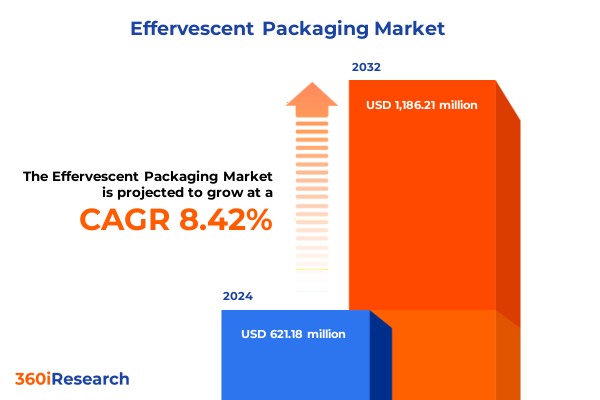

The Effervescent Packaging Market size was estimated at USD 668.79 million in 2025 and expected to reach USD 724.84 million in 2026, at a CAGR of 8.53% to reach USD 1,186.20 million by 2032.

Charting the Opening Landscape of Effervescent Packaging Through Key Drivers, Consumer Adoption Trends, and Technological Innovation Catalysts

The effervescent packaging sector has rapidly emerged as a pivotal enabler for industries ranging from nutraceuticals to consumer beverages, offering a compelling blend of convenience and performance. Built on the principle of delivering active ingredients in a dry, stabilized format, these systems leverage specialized materials and closure designs to protect effervescent formulations from moisture while ensuring rapid dissolution at point of use. As consumer lifestyles evolve toward on-the-go consumption and single-serve convenience, demand for compact, portable, and user-friendly packaging solutions has intensified.

Technological breakthroughs in material science have catalyzed the emergence of novel packaging formats, including advanced foil laminates and multi-layer composites that offer superior barrier properties without compromising sustainability goals. Concurrently, automation and digital printing innovations are reshaping production efficiencies, enabling rapid prototyping and small-batch customization. These trends underscore the market’s momentum, driven by an intricate interplay of consumer preferences, regulatory pressures for eco-friendly materials, and the pursuit of differentiation through unique user experiences. In this dynamic environment, understanding the foundational drivers and innovation pathways is critical for stakeholders seeking to capitalize on the opportunities embedded within effervescent packaging.

Uncovering the Pivotal Shifts Redefining Effervescent Packaging Strategies Driven by Sustainability, Digitalization, and Evolving Consumer Expectations

The landscape of effervescent packaging is undergoing transformative shifts fueled by an unwavering focus on sustainability and the integration of digital technologies. Converging regulatory frameworks across major markets are mandating reduced plastic usage and increased recyclability, prompting material suppliers and converters to pivot toward mono-materials and easily separable composites. This transition is redefining value chains, catalyzing investment in research for biodegradable coatings and polymer alternatives that can marry high barrier performance with end-of-life considerations.

Parallel to material evolution, digitalization is revolutionizing packaging functionality and consumer engagement. Smart closures equipped with NFC tags and QR codes are facilitating authentication, dosage tracking, and direct-to-consumer communication channels, thereby enhancing brand loyalty and data collection capabilities. Additionally, the surge of e-commerce has led to a reimagining of protective packaging design, with structural reinforcements and tamper-evident features becoming indispensable for preserving effervescent product integrity during extended transit routes. These pivotal movements illustrate how sustainability imperatives and digital innovations are collectively shaping strategic priorities across the effervescent packaging ecosystem.

Analyzing the Combined Effects of Recent United States Tariff Implementations on Effervescent Packaging Supply Chains and Cost Structures in 2025

In 2025, the imposition of additional tariffs by the United States on imported aluminum and certain polymer materials has introduced new dynamics to the effervescent packaging supply chain. Manufacturers reliant on imported foil laminates and aluminum components have encountered elevated landed costs, prompting a renewed emphasis on supply chain resilience. Firms are now evaluating domestic sourcing agreements and multilateral trade partnerships to mitigate exposure to fluctuating tariff regimes, with many exploring nearshoring alternatives to rein in lead times and foreign exchange volatility.

These cost pressures have also accelerated the industry’s pursuit of material efficiency and design optimization. Collaborative engagements between brand owners and converters are focusing on gauge reduction techniques and hybrid material constructs that maintain barrier integrity at lower weight points. Moreover, the threat of further tariff escalations has spurred companies to diversify their supplier networks, incorporating secondary sourcing strategies to safeguard continuity. Collectively, these responses underscore how the cumulative impact of 2025 tariffs is reshaping supply-side economics and driving innovation in cost-management solutions for effervescent packaging.

