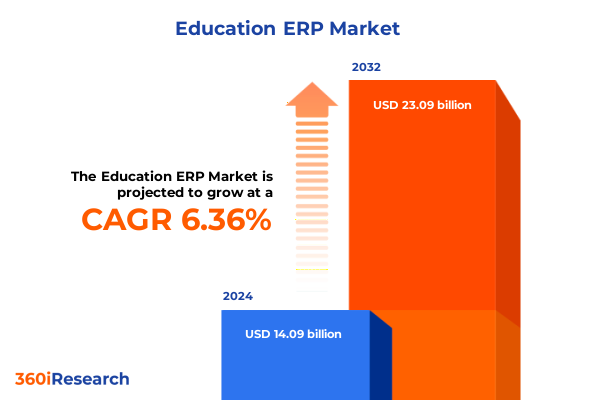

The Education ERP Market size was estimated at USD 14.98 billion in 2025 and expected to reach USD 15.93 billion in 2026, at a CAGR of 6.37% to reach USD 23.09 billion by 2032.

Unveiling the Critical Role of Integrated Enterprise Solutions in Modern Educational Institutions to Drive Operational Excellence Across Diverse Learning Environments

The educational environment is undergoing a profound transformation as institutions seek to integrate administrative operations, academic delivery, and stakeholder engagement into a unified, technology-driven ecosystem. This evolution is driven by the imperative to optimize resource utilization, enhance data transparency, and improve the overall learning experience for administrators, educators, and students alike. Integrated Enterprise Resource Planning solutions have emerged as the linchpin in this digital metamorphosis, enabling educational organizations to streamline workflows, facilitate real-time collaboration, and unlock actionable insights that inform strategic decision-making.

As institutions of all sizes and types confront growing pressures to demonstrate operational efficiency and accountability, the adoption of robust ERP platforms becomes a competitive necessity. With seamless integration across finance, human resources, student information, and learning management modules, these systems provide a comprehensive foundation upon which educational entities can build agile, data-centric strategies. The confluence of regulatory compliance requirements, rising expectations for personalized learning, and the relentless pace of technological innovation underscores the critical role of ERP solutions in driving institutional resilience and future-readiness within the sector.

Navigating the Rapid Evolution of Educational Technology Ecosystems Underpinned by Widespread Cloud Adoption and Intelligent Automation

The Education ERP landscape is witnessing rapid and transformative shifts as cloud computing, artificial intelligence, and advanced analytics redefine traditional operational models. The migration toward cloud-based deployments has catalyzed a democratization of access, allowing institutions to leverage scalable infrastructure without prohibitive capital expenditures. Concurrently, providers are embedding AI-driven capabilities into core modules, facilitating predictive analytics for enrollment management, personalized learning paths, and proactive risk mitigation in student performance monitoring.

Moreover, the emergence of hybrid learning modalities has necessitated seamless integration between asynchronous courseware and real-time virtual classrooms. In response, ERP vendors are increasingly offering modular solutions that interoperate with specialized learning platforms, ensuring cohesion across administrative and academic functions. These advancements underscore a broader trend toward platform convergence, where the boundaries between enterprise administration, content delivery, and stakeholder engagement are dissolving under the pressure of holistic digital transformation.

In parallel, a heightened focus on data sovereignty and cybersecurity is reshaping deployment choices, driving institutions to assess private cloud, public cloud, or on premises configurations based on regulatory environments and risk tolerance. This nuanced decision-making process highlights the strategic importance of flexible ERP architectures, capable of accommodating evolving security mandates while maintaining uninterrupted service delivery.

Assessing the Cumulative Effects of 2025 US Tariff Policies on Technology Procurement and Implementation Costs in Educational Environments

In 2025, United States tariff policies on imported hardware and software components have compounded the complexities faced by educational institutions seeking to modernize their ERP infrastructures. The cumulative impact of these tariff impositions has translated into elevated total cost of ownership calculations, prompting procurement teams to reexamine vendor contracts, negotiate volume discounts, and explore localized supply chain alternatives. As a result, project timelines have extended and capital budgets have been reallocated to account for increased duties on networking equipment, servers, and specialized educational devices.

This heightened cost sensitivity has fueled demand for cloud-based ERP deployments that minimize upfront hardware expenditures and reduce exposure to volatile trade regulations. Institutions are gravitating toward subscription-based licensing models and multi-tenant architectures that shift capital burdens toward predictable operational expenses. In tandem, collaborative purchasing consortiums and regional cooperatives have gained traction as mechanisms to aggregate demand, secure favorable pricing, and mitigate the financial strain imposed by tariffs on educational technology investments.

