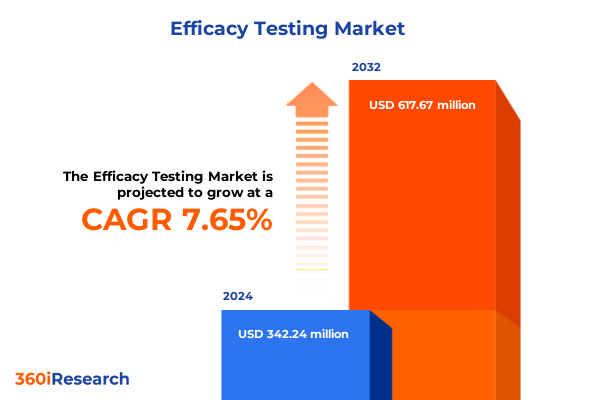

The Efficacy Testing Market size was estimated at USD 363.12 million in 2025 and expected to reach USD 388.86 million in 2026, at a CAGR of 7.88% to reach USD 617.67 million by 2032.

Unveiling the Strategic Imperative and Foundational Objectives That Underpin Efficacy Testing in a Transforming Global Market

The landscape of efficacy testing has evolved from a specialized niche to a strategic imperative for organizations navigating complex regulatory and technological environments. As stakeholders demand more rigorous validation of performance, safety, and reliability, efficacy testing serves as the linchpin that bridges innovative product development with market readiness. This report sets out to elucidate the foundational objectives behind contemporary efficacy testing, highlighting critical drivers such as regulatory compliance, competitive differentiation, and the pursuit of accelerated approval pathways.

Building on these foundational objectives, the introduction outlines the scope of this analysis, which encompasses transformational market forces, the tangible impact of recent tariff policies, and insightful segmentation and regional breakdowns. By anchoring our approach in a multidimensional perspective-covering component categories, deployment models, enterprise profiles, distribution channels, and industry verticals-this section lays the groundwork for a comprehensive discussion. Through clear articulation of purpose and methodology, readers will understand how efficacy testing not only ensures product integrity but also fuels strategic decision making in an increasingly dynamic global marketplace.

Revolutionary Drivers and Emerging Dynamics Redefining the Efficacy Testing Landscape Across Industries and Use Cases

Efficacy testing is undergoing a profound transformation as digital technologies, regulatory shifts, and evolving customer expectations converge to redefine traditional paradigms. Artificial intelligence and machine learning have begun to reshape data analysis frameworks, enabling predictive modeling that accelerates cycle times and refines experimental designs. In parallel, the rise of real-world evidence and post-market surveillance requirements has elevated the importance of longitudinal data collection, driving investment in remote and decentralized testing capabilities.

Moreover, sustainability imperatives and the push for greener laboratory practices are motivating organizations to adopt resource-efficient platforms and reduce waste across testing protocols. The integration of Internet of Things sensor networks with cloud-based analytics has unlocked novel real-time monitoring opportunities, ensuring that critical parameters are captured continuously rather than in discrete intervals. As a result, efficacy testing is shifting from episodic validation to ongoing governance, demanding more agile methodologies that align with rapid iteration cycles and complex value chains. This metamorphosis underscores the need for stakeholders to reassess existing frameworks, embrace cross-functional collaboration, and invest in scalable technologies capable of supporting next-generation testing requirements.

Analyzing the Cumulative Consequences of the 2025 United States Tariff Adjustments on Efficacy Testing Operations and Supply Networks

The introduction of additional tariffs on laboratory equipment, reagents, and critical components in 2025 has precipitated a reevaluation of supply chain strategies across the efficacy testing ecosystem. Organizations have faced increased costs for imported networking devices, servers, and storage systems that underpin data-intensive testing platforms. As a direct consequence, procurement teams are weighing the trade-offs between maintaining existing vendor relationships and qualifying domestic alternatives to mitigate exposure to fluctuating tariff schedules.

These customs duties have also influenced project timelines, as lead times for essential hardware have extended due to redistribution of sourcing priorities. Testing laboratories, in response, are forging partnerships with local equipment manufacturers and exploring consortium-based procurement models to spread risk across multiple stakeholders. Meanwhile, contractual agreements have been renegotiated to include tariff-pass-through clauses, ensuring that cost escalations do not erode long-term service margins. Through adaptive supply chain reinvention, many organizations are discovering opportunities to strengthen supply resilience, accelerate decision-gating processes, and enhance overall operational agility in the face of evolving trade policies.