Extracting Actionable Intelligence from Segmentation Analyses Covering Packaging Formats, Material Varieties, Distribution Pathways, and Closure Types

Segmentation analysis provides clear insights into the distinct preferences and performance requirements across packaging formats, beginning with bottles, canisters, pouches, sachets, and strips. Within bottle formats, a breakdown across aluminum, glass, and plastic variants reveals that aluminum bottles with pressed or screw caps are favored in premium applications, while plastic bottles with flip-top and snap-on closures serve mainstream nutraceutical products. Canisters, whether metal or plastic with screw caps, are favored for bulk-dose convenience, whereas foil and plastic pouches, sealed via heat or zip closures, are increasingly selected for on-demand effervescence due to their reduced material footprint. Sachet offerings, spanning aluminum foil, laminated paper, and plastic constructions in single or multi-dose formats, demonstrate an optimal balance of portability and moisture exclusion. Trends in strip formats, including aluminum-plastic and paper-plastic variants with multiple cell counts, indicate rising adoption in pharmaceutical and dietary supplement categories.

Material classification further refines strategic decision-making, illustrating how aluminum composites, multilayer structures, and laminated papers compare to plastic resins like PET and high-density polyethylene in barrier performance, recyclability, and cost profiles. Distribution channels reveal that traditional offline retail remains steadfast for pharmacy and health store networks, while online sales platforms are driving growth through direct-to-consumer subscription models. Finally, closure types such as flip-top, heat seal, screw cap, and zipper closures each play a pivotal role in user experience, punctuating the importance of closure selection in maintaining product freshness and ease of use.

This comprehensive research report categorizes the Effervescent Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Material Type

- Closure Type

- Distribution Channel

Unveiling Regional Dynamics Shaping Effervescent Packaging Adoption Patterns across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional insights highlight divergent adoption trajectories across the Americas, Europe Middle East Africa, and Asia Pacific, shaped by economic, regulatory, and cultural factors. In the Americas, strong demand from wellness and sports nutrition brands has solidified effervescent solutions as mainstream offerings in mass-market and specialty storefronts. This region’s well-established infrastructure for aluminum foil production and advanced polyethylene recycling systems underpins ongoing investments in packaging innovation.

Conversely, the Europe Middle East Africa corridor is characterized by rigorous sustainability regulations and extended producer responsibility schemes that compel brands to pursue recyclable or compostable materials. Here, laminate simplification and the adoption of mono-materials have gained traction, supported by collaborative initiatives between government bodies, material suppliers, and conversion partners. Meanwhile, in Asia Pacific, rapid urbanization and digital retail growth are catalyzing demand for convenient single-serve formats. China’s dynamic e-commerce channels and India’s burgeoning health supplement market are contributing to a fast-evolving landscape where localized material sourcing and cost-competitive production models are key to market entry and expansion.

This comprehensive research report examines key regions that drive the evolution of the Effervescent Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Landscapes and Strategic Movements of Leading Manufacturers Powering Innovation in the Effervescent Packaging Sector

A handful of industry leaders are driving innovation and setting benchmarks within the effervescent packaging domain. Global suppliers are leveraging proprietary barrier coatings and high-speed form-fill-seal technologies to meet accelerating production demands while adhering to tighter environmental standards. Strategic alliances between converters and chemical providers are unlocking next-generation film formulations that offer improved seal integrity and moisture resistance at reduced thickness.

Meanwhile, emerging players are carving niches through specialized offerings such as custom-printed pharmacy-grade sachets and modular strip designs that simplify dosage control. Collaborative ventures between large multinationals and regional converters are streamlining technology transfers and enabling local market customization. These shifts underscore a competitive landscape where agility, R&D partnerships, and vertical integration are critical differentiators. As packaging technology continues to evolve, the leading companies are those that align their innovation pipelines with sustainability targets and evolving consumer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Effervescent Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpla Werke Alwin Lehner GmbH & Co KG

- Amcor plc

- Amerilab Technologies, Inc.

- Ball Corporation

- Berry Global Group, Inc.

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- Crown Holdings, Inc.

- Desiccant Technologies Group, Inc.

- Gerresheimer AG

- Hebei Xinfuda Medical Packaging Co., Ltd.

- Hebei Xinfuda Plastic Products Co., Ltd.

- Huhtamaki Oyj

- Mondi plc

- Nutrilo GmbH

- Parekhplast India Ltd.

- Romaco Pharmatechnik GmbH

- Sanner GmbH

- Schott AG

- Sealed Air Corporation

- Tower Laboratories Ltd.

