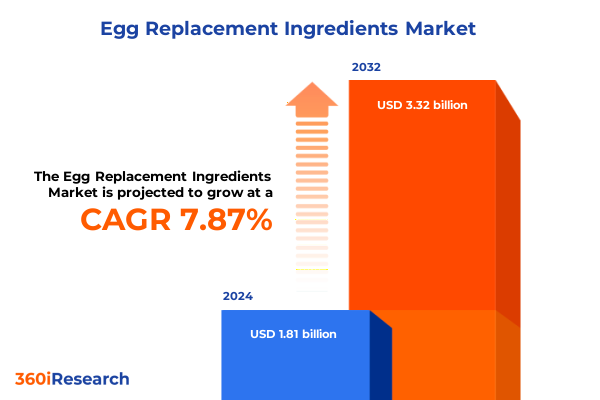

The Egg Replacement Ingredients Market size was estimated at USD 1.94 billion in 2025 and expected to reach USD 2.08 billion in 2026, at a CAGR of 7.98% to reach USD 3.32 billion by 2032.

Navigating the Emergence of Egg Replacements as a Cornerstone of Modern Food Innovation and Sustainability in Ingredient Formulations

Modern food innovation is undergoing a significant transformation as egg replacements emerge as a versatile and sustainable alternative in culinary formulations. Driven by growing consumer demand for clean-label and allergen-free products, manufacturers are increasingly seeking ingredients that can replicate the emulsification, binding, and leavening properties traditionally provided by eggs. This shift underscores a critical inflection point where innovation intersects with health, environmental, and regulatory considerations.

In recent years, the proliferation of plant-based diets and the heightened focus on food safety have catalyzed extensive research into egg substitutes. Stakeholders across the food supply chain recognize that egg replacement solutions not only address allergen concerns but also enhance shelf stability and reduce supply-chain volatility tied to poultry production. As ingredient technologists refine formulations, novel offerings leverage plant proteins and hydrocolloids to achieve functional equivalence, broadening the scope of applications from bakery to savory sauces.

Consequently, the landscape of egg replacement ingredients is evolving into a dynamic arena of competitive differentiation. Companies that prioritize ingredient transparency and sustainability are well-positioned to meet the expectations of eco-conscious consumers. As this market continues to gain momentum, understanding its foundational drivers becomes imperative for decision-makers seeking to innovate and capture emerging growth opportunities.

Uncovering the Paradigm Shift Driving the Widespread Adoption and Technological Advancements of Egg Replacement Solutions in the Global Food Industry

Over recent years, the egg replacement ingredients space has witnessed a remarkable transformation marked by technological breakthroughs and shifting consumer preferences. Novel extraction techniques and precision formulation methods have enabled the development of plant-based proteins and functional blends that rival the performance of eggs across diverse culinary applications. Simultaneously, advancements in enzymatic processing and emulsification technologies have further elevated product quality, leading to cleaner flavor profiles and enhanced textural properties.

Alongside these technological developments, regulatory frameworks and labeling standards have evolved to support transparency and facilitate market acceptance. Harmonized guidelines around allergen declarations and ingredient sourcing have reduced barriers to market entry, enabling manufacturers to streamline their product development cycles. Moreover, the convergence of sustainability imperatives with cost efficiencies has driven the adoption of alternative protein sources, including pea, soy, and wheat proteins, which offer scalability without compromising functionality.

This transformative period highlights a convergence of innovation, policy, and consumer advocacy. Ingredient suppliers and end-product manufacturers are navigating an ecosystem in which agility and collaboration become key differentiators. By staying attuned to these paradigm shifts, stakeholders can better anticipate market demands and leverage emerging technologies to capture share in a rapidly evolving industry.