Illuminating Strategic Segmentation Insights Shaping Efficacy Testing Needs Across Components Deployment Modes Enterprise Sizes Channels and Industry Verticals

When examining the market through the lens of component breakdown, hardware solutions, encompassing networking equipment, servers, and storage systems, form the backbone of test infrastructure, while services offerings divide into managed engagements that deliver ongoing support and professional consulting that addresses bespoke protocol development, and the software domain spans both application tools that orchestrate test workflows and system platforms that ensure robust data management. Transitioning to deployment models, the spectrum ranges from fully cloud-based architectures offering elastic scalability to on-premise installations favored by organizations with stringent data sovereignty needs, with hybrid approaches emerging as a bridge that combines private and public cloud environments for cost-effective performance optimization.

Enterprise size further differentiates market dynamics, as large organizations leverage substantial resource pools to pilot cutting-edge testing modalities, whereas small and medium enterprises prioritize modular solutions that balance functionality with capital constraints. Distribution channels illustrate distinct go-to-market pathways: offline routes harness direct sales engagements and retail partnerships to deliver hands-on demonstrations, while online ecosystems streamline procurement via corporate websites and third-party e-commerce platforms, expanding reach into new customer segments. Finally, industry verticals shape demand profiles, with financial services and insurance firms emphasizing risk mitigation protocols, government agencies requiring compliance with public sector mandates, healthcare organizations focusing on payer, pharmaceutical, and provider use cases, and sectors such as IT and telecom, manufacturing, and retail each adapting efficacy testing to their unique operational and regulatory landscapes.

This comprehensive research report categorizes the Efficacy Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Distribution Channel

- Industry Vertical

Uncovering Regional Dynamics and Growth Drivers Influencing Efficacy Testing Adoption Across the Americas Europe Middle East Africa and Asia Pacific

Regional landscapes are evolving rapidly, driven by distinct regulatory frameworks, investment climates, and innovation ecosystems. In the Americas, mature markets continue to prioritize harmonization with federal and state guidelines, fostering an environment where advanced data analytics and remote monitoring platforms see accelerated adoption. Local content requirements and domestic incentives further influence sourcing decisions, prompting closer collaboration between equipment suppliers and testing laboratories.

Across Europe, the Middle East, and Africa, diverse regulatory regimes coexist alongside initiatives aimed at aligning standards across borders. This convergence has spurred demand for unified testing protocols and centralized data repositories that can accommodate multi-jurisdictional reporting. At the same time, emerging markets within this region are investing in domestic laboratory build-outs and public-private partnerships to address capacity gaps.

In Asia-Pacific, rapid industrialization and government-led initiatives to bolster local manufacturing have elevated efficacy testing to a strategic priority. The proliferation of cloud-native test platforms and regional data centers supports decentralized testing networks, while regulatory bodies are increasingly embracing risk-based assessment models. As a result, stakeholders in this region are balancing the pursuit of scale with the need for rigorous compliance, creating a fertile environment for innovative testing solutions.

This comprehensive research report examines key regions that drive the evolution of the Efficacy Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Positioning and Strategic Initiatives of Leading Efficacy Testing Providers to Navigate Intensifying Market Rivalry

The competitive arena for efficacy testing has intensified as major providers deploy strategic initiatives to capture market share and differentiate their service portfolios. Leading organizations are investing in end-to-end digital platforms that integrate study design, execution, and analytics, while forging alliances with cloud service providers to ensure seamless data flow and compliance. Mergers and acquisitions have emerged as a rapid route to expand geographic reach and augment technical capabilities, with several firms absorbing niche specialists in areas such as real-world evidence generation and decentralized trial frameworks.

In addition to corporate consolidation, companies are diversifying their offerings to include managed services that bundle equipment leasing, on-site technical support, and subscription-based analytics tools. Strategic partnerships with academic institutions and technology startups enable early access to novel assay methodologies and AI-driven insight engines. As competition grows, pricing models have shifted toward outcome-based frameworks, aligning provider incentives with client success metrics. This evolution underscores the necessity for organizations to continually reassess vendor roadmaps, benchmark service level agreements, and engage in co-innovation practices that accelerate time to insight.

This comprehensive research report delivers an in-depth overview of the principal market players in the Efficacy Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- bioMérieux SA

- Bureau Veritas S.A.

- Charles River Laboratories International, Inc.

- Eurofins Scientific SE

- ICON plc

- Intertek Group plc

- IQVIA Holdings Inc.

- Laboratory Corporation of America Holdings

- PPD, Inc.

