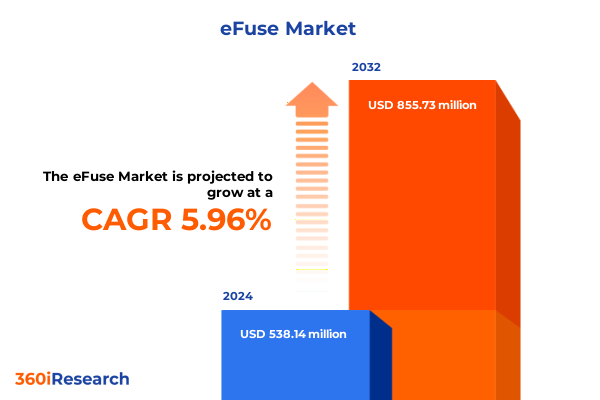

The eFuse Market size was estimated at USD 569.19 million in 2025 and expected to reach USD 602.14 million in 2026, at a CAGR of 5.99% to reach USD 855.73 million by 2032.

Harnessing the Power of Modern Electronic Fuses to Safeguard Advanced Circuits with Industry-Defining Unparalleled Precision and Reliability

In an era defined by rapid technological advancement and increasing demand for electronic safety, the role of electronic fuses has never been more pivotal. Electronic fuses, or eFuses, serve as intelligent protection devices that offer dynamic current and voltage management far beyond the capabilities of conventional passive components. By monitoring real-time conditions within circuits and responding instantaneously to anomalies, these semiconductor-driven solutions are revolutionizing how engineers safeguard complex systems across consumer, automotive, industrial, and telecommunications applications.

The foundation of this market landscape lies in the need for smarter, more precise power protection mechanisms. Traditional fuses, while effective to a point, are inherently limited by their one-time operation and delayed reaction times. By contrast, eFuses bring programmability, fault logging, thermal shutdown, and even dynamic current limiting to the table, reshaping reliability and performance benchmarks. Their integration into next-generation designs underpins device longevity, system resilience, and user safety, enabling disruptive applications from electric vehicle powertrains to edge computing nodes.

This executive summary offers a concise yet comprehensive vista of the evolving electronic fuse landscape. It spotlights transformative market shifts, evaluates the repercussions of recent tariff measures, uncovers key segmentation and regional drivers, profiles industry frontrunners, and delineates actionable recommendations. As decision-makers navigate this dynamic environment, the ensuing analysis will illuminate critical considerations and strategic pathways for capitalizing on the burgeoning eFuse opportunity.

Navigating the Rapidly Shifting Electronic Fuse Market Driven by Electrification Digitalization and Ever-Increasing Power Density Demands

The electronic fuse market is being reshaped by a confluence of disruptive forces that are redefining power management standards across industries. Driven by the accelerating shift toward electrification, vehicles and industrial systems alike now demand highly integrated, compact solutions capable of managing higher power densities without sacrificing safety. Simultaneously, the proliferation of connected devices-from smart home installations to advanced telecommunications infrastructure-has intensified the need for adaptive protection mechanisms that can accommodate fluctuating loads and unpredictable transient events.

Moreover, miniaturization trends, fueled by consumer desire for thinner, lighter gadgets, have placed unprecedented pressure on component footprints. eFuses that once occupied substantial board real estate are now being engineered into wafer-level and chip-scale packages, enabling seamless integration within densely packed PCBs. At the same time, emerging wide-bandgap materials such as silicon carbide and gallium nitride are catalyzing new performance thresholds, prompting eFuse manufacturers to tailor their solutions for compatibility with next-gen semiconductor platforms.

Supply chain resiliency has also emerged as a critical pivot point. Geopolitical tensions and semiconductor shortages have underscored the importance of diversified sourcing strategies and localized manufacturing capabilities. As original equipment manufacturers and system integrators strive to secure component availability, strategic partnerships between device designers and foundry networks are proliferating. Against this backdrop of technological, commercial, and operational transformation, stakeholders must remain agile, leveraging both incremental enhancements and radical innovations to stay ahead in the rapidly evolving electronic fuse landscape.

Assessing the Far-Reaching Influence of 2025 United States Tariff Adjustments on Electronic Fuse Supply Chains and Cost Structures

In 2025, the United States enacted a series of tariff amendments targeting semiconductor components, which has had a pronounced cascading effect on the global electronic fuse ecosystem. These measures, designed to incentivize domestic manufacturing and mitigate reliance on overseas suppliers, introduced elevated duties on key raw materials and finished devices sourced from select regions. Consequently, original equipment manufacturers have been compelled to reassess their procurement strategies, weighing the trade-off between increased unit costs and the benefits of onshore production security.

