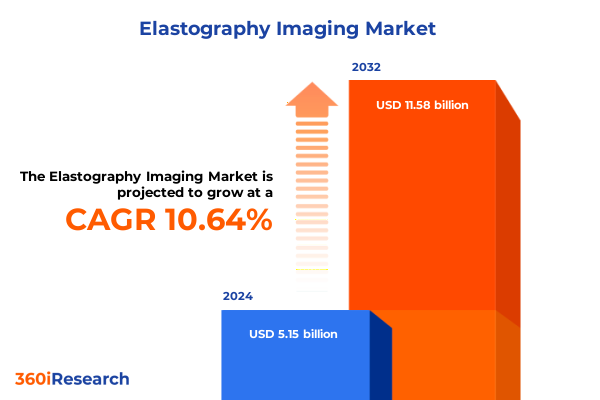

The Elastography Imaging Market size was estimated at USD 5.70 billion in 2025 and expected to reach USD 6.31 billion in 2026, at a CAGR of 10.65% to reach USD 11.58 billion by 2032.

Unveiling the Revolution in Elastography Imaging Technologies and Market Dynamics Transforming Diagnostic Precision Across Healthcare Settings

Elastography imaging stands at the forefront of non-invasive diagnostic innovation, leveraging advances in wave physics to map tissue stiffness and inform clinical decision-making with unprecedented precision. By harnessing either magnetic resonance elastography or ultrasound elastography, practitioners can detect pathologies in breast, liver, musculoskeletal, and thyroid tissues long before they manifest structural abnormalities on conventional imaging modalities. This technology not only enhances early detection but also supports treatment monitoring for chronic conditions such as hepatic fibrosis, enabling clinicians to adjust therapeutic strategies based on quantitative feedback rather than solely qualitative observations.

As the healthcare ecosystem shifts toward value-based care, the ability to deliver accurate, reproducible, and cost-effective diagnostic data has become indispensable. Elastography’s capacity to reduce invasive biopsy procedures while increasing diagnostic confidence underscores its appeal across hospitals, academic research institutes, and diagnostic imaging centers. Concurrently, improvements in hardware design, software analytics, and service offerings have collectively propelled the integration of elastography into routine workflows. This report unpacks these dynamics, offering stakeholders a holistic view of how technological, clinical, and operational factors converge to accelerate the adoption of elastography imaging in 2025 and beyond.

Exploring How Integration of Advanced Elastography Techniques Regulatory Evolution and Clinical Adoption Is Redefining the Diagnostic Imaging Landscape

The elastography imaging landscape is undergoing a profound transformation driven by converging forces in technology, regulation, and clinical practice. Artificial intelligence and machine learning algorithms have been integrated into software suites to automate stiffness mapping, reduce operator dependency, and standardize results across sites. At the same time, miniaturization of ultrasound transducers and MR-compatible hardware has made elastography more accessible in outpatient settings, empowering smaller clinics and rural hospitals to augment their diagnostic portfolios.

On the regulatory front, recent updates to imaging guidelines by leading health authorities have explicitly recognized elastography as a recommended adjunct for liver fibrosis staging and breast lesion characterization. These endorsements have catalyzed reimbursement approvals in major healthcare markets, further incentivizing capital investment into elastography-capable systems. Moreover, the emergence of combined MR-ultrasound hybrid suites promotes a seamless patient experience, offering both anatomical and functional insights in a single visit. Taken together, these shifts underscore how advancements in technology and policy are synergistic, positioning elastography as a standard component of comprehensive diagnostic imaging pathways.

Assessing the Cumulative Impact of 2025 United States Tariffs on Elastography Equipment Supply Chains Clinical Adoption and Pricing Strategies

In early 2025, the United States introduced a new tranche of tariffs targeting imported medical imaging hardware, including components integral to elastography systems. These measures, intended to bolster domestic manufacturing, have had a ripple effect on the availability and price of key hardware subassemblies, particularly MR-compatible actuators and high-frequency ultrasound transducers. As OEMs navigate increased landed costs, some have sought to locally source parts or renegotiate supplier contracts to maintain pricing discipline.

This shift in supply chain dynamics has prompted diagnostic imaging centers and hospitals to reassess procurement strategies. Group purchasing organizations are increasingly leveraging volume-based negotiations, while service providers explore modular upgrade paths that avoid full system replacements. Concurrently, a subset of manufacturers has accelerated plans for on-shore production facilities, aiming to mitigate future tariff exposures. Despite initial concerns about cost inflation, the market has shown resilience; clinical demand for elastography remains strong, and end users are adapting through multi-vendor partnerships and extended service agreements. Ultimately, the 2025 tariff landscape is driving greater supply chain diversification and fostering innovation in hardware configuration to preserve both accessibility and affordability.