Deriving Strategic Insights Through Multifaceted Segmentation Analysis Spanning Deployment Types Institution Roles and Functional Domains

A nuanced segmentation of the Education ERP market reveals critical insights into adoption patterns and solution preferences. Based on Deployment Type, institutions are weighing the trade-offs between on premises systems and cloud-based platforms, with some favoring private cloud configurations for enhanced data control while others prioritize the scalability of public cloud models. Such distinctions guide vendors in tailoring their service-level agreements and support structures to meet diverse risk profiles.

Institution Type segmentation further differentiates requirements across Higher Education, K–12 schools, and Vocational Training centers, each demanding specialized functionalities and compliance features. Higher education entities, for instance, seek advanced research management and funding modules, whereas K–12 institutions emphasize streamlined student information and parental communication tools. Vocational training providers, meanwhile, prioritize competency tracking and workforce alignment capabilities.

Examining End User segments underscores the importance of role-based workflows; Administrative Staff focus on efficiency in financial management and payroll processing, Educators require integrated learning management systems to deliver asynchronous and synchronous content, and Students benefit from self-service portals that centralize enrollment, billing, and course materials. Layered onto these dimensions, Functional Module segmentation highlights that financial management suites, encompassing accounting, billing, and budgeting, must interoperate seamlessly with human resources management modules for payroll, recruitment, and training, as well as with learning management systems that support both asynchronous and synchronous instruction and robust student information systems.

Finally, Organization Size segmentation reveals that large institutions leverage enterprise-wide ERP ecosystems with deep customization, medium-sized entities seek balanced out-of-the-box solutions with moderate configurability, and small institutions adopt streamlined, user-friendly platforms that minimize internal IT overhead. These segmentation insights equip vendors and decision-makers with a precise understanding of feature prioritization, pricing strategies, and service delivery models tailored to each institutional profile.

This comprehensive research report categorizes the Education ERP market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Institution Type

- Functional Module

- Organization Size

- End User

- Deployment Type

Unlocking Regional Variations in Educational ERP Adoption and Innovation Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics continue to shape the Education ERP market as providers and institutions adapt to localized regulatory frameworks, economic conditions, and technological infrastructures. In the Americas, digital maturity levels vary significantly between North and South regions, driving demand for modular, interoperable solutions that can be deployed rapidly across rural and urban districts. The emphasis on affordability and interoperability with legacy systems is a hallmark of this region’s procurement strategies.

Across Europe, the Middle East, and Africa, data residency requirements and evolving privacy regulations are accelerating interest in private cloud and on premises deployments. Institutions in EMEA are increasingly partnering with local data centers and regional service providers to ensure compliance with stringent data protection standards while accessing advanced analytics and AI-driven functionalities. Language localization and multi-currency support also rank highly among regional priorities.

In the Asia-Pacific region, significant investments in education infrastructure are fueling rapid ERP adoption across nations with diverse maturity levels. Countries with established digital ecosystems are piloting AI-enhanced modules and mobile-first interfaces to engage stakeholders, whereas emerging markets focus on foundational modules such as student information systems and financial management to bridge administrative gaps. Cross-border collaborations and public-private partnerships are prominent, as governments seek to standardize educational data frameworks and streamline funding mechanisms across jurisdictions.

This comprehensive research report examines key regions that drive the evolution of the Education ERP market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Dynamics and Strategic Differentiators Among Leading Educational ERP Providers Shaping Market Trajectory

Leading ERP vendors are differentiating themselves through strategic partnerships, vertical specialization, and continuous innovation. Some providers have established alliances with cloud infrastructure leaders to optimize performance, resiliency, and scalability of their hosted solutions, while others invest heavily in AI research to embed predictive insights and natural language interfaces into their platforms. The competitive landscape is further shaped by acquisitions targeting niche learning analytics and student engagement startups to expand product portfolios.

Customer success initiatives have become a critical battleground, with top providers offering dedicated advisory services, extensive training ecosystems, and tailored implementation accelerators. These value-add services not only foster higher retention rates but also facilitate deeper integration with institutional processes. Vendors that excel in creating vibrant user communities and developer ecosystems are gaining momentum as they harness collective innovation to extend platform capabilities.

Moreover, the ability to deliver flexible pricing structures-ranging from subscription-based models to consumption-based billing-has emerged as a key differentiator. Institutions increasingly demand transparency and predictability in long-term costs, prompting vendors to offer tiered service plans and modular licensing options. This approach allows organizations to align investments with evolving functional requirements and budgetary cycles, reinforcing vendor credibility and fostering sustainable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Education ERP market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anthology Inc.

- Blackbaud, Inc.

- Ellucian Company L.P.

