategic collaborations have emerged between material innovators and domestic producers to localize key ingredient streams. This repatriation of supply chain segments not only reduces exposure to fluctuating international trade policies but also aligns with nearshoring trends aimed at enhancing resilience. Furthermore, the tariff environment has galvanized raw material technology providers to refine low-cost extraction processes and to develop alternative feedstocks, such as plant-derived cellulose, that bypass higher-duty classifications. As we proceed to segmentation insights, it is important to keep in mind how these tariff-driven shifts are reshaping material availability, cost structures, and project timelines for edible packaging ventures.

Decoding Multifaceted Segmentation Dynamics Across Material Packaging Format Application End User Source and Technology in Edible Packaging

A nuanced appreciation of the edible packaging landscape requires a detailed examination of material types, each of which offers distinct performance characteristics. Composite matrices, formed through the union of polysaccharide and lipid components or protein and polysaccharide blends, grant formulators the flexibility to tailor barrier properties for moisture and aroma control. Lipid-driven solutions, spanning oil to wax bases, deliver hydrophobic surfaces that extend shelf life, while polysaccharide formulations derived from alginate, cellulose, or starch provide structural integrity and film clarity. Equally significant, protein-based constructs, whether sourced from casein, gelatin, or soy, offer adhesion properties that facilitate edible coatings for delicate perishable foods.

Turning to packaging formats, the edible market encompasses liquid and powder capsules designed for precise ingredient delivery, as well as stretch and barrier films that integrate seamlessly with automated filling lines. Coatings applied to fruits and meats leverage food-grade polymers to inhibit microbial growth while preserving freshness. Pouches-whether single-use or resealable-combine convenience and sustainability for on-the-go applications. Each of these delivery systems finds tailored applications across beverages, bakery goods, dairy products, and meat items, with additional inroads in cosmetic wrapping and pharmaceutical encasement. End users span caterers and restaurants to large-scale beverage and food manufacturers, as well as specialty retail stores and supermarket chains. Behind these formats, source differentiation emerges as a pivotal theme: animal proteins, microbial exopolymers such as bacterial cellulose and algae derivatives, and plant-based cellulose, corn, and seaweed feedstocks each drive unique value propositions. The final layer of segmentation speaks to production technology, from solvent casting or film casting and cold and thermal extrusion to advanced methods like electrospraying and 3D printing using fused deposition or precision inkjet techniques, all of which are enabling precision, scalability, and cost optimization.

This comprehensive research report categorizes the Edible Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Packaging Format

- Source

- Technology

- Application

Unraveling Regional Nuances in Adoption and Market Development Spanning Americas Europe Middle East & Africa and Asia-Pacific Territories

Regional market conditions exhibit considerable heterogeneity as adoption of edible packaging accelerates across key geographies. In the Americas, robust investment in sustainable packaging initiatives and a well-established foodservice infrastructure have fostered early pilot programs for edible films and capsules. North American stakeholders, including major beverage manufacturers, are partnering with biomaterial start-ups to integrate edible elements into snack wrappers and functional beverage delivery systems. Meanwhile, Latin American producers are exploring locally abundant feedstocks-such as cassava-based starch-to develop cost-effective, edible barrier films.

Across Europe, Middle East & Africa, regulatory frameworks mandating single-use plastic reduction have been a powerful catalyst. European Union directives and country-level bans on non-recyclable packaging are driving brand owners to transition toward edible coatings for fresh produce and cheese products. In the Middle East, supply chain localization and water scarcity concerns heighten interest in lightweight edible packaging that can reduce logistics costs and preserve quality in high-temperature climates. Africa’s nascent bioeconomy, buoyed by microbial feedstock ventures, is demonstrating proof of concept in pilot production facilities.

In the Asia-Pacific region, rapid urbanization and evolving consumer preferences for premium fresh foods are accelerating demand for edible films and coatings in markets such as Japan, South Korea, and Australia. Simultaneously, Southeast Asian manufacturers are capitalizing on abundant seaweed and rice starch resources, forging public-private partnerships to scale edible packaging production. Together, these regional dynamics underscore the importance of a tailored go-to-market approach and localized feedstock strategies.

This comprehensive research report examines key regions that drive the evolution of the Edible Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Initiatives Collaborations and Innovations Driving Leadership Among Key Players in the Edible Packaging Market

Leading companies in edible packaging are distinguishing themselves through targeted R&D collaborations, strategic partnerships, and pilot initiatives that validate performance in real-world environments. Several food ingredient conglomerates have launched joint ventures with material science specialists to co-develop proprietary polysaccharide blends with optimized mechanical strength and edible sensorial properties. Simultaneously, start-up ventures focused on seaweed and microbial cellulose have secured series funding to expand production capacity and secure off-take agreements with global retailers.

Cross-industry partnerships are also growing in prominence: technology providers are working with pharmaceutical formulators to adapt edible encapsulation techniques for controlled-release drug delivery, while personal care brands are exploring protein-based edible wrappers for single-use cosmetic samples. In addition, a handful of packaging machinery manufacturers are retrofitting existing lines to accommodate edible film lamination and capsule filling processes, thereby reducing capital investments for end users. These collaborative and integrative approaches are accelerating time to market, driving cost efficiencies, and reinforcing the critical role of shared innovation ecosystems in propelling edible packaging from concept to commercial scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Edible Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Aquapak Polymers Ltd.