The immediate impact manifested as upward pressure on component pricing, prompting design teams to explore cost-containment measures. Alternative sourcing corridors emerged, including expanded collaborations with North American and near-shoring partners, to circumvent tariff triggers. Simultaneously, manufacturers have accelerated investment in state-of-the-art assembly and test facilities within the United States. These initiatives are not only a response to fiscal policy but also a proactive step toward enhanced supply chain transparency and reduced lead-time variability.

Over time, the cumulative tariff burden has driven diversification of the global eFuse manufacturing footprint. Several leading semiconductor houses have announced capacity expansions in Mexico and Canada, while forging alliances with domestic foundries to localize critical process steps. This recalibration is fostering a more resilient and regionally balanced value chain, albeit with transitional cost premiums. In parallel, end-users are increasingly factoring total cost of ownership-including logistics, tariffs, and inventory carrying costs-into their component selection models, ensuring that long-term resilience and performance remain prioritized alongside unit pricing.

Unlocking Critical Market Dynamics Through A Multifaceted Examination of Product Types Voltages Packages Applications and End Use Industries

The electronic fuse landscape spans a diverse array of product types, each tailored to meet the specific protection requirements of modern electronic systems. Discrete eFuses continue to command significant usage in applications where modularity and straightforward implementation are paramount, whereas integrated solutions are gaining traction as designers seek compact, multifunctional devices that combine overcurrent, overvoltage, and thermal protections on a single chip. One-time programmable variants are strategically deployed in high-security environments where irreversible fault logging is required, while resettable eFuses appeal to fields prioritizing maintenance-free repeatability, such as consumer electronics and telecommunications.

Voltage requirements further segment the market into distinct tiers. High-voltage eFuses rated above 24 volts drive industrial, renewable energy, and electric vehicle infrastructures, where robust surge handling and fault isolation are critical. Low-voltage devices under 5 volts dominate battery-powered and portable consumer gadgets, emphasizing minimal quiescent currents and compact package footprints. Between these extremes, the 5 to 24-volt category addresses the broad expanse of automotive electronics and intermediate industrial controls, balancing protection granularity with power efficiency.

Packaging formats also exert a considerable influence on device adoption. The chip-scale package is often the format of choice for ultra-compact designs and space-constrained wearables. Dual and quad flat no-lead packages offer a combination of thermal performance and ease of reflow soldering for mainstream electronics, while small outline no-lead packages represent a versatile mid-range choice. Wafer-level packaging is rapidly gaining momentum where highest integration density and performance uniformity are demanded, often in tandem with advanced silicon technologies.

Functional segmentation highlights the specific protection scenarios addressed by eFuses, from inrush current limiting and overcurrent protection to overvoltage and reverse current blocking. Applications requiring fast response to thermal events or short circuits increasingly rely on specialized eFuse architectures that integrate real-time diagnostics and self-resetting mechanisms. Distribution channels reflect evolving purchasing behaviors: traditional offline channels retain strong influence in industrial and aerospace markets due to stringent qualification processes, whereas online channels are expanding rapidly across consumer and small-volume segments, driven by digital procurement platforms.

Finally, end use industries illustrate the broad applicability of electronic fuses. Aerospace and defense applications demand the highest reliability thresholds and extensive qualification testing. Automotive and transportation systems leverage eFuses as foundational elements of electric powertrains, charging infrastructure, and advanced driver assistance systems. Consumer electronics represent the fastest growing segment as devices proliferate and form factors shrink. In healthcare, strict regulatory compliance and fault tolerance underpin eFuse selection. IT and telecommunications infrastructure capitalize on eFuses to safeguard high-density servers, data centers, and 5G network equipment. Together, these segmentation insights illuminate the multifaceted nature of the market and guide strategic focus areas for stakeholders.

This comprehensive research report categorizes the eFuse market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Voltage Rating

- Package Type

- Application

- Distribution Channel

- End Use Industry

Illuminating Regional Growth Patterns and Strategic Opportunities Spanning Americas Europe Middle East Africa and Asia Pacific Territories

Across the Americas, the drive toward electrification and digital infrastructure is catalyzing robust demand for electronic fuses. In North America, OEMs are rapidly integrating advanced eFuse solutions into electric vehicle platforms, data center power modules, and industrial automation controls. Government incentives promoting domestic semiconductor production have spurred localized capacity expansions, leading to improved supply chain visibility and reduced lead times. Latin America’s emerging renewable energy projects are also tapping into high-voltage eFuse technologies to safeguard solar inverters and wind turbine electronics, creating new avenues for growth.

