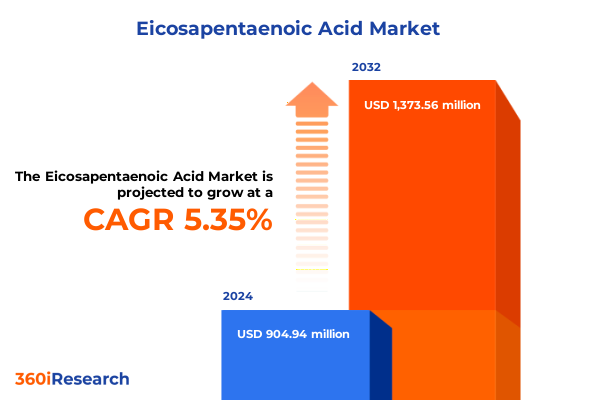

The Eicosapentaenoic Acid Market size was estimated at USD 953.98 million in 2025 and expected to reach USD 1,011.61 million in 2026, at a CAGR of 5.34% to reach USD 1,373.56 million by 2032.

Unveiling the Pivotal Role of Eicosapentaenoic Acid in Modern Health, Nutrition, and Industrial Applications Amidst Growing Global Demand

Eicosapentaenoic Acid (EPA) has emerged as a cornerstone ingredient in health, nutritional, and industrial applications, driven by its scientifically validated benefits and versatility. In recent years, the recognition of omega-3 fatty acids in cardiovascular protection, cognitive development, and anti-inflammatory responses has propelled EPA from a niche supplement to a mainstream functional ingredient in fortified foods, beverages, and nutraceutical formulations. Concurrently, advancements in extraction and purification technologies have broadened EPA’s applicability in personal care, skincare, and even specialized animal feed, reflecting a holistic shift towards wellness-oriented consumption across demographics.

Amidst this backdrop, market stakeholders are navigating a dynamic environment shaped by evolving regulatory standards, sustainability imperatives, and consumer demand for transparency. The demand for clean-label, non-GMO, and traceable sources of EPA has accelerated investment in microalgae cultivation and novel processing methods. At the same time, traditional fish oil producers are adapting to supply chain constraints and geopolitical fluctuations. As a result, industry participants are compelled to innovatively differentiate their offerings through advanced delivery formats, targeted health claims, and strategic partnerships, underscoring the pivotal role of EPA in addressing global health challenges and driving commercial growth.

Dramatic Transformations Shaping the Eicosapentaenoic Acid Landscape Driven by Innovation, Sustainability, and Evolving Consumer Preferences

The landscape of the Eicosapentaenoic Acid market is undergoing transformative shifts driven by technological breakthroughs, sustainability commitments, and evolving regulatory frameworks. Innovations in microencapsulation, for instance, are enabling more stable and bioavailable liquid concentrates and powders, which in turn support tailored functional beverage and fortified food formulations. At the same time, the proliferation of high-concentration softgel capsules and chewable tablets is redefining convenience and consumer experience, allowing brands to cater to diverse preferences, from on-the-go nutrition to family-friendly delivery formats.

Sustainability has become a defining theme, as traditional reliance on fish oil is increasingly balanced by investments in macroalgae and microalgae production systems. These biologically engineered platforms offer consistent EPA yields while reducing pressure on marine ecosystems, appealing to eco-conscious consumers and regulators alike. Moreover, digital traceability tools are enhancing transparency across the value chain, enabling brands to authenticate source integrity and differentiate in competitive retail channels. Collectively, these shifts are not only reshaping product portfolios but also influencing strategic priorities, as companies realign resources to capitalize on emergent growth corridors and fortify resilience against supply disruptions.

Assessing the Far-Reaching Effects of 2025 United States Import Tariffs on the Eicosapentaenoic Acid Supply Chain, Costs, and Market Dynamics

In early 2025, the United States government enacted sweeping import tariffs that reverberated across the Eicosapentaenoic Acid supply chain and reshaped market economics. On April 5, a uniform 10 percent ad valorem duty was applied to all imports not otherwise exempted, followed by country-specific rates instituted on April 9, targeting a range of goods under reciprocal tariff policies as outlined in the Presidential memorandum on trade deficits. While foundational chemicals and energy products received exemptions, omega-3 oils including EPA and DHA were not automatically sheltered, prompting industry associations to petition for inclusion based on their critical health applications.

The cumulative effect of these policies manifested as elevated procurement costs for marine-based and algal EPA producers, leading to margin compression among exporters and downstream formulators. Supply chains were forced to adapt through price renegotiations, strategic stockpiling, and accelerated domestic capacity expansions. In parallel, some market players explored tariff engineering, reclassifying derivatives to leverage Annex II exemptions for pharmaceutical-grade oils, while others diversified their sourcing geographically to mitigate bilateral risk. As the industry continues to adjust, the interplay between regulatory intervention and corporate strategy will remain a critical determinant of competitive positioning and supply chain resilience.