Assessing the Far Reaching Consequences of 2025 United States Tariffs on the Supply Chain and Pricing Dynamics of Egg Replacement Ingredients

The implementation of new tariff structures in the United States during 2025 has reshaped trade dynamics for egg replacement ingredients, triggering ripple effects throughout the supply chain. Import duties on key plant protein sources have elevated raw material costs, compelling suppliers to reassess sourcing strategies and negotiate new contracts. These adjustments have, in turn, influenced processing economics and packaging costs, particularly for powder-based formulations that rely on imported concentrates and isolates.

As costs have fluctuated, manufacturers have explored alternative supply corridors and invested in domestic protein extraction capabilities. This strategic pivot aims to mitigate exposure to import levies and enhance supply reliability. Notably, companies with vertically integrated operations have leveraged in-house processing and localized ingredient networks to maintain stable pricing for end consumers. Nonetheless, the overall market has experienced tightening margins, prompting a wave of cost optimization initiatives and collaborative procurement models.

In parallel, the tariff-driven recalibration has accelerated innovation in liquid egg replacement offerings that utilize locally sourced proteins. By pivoting to formulations designed around regional commodities, producers have reduced dependency on higher-tariff imports and reinforced supply-chain resilience. These adaptive strategies underscore the critical importance of agility in navigating evolving trade policies, ensuring that manufacturers can sustain product quality while managing cost pressures effectively.

Revealing In Depth Segmentation Insights That Illuminate Consumer Preferences and Industrial Needs Across Forms Applications Industries and Sources

A nuanced understanding of market segmentation reveals how form, application, industry, and source interplay to shape product development and commercialization strategies. When analyzing form, liquid formulations have gained traction in applications where ease of integration and rapid blending are paramount, while powder formats remain favored for dry-mix formulations and extended shelf life. These distinctions influence manufacturing investments in equipment for precise dosing and reconstitution systems.

Exploring applications further illuminates demand drivers: bakery producers prioritize emulsification and moisture retention in batters and doughs, while confectionery manufacturers value whipping and aeration capabilities in meringue-like textures. The meat products sector demands bind and moisture control to replicate the functional role of eggs in sausages and patties, whereas sauces and dressings rely on stable emulsions to achieve creamy textures and shelf stability.

End-use industries frame how ingredient suppliers tailor their go-to-market approaches. The food manufacturing sector focuses on high-volume partnerships and standardized specifications, the food service channel emphasizes ease of use and consistent performance under varied kitchen conditions, and household consumers seek convenient retail-ready options that deliver reliable results in home baking and cooking.

Finally, source considerations are critical: pea protein offers a neutral flavor profile and hypoallergenic attributes, soy protein delivers robust gelation properties and cost-effectiveness, and wheat protein contributes viscoelasticity critical for certain dough-based applications. By integrating insights across form, application, industry, and source dimensions, stakeholders can optimize product portfolios to address diverse market requirements.

This comprehensive research report categorizes the Egg Replacement Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Application

- End Use Industry

Examining Regional Nuances and Growth Potential for Egg Replacement Ingredients Across Key Global Markets and Economic Blocs

Regional dynamics exhibit distinct trajectories that influence market entry and expansion strategies for egg replacement ingredients. In the Americas, innovation hubs in North America drive early adoption of plant-based solutions, supported by a strong network of co-manufacturers and distribution partners. Latin American markets, characterized by emerging middle-class growth, present opportunities for value-oriented powder formats that align with improving cold-chain infrastructure.

Moving to Europe, the Middle East & Africa region, regulatory alignment around sustainability standards and allergen transparency has fostered a conducive environment for novel ingredient launches. Western European nations lead in premium product development, while Eastern European markets demonstrate rapid uptake of cost-effective soy and wheat protein-based solutions. In the Middle East & Africa, partnerships with local foodservice operators have catalyzed awareness of egg-free options in both retail and institutional channels.