In Europe, Middle East, and Africa, regulatory frameworks emphasizing energy efficiency and safety compliance are key growth drivers. European OEMs are prioritizing devices that meet stringent functional safety standards, particularly in automotive and industrial sectors. Renewable energy initiatives across the Middle East present significant opportunities for high-voltage and temperature-resilient eFuse solutions, while Africa’s nascent but rapidly developing telecom infrastructure is adopting low-voltage variants to enhance network reliability. Strategic partnerships between regional distribution networks and global manufacturers have improved accessibility, enabling quicker specification and deployment cycles.

Asia-Pacific remains the global manufacturing powerhouse, with China housing the largest concentration of semiconductor fabs and assembly facilities. This region benefits from both mature mass-market adoption in consumer electronics and explosive growth in electric mobility. Japan and South Korea continue to spearhead technical innovation, particularly in wafer-level packaging and wide-bandgap compatibility. Meanwhile, India’s accelerating digital transformation and infrastructure modernization are driving demand for versatile, cost-effective eFuse products. Collectively, these regional dynamics underscore the importance of tailored market strategies that align product offerings with localized performance requirements and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the eFuse market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Leading Innovators and Strategic Movements Shaping the Competitive Electronic Fuse Landscape Across Global Industry Players

In the competitive realm of electronic fuse solutions, a handful of leading semiconductor companies have distinguished themselves through innovation, strategic alliances, and diversified portfolios. One such industry titan has expanded its eFuse offerings across high-voltage and low-voltage segments, leveraging proprietary process technologies to achieve minimal leakage currents and rapid fault response times. Another key player has focused on integrating power management and protection features within system-on-chip architectures, enabling customers to streamline board layouts and reduce bill-of-materials complexity.

Strategic acquisitions and joint ventures have further reshaped the competitive landscape. Market leaders have acquired specialized design houses to bolster their patent portfolios and accelerate time to market for next-generation architectures. Others have partnered with advanced materials companies to pioneer eFuses optimized for silicon carbide and gallium nitride switches, addressing the critical needs of electric vehicle and renewable energy applications. Several organizations have also forged distribution agreements with global electronics distributors, ensuring seamless access for both high-volume and niche customers.

Emerging players are carving out unique value propositions by focusing on software-defined protection features, offering cloud-enabled monitoring and device health analytics. These firms are collaborating with system integrators and software platform providers to deliver turnkey solutions that extend beyond hardware, encompassing firmware configurability, remote diagnostics, and lifecycle management. This trend toward holistic protection ecosystems is fostering a new wave of competition, compelling established manufacturers to fortify their offerings with enhanced digital services and user-friendly configuration tools.

Collectively, these strategic movements underscore an industry in flux-one where technological differentiation, supply chain agility, and value-added services define market leadership. As the electronic fuse domain continues to evolve, the interplay between innovation and collaboration will determine which organizations emerge as enduring frontrunners.

This comprehensive research report delivers an in-depth overview of the principal market players in the eFuse market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alpha and Omega Semiconductor Limited

- Analog Devices, Inc.

- Diodes Incorporated

- Eaton Corporation Plc

- Infineon Technologies AG

- Microchip Technology Incorporated

- Monolithic Power Systems, Inc.

- Nuvoton Technology Corporation

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Qorvo, Inc.

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- Schneider Electric SE

- Semtech Corporation

- Silergy Corp.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- Tower Semiconductor Ltd.

- Vishay Intertechnology, Inc.

Empowering Industry Leaders with Tactical Strategies to Accelerate Innovation Strengthen Supply Chains and Capitalize on Emerging Market Niches

Industry leaders must adopt a proactive posture to maintain competitive advantage amid rapid technological evolution and geopolitical uncertainties. Prioritizing investment in integrated eFuse solutions that offer programmable protections and in-system configurability will enable rapid adaptation to diverse application requirements, from electric vehicle charging stations to 5G network nodes. Concurrently, expanding R&D focus on wide-bandgap material compatibility and ultra-low leakage currents can unlock novel opportunities in high-efficiency power conversion and harsh-environment systems.

To bolster supply chain resilience, organizations should diversify their manufacturing footprint by forging partnerships with regional foundries and assembly providers, thereby reducing exposure to tariff fluctuations and shipping constraints. Near-shoring critical process steps, complemented by strategic inventory buffering, will mitigate lead-time risks and enhance production agility. At the same time, cultivating multi-tier distribution alliances-spanning both offline and online channels-will facilitate broader market penetration, catering to both traditional industrial segments and digitally native customers.

Moreover, companies can gain a strategic edge by embedding digital services within their eFuse portfolios. Cloud-enabled diagnostics, remote configuration tools, and real-time fault analytics elevate protection solutions from standalone components to comprehensive system enablers. These value-added services not only deepen customer engagement but also generate recurring revenue streams through subscription-based support offerings.

