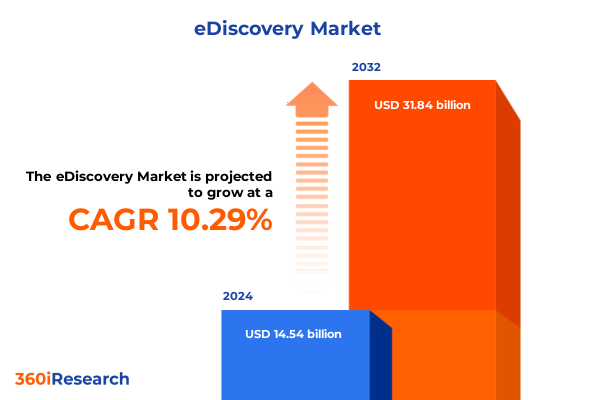

The eDiscovery Market size was estimated at USD 14.54 billion in 2024 and expected to reach USD 15.99 billion in 2025, at a CAGR of 10.29% to reach USD 31.84 billion by 2032.

Redefining the eDiscovery Frontier Through the Evolution of Digital Legal Processes and Technological Integration

In an era defined by exponential data growth and increasingly complex legal requirements, the field of electronic discovery has emerged as a critical intersection of technology, law, and risk management. As organizations grapple with vast amounts of unstructured and structured data generated across myriad communication channels, the ability to efficiently identify, preserve, and produce relevant information has become a cornerstone of legal preparedness. Beyond mere data handling, the modern eDiscovery process now demands sophisticated analytics, seamless integration with enterprise systems, and robust security protocols to ensure compliance with evolving regulatory mandates.

Stakeholders from corporate legal departments to external counsel and service providers are navigating a landscape where speed, accuracy, and defensibility of discovery processes directly impact both financial and reputational outcomes. Against this backdrop, the interplay of managed and professional services with advanced software platforms underscores a transformation that goes far beyond traditional document review. It extends to real-time early case assessment, proactive risk mitigation strategies, and continuous learning systems powered by artificial intelligence. This report delves into the core drivers of this evolution, shedding light on the technological advances and strategic considerations that are reshaping how organizations approach eDiscovery.

Unleashing the Next Wave of Innovation in eDiscovery Driven by Cutting-Edge AI Advancements, Cloud Migration, and Data Analytics

The eDiscovery landscape is undergoing a seismic shift fueled by the integration of artificial intelligence, the rapid adoption of cloud architectures, and the growing imperative for data-driven decision making. Machine learning algorithms are now capable of predictive coding, semantic analysis, and entity extraction with unprecedented accuracy, thus drastically reducing the time and cost associated with large-scale document review. These AI-driven capabilities are blurring the lines between traditional professional services-such as consulting, integration and implementation, and support and maintenance-and embedded software offerings that automate key workflows.

Concurrently, cloud deployment models are revolutionizing infrastructure scalability and collaboration. Organizations are increasingly moving away from on-premise legacy platforms toward cloud-native solutions that facilitate global access, elastic processing power, and streamlined system updates. This dynamic shift is complemented by robust managed services that oversee complex configuration and maintenance tasks, enabling legal teams to redirect focus from technical upkeep to strategic litigation readiness. Moreover, data analytics and visualization tools are enabling deeper insights into case trends, enabling legal professionals to anticipate opposing counsel’s strategies and tailor responses proactively.

Assessing the Reverberations of United States Tariffs on eDiscovery Operations and Cross-Border Legal Data Exchange in 2025

In 2025, the cumulative effects of United States tariffs on imported technology components and related services are creating ripple effects across the eDiscovery sector. Tariffs imposed on servers, storage arrays, and networking equipment have elevated capital expenditure considerations for on-premise deployments, prompting many end users to reevaluate total cost of ownership. As hardware costs climb, cloud-based providers are positioned to capture additional market share through subscription-based models that absorb tariff impacts within revised pricing structures.

Moreover, cross-border data transfers and international collaboration are encountering greater scrutiny due to tariffs that indirectly strain vendor supply chains. Service providers are increasingly investing in regional data centers to mitigate the risks associated with elevated import duties, ensuring compliance with local regulations while maintaining competitive service-level agreements. These localization efforts, however, come with integration complexity and require heightened coordination among consulting, support and maintenance teams to preserve consistency in workflow and security standards across distributed environments.

The heightened cost structure has also driven renewed interest in software offerings that optimize data processing and minimize unnecessary data movement. By prioritizing advanced data identification and targeted preservation, legal teams can mitigate tariff-related expenditures and maintain efficiency in their discovery operations. This recalibration of resources underscores the importance of strategic technology investment in a tariff-impacted market.

