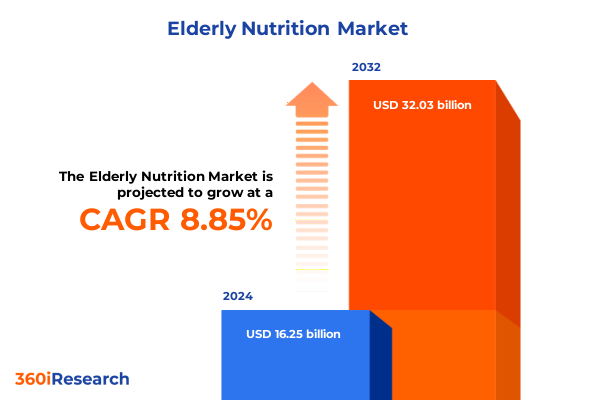

The Elderly Nutrition Market size was estimated at USD 17.61 billion in 2025 and expected to reach USD 19.09 billion in 2026, at a CAGR of 8.91% to reach USD 32.03 billion by 2032.

Understanding the Evolving Imperatives of Elderly Nutrition Amid Demographic Shifts and Health Priorities Across Global Markets

The demographic landscape is undergoing an unprecedented shift as aging populations grow in both developed and emerging markets. Health systems and policymakers face mounting pressures to address the unique nutritional requirements of older adults, whose physiological changes, chronic health conditions, and evolving lifestyle patterns demand targeted solutions. Improving quality of life for seniors now extends beyond mere caloric intake; it encompasses cognitive health, mobility support, immune resilience, and disease management.

Against this backdrop, the elderly nutrition sector has emerged as a dynamic arena where research, innovation, and market forces intersect. Technological advances in nutrient delivery and personalized nutrition frameworks are converging with insights from gerontology and epidemiology to redefine product development. Meanwhile, shifting consumer expectations and heightened awareness of preventative health measures are driving demand for tailored interventions that align with individual health goals.

This introduction sets the stage for an in-depth exploration of how demographic trends, scientific breakthroughs, and evolving market dynamics are reshaping the requirements and opportunities within elderly nutrition. By examining these foundational drivers, stakeholders can better anticipate emerging needs, invest strategically in R&D, and deliver impactful solutions that support healthy aging and sustainable growth.

Charting the Profound Technological, Policy and Consumer Behavior Transformations Redefining Elderly Nutrition Solutions and Market Dynamics

Over the last decade, the convergence of digital health technologies and consumer-centric policy reforms has accelerated the evolution of elderly nutrition. Telehealth platforms now facilitate remote dietary assessments and real-time monitoring, enabling healthcare providers to deliver personalized nutrition plans that adapt to changing health status. Concurrently, regulatory bodies have introduced incentives for fortification and functional claims, encouraging manufacturers to invest in evidence-based formulations that support bone density, cardiovascular health, and cognitive function.

Meanwhile, consumer behavior has undergone a paradigm shift, as older adults increasingly embrace online shopping, subscription-based supplement services, and mobile health applications. This digital transition has opened new avenues for personalized engagement and loyalty-building, while data analytics and AI-driven insights are refining product innovation cycles. As a result, competition has intensified among established food conglomerates and agile startups aiming to differentiate through novel nutrient delivery systems, clean label transparency, and sustainability commitments.

Furthermore, cross-sector collaborations-such as partnerships between food scientists, geriatrics specialists, and regulatory agencies-are fostering a more holistic approach to product development. These alliances are redefining market benchmarks, where efficacy, safety, and convenience intersect with emerging wellness trends. In this transformative landscape, the ability to anticipate and respond to rapid technological, policy, and consumer shifts will determine which organizations lead the next wave of elderly nutrition solutions.

Assessing the Cumulative Effects of New United States Tariff Policies on Elderly Nutrition Supply Chains and Consumer Affordability in 2025

The introduction of new U.S. import tariffs in 2025 has reverberated across elderly nutrition supply chains, driving price volatility for both ingredients and finished products. Fresh produce, widely used in functional foods and fortified meals, has seen a 5% increase in retail costs due to higher import duties and the knock-on effects of labor constraints in domestic agriculture. Meanwhile, staples such as cooking oils and rice-key components in phosphate-controlled diets and diabetic-friendly formulations-are subject to a 10% ad valorem tariff, contributing to an overall 2.6% rise in grocery expenditures for households with older adults.

Canned proteins like tuna and beans, essential for long-term pantry stability and protein supplementation, have also been impacted by steel and aluminum tariffs. The doubling of duties on tin mill steel to 50% has increased the cost of canned goods by up to 15%, tightening margins for both regional food banks and commercial meal replacement producers. At the same time, dietary supplement ingredients-ranging from omega-3 fatty acids to specialty amino acids-face uncertain treatments under Section 232 investigations, prompting trade groups to lobby for exemptions to prevent supply disruptions and price spikes.