- Archer-Daniels-Midland Company

- Avery Dennison Corporation

- BASF SE

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- JRF Technology LLC

- Kuraray Co., Ltd.

- Loliware Inc.

- Mitsubishi Chemical Group Corporation

- Mondelez International, Inc.

- Monosol LLC

- Notpla Ltd.

- PT Evoware Jaya

- TIPA Corp.

- WikiFoods Inc.

Translating Insights into Actionable Strategies That Industry Leaders Can Implement to Navigate Challenges and Capitalize on Edible Packaging Trends

Industry leaders can capitalize on the momentum of edible packaging by prioritizing cross-functional innovation and forging strategic alliances. First, integrating R&D efforts with raw material suppliers can accelerate the development of novel biopolymer blends and reduce the lead time for commercialization. By co-investing in pilot lines and shared testing facilities, companies can de-risk scale-up and refine processing parameters. Next, establishing partnerships with foodservice operators and retailers for real-world trials can generate compelling proof-of-performance data and drive consumer acceptance. These trial programs should be supported by consumer research that explores taste, texture, and usability perceptions.

Additionally, diversifying feedstock sources and investing in flexible manufacturing platforms will prove critical for navigating evolving trade policies and raw material constraints. Embracing modular production technologies such as extrusion and 3D printing can enable rapid iteration of film thickness and coating compositions. Finally, embedding edible packaging within broader sustainability narratives-through clear labeling, traceability platforms, and end-of-life communications-will differentiate brands and foster consumer trust. By executing these recommendations, industry leaders can translate macro trends into tangible competitive advantages in the edible packaging arena.

Outlining a Rigorous Research Framework Integrating Primary Engagement Secondary Intelligence and Robust Validation for Reliable Market Insights

This analysis draws upon a robust research framework that integrates both primary and secondary methodologies to ensure depth and reliability. Primary insights were obtained through in-depth interviews with key stakeholders across the edible packaging ecosystem, including material technologists, brand marketing executives, packaging engineers, and regulatory experts. These conversations illuminated real-time challenges in scale-up, sourcing, and compliance, while also uncovering emerging applications and consumer usage patterns.

Secondary intelligence was sourced from scientific journals, patent filings, industry white papers, and environmental policy directives to confirm material properties, regulatory trajectories, and technology readiness levels. Market signals, including partnership announcements and pilot launch news, were monitored through targeted news feeds and corporate disclosures. Finally, insights were validated via cross-functional review sessions that aligned commercial perspectives with technical feasibility assessments. This mixed-method approach ensures that our findings are grounded in practical experience and reflective of the most recent advancements in edible packaging innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Edible Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Edible Packaging Market, by Material Type

- Edible Packaging Market, by Packaging Format

- Edible Packaging Market, by Source

- Edible Packaging Market, by Technology

- Edible Packaging Market, by Application

- Edible Packaging Market, by Region

- Edible Packaging Market, by Group

- Edible Packaging Market, by Country

- United States Edible Packaging Market

- China Edible Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3975 ]

Synthesizing Core Learnings and Forward Looking Perspectives to Articulate the Critical Role of Edible Packaging in Modern Consumption Practices

As the world seeks to reconcile consumer convenience with environmental stewardship, edible packaging stands out as a pragmatic bridge between innovation and sustainability. The key drivers of regulatory pressure, consumer demand, and technological maturity have aligned to propel edible films, coatings, capsules, and pouches into both pilot and commercial stages. While U.S. tariff adjustments introduced fresh complexity in 2025, they also catalyzed supply chain localization and feedstock diversification strategies that may ultimately strengthen industry resilience.

Segmentation analysis reveals that material type, packaging format, application, end user, source, and production technology each contribute critical insights that inform go-to-market strategies. Regional nuances underscore the need for localized feedstock sourcing and partnership models. Leading companies are demonstrating that cross-industry collaboration and iterative scale-up can expedite adoption. To succeed in this dynamic environment, stakeholders must embrace interoperable innovation, strategic alliances, and consumer-centric validation. With these principles in hand, edible packaging is poised to evolve from an intriguing alternative into a mainstream enabler of circularity and resource efficiency.

Empowering Decision Makers with Direct Access to InDepth Edible Packaging Market Research Insights Through Engagement with Ketan Rohom

If you’re ready to leverage comprehensive insights that will inform strategic decision making in the rapidly evolving edible packaging market, connect with Ketan Rohom, Associate Director, Sales & Marketing at our organization. Ketan brings an in-depth understanding of market drivers and sector dynamics, and can guide you through the breadth of analysis contained within this complete market research report. By partnering directly with him, you gain immediate access to tailored intelligence, competitive benchmarking, and actionable recommendations that can accelerate your innovation roadmap. Seize this opportunity to position your business at the forefront of the sustainability revolution. Reach out to Ketan today to secure your copy of the full report and discover how you can transform your packaging strategies for a resilient, circular future.

- How big is the Edible Packaging Market?

- What is the Edible Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?