Finally, industry participants should pursue collaborative innovation by aligning with semiconductor foundries, materials suppliers, and system integrators. Co-development initiatives can accelerate technology roadmaps while ensuring seamless ecosystem compatibility. By embracing these actionable recommendations-spanning product innovation, supply chain optimization, digital service integration, and cross-industry collaboration-leaders can position themselves to capitalize on emerging market opportunities and drive long-term growth.

Detailing Rigorous Research Methodology Combining Primary Interviews Secondary Sources and Quantitative Data Triangulation for Robust Insights

This analysis synthesizes insights drawn from a multifaceted research framework designed to ensure both breadth and depth of understanding. Primary research initiatives included in-depth interviews with senior design engineers, procurement leaders, and system integrators across key end use industries. These conversations provided firsthand perspectives on technical priorities, sourcing challenges, and emerging application trends.

Complementing the primary data, secondary research encompassed a thorough review of publicly available technical papers, regulatory filings, patent databases, and industry conference proceedings. This secondary intelligence enabled mapping of evolving technology roadmaps and identification of disruptive entrants. Proprietary databases on global semiconductor shipments and tariff schedules were also leveraged to quantify supply chain shifts and regional production capacities.

Quantitative triangulation methods were applied to reconcile insights from primary interviews and secondary sources. A structured survey of OEMs and contract manufacturers facilitated statistical validation of adoption patterns and purchasing preferences. Advanced data modeling techniques ensured that segmentation analyses accurately reflect cross-correlations between product types, voltage ratings, package formats, and end use demands.

Finally, an expert panel comprising industry veterans and academic researchers convened to challenge preliminary findings, refine interpretations, and validate strategic recommendations. This rigorous, iterative methodology underscores the reliability of the insights presented in this report, equipping stakeholders with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our eFuse market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- eFuse Market, by Product Type

- eFuse Market, by Voltage Rating

- eFuse Market, by Package Type

- eFuse Market, by Application

- eFuse Market, by Distribution Channel

- eFuse Market, by End Use Industry

- eFuse Market, by Region

- eFuse Market, by Group

- eFuse Market, by Country

- United States eFuse Market

- China eFuse Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Perspectives Emphasizing the Pivotal Role of Electronic Fuses in Ensuring Next Generation Electrical System Safety and Performance

As global industries accelerate toward electrification, connectivity, and ever-tighter safety standards, electronic fuses stand at the forefront of circuit protection innovation. Their ability to deliver rapid, programmable fault response, real-time diagnostics, and seamless integration within compact form factors positions them as indispensable enablers of next-generation systems. The transformative shifts in supply chain dynamics-shaped by tariff realignments and near-shoring imperatives-underscore the need for agile, localized manufacturing strategies to preserve both cost competitiveness and operational resilience.

Segmentation analyses reveal a market defined by diverse product modalities, tailored voltage capabilities, and specialized package technologies, each addressing unique application requirements across aerospace, automotive, consumer electronics, healthcare, and telecommunications. Regional dynamics further highlight the importance of customized go-to-market approaches, as North America focuses on onshore capacity growth, EMEA prioritizes regulatory compliance and industrial automation, and Asia-Pacific drives mass market scale and material innovation.

Leading semiconductor houses and nimble challengers alike are advancing proprietary eFuse architectures, forging partnerships, and embedding digital services to differentiate their offerings. In this competitive environment, organizations that strategically invest in integrated solutions, diversify supply chains, and embrace value-added analytics will be best positioned to seize emerging growth corridors.

Ultimately, the electronic fuse market is poised for continued expansion as industries worldwide seek smarter, more reliable power protection. Stakeholders who leverage the comprehensive insights and strategic recommendations outlined herein will be empowered to navigate disruptions, capitalize on new opportunities, and secure a leadership stance in the evolving landscape of electronic fuse technology.

Engage with Ketan Rohom to Unlock Exclusive Market Intelligence on Electronic Fuse Innovations and Propel Your Strategic Decision Making Forward

To explore the full breadth of insights on innovation drivers, tariff implications, regional dynamics, and actionable strategies within the electronic fuse market, reach out today to Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide your team through a customized overview of the report’s detailed findings, helping you tailor solutions that align precisely with your business objectives. Engage directly to schedule a personalized consultation, unlock exclusive data tables, and gain immediate access to in-depth company profiles, proprietary segmentation analyses, and forward-looking trend forecasts. With Ketan’s strategic guidance, your organization can accelerate time to market, optimize supply chain resilience, and position itself at the forefront of emerging opportunities in power management technology. Don’t miss the chance to leverage this comprehensive resource and secure a competitive edge in tomorrow’s electronic fuse landscape - contact Ketan Rohom today and take the next step toward data-driven success.

- How big is the eFuse Market?

- What is the eFuse Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?