Although some exemptions under Annex II have spared certain vitamins and minerals from ad valorem duties-resulting in an estimated $218–$247 million in avoided costs for supplement manufacturers between April and June 2025 -the broader tariff environment continues to challenge procurement strategies. Supply chain teams are increasingly diversifying sourcing, negotiating long-term contracts, and exploring domestic ingredient development to mitigate exposure. As affordability pressures mount for older consumers on fixed incomes, collaboration among policymakers, industry associations, and manufacturers will be critical to balancing national security objectives with the imperative of ensuring access to essential nutrition.

Revealing Multidimensional Segmentation Influences Spanning Ingredients, Product Types, Distribution Channels and Dietary Needs for Elderly Nutrition Development

Deep analysis of ingredient segmentation reveals that while carbohydrate sources like dietary fibers and sugars remain foundational for energy maintenance in aging populations, the nuanced inclusion of polyunsaturated fats-particularly omega-3 fatty acids-has become pivotal for cognitive and cardiovascular support. Moreover, targeted protein interventions harnessing whey, soy, and casein proteins are designed to counteract sarcopenia, whereas the optimized inclusion of calcium and vitamin A addresses bone health and immune resilience.

Equally critical is the evolution of product formats, where dietary supplements, fortified functional foods, and healthcare-specific nutrition converge with convenient meal replacement products. Herbal, mineral, and vitamin supplements provide precision dosing, while probiotic yogurts and nutritional bars deliver gut health benefits in on-the-go formats. Disease-specific healthcare foods are tailored to digestive and metabolic conditions, and energy bars, protein shakes, and nutrient-dense soups offer practical solutions for seniors with reduced appetites or chewing difficulties.

Channel strategies further differentiate market dynamics, as the proliferation of e-commerce platforms and direct-to-consumer company websites complements traditional grocery and pharmacy distribution. Specialty dietetic and health food stores provide expert-curated selections, while large supermarket chains leverage scale to offer value-driven bundling and loyalty incentives. Finally, the segmentation by dietary need-spanning diabetic-friendly, gluten-free, lactose-free, and low-sodium options-caters to the diverse medical and lifestyle requirements of the elderly, underscoring the importance of precision nutrition in addressing both chronic conditions and quality-of-life aspirations.

This comprehensive research report categorizes the Elderly Nutrition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredients

- Form

- Route of Administration

- End-User

- Application

- Distribution Channel

Exploring Regional Nuances Across Americas Europe Middle East Africa and Asia Pacific That Shape Elderly Nutrition Demand and Distribution Patterns

Regional market characteristics underscore the varied trajectories of elderly nutrition adoption and distribution. In the Americas, where aging populations coexist with diverse socioeconomic strata, innovation is driven by collaborations between academic institutions, healthcare providers, and food manufacturers to integrate preventive nutrition into public health programs. Cross-border trade agreements and logistics networks further enhance access to specialized ingredients, though affordability remains a key consideration for low- and middle-income demographics.

Europe, the Middle East, and Africa exhibit a mosaic of regulatory frameworks and consumer preferences. Advanced economies within the European Union are witnessing rapid uptake of personalized nutrition services supported by stringent health claims regulations, while emerging markets in the Middle East leverage private sector investment to upscale fortified dairy and functional beverage offerings. Across Africa, supply chain challenges persist, but public-private partnerships are scaling up local production of fortified staples and culturally tailored dietary supplements, reflecting a growing emphasis on local sourcing and economic empowerment.

In the Asia-Pacific region, demographic shifts are particularly pronounced, with countries such as Japan, South Korea, and Australia leading in the integration of technology-enabled nutrition monitoring and home-delivery models. Simultaneously, rapidly aging populations in Southeast Asia and India are catalyzing demand for affordable, shelf-stable solutions, driving manufacturers to optimize formulations for regional taste profiles and climatic conditions. These regional insights highlight the importance of tailored strategies that align product innovation, regulatory compliance, and distribution networks with the distinct needs of elderly consumers across the globe.

This comprehensive research report examines key regions that drive the evolution of the Elderly Nutrition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Competitive Dynamics of Leading Businesses Innovating in the Elderly Nutrition Sector Globally

Leading companies in elderly nutrition are differentiating through strategic partnerships, R&D investments, and acquisitions targeted at niche segments. Global conglomerates are forming alliances with biotech firms to advance precision nutrient delivery platforms, while mid-sized innovators are capitalizing on clean label and sustainability credentials to capture discerning senior consumers.

Product portfolios are expanding to include multi-functional offerings that address overlapping health concerns, such as cognitive decline, bone density loss, and cardiovascular aging. Competitive dynamics are further influenced by targeted marketing campaigns that leverage digital channels and community-based outreach, fostering brand loyalty and adherence. As competition intensifies, evidence-backed efficacy and transparent ingredient sourcing have become critical differentiators, prompting leading players to publish clinical studies and secure third-party certifications.