- Infinite Campus, Inc.

- Infor, Inc.

- Jenzabar, Inc.

- Microsoft Corporation

- Oracle Corporation

- PowerSchool Holdings, Inc.

- SAP SE

- Skyward, Inc.

- TechnologyOne Limited

- Tyler Technologies, Inc.

- Unit4 N.V.

- Workday, Inc.

Empowering Institutional Leaders with Actionable Strategies to Harness ERP Capabilities for Enhanced Agility and Educational Outcomes

To capitalize on the momentum in the Education ERP market, institutional leaders should prioritize the adoption of cloud-native architectures that enable rapid scaling, robust disaster recovery, and seamless updates. By leveraging modular ERP components, organizations can implement high-impact functionalities in phased rollouts, minimizing disruption while accelerating time to value. Integrating advanced analytics modules early in the deployment roadmap will empower stakeholders with actionable insights on student retention, resource utilization, and financial performance.

Collaboration with ecosystem partners is equally essential; institutions should forge alliances with specialized technology firms, system integrators, and service providers to complement core ERP capabilities. These partnerships facilitate access to domain-specific plugins, compliance accelerators, and tailored training programs that enhance user adoption and operational efficiency. Engaging end users through co-creation workshops ensures that solution configurations align with real-world workflows and pedagogical objectives.

Data governance frameworks must be established from project inception to safeguard privacy and ensure regulatory compliance. By implementing role-based access controls, encryption protocols, and regular security audits, organizations can build trust among stakeholders and mitigate risks associated with cyber threats. Finally, embedding continuous improvement processes, including periodic health checks and user feedback loops, will sustain platform performance and drive ongoing innovation in educational delivery and operational management.

Employing a Rigorous Mixed Method Research Approach Integrating Primary Stakeholder Engagement with Robust Secondary Data Analysis

This study employs a rigorous mixed-method research approach, integrating primary stakeholder engagement with comprehensive secondary data analysis. Primary research comprises in-depth interviews and structured surveys conducted with C-suite executives, IT leaders, academic administrators, and end users across diverse educational institutions globally. These engagements provide nuanced insights into functional requirements, adoption drivers, and implementation challenges.

Secondary research involves a thorough examination of industry publications, white papers, vendor collateral, and technology journals to contextualize market trends, regulatory influences, and disruptive innovations. Publicly available financial reports and patent databases supplement this analysis, offering visibility into vendor strategies, R&D investments, and competitive positioning. Cross-referencing multiple sources ensures the validity and reliability of key findings.

Data triangulation underpins the research integrity, with quantitative metrics validated against qualitative feedback to identify convergent themes and divergent viewpoints. The methodological framework emphasizes transparency, reproducibility, and methodological rigor, enabling readers to assess the robustness of conclusions and to apply insights with confidence within their institutional contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Education ERP market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Education ERP Market, by Institution Type

- Education ERP Market, by Functional Module

- Education ERP Market, by Organization Size

- Education ERP Market, by End User

- Education ERP Market, by Deployment Type

- Education ERP Market, by Region

- Education ERP Market, by Group

- Education ERP Market, by Country

- United States Education ERP Market

- China Education ERP Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Consolidating Key Learnings to Inform Strategic Decision Making in Educational ERP Adoption and Implementation Efforts

The converging forces of technological innovation, regulatory dynamics, and evolving pedagogical models are reshaping the Education ERP market at an unprecedented pace. Institutions that embrace cloud-enabled platforms, leverage advanced analytics, and adopt modular deployment strategies stand to achieve operational efficiencies, enriched learning experiences, and measurable performance outcomes. A strategic, data-driven approach to ERP selection and implementation is critical for sustainable competitive advantage.

Looking ahead, ongoing collaboration between vendors and educational communities will drive continuous enhancement of platform capabilities and user experiences. As the marketplace matures, differentiation will hinge on the ability to deliver personalized support models, AI-infused functionalities, and seamless interoperability across the broader ecosystem of educational technologies.

Secure Comprehensive Market Insights and Competitive Intelligence by Engaging with Ketan Rohom Associate Director of Sales Marketing Today

To delve deeper into these actionable insights and gain a comprehensive understanding of the evolving Education ERP market landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly with Ketan, you will secure a tailored consultation that aligns with your organization’s strategic objectives and ensures immediate access to the full market research report. His expertise will guide you through the report’s key findings, competitive intelligence, and implementation best practices, enabling you to make data-driven decisions with confidence.

Connect with Ketan today to unlock unparalleled market intelligence, drive transformative educational outcomes, and position your institution at the forefront of digital innovation.

- How big is the Education ERP Market?

- What is the Education ERP Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?