In Asia-Pacific, urbanization and evolving dietary habits have accelerated demand for ready-to-use liquid egg replacements, particularly in the bakery and confectionery segments. Key markets such as China and Japan emphasize clean-label credentials and traceability, prompting suppliers to enhance provenance documentation and leverage regional agricultural outputs. Southeast Asian economies are increasingly integrating pea and wheat protein alternatives into traditional recipes, reflecting a balance between innovation and cultural culinary practices.

By tailoring approaches to these regional nuances, ingredient providers can develop market-specific value propositions and collaborate with local stakeholders to drive sustained growth across each geographic cluster.

This comprehensive research report examines key regions that drive the evolution of the Egg Replacement Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Competitive Landscape of the Egg Replacement Ingredients Market

The competitive landscape of egg replacement ingredients is shaped by a cohort of innovative players and strategic partnerships. Leading global ingredient producers are investing in research collaborations with academic institutions to advance functional properties of plant-based proteins. These alliances extend to joint ventures with technology startups focused on precision fermentation and enzymatic enhancements, expanding the scope of high-performance egg alternatives.

Mid-sized ingredient houses are differentiating through niche product lines that cater to health-driven consumer segments, such as allergy-sensitive populations and clean-label advocates. By combining proprietary processing techniques with customized application support, these firms have carved out significant share in specialized bakery and confectionery channels. Meanwhile, contract manufacturing organizations are bolstering capacity with modular production lines capable of handling both liquid and powder formats.

Cross-industry partnerships are also emerging as a key trend, with meat processors and sauce formulators co-developing turnkey solutions that integrate egg replacements seamlessly into existing production workflows. This collaborative model reduces formulation complexity for end users and accelerates time to market for new product launches.

Amidst this competitive ecosystem, suppliers that emphasize robust technical support and transparent supply chains are gaining favor. By nurturing long-term client relationships and leveraging digital platforms for formulation optimization, these companies are poised to lead the next wave of innovation in egg replacement ingredient solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Egg Replacement Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK Foods AB

- Archer Daniels Midland Company

- Arla Foods amba

- Axiom Foods, Inc.

- Bob’s Red Mill Natural Foods, Inc.

- Cargill, Incorporated

- Corbion N.V.

- Eat Just, Inc.

- Euroduna Food Ingredients GmbH

- Fiberstar, Inc.

- Florida Food Products LLC

- Ingredion Incorporated

- J&K Ingredients, Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Koninklijke DSM N.V.

- MGP Ingredients, Inc.

- Natural Products, Inc.

- Novozymes A/S

- Orchard Valley Foods Limited

- Puris Holdings, LLC

- Roquette Frères S.A.

- Suedzucker AG

- TerraVia Holdings, Inc.

- The Scoular Company

Strategic Guidance for Industry Leaders to Capitalize on Growing Demand and Drive Collaborative Innovation in Egg Replacement Technologies

To thrive in the evolving egg replacement sector, industry leaders must adopt a multifaceted strategy that balances innovation, collaboration, and operational excellence. Emphasizing targeted research partnerships with universities and specialized labs can expedite the development of next-generation functional ingredients, enabling faster adoption by both bulk manufacturers and artisanal producers.

Procuring raw materials through diversified sourcing agreements is essential to mitigate the impact of geopolitical shifts and tariff fluctuations. Establishing alliances with farmers and co-ops for direct procurement of pea, soy, and wheat proteins can secure stable supply volumes and foster traceability initiatives that resonate with sustainability-conscious consumers. Concurrently, investing in localized processing facilities can reduce logistics overhead and ensure consistent quality across both liquid and powder formats.

Cultivating digital platforms for customer engagement offers another avenue for differentiation. Interactive formulation tools and virtual technical support can streamline product development cycles for foodservice operators and household consumers alike. By integrating real-time feedback mechanisms, suppliers can refine offerings swiftly and build brand loyalty.

Finally, proactive regulatory monitoring and participation in industry associations will enable companies to anticipate policy changes and advocate for harmonized standards. Through these actionable recommendations, stakeholders can position themselves to capture the growing momentum in the egg replacement market and secure durable competitive advantages.