Revealing the Diverse eDiscovery Market Landscape Through Comprehensive Component, Organization, Deployment, Application, and Industry Perspectives

The eDiscovery market’s heterogeneity is best understood through a multidimensional lens that integrates functional components, organizational characteristics, deployment preferences, use case applications, and industry-specific requirements. Component-wise, services encompass both managed offerings, which deliver end-to-end operational oversight, and professional engagements that delve into consulting, integration and implementation, along with ongoing support and maintenance. These services operate in parallel with software modules tailored for data collection, identification, management, preservation, processing, production, review and analysis, early case assessment, and legal hold.

Organizationally, large enterprises demand scalability, complex workflow orchestration, and stringent governance controls, whereas small and medium businesses prioritize cost-effectiveness and ease of deployment. Deployment models further differentiate market participation, with cloud implementations offering rapid time-to-value and on-premise options catering to entities with sensitive data mandates or legacy infrastructure investments. Across applications, the spectrum ranges from civil litigation and criminal investigations to data breach and cybersecurity incident response, fraud detection and prevention, internal investigations, mergers and acquisitions due diligence, and regulatory compliance efforts.

Industry end users introduce additional nuances, as sectors such as banking, financial services and insurance navigate highly regulated environments requiring rigorous audit trails, and healthcare and life sciences uphold patient privacy under strict data protection statutes. Conversely, IT and telecommunications, manufacturing, media and entertainment, as well as retail and consumer goods, emphasize agility and cross-functional collaboration to address rapidly evolving litigation and compliance landscapes. This intricate segmentation framework reveals unique value propositions and adoption drivers within each dimension of the eDiscovery ecosystem.

This comprehensive research report categorizes the eDiscovery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Data Source

- Case Type

- Deployment Mode

- Organization Size

- User Type

- Industry

Unearthing Regional Dynamics Impacting eDiscovery Adoption Across the Americas, EMEA, and Asia-Pacific Jurisdictions

Regional dynamics play a pivotal role in shaping eDiscovery adoption strategies and solution preferences. In the Americas, particularly the United States and Canada, mature regulatory frameworks such as the Federal Rules of Civil Procedure drive widespread adoption of advanced data analytics and defensible automation processes. The concentration of leading software vendors and service providers in Silicon Valley and major financial hubs accelerates innovation and competitive pricing models.

Across Europe, the Middle East, and Africa, organizations contend with a mosaic of data privacy regulations, from the General Data Protection Regulation in the European Union to emerging sovereignty laws in the Middle East and Africa. This divergence encourages the growth of hybrid deployment models and managed services that ensure compliance across multiple jurisdictions. Localized data centers and privacy-by-design principles are critical, as end users require solutions that can adapt to shifting regulatory landscapes without sacrificing scalability.

In the Asia-Pacific region, burgeoning economies in China, India, Australia, and Southeast Asia are witnessing rapid digitization and corresponding legal complexities. The pace of infrastructure modernization and the proliferation of digital communication tools have spurred demand for cloud-based legal hold and early case assessment tools. Meanwhile, regional partnerships between global service providers and local consulting firms foster tailored solutions that reflect unique cultural and legal nuances. These regional insights underscore the importance of flexible architectures and compliance-focused service models in an increasingly interconnected world.

This comprehensive research report examines key regions that drive the evolution of the eDiscovery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Drivers Shaping the Future of eDiscovery Solutions and Services

A handful of leading technology firms and specialized service providers dominate the competitive landscape, continuously refining their portfolios through strategic acquisitions and organic innovation. These entities deliver end-to-end platforms that integrate advanced analytics, machine learning–powered review, and collaborative workflows designed to reduce risk and accelerate case outcomes. Strategic alliances between software vendors and managed service firms further differentiate offerings by bundling technical expertise with domain-specific legal guidance.

Emerging challengers are carving niches by focusing on modular, API-driven ecosystems that allow for seamless integration with enterprise content management systems, customer relationship management databases, and cybersecurity monitoring tools. Their agility in incorporating early case assessment and legal hold modules into unified platforms appeals to organizations seeking turnkey solutions with minimal customization overhead. Additionally, support and maintenance specialists have enhanced their portfolios with 24/7 global support centers and AI-driven incident response capabilities, ensuring uninterrupted access to critical systems.

These market leaders and innovators continuously invest in research and development to address evolving pain points such as data sovereignty, cross-border collaboration, and scalability under high-volume workloads. Their strategic roadmaps emphasize open architecture, continuous security hardening, and user-centric design to meet the dynamic demands of enterprise legal teams across diverse sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the eDiscovery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Array

- Commvault Systems, Inc.

- Conduent, Inc.

- Consilio LLC

- CS DISCO, Inc.

- Cyforce Pvt. Ltd.

- Deloitte Touche Tohmatsu Limited

- Digital WarRoom

- Elevate Services, Inc.

- Epiq Systems, Inc.

- Everlaw, Inc.

- Exterro, Inc.

- FRONTEO Inc.