Deep Insights into Application, Form, Source, and Distribution Channel Segmentation That Reveal Critical Opportunities and Challenges

A nuanced understanding of market segmentation is essential for recognizing bespoke opportunities and potential constraints across applications, forms, sources, and distribution channels. Within applications, the demand for aquaculture and livestock feed has surged in tandem with the aquaculture sector’s rapid growth, whereas pet food formulations are increasingly enriched with microencapsulated liquid EPA to support animal health. In the cosmetics arena, skincare formulations enriched with purified powder derivatives of EPA are gaining traction for their anti-inflammatory properties, while personal care products leverage oil emulsion formats for enhanced dermal delivery. Meanwhile, fortified foods and functional beverages rely heavily on blended powders and oil emulsions to achieve precise dosing and clean labeling.

When considering product forms, the shift toward softgel capsules, particularly high-concentration formats, underscores consumer preference for compact, dosage-standardized solutions, contrasted by the resurgence of standard tablets and chewable variants as cost-effective alternatives. In source dynamics, macroalgae-derived EPA is emerging as a sustainable substitute for traditional industrial-grade fish oil, even as microalgae platforms cater to pharmaceutical-grade specifications. Distribution patterns likewise reveal segmentation nuances: e-commerce channels, especially third-party platforms, drive convenience-focused purchasing, while hospital and retail pharmacies remain pivotal for prescription-grade formulations, and supermarkets and specialty stores serve as key touchpoints for mass-market nutraceuticals.

This comprehensive research report categorizes the Eicosapentaenoic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Application

- Distribution Channel

Region-Specific Trends Uncovered for the Americas, Europe Middle East & Africa, and Asia-Pacific Highlighting Unique Drivers and Barriers

Regional factors play a decisive role in shaping market potential and strategic priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust R&D infrastructures and established supply networks underpin high consumption of cardiovascular-focused nutraceuticals, but producers face trade headwinds and regulatory scrutiny, particularly in the wake of reciprocal tariffs. Canada and the United States have meanwhile advanced local algae cultivation projects to offset import challenges and enhance self-sufficiency.

Across Europe Middle East & Africa, stringent regulatory frameworks for health claims and novel food approvals influence product launches, steering companies toward marine-derived and lab-grown EPA solutions that meet safety and traceability benchmarks. The Middle East has emerged as a hub for large-scale algae bioprocessing investments, while North African nations are positioning themselves as low-cost raw material exporters. Conversely, the European Union continues to refine labeling standards and sustainability criteria, affecting formulation strategies across cosmetics and pharmaceutical segments.

In Asia-Pacific, soaring demand in China, Japan, and India is fueled by rising consumer awareness of cognitive and joint health benefits, propelling both instant-release softgel capsules and functional beverage innovations. Australia stands out as a leading exporter of purified fish oil, while Southeast Asian markets are witnessing the rapid emergence of domestic algal EPA ventures. Across the region, e-commerce penetration and expanding retail pharmacy networks are optimizing distribution reach and enabling tailored marketing strategies.

This comprehensive research report examines key regions that drive the evolution of the Eicosapentaenoic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles and Competitive Innovations of Leading Companies Shaping the Eicosapentaenoic Acid Market Through Partnership and R&D

Leading entities in the Eicosapentaenoic Acid market are differentiating through integrated value chain strategies, advanced R&D, and collaborative ventures. Global ingredient suppliers have prioritized capacity expansions in microalgae fermentation and downstream purification, investing in modular bioreactor installations that allow for scalable production. Parallel to these infrastructure commitments, major players are pursuing joint ventures with biotechnology startups to accelerate novel strain development and optimize EPA yields.

Pharmaceutical-grade oil producers have forged alliances with medical research institutions to validate high-purity injectable formulations, opening new revenue streams in specialized therapeutic applications. In contrast, nutraceutical specialists have moved to enhance shelf-stable blended powders and customized softgel blends through proprietary encapsulation techniques. Meanwhile, upstream fish oil companies are retrofitting their supply models with blockchain-enabled traceability solutions to verify catch origins and meet consumer demand for ethical sourcing.

At the distribution level, cross-sector partnerships between ingredient suppliers and leading e-commerce platforms have streamlined direct-to-consumer channels, while collaborations with pharmacy chains are optimizing in-store educational initiatives. Collectively, these strategic maneuvers underscore the competitive imperative to integrate technological innovation, regulatory compliance, and go-to-market agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Eicosapentaenoic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AlgiSys BioSciences Inc.

- Archer Daniels Midland Company

- Arctic Nutrition AG

- Asterisk Laboratories (I) Pvt. Ltd.

- BASF SE

- BIOSEARCH, SA

- Cayman Chemical Company

- Corbion N.V.

- Croda International PLC

- Epax Norway AS

- Evonik Industries AG

- Golden Omega S.A.

- Indo Rama Engineers

- KD Pharma Group

- Koninklijke DSM N.V.

- Novasep Holding SAS

- Novotech Nutraceuticals, Inc.

- Omega Protein Corporation

- Orkla Health AS

- Pelagia AS

- Santa Cruz Biotechnology, Inc.

- Shandong Yuwang Pharmaceutical Co., Ltd.

- SimSon Pharma Limited

- Sinomega Biotech Engineering Co.,Ltd.

- Toronto Research Chemicals Inc.

