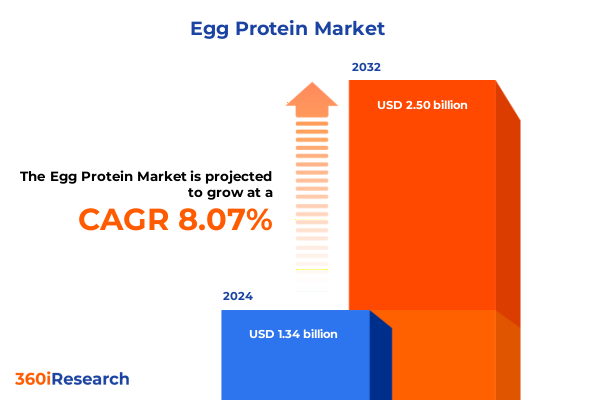

The Egg Protein Market size was estimated at USD 1.44 billion in 2025 and expected to reach USD 1.57 billion in 2026, at a CAGR of 8.09% to reach USD 2.50 billion by 2032.

Examining How Consumer Health Priorities and Processing Innovation Are Elevating Egg Protein into the Forefront of Functional Nutrition

Egg protein has emerged as a standout ingredient in the broader protein landscape, driven by growing consumer focus on clean-label nutrition, functional benefits, and versatile applications. Over the past several years, scientific research has increasingly validated eggs as a high-quality source of bioavailable amino acids, positioning egg-derived proteins as a premium alternative to plant- and dairy-based sources. This trend is reinforced by heightened interest in muscle recovery, weight management, and immunonutrition among both professional athletes and health-conscious consumers, creating fertile ground for product innovation and diversified ingredient adoption.

Simultaneously, the egg protein ecosystem has adapted to accommodate evolving demands for convenience, sustainability, and premiumization. Advances in processing technology, such as optimized spray- and freeze-drying methods, have improved solubility, texture, and shelf stability, empowering manufacturers to incorporate egg protein across an expanding assortment of food, beverage, and supplement formulations. As a result, leading food technologists and formulators are exploring novel applications that harness the functional and sensory attributes of egg protein, from emulsification in meat analogues to botanically infused protein beverages. By recognizing these drivers and technological enablers, stakeholders can better understand how egg protein is carving out a differentiated niche in a crowded protein space.

Unpacking the Convergence of Consumer Demand, Sustainability Imperatives, and Digital Innovation Driving the Future of Egg Protein

The egg protein sector has experienced fundamental transformation as shifting consumer preferences, regulatory pressures, and technological breakthroughs converge to reshape the competitive landscape. Consumers are no longer satisfied with basic protein offerings; they demand multifunctional ingredients that deliver proven physiological benefits, clean-label declarations, and minimal environmental impact. In response, ingredient suppliers and end-product manufacturers are co-investing in research and development to enhance bioactive peptide profiles, reduce allergenicity, and validate health claims through clinical studies.

Additionally, sustainability imperatives have catalyzed improvements in supply chain transparency, forging partnerships between egg producers and downstream processing facilities to reduce carbon footprints and optimize resource utilization. Traceability systems and blockchain initiatives are increasingly adopted to certify humane farming practices and feed-to-product accountability. Meanwhile, digitalization across processing plants enables real-time quality monitoring and predictive maintenance, bolstering operational efficiency and reducing downtime. Taken together, these transformative shifts underscore the dynamic nature of the egg protein landscape, where agility, collaboration, and science-driven innovation are paramount for competitive differentiation.

Assessing How Recent U.S. Import Duty Increases Are Reshaping Supply Chains, Sourcing Strategies, and Domestic Production Capacity

In 2025, the cumulative effect of U.S. import tariffs on dried egg protein and related derivatives has significantly altered global supply dynamics and cost structures. Incremental duties imposed on key trade partners have resulted in higher landed costs for imported albumin and whole egg powders, compelling many manufacturers to reevaluate sourcing strategies. These tariff measures, instituted in response to broader trade policy shifts, have disrupted traditional supply routes and prompted a recalibration of procurement networks.

As tariffs elevated import expenses, domestic processing capacity has garnered increased investment interest, accelerating expansions in freeze-drying infrastructure and spray-drying facilities. Manufacturers seeking to mitigate tariff-induced margin erosion have strengthened collaborations with local egg producers, fostering integrated value chains that deliver greater pricing stability. Concurrently, some innovators have pursued strategic sourcing from non-traditional regions with lower tariff burdens, diversifying supplier portfolios to buffer against geopolitical volatility. While these adjustments have created near-term supply chain complexity, they have also stimulated localized capacity growth and reinforced resilience in the egg protein sector.

