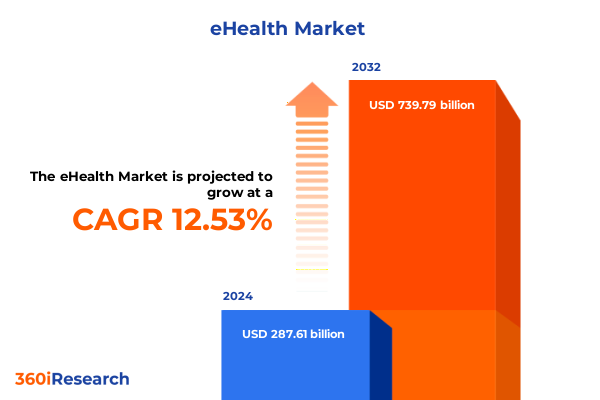

The eHealth Market size was estimated at USD 322.74 billion in 2025 and expected to reach USD 362.17 billion in 2026, at a CAGR of 12.58% to reach USD 739.79 billion by 2032.

Unveiling the transformative journey of digital health innovation and patient-centric integration reshaping global healthcare delivery ecosystems

The evolution of digital health has transcended traditional clinical boundaries, enabling seamless patient engagement and real-time data exchange. This report embarks on a journey through the intricate landscape of electronic health record integration, telemedicine platforms, and remote monitoring solutions, capturing the most pivotal trends reshaping healthcare delivery. As stakeholders navigate an environment characterized by rapid technological advances and shifting regulatory mandates, the context provided here serves as a foundational guide for understanding the forces propelling the eHealth ecosystem.

Throughout this introduction, the intention is to establish a holistic perspective on the drivers of digital health adoption, from the imperatives of value-based care to the imperative of interoperability. By contextualizing the interplay between emerging technologies such as artificial intelligence and cloud computing with patient-centric models, this section lays the groundwork for a deeper exploration of how these elements converge to redefine clinical workflows and patient outcomes.

Exploring the seismic evolution of digital health ecosystems driven by AI, interoperability breakthroughs, and the rise of patient-centric telemedicine services

Healthcare organizations worldwide are undergoing a profound transformation, driven by the integration of intelligent analytics and cloud-native infrastructures. Artificial intelligence now underpins diagnostic assistance and predictive maintenance of critical medical devices, shifting providers toward proactive models of care. In parallel, the advent of standardized interoperability frameworks has dismantled silos, allowing disparate systems to communicate seamlessly, thereby enhancing care coordination across inpatient and outpatient settings.

Furthermore, telemedicine services have evolved from a niche offering to a mainstream avenue for both routine consultations and specialized care. Patient adoption has accelerated as mobile health applications deliver personalized insights and facilitate chronic disease management. In tandem with these developments, healthcare payers and regulators are aligning incentives around outcomes, which in turn reinforces the momentum toward digital health solutions that can demonstrate measurable improvements in quality and efficiency. Consequently, the digital health landscape has matured into an ecosystem where technology, policy, and patient empowerment intersect to drive sustainable innovation.

Analyzing the cumulative repercussions of 2025 United States tariffs on digital health infrastructure, supply chain dynamics, and technology deployment costs

In 2025, the United States introduced a series of tariffs targeting imported hardware components and specialized devices integral to digital health solutions. These measures have reverberated across supply chains, prompting manufacturers to reassess sourcing strategies and logistics networks. As companies seek to mitigate cost pressures, there has been a notable pivot toward domestic assembly facilities and strategic partnerships aimed at localizing production of key monitoring devices and wearables.

Moreover, software providers and cloud service operators faced increased operational expenses as licensing agreements and data center equipment imports incurred higher levies. This environment has catalyzed negotiations of long-term procurement contracts, as well as the pursuit of alternative procurement avenues to preserve budgetary flexibility for healthcare systems. Ultimately, the cumulative impact of these tariffs has underscored the strategic importance of supply chain resilience and has encouraged stakeholders to diversify technology stacks, adopt hybrid delivery modalities, and secure multi-vendor partnerships to sustain digital health deployment momentum.