Actionable Strategies for Industry Leaders to Navigate Market Volatility, Leverage Segmentation Insights, and Capitalize on Growth Opportunities

To thrive in a rapidly evolving environment, industry stakeholders must adopt multifaceted, forward-looking strategies. First, diversifying raw material portfolios by investing in both macroalgae and industrial-grade fish oil sources can mitigate geopolitical and regulatory risks while ensuring supply continuity. Equally important is the pursuit of advanced purification and encapsulation technologies to enhance product stability and bioavailability, thereby reinforcing value propositions across applications.

Engagement with policy-making bodies and trade associations is critical to influence tariff policies and secure balanced exemption frameworks for essential health-promoting ingredients. Companies should also prioritize data-driven demand forecasting and integrated supply chain visibility systems to proactively manage inventory levels and respond to rapid market shifts. In parallel, strengthening distribution networks through selective partnerships with e-commerce platforms, pharmacy chains, and specialty retailers can optimize market penetration and consumer outreach.

Finally, fostering open innovation ecosystems through joint research programs with academic institutions and start-ups will accelerate the development of next-generation EPA derivatives and delivery formats. By aligning strategic investments with sustainability goals and consumer expectations, industry leaders can capitalize on emerging growth corridors while maintaining operational resilience.

Robust Research Methodology Combining Primary Interviews and Secondary Data to Deliver Reliable Insights into the Eicosapentaenoic Acid Market

The research underpinning this report was conducted using a robust, multi-stage methodology to ensure insights are both reliable and actionable. Initially, an extensive secondary research phase reviewed technical literature, regulatory filings, patent databases, and open-source industry analyses to map the current EPA landscape and identify key growth vectors. This groundwork was complemented by primary interviews with executives, R&D leaders, and supply chain experts to validate emerging trends and gather nuanced perspectives on market drivers and constraints.

Quantitative data was triangulated through cross-referencing import-export statistics, revenue disclosures, and company annual reports, with particular attention to segmentation metrics such as application uptake, form preferences, and distribution channel performance. Geographic analyses were informed by trade flow records and regional regulatory updates to capture localized dynamics. Insights were further stress-tested via scenario modeling that examined the impact of tariff shocks, raw material shortages, and regulatory shifts across different stakeholder archetypes.

Finally, findings were consolidated by an interdisciplinary team of market analysts and subject matter experts who evaluated the implications for investment, product development, and go-to-market strategies. This rigorous approach ensures that the report delivers a comprehensive, 360-degree view of the Eicosapentaenoic Acid market’s current and prospective contours.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Eicosapentaenoic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Eicosapentaenoic Acid Market, by Form

- Eicosapentaenoic Acid Market, by Source

- Eicosapentaenoic Acid Market, by Application

- Eicosapentaenoic Acid Market, by Distribution Channel

- Eicosapentaenoic Acid Market, by Region

- Eicosapentaenoic Acid Market, by Group

- Eicosapentaenoic Acid Market, by Country

- United States Eicosapentaenoic Acid Market

- China Eicosapentaenoic Acid Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Key Concluding Observations on Market Resilience, Emerging Trends, and Strategic Imperatives in the Eicosapentaenoic Acid Industry

The Eicosapentaenoic Acid industry has demonstrated remarkable resilience, balancing innovation with strategic adaptation in the face of geopolitical shifts and evolving consumer priorities. The convergence of microalgae-based production systems, advanced encapsulation techniques, and integrated supply chain frameworks has expanded the boundaries of EPA applications across health, cosmetic, and feed sectors. Meanwhile, regulatory movements toward greater transparency and sustainability are catalyzing a wave of novel product formulations and ethical sourcing initiatives.

Despite cost pressures introduced by 2025 tariffs and fluctuating raw material availability, the sector’s diversification into alternative sources and derivative formats has buffered performance and opened new corridors for value creation. Regional markets each present distinct opportunities: the Americas continue to lead in nutraceutical innovation, Europe Middle East & Africa excels in regulatory compliance and large-scale cultivation, while Asia-Pacific drives volume growth through rising consumer health awareness and digital commerce expansion.

Looking ahead, the interplay between technological progress, policy developments, and shifting demand patterns will define the competitive landscape. Organizations that integrate robust risk management practices, maintain strategic flexibility, and invest in collaborative innovation will be best positioned to harness the full potential of the Eicosapentaenoic Acid market’s promising trajectory.

Next Steps to Acquire the Comprehensive Eicosapentaenoic Acid Market Report and Connect with Ketan Rohom for Tailored Sales Support

The comprehensive Eicosapentaenoic Acid market report offers unparalleled insights to inform strategic decisions and enhance competitive positioning. To access this in-depth analysis and leverage tailored support for your organization’s needs, prospective clients are invited to reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan will provide direct guidance on report customization, licensing options, and bundled consulting services. By securing this report, decision-makers will gain the critical intelligence required to navigate complex market dynamics and capitalize on emerging opportunities. Contact Ketan to explore flexible pricing packages and initiate a detailed discussion on how this research can drive your business objectives forward.

- How big is the Eicosapentaenoic Acid Market?

- What is the Eicosapentaenoic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?