Deriving Actionable Insights from Product Type, Application, Processing Technology, Distribution Channel, Source, and Grade Dimensions

Diving into product type reveals that albumin remains the most versatile format, prized for its functional properties in whipping, foaming, and gelling applications, while whole egg powder brings cost advantages to bakery and confectionery producers, and yolk powder is leveraged for its lecithin-rich emulsification potential. In applications, the breadth spans from indulgent bakery and confectionery creations to high-performance sports nutrition formulations, with burgeoning interest in functional foods, beverages, and even personal care and pharmaceutical excipients. On the processing front, freeze-dried variants command attention for their superior retention of bioactivity and flavor integrity, while spray-dried formats offer scalability and cost-efficiency that align with high-volume production.

Examining distribution channels uncovers that online retail platforms have surged in prominence, enabling direct-to-consumer access and niche brand storytelling, whereas specialty stores and supermarkets continue to appeal to ingredient buyers seeking breadth of choice and immediate availability. Underlying these dynamics, source segmentation differentiates duck egg proteins, which are prized for unique fatty acid profiles, from the more ubiquitous hen egg derivatives. Finally, grade segmentation delineates feed-grade products destined for animal nutrition from food-grade variants subject to stricter quality and safety standards. By synthesizing these intersecting dimensions, stakeholders can pinpoint opportunities to tailor product offerings and distribution tactics to capture maximum value across the egg protein spectrum.

This comprehensive research report categorizes the Egg Protein market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Processing Technology

- Source

- Grade

- Application

- Distribution Channel

Illuminating the Distinct Drivers and Infrastructure Considerations Shaping Egg Protein Adoption across the Americas, EMEA, and Asia-Pacific

Regional dynamics in egg protein consumption and production underscore the importance of tailored market approaches. In the Americas, strong legacy demand in dietary supplements and sports nutrition is reinforced by robust domestic egg production and well-established processing networks. This region benefits from integrated supply chains that support rapid scale-up of innovative protein ingredients, though ongoing tariff fluctuations continue to introduce sourcing complexities and spur volume shifts toward domestic channels.

Across Europe, the Middle East, and Africa, regulatory frameworks and consumer preferences diverge markedly, with stringent food safety standards in the European Union driving demand for high-purity, certified traceable egg proteins, while emerging markets in the Middle East and Africa present untapped growth potential amid infrastructure development. These disparate conditions require manufacturers to align product specifications and marketing narratives to local compliance regimes and cultural tastes.

Asia-Pacific stands out as the fastest-evolving region, propelled by expanding health and wellness awareness, rising disposable incomes, and a proliferation of functional food and beverage launches incorporating egg protein. Governments in key markets are investing in agricultural modernization, which is helping to expand egg production volumes and improve processing capabilities. Collectively, these regional insights point to differentiated strategies based on local drivers, regulatory landscapes, and infrastructure maturity.

This comprehensive research report examines key regions that drive the evolution of the Egg Protein market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Navigating the Competitive Terrain Defined by Established Suppliers, Agile Innovators, and Strategic Collaborations in Egg Protein

The competitive landscape of the egg protein market is defined by a combination of established ingredient suppliers and agile specialty producers. Longstanding companies with integrated operations continue to leverage scale advantages in sourcing and processing, reinvesting in technological upgrades to enhance product performance and operational resilience. Simultaneously, nimble challengers and regional players are carving out niches by focusing on tailor-made formulations, sustainability certifications, and direct partnerships with niche end-market brands.

Collaborative ventures between ingredient innovators and academic institutions are expanding the frontiers of bioactive peptide research and novel delivery systems. Rising collaborations also extend to co-manufacturing alliances that optimize facility utilization and expedite time to market for new formulations. Furthermore, strategic mergers and acquisitions remain a key avenue for industry consolidation, enabling companies to pool R&D assets, broaden application capabilities, and achieve synergies in distribution. These multifaceted competitive dynamics underscore the importance of agility, R&D prowess, and strategic partnerships in establishing market leadership within the egg protein arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Egg Protein market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adriaan Goede B.V.

- Avangardco IPL Public Stock Company

- Ballas Egg Products GmbH

- Cal-Maine Foods, Inc.

- Dalian Hanovo Foods Co., Ltd.

- EIPRO Ei-Produktkompanie GmbH & Co. KG

- Eurovo Group S.r.l.

- Glanbia plc

- HiMedia Laboratories Pvt. Ltd.

- Huachiew Group Co., Ltd.

- Interovo Egg Group B.V.

- Kaifeng Jinshan Egg Products Co., Ltd.

- Michael Foods, Inc.