Outlining the Comprehensive Research Methodology Employed to Deliver Rigorous Insights and Ensure Data Integrity in Market Analysis

The insights presented in this report are derived from a rigorous research methodology designed to ensure both depth and reliability. Initially, a comprehensive secondary research phase encompassed the review of scientific journals, patent filings, regulatory documents, and industry association reports to establish a foundational understanding of ingredient properties, functional requirements, and policy landscapes.

This was followed by an extensive primary research process involving in-depth interviews with key stakeholders across the value chain, including ingredient suppliers, food manufacturers, R&D specialists, and regulatory experts. These conversations provided qualitative perspectives on formulation challenges, adoption drivers, and emerging application opportunities in bakery, confectionery, meat products, and sauces.

Quantitative data analysis was conducted by aggregating insights from manufacturing databases, trade records, and customs filings to quantify trade flows and tariff impacts. Proprietary analytical frameworks were then applied to synthesize segmentation insights across form, application, end-use industry, and source dimensions. Geographical mapping techniques facilitated the evaluation of regional market nuances across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

By integrating multiple data sources and triangulating findings, this methodology delivers a holistic view of the egg replacement ingredients market. The approach emphasizes transparency, reproducibility, and stakeholder validation at every stage, ensuring that the conclusions and recommendations are both actionable and grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Egg Replacement Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Egg Replacement Ingredients Market, by Form

- Egg Replacement Ingredients Market, by Source

- Egg Replacement Ingredients Market, by Application

- Egg Replacement Ingredients Market, by End Use Industry

- Egg Replacement Ingredients Market, by Region

- Egg Replacement Ingredients Market, by Group

- Egg Replacement Ingredients Market, by Country

- United States Egg Replacement Ingredients Market

- China Egg Replacement Ingredients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Critical Findings to Illuminate the Path Forward for Stakeholders Embracing Egg Replacement Ingredient Solutions

The exploration of egg replacement ingredients underscores a transformative trajectory for the food industry, driven by consumer demand for healthful, sustainable, and allergen-free solutions. Advances in plant protein technologies, coupled with strategic supply-chain adaptations in response to tariff changes, have expanded the functional repertoire of egg substitutes. These developments are reshaping traditional formulations across bakery, confectionery, meat products, and sauces, and redefining the parameters of product innovation.

Segmentation insights reveal that the interplay of form, application, industry context, and source is central to tailoring ingredient offerings that meet specific performance criteria. Regional analyses further highlight the imperative of localizing strategies to align with market maturity, regulatory frameworks, and cultural preferences. Leadership in this space is contingent on dynamic collaboration among ingredient innovators, food manufacturers, and regulatory bodies to coalesce around harmonized standards and sustainable practices.

Looking ahead, the confluence of technological breakthroughs, shifting trade policies, and evolving consumer values will continue to drive momentum in the egg replacement sector. Stakeholders who embrace agility, invest in R&D partnerships, and prioritize transparent sourcing will be best positioned to capitalize on emerging opportunities. This report synthesizes the critical insights necessary to inform strategic decisions and chart a course for sustained growth in a rapidly advancing market.

Empower Your Strategic Decisions Today Connect with Ketan Rohom to Unlock Exclusive Insights and Secure Your Comprehensive Egg Replacement Market Report

To embark on a comprehensive exploration of egg replacement ingredients tailored to your organization’s strategic needs, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, for immediate access to in-depth analysis and customizable market reports. Engage with an expert who can align the insights within this report to your unique objectives and ensure you receive precise recommendations for actionable growth in the dynamic egg replacement sector. Don’t miss the opportunity to gain a competitive edge-initiate your consultation today and secure your copy of the definitive egg replacement ingredients report.

- How big is the Egg Replacement Ingredients Market?

- What is the Egg Replacement Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?