- FTI Consulting, Inc.

- Innovative Driven

- International Business Machines Corporation

- International Litigation Services

- KLDiscovery Ontrack, LLC

- LexisNexis by RELX Group

- Lighthouse Document Technologies Inc.

- Microsoft Corporation

- Morae Global Corporation

- Nextpoint, Inc.

- Nuix Limited

- Open Text Corporation

- Proofpoint, Inc.

- Relativity ODA LLC

- Repario Data

- Reveal Data Corporation

- Smarsh Inc.

- Thomson Reuters Corporation by The Woodbridge Company Limited

- TransPerfect Global, Inc.

- Veritas Technologies LLC by Cohesity, Inc.

Strategic Imperatives for Business Leaders to Navigate Complexity and Leverage eDiscovery Opportunities Effectively

To capitalize on emerging opportunities and mitigate risks in the evolving eDiscovery environment, industry leaders must adopt a holistic strategic framework. First, cultivating an ecosystem mindset that balances proprietary platforms with best-in-class third-party integrations can unlock synergies between advanced analytics and specialized services. This approach enables organizations to optimize workflows without sacrificing flexibility or vendor neutrality.

Second, prioritizing data governance and compliance by embedding privacy-by-design principles and automated audit trails into every stage of the discovery lifecycle will enhance defensibility while reducing manual oversight. Leveraging early case assessment and intelligent data reduction techniques can further streamline operations, significantly lowering the volume of data subject to review and associated costs.

Third, investing in talent development and cross-functional training ensures that legal, IT, and security teams possess the requisite skills to manage sophisticated eDiscovery tools and evolving regulatory challenges. Implementing continuous learning programs and certification pathways will foster internal expertise and reduce dependency on external consultants. Finally, establishing a proactive innovation fund to pilot emerging technologies-such as blockchain for chain-of-custody verification or generative AI for document summarization-can position organizations at the forefront of legal technology evolution.

Outlining Rigorous Research Approach Combining Qualitative Expert Insights and Quantitative Data Collection Methodologies

This research initiative employed a dual-phased methodology combining qualitative expert interviews with structured quantitative data collection. In the qualitative phase, leading practitioners in corporate legal departments, external counsel, technology solution architects, and managed service executives were engaged through in-depth interviews and roundtable discussions to uncover emerging challenges, success factors, and adoption drivers.

Concurrently, the quantitative phase encompassed a systematic survey of end users across industries and regions, capturing preferences related to deployment modes, component utilization, and functional requirements. Data validation was achieved through cross-referencing publicly available regulatory filings, technology vendor disclosures, and anonymized usage statistics provided by select service providers.

Analytical frameworks such as SWOT analysis and scenario modeling were applied to forecast potential adoption trajectories under varying regulatory and economic conditions, while sensitivity analyses evaluated the impact of cost fluctuations-such as those stemming from tariff adjustments-on deployment decisions. The integration of qualitative insights with robust quantitative metrics ensured a comprehensive perspective on the multifaceted eDiscovery market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our eDiscovery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- eDiscovery Market, by Offering

- eDiscovery Market, by Data Source

- eDiscovery Market, by Case Type

- eDiscovery Market, by Deployment Mode

- eDiscovery Market, by Organization Size

- eDiscovery Market, by User Type

- eDiscovery Market, by Industry

- eDiscovery Market, by Region

- eDiscovery Market, by Group

- eDiscovery Market, by Country

- United States eDiscovery Market

- China eDiscovery Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Concluding Insights on the Strategic Imperative of eDiscovery Evolution for Legal Preparedness and Competitive Advantage

The continued evolution of eDiscovery underscores its strategic importance for legal preparedness, risk mitigation, and competitive differentiation. The convergence of artificial intelligence, cloud technologies, and domain-specific expertise has transformed historic manual processes into streamlined, defensible operations capable of handling the relentless expansion of enterprise data.

Organizations that embrace holistic frameworks-integrating services and software across diverse deployment and application scenarios-will achieve superior responsiveness to litigation and compliance demands. Moreover, the ability to adapt to regional regulatory nuances and tariff-induced cost variances will determine long-term success in an increasingly global market. As industry leaders refine their eDiscovery strategies, the fusion of proactive data governance, advanced analytics, and cross-functional collaboration will emerge as the defining paradigm for legal excellence.

Engage with Ketan Rohom to Access the Comprehensive eDiscovery Market Intelligence Report and Empower Decision-Making

For purchasing the definitive eDiscovery market research report and gaining unparalleled insights tailored to your organization’s needs, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Leverage his expertise to secure comprehensive intelligence that equips your teams with the confidence to drive strategic initiatives and outmaneuver competitors. Engage today to transform your understanding of the evolving eDiscovery landscape into actionable strategies and sustainable growth.

- How big is the eDiscovery Market?

- What is the eDiscovery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?