Decoding critical eHealth market segments across applications, product types, delivery modes, and end user categories to reveal strategic adoption drivers

An intricate tapestry of digital health applications underscores the market’s diversity, spanning EHR and EMR solutions delivered both on-premise and via cloud architectures. Within these environments, descriptive analytics provide retrospective insights while predictive analytics forecast patient risk profiles, empowering providers to tailor intervention strategies. Mobile health offerings have bifurcated into chronic disease management tools and fitness applications that engage consumers outside clinical settings, fostering continuous health monitoring and lifestyle coaching.

Hardware innovations encompass both monitoring devices and wearables, integrating seamlessly with administrative and clinical software platforms to automate workflows and enhance decision support. Service portfolios range from managed solutions that deliver end-to-end oversight of technology environments to professional consulting that steers program implementation. Delivery modes vary from public and private cloud models to on-premise installations managed by enterprise and small to medium-sized organizations, each addressing unique preferences for data sovereignty and scalability. Across end users, diagnostic and specialty clinics leverage tailored systems for focused care pathways, home care providers facilitate remote chronic disease and elderly care services, and both government and private hospitals adopt comprehensive digital health suites to optimize clinical operations and elevate patient experiences.

This comprehensive research report categorizes the eHealth market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Delivery Mode

- Application

- End User

Uncovering regional eHealth adoption nuances across Americas innovation hubs, EMEA regulatory frameworks, and Asia-Pacific digital health expansion corridors

Across the Americas, digital health adoption is spearheaded by extensive telemedicine networks and early integration of cloud-native platforms, enabling providers to manage patient load efficiently while expanding access in rural regions. Regulatory initiatives incentivize interoperability and data exchange, laying the groundwork for innovative payment models that reward quality outcomes rather than volume of services.

In the Europe, Middle East & Africa region, stringent data privacy regulations and diverse healthcare funding frameworks have shaped a cautious yet strategic uptake of digital solutions. Providers often engage in consortiums to pilot large-scale analytics programs, with emphasis on cross-border health information exchange and AI-driven insights for population health management. Meanwhile, national digital health strategies have accelerated vendor accreditation programs, ensuring that technology deployments align with public health priorities.

Asia-Pacific markets reflect a blend of advanced urban healthcare ecosystems and rapidly growing digital health corridors in emerging economies. Investments in mobile health infrastructure and remote patient monitoring have surged, driven by large-scale public health initiatives to address chronic disease challenges. Public-private partnerships have become instrumental in bridging gaps in telemedicine accessibility, as cloud-based platforms extend specialist expertise to underserved communities and support scalable health campaigns.

This comprehensive research report examines key regions that drive the evolution of the eHealth market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating strategic initiatives and competitive positioning of leading digital health companies steering innovation, partnerships, and platform advancements

Leading digital health vendors have adopted distinct strategies to solidify their market positions. One major platform provider has pursued strategic alliances with electronic medical record integrators to offer end-to-end care coordination suites that embed predictive analytics into clinical workflows. Meanwhile, a prominent device manufacturer has expanded its wearable portfolio through acquisitions of specialized sensor start-ups, enhancing capabilities for real-time physiological monitoring.

Software pioneers have launched modular application marketplaces, enabling healthcare organizations to customize deployment bundles that align with specific care pathways and patient engagement objectives. Cloud service providers have fortified their healthcare compliance offerings, embedding advanced encryption protocols and identity management tools to meet evolving security standards. Telehealth specialists have diversified into asynchronous consultation tools, complementing live video services with store-and-forward capabilities that optimize clinician efficiency and broaden patient access. Collectively, these strategic moves underscore a competitive landscape where innovation, collaboration, and compliance are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the eHealth market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allscripts Healthcare Solutions, Inc.

- Alphabet Inc.

- Amwell Corp.

- Apple Inc.

- Babylon Holdings Limited

- Cerner Corporation

- Epic Systems Corporation

- General Electric Company

- Koninklijke Philips N.V.