- Uflex Limited

- Unither Pharmaceuticals SA

- West Pharmaceutical Services, Inc.

- Winpak Ltd.

Recommending Practical Strategic Initiatives for Industry Stakeholders to Capitalize on Emerging Trends and Drive Growth in Effervescent Packaging

Industry stakeholders must prioritize material innovation and supply chain flexibility to thrive in the effervescent packaging arena. Embracing low-gauge laminate solutions and exploring bio-based polymer alternatives can reduce dependence on tariff-affected imports while meeting regulatory mandates. Investing in agile manufacturing platforms capable of rapid format changes will allow brands to capitalize on emerging consumer trends without succumbing to extended lead times.

Furthermore, developing intelligent packaging features-such as RFID-enabled closures and serialized QR codes-will strengthen brand differentiation and foster direct engagement with end users. Companies should also allocate resources to digital commerce strategies, optimizing packaging formats for subscription fulfillment and last-mile protection. By fostering cross-functional collaboration between procurement, R&D, and marketing teams, organizations can synchronize growth objectives with technical feasibility, ensuring that product launches align with both performance criteria and sustainability commitments. This integrated approach will be indispensable for maintaining competitive advantage in a dynamic effervescent packaging ecosystem.

Detailing the Rigorous Methodological Frameworks and Data Collection Approaches Underpinning Insights into Effervescent Packaging Market Research

The research methodology underpinning these insights integrates a balanced combination of primary and secondary data collection techniques. Primary research involved in-depth interviews with packaging engineers, procurement specialists, and brand managers to capture firsthand perspectives on material performance, cost pressures, and regulatory compliance. These qualitative inputs were supplemented by site visits to production facilities and focus groups conducted with end users to validate functionality and user experience hypotheses.

Secondary research encompassed a systematic review of trade publications, patent filings, and governmental policy documents to map technological advancements and legislative drivers. Additionally, a proprietary database of global supplier profiles was analyzed to benchmark innovation capabilities and geographic reach. Quantitative analyses utilized shipment data, tariff schedules, and material cost indices to identify cost trends and supply chain shifts. Triangulation of multiple data streams ensured the robustness of findings, while iterative expert reviews calibrated the conclusions against real-world market developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Effervescent Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Effervescent Packaging Market, by Packaging Type

- Effervescent Packaging Market, by Material Type

- Effervescent Packaging Market, by Closure Type

- Effervescent Packaging Market, by Distribution Channel

- Effervescent Packaging Market, by Region

- Effervescent Packaging Market, by Group

- Effervescent Packaging Market, by Country

- United States Effervescent Packaging Market

- China Effervescent Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 4293 ]

Synthesizing Core Findings to Articulate the Overarching Significance of Effervescent Packaging Innovations and Strategic Implications for Stakeholders

The convergence of sustainability imperatives, digitalization, and evolving consumer behaviors has spotlighted effervescent packaging as a transformative solution across diverse end markets. Regulatory pressures to minimize environmental impact are steering material innovation toward mono-layer and bio-based alternatives, while digital features embedded in closures and labels are generating new avenues for consumer engagement. The cumulative effect of 2025 U.S. tariffs has further accelerated supply chain diversification efforts, prompting industry participants to explore alternative sourcing and cost-management strategies.

Segmentation analysis illustrates the nuanced preferences across format, material, channel, and closure dimensions, offering a roadmap for targeted product development. Regional insights reveal distinct adoption patterns, with each geography presenting unique regulatory landscapes and consumer demands. Leading companies are differentiating through strategic alliances and technological advances, underscoring the importance of agility and collaboration. Collectively, these findings highlight the strategic imperatives for stakeholders to align innovation pipelines with market realities, ensuring their offerings resonate with both performance expectations and sustainability commitments.

Inviting Decision Makers to Secure Effervescent Packaging Market Insights through Personalized Consultation with Ketan Rohom to Drive Informed Investments

Engaging directly with Ketan Rohom offers an unparalleled opportunity to access tailored guidance on navigating the complexities of the effervescent packaging market. As Associate Director of Sales and Marketing, he brings deep sector knowledge, enabling stakeholders to align investments with emerging trends and regulatory landscapes. Through a personalized consultation, prospective clients will gain clarity on strategic priorities, supply chain optimization approaches, and potential collaboration models with leading innovators in the field. By partnering with Ketan, decision makers can accelerate time to market, validate business cases, and fine-tune their portfolios to capture new growth levers. Those ready to translate insights into action are encouraged to reach out and secure their competitive advantage.

- How big is the Effervescent Packaging Market?

- What is the Effervescent Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?