Mapping Critical Market Segmentation Insights Spanning Products Components End Users Technologies and Applications Driving Elastography Imaging Growth

A nuanced understanding of market segmentation is vital to evaluating where elastography imaging solutions can deliver the greatest value. When considering product types, magnetic resonance elastography and ultrasound elastography each occupy distinct niches. Magnetic resonance elastography excels in whole-organ stiffness mapping, making it indispensable for liver and musculoskeletal applications, whereas ultrasound elastography’s portability and cost efficiency have driven widespread use for breast and thyroid imaging.

Turning to component considerations, hardware advancements in piezoelectric transducers and MR-compatible drivers are complemented by sophisticated software platforms that employ machine learning to enhance image quality, while service offerings ensure optimized system uptime and data integrity. End users such as academic research institutes harness elastography to push the boundaries of tissue characterization science, whereas diagnostic imaging centers leverage rapid exam times to increase throughput, and hospitals integrate the technology to support multidisciplinary treatment planning. From a technology perspective, shear wave elastography has become the benchmark for quantitative stiffness assessment, while strain elastography retains popularity for its qualitative tissue contrast in real-time scanning.

Finally, application diversity-from breast lesion differentiation to quantification of hepatic fibrosis, from musculoskeletal injury evaluation to thyroid nodule characterization-illustrates how elastography’s clinical utility spans multiple therapeutic areas. These segmentation insights illuminate the performance requirements and deployment strategies that drive adoption across varied healthcare settings.

This comprehensive research report categorizes the Elastography Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Component

- Technology

- End User

- Application

Uncovering Regional Dynamics Influencing Elastography Imaging Adoption Across the Americas Europe Middle East Africa and the Asia Pacific

Regional dynamics play a pivotal role in shaping the adoption and evolution of elastography imaging. In the Americas, robust reimbursement frameworks for liver disease assessment have propelled early uptake, especially in the United States where nonalcoholic fatty liver disease prevalence has spurred investment in quantitative diagnostic tools. Latin American markets, while still developing infrastructure, are showing growing interest in ultrasound elastography due to its favorable cost-to-benefit ratio.

Meanwhile, in Europe, Middle East, and Africa, heterogeneous regulatory pathways demand tailored market entry strategies. Western European nations often benefit from uniform clinical guidelines that recognize elastography’s role in fibrosis staging, whereas countries in the Middle East and Africa are at varying stages of technology adoption, often prioritizing portable ultrasound solutions where capital constraints persist. Collaborative research networks across EMEA are also advancing multicenter studies that validate elastography endpoints, further supporting regulatory approvals.

Across Asia-Pacific, high patient volumes, government-backed healthcare initiatives, and rising awareness of chronic diseases are driving a surge in demand for both MR and ultrasound elastography. Japan and South Korea continue to lead in technological innovation, integrating AI-powered analytics into their systems, while emerging markets such as India and Southeast Asia are rapidly scaling up diagnostic centers equipped with cost-effective ultrasound elastography solutions. These regional insights underscore the importance of adaptive go-to-market strategies that align with local reimbursement, infrastructure, and clinical research priorities.

This comprehensive research report examines key regions that drive the evolution of the Elastography Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements Innovations and Competitive Positioning of Leading Companies Shaping the Elastography Imaging Market in 2025

Leading players in the elastography imaging market are deploying diverse strategies to consolidate their competitive positioning. Global OEMs are investing in cross-platform compatibility, ensuring that both magnetic resonance and ultrasound systems share intuitive user interfaces and analytics modules. Several have forged partnerships with AI vendors to embed deep-learning algorithms for automated stiffness quantification and incidental finding detection.

At the same time, nimble specialist firms are challenging incumbents by introducing point-of-care ultrasound elastography devices that can be integrated into existing diagnostic workflows with minimal footprint. These companies emphasize rapid application programming interfaces for seamless data transfer into electronic health record systems, appealing to hospitals focused on interoperability.

Service providers are differentiating through outcome-based maintenance contracts, promising predefined uptime metrics and on-site calibration services. Software innovators, meanwhile, are offering cloud-based analytics platforms that democratize access to advanced post-processing, enabling academic and clinical users to collaborate on multicenter trials without the need for local high-performance computing resources. Collectively, these strategic moves demonstrate a market in which innovation, partnership, and customer-centric offerings define success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Elastography Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Instrumentations

- BK Medical Holding Company, Inc.

- Boston Scientific Corporation

- Canon Medical Systems Corporation

- CHISON Medical Technologies Co., Ltd.

- Clarius Mobile Health Corp.

- Dawei Medical (Jiangsu) Corp., Ltd.

- Esaote SpA

- Fujifilm Holdings Corporation

- GE HealthCare Technologies Inc.

- Hitachi, Ltd.

- Jiangsu Aegean Technology Co.,Ltd

- Koninklijke Philips N.V.

- Mindray Medical International Limited

- Neusoft Medical Systems Co., Ltd.

- Resoundant, Inc.

- Samsung Medison Co., Ltd.

- Shantou Institute of Ultrasonic Instruments Co., Ltd.