- McKesson Corporation

- Oracle Corporation

- Ping An Healthcare and Technology Company Limited

- Siemens Healthineers AG

- Teladoc Health, Inc.

- UnitedHealth Group Incorporated

Proposing actionable strategies for healthcare industry executives to leverage digital trends, navigate regulatory complexities, and address tariff-driven supply challenges

Industry leaders should prioritize investments in scalable analytics platforms that integrate seamlessly with existing care delivery systems, thereby unlocking predictive care pathways and reducing operational overhead. Embracing modular technology architectures will enable organizations to adapt rapidly to shifting regulatory requirements and tariff-induced cost fluctuations. Furthermore, establishing multi-vendor ecosystems with standardized interoperability protocols will foster resilience and enhance clinical collaboration.

Stakeholders must also strengthen cybersecurity frameworks, ensuring that patient data protections evolve in tandem with expanding digital footprints. Engaging in public-private partnerships can mitigate supply chain disruptions by diversifying procurement channels and supporting localized manufacturing initiatives. It is equally important to cultivate patient engagement strategies that leverage mobile health tools to drive adherence and satisfaction. By aligning investment decisions with emerging care models and regulatory imperatives, industry executives can position their organizations to capitalize on the full spectrum of digital health opportunities.

Detailing the rigorous research methodology combining expert interviews, secondary data analysis, and triangulation techniques for comprehensive eHealth insights

The research process underpinning this report combined targeted expert interviews with healthcare executives, technology innovators, and policy experts to capture qualitative nuances of digital health adoption. These insights were triangulated against secondary data sources, including peer-reviewed studies, publicly available regulatory filings, and sector reports, to validate emerging themes and quantify adoption patterns. Analytical frameworks incorporated cross-sector benchmarking to identify best practices in technology implementation and operational governance.

In addition, a rigorous segmentation exercise was conducted to map applications, product types, delivery modes, and end user categories, enabling a granular assessment of market drivers and barriers. Data synthesis employed structured coding techniques to ensure consistency across thematic analyses, while scenario planning exercises provided a forward-looking perspective on how regulatory shifts and geopolitical factors may influence digital health trajectories. This blended methodology ensures that the findings presented herein rest on a foundation of robust, multi-dimensional evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our eHealth market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- eHealth Market, by Product Type

- eHealth Market, by Delivery Mode

- eHealth Market, by Application

- eHealth Market, by End User

- eHealth Market, by Region

- eHealth Market, by Group

- eHealth Market, by Country

- United States eHealth Market

- China eHealth Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Summarizing pivotal eHealth findings to guide strategic decision making amid evolving technological, regulatory, and geopolitical influences in healthcare

As digital health continues to mature, stakeholders must navigate an ever-evolving landscape defined by technological innovation, regulatory dynamics, and global trade considerations. The convergence of artificial intelligence, cloud-native infrastructures, and patient-centric care models has unlocked pathways for more proactive and personalized healthcare delivery. Simultaneously, external forces such as tariff adjustments and data privacy mandates have introduced new complexities that require strategic foresight.

Ultimately, the insights presented in this report highlight the imperative for healthcare organizations to adopt flexible, modular technology architectures, diversify supply chains, and invest in analytics capabilities. By doing so, they can enhance operational resilience, drive improved patient outcomes, and sustain competitive differentiation. In an era where digital health is no longer optional but essential, informed decision making rooted in comprehensive market understanding will be the key determinant of long-term success.

Engage with Associate Director Ketan Rohom for exclusive access to comprehensive eHealth insights and to empower your organization with strategic advantage

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how these in-depth eHealth insights can empower your strategic initiatives and drive sustainable growth. The market research report offers a comprehensive analysis of emerging digital health trends, regulatory impacts, and key competitive strategies, equipping you with the actionable intelligence necessary to make informed decisions. Reach out today to secure your copy and gain the strategic edge your organization needs to thrive in an increasingly complex healthcare environment.

- How big is the eHealth Market?

- What is the eHealth Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?