- Nepra Foods Inc.

- NOW Health Group, Inc.

- Ovostar Union N.V.

- PoLoPo

- Rose Acre Farms, LLC

- SF Vivesa Holding S.R.O.

- SKM Egg Products Export (India) Ltd.

- Sparboe Farms, Inc.

- Stern-Wywiol Gruppe GmbH & Co. KG

- Taiyo Kagaku Co., Ltd.

- Wulro B.V.

- Zhejiang Tianyuan Egg Industry Co., Ltd.

Implementing Strategic Sourcing, Processing Advancements, and Collaborative Innovation to Strengthen Market Position

Industry leaders should prioritize diversification of sourcing portfolios to mitigate tariff and geopolitical risks, ensuring seamless access to high-quality egg proteins across multiple regions and processing formats. Investments in processing innovation, including automation and real-time quality analytics, will be critical to maintain cost competitiveness and deliver consistent functional performance. Additionally, forging deeper partnerships with regulatory bodies and certification organizations can facilitate entry into high-growth markets by meeting stringent quality, sustainability, and traceability requirements.

Equally important is the cultivation of end-user relationships through co-creation initiatives, where ingredient suppliers collaborate directly with brand owners to tailor egg protein functionalities for specific applications. This approach accelerates new product development cycles and strengthens customer loyalty. Finally, building robust consumer education platforms that highlight the unique advantages of egg-derived proteins-including bioavailability, clean-label attributes, and multi-functionality-can drive wider acceptance across mainstream and emerging categories.

Detailing a Rigorous Approach Integrating Secondary Analysis, Expert Interviews, Benchmarking, and Validation Workshops

Our research methodology combined comprehensive secondary research with targeted primary interviews across the egg protein value chain. Secondary sources included industry publications, trade associations, and regulatory filings, which were systematically reviewed to understand evolving tariff legislation, production capacities, and application trends. To validate these insights, in-depth interviews were conducted with senior executives at leading ingredient suppliers, contract manufacturers, and end-product formulators, providing firsthand perspectives on market dynamics and competitive strategies.

Quantitative data on production volumes, trade flows, and processing capacities were triangulated with qualitative feedback from supply chain experts to ensure accuracy and relevance. A parallel supplier benchmarking exercise evaluated operational efficiencies, technological readiness, and sustainability credentials, while scenario analysis simulated the potential effects of further trade policy shifts. Finally, a validation workshop with select industry participants was held to refine key findings and recommendations, guaranteeing that the final report reflects practical realities and addresses stakeholder priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Egg Protein market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Egg Protein Market, by Product Type

- Egg Protein Market, by Processing Technology

- Egg Protein Market, by Source

- Egg Protein Market, by Grade

- Egg Protein Market, by Application

- Egg Protein Market, by Distribution Channel

- Egg Protein Market, by Region

- Egg Protein Market, by Group

- Egg Protein Market, by Country

- United States Egg Protein Market

- China Egg Protein Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Opportunities and Challenges to Illuminate the Strategic Path Forward for Egg Protein Stakeholders

The egg protein ecosystem is poised for sustained evolution, driven by the interplay of consumer demand for functional nutrition, technological advancements, and shifting trade policies. Through careful analysis of product, application, processing, regional, and competitive dimensions, this report has illuminated the opportunities and challenges that define the current landscape. Stakeholders equipped with these insights can anticipate headwinds related to tariff volatility and regulatory complexity, while capitalizing on growth vectors in high-value applications and emerging markets.

As the industry continues to mature, success will hinge on agility across sourcing, innovation in processing, and strategic partnerships that bridge value chain segments. By aligning investments with evolving consumer expectations and supply chain realities, market participants can secure their role in shaping the future of egg protein. Ultimately, the convergence of science-driven product development and resilient supply strategies will determine which organizations thrive in this dynamic environment.

Engage Directly with the Associate Director of Sales & Marketing to Secure Exclusive Insights and Customized Solutions for Egg Protein Market Leadership

For leaders seeking to leverage the strategic insights outlined herein, connecting directly with Ketan Rohom, Associate Director of Sales & Marketing, can unlock deeper understandings and customized solutions tailored to your organization’s requirements. By engaging with Ketan, you gain access to an exclusive preview of actionable intelligence that can strengthen your market positioning, optimize product portfolios, and accelerate innovation initiatives across the egg protein value chain. Reach out to explore bespoke consulting services, secure priority delivery of the full market research report, and discuss bespoke engagement models that align with your growth objectives. Take the next step today to secure your competitive advantage and harness the full potential of egg protein as a transformative ingredient.

- How big is the Egg Protein Market?

- What is the Egg Protein Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?