- Shimadzu Corporation

- Siemens AG

- SonoScape Medical Corp.

- SternMed GmbH

- SuperSonic Imagine SA

- Toshiba Corporation

- Zimmer MedizinSysteme GmbH

Actionable Strategic Recommendations for Industry Leaders to Navigate Technological Advances Regulatory Challenges and Competitive Pressures in Elastography Imaging

To thrive amidst intensifying competition and evolving regulatory landscapes, industry leaders should consider a multi-pronged approach. First, prioritizing investment in software and AI integration will enhance diagnostic accuracy and streamline user workflows, thereby strengthening clinical value propositions. Second, expanding partnerships with academic research institutes can accelerate validation studies, generating robust clinical evidence that supports reimbursement and guideline inclusion.

In parallel, organizations should pursue regional diversification by tailoring product configurations to local infrastructure and reimbursement environments. For instance, portable ultrasound elastography platforms can address capacity constraints in emerging markets, while advanced MR elastography suites can capture premium segments in developed healthcare systems. Supply chain resilience must also be fortified through dual sourcing arrangements and strategic on-shore manufacturing partnerships to mitigate tariff-driven cost volatility.

Finally, offering innovative service models-such as outcome-based maintenance agreements and cloud-delivered analytics-will create stickiness with end users and differentiate offerings in a crowded marketplace. By aligning these strategic imperatives with clear execution roadmaps, companies can position themselves for sustained growth and leadership in the rapidly expanding elastography imaging sector.

Transparency in Research Methodology Detailing Data Sources Analytical Frameworks and Validation Processes Underpinning Elastography Imaging Market Insights

Our research methodology is founded on a rigorous blend of primary and secondary data collection, ensuring that insights are both comprehensive and verifiable. Initially, we conducted in-depth interviews with key opinion leaders, including radiologists, biomedical engineers, and procurement specialists, to capture qualitative perspectives on clinical applications, technology adoption hurdles, and service expectations.

Concurrently, secondary research involved systematic analysis of peer-reviewed journals, health authority guidelines, and regulatory filings to benchmark diagnostic protocols and reimbursement criteria. Data triangulation was employed to reconcile discrepancies between stakeholder interviews and published sources, thereby strengthening the accuracy of segmentation and regional insights.

Quantitative validation was achieved through targeted surveys distributed to diagnostic centers and hospitals, which provided real-world usage data across product types, component preferences, and application areas. Finally, our analytical framework integrated time-series analysis of pricing trends, supply chain mapping, and competitive landscaping to generate holistic recommendations. Throughout this process, strict quality control protocols were applied to review data integrity, eliminate biases, and ensure that findings reflect the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Elastography Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Elastography Imaging Market, by Product

- Elastography Imaging Market, by Component

- Elastography Imaging Market, by Technology

- Elastography Imaging Market, by End User

- Elastography Imaging Market, by Application

- Elastography Imaging Market, by Region

- Elastography Imaging Market, by Group

- Elastography Imaging Market, by Country

- United States Elastography Imaging Market

- China Elastography Imaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Guide Stakeholders in Harnessing Opportunities within the Evolving Elastography Imaging Market

As elastography imaging cements its role in modern diagnostics, stakeholders are positioned at a strategic inflection point. The convergence of advanced hardware, intelligent software and favorable regulatory endorsements is driving widespread adoption across clinical environments. Simultaneously, tariff shifts and supply chain reconfigurations present both challenges and opportunities for cost management and localization of production.

Segmentation insights reveal that product, component, end-user, technology, and application dynamics each contribute to differentiated growth pathways. Regional analyses further underscore that adaptive strategies-sensitive to reimbursement structures and infrastructure constraints-are key to unlocking market potential. The competitive landscape is characterized by rapid innovation, strategic partnerships, and service-centric offerings that collectively elevate the bar for diagnostic efficacy and customer engagement.

Moving forward, success will hinge on the ability to integrate AI-enabled analytics, diversify supply chains, and strengthen clinical evidence through collaborative research. By synthesizing these threads, organizations can harness the full power of elastography to enhance patient outcomes, streamline workflows, and create sustainable value in an increasingly dynamic healthcare market.

Engage with Ketan Rohom to Explore the Comprehensive Elastography Imaging Report and Capitalize on Market Opportunities Through Expert Insights

To access the full breadth of insights and strategic imperatives shaping the elastography imaging sector today, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan will guide you through the report’s most critical findings, answer your inquiries about methodology and segmentation, and help tailor the data to your organization’s unique needs. His expertise ensures that you can leverage the projections, regional analyses, and competitive strategies identified in our study to reinforce your market position and drive growth. Engage with Ketan directly to secure your copy of the comprehensive elastography imaging market report and unlock actionable data that empowers decision-making across product development, market access, and strategic partnerships. Let’s chart a course toward innovative diagnostics and heightened clinical outcomes-connect with Ketan Rohom today to get started.

- How big is the Elastography Imaging Market?

- What is the Elastography Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?