- QIAGEN N.V.

- SGS SA

- Syneos Health, Inc.

Formulating Targeted Action Plans and Strategic Roadmaps to Enhance Operational Efficiency and Foster Innovation in Efficacy Testing Operations

To capitalize on emerging market opportunities and fortify operational resilience, industry leaders should pursue a set of targeted actions. First, investing in modular infrastructure-comprised of scalable hardware configurations and interoperable software suites-enables rapid adaptation to shifting project scopes and evolving regulatory requirements. Second, cultivating strategic supplier relationships, particularly with domestic manufacturers, can buffer against tariff-induced disruptions and streamline logistic pathways.

Equally important is the integration of advanced analytics capabilities, including AI-powered data visualization and predictive modeling, to enhance decision quality and reduce cycle times. Organizations should pilot hybrid deployment frameworks that allocate sensitive workloads to private cloud environments while leveraging public cloud elasticity for burst capacity. Finally, fostering cross-disciplinary training programs ensures that technical teams remain proficient in emerging assay techniques and data governance standards. Through these concerted efforts, stakeholders can transform challenges into competitive advantages and set the stage for sustained growth.

Detailing Rigorous Research Methodology and Multistage Analytical Framework Underpinning the Comprehensive Efficacy Evaluation Report

The research methodology underpinning this report is grounded in a multistage analytical framework designed to balance qualitative insights with quantitative rigor. Initially, secondary research established a comprehensive baseline, drawing on publicly available regulatory documentation, industry publications, and peer-reviewed studies. This was followed by a series of primary interviews with senior executives, technical directors, and procurement specialists to capture firsthand perspectives on emerging trends and pain points.

Subsequent data triangulation involved synthesizing inputs from multiple sources, ensuring validation through cross-referencing of survey results, interview transcripts, and third-party databases. Advanced analytical techniques-including scenario modeling, sensitivity analysis, and cluster mapping-were applied to discern nuanced relationships among segment variables. Throughout this process, rigorous quality control checks, peer reviews, and iterative feedback loops guaranteed accuracy and objectivity. The result is a robust research foundation that delivers actionable intelligence and empowers stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Efficacy Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Efficacy Testing Market, by Component

- Efficacy Testing Market, by Deployment Mode

- Efficacy Testing Market, by Distribution Channel

- Efficacy Testing Market, by Industry Vertical

- Efficacy Testing Market, by Region

- Efficacy Testing Market, by Group

- Efficacy Testing Market, by Country

- United States Efficacy Testing Market

- China Efficacy Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate Pathways for Future Efficacy Testing Enhancements and Market Resilience

The analysis presented throughout this report reveals a rapidly evolving efficacy testing sector shaped by technological innovation, shifting trade policies, and nuanced regional dynamics. Key findings underscore the importance of adopting digital and hybrid deployment models, forging resilient supply chain partnerships in response to tariff pressures, and leveraging segmentation-based strategies to align offerings with the unique needs of diverse end-user groups. Competitive intensity is rising, driving the need for providers to differentiate through value-added services and outcome-oriented pricing.

Strategic imperatives emerge clearly: invest in scalable, interoperable platforms; prioritize partnerships that strengthen supply continuity; integrate analytics capabilities to optimize decision processes; and tailor go-to-market approaches to reflect regional regulatory landscapes. By synthesizing these insights, stakeholders can chart a proactive path that not only navigates current challenges but also capitalizes on future growth vectors. In essence, this report illuminates the roadmap for organizations seeking to enhance testing efficacy, drive operational excellence, and secure a sustainable competitive edge.

Secure Your Comprehensive Efficacy Testing Market Intelligence Report Today Ignite Data Driven Decision Making with Expert Guidance from Ketan Rohom

For decision makers seeking to deepen their understanding and drive strategic outcomes, securing the full efficacy testing market intelligence report is the next critical step. By partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, organizations gain tailored guidance on leveraging the latest insights to optimize resource allocation, mitigate tariff-related risks, and capitalize on emerging deployment models. This comprehensive resource arms stakeholders with nuanced analyses of component segmentation, regional dynamics, and competitive positioning, empowering data driven decisions that translate into measurable operational improvements. Reach out to Ketan Rohom to discuss customized access packages, exclusive advisory sessions, and accelerated delivery timelines that align with your organizational priorities. Elevate your strategic planning with a definitive roadmap backed by rigorous research and expert interpretation-acquire the full report today.

- How big is the Efficacy Testing Market?

- What is the Efficacy Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?