Moreover, strategic acquisitions are reshaping the competitive landscape, as established nutrition brands integrate specialized supplement lines and meal replacement technologies. These moves not only broaden product breadth but also enable cross-selling and channel expansion, positioning companies to meet evolving consumer expectations. Finally, investment in digital platforms-from tele-nutrition services to AI-driven personalization engines-is setting the stage for the next frontier of elderly nutrition, where data-driven insights underpin both product refinement and consumer engagement strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Elderly Nutrition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- Abbott Laboratories

- Amway Corporation

- Baxter International Inc.

- Bayer AG

- British Biologicals

- Centrum by Haleon Group

- Danone S.A.

- Dr. Reddy's Laboratories

- Fresenius Kabi AG

- GlaxoSmithKline PLC

- Herbalife Nutrition Ltd.

- Koninklijke DSM N.V.

- Meiji Holdings Co., Ltd.

- Nature’s Sunshine Products, Inc.

- Nestlé S.A.

- Nordic Naturals

- NoW Health Group, Inc.

- Otsuka Pharmaceuticals Co., Ltd.

- RBK Nutraceuticals Pty. Ltd.

- Reckitt Benckiser Group PLC

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Terry Naturally Vitamins by Europharma

- Unilever PLC

- Valio Ltd.

Delivering Targeted Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in Elderly Nutrition

Industry leaders should prioritize strategic agility by fostering cross-functional collaborations that integrate R&D, regulatory, and commercial teams. Establishing dedicated eldercare innovation hubs will accelerate the translation of clinical research into market-ready formulations that address specific aging-related health challenges.

Furthermore, enhancing supply chain resilience through diversified sourcing agreements and nearshoring initiatives can mitigate exposure to tariff fluctuations and geopolitical disruptions. Implementing advanced analytics for demand forecasting and inventory management will help balance product availability with cost-efficiency, especially for high-priority segments such as diabetic-friendly and low-sodium offerings.

Marketing strategies should leverage omnichannel engagement, combining digital wellness platforms with community-based education programs to drive awareness and adherence. Building partnerships with healthcare providers and senior living facilities can facilitate integrated nutrition interventions, reinforcing brand credibility and supporting holistic care pathways. Finally, pursuing sustainability commitments-such as eco-friendly packaging and carbon-neutral manufacturing-will resonate with socially conscious seniors and strengthen competitive positioning in a value-driven market.

Methodological Framework and Data Collection Processes Underpinning Comprehensive Analysis of Elderly Nutrition Market Trends and Stakeholder Insights

Our research methodology integrates both primary and secondary data collection, ensuring a robust and transparent analytical framework. Primary research includes in-depth interviews with key opinion leaders, nutritionists, and supply chain executives across major markets. These conversations provide nuanced perspectives on formulation challenges, regulatory hurdles, and consumer behavior trends.

Secondary research encompasses a comprehensive review of scientific journals, trade publications, and publicly available regulatory documents. Ingredient usage patterns, formulation efficacy data, and policy developments are cross-verified against proprietary databases and industry association reports to ensure accuracy and relevance.

Quantitative analysis employs statistical modeling to identify growth drivers and segmentation trends, while qualitative insights illuminate emerging opportunities and potential risks. Each data point is triangulated through multiple independent sources to mitigate bias. Geographical coverage spans the Americas, EMEA, and Asia-Pacific regions, with a focused lens on local market dynamics and distribution networks. Finally, our findings are validated through expert panel reviews, ensuring that the conclusions and recommendations reflect the most current and actionable intelligence available to stakeholders in elderly nutrition.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Elderly Nutrition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Elderly Nutrition Market, by Product Type

- Elderly Nutrition Market, by Ingredients

- Elderly Nutrition Market, by Form

- Elderly Nutrition Market, by Route of Administration

- Elderly Nutrition Market, by End-User

- Elderly Nutrition Market, by Application

- Elderly Nutrition Market, by Distribution Channel

- Elderly Nutrition Market, by Region

- Elderly Nutrition Market, by Group

- Elderly Nutrition Market, by Country

- United States Elderly Nutrition Market

- China Elderly Nutrition Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2862 ]

Synthesis of Key Findings and the Strategic Imperatives Driving Future Developments in Elderly Nutrition Solutions Amid Global Demographic Evolution

This report synthesizes critical findings on demographic imperatives, transformative market shifts, the impact of new tariff regimes, and in-depth segmentation and regional analyses to offer a cohesive narrative on elderly nutrition. The convergence of aging populations with advances in personalized nutrition and functional formulations underscores the strategic importance of targeted product development and flexible distribution strategies.

As the competitive landscape intensifies, companies that excel in evidence-based innovation, supply chain resilience, and multi-channel engagement will lead the next phase of growth. Regional nuances-from the Americas’ diverse socioeconomic demands to Europe’s regulatory rigor and Asia-Pacific’s tech-enabled distribution models-highlight the necessity of localized strategies that align with consumer preferences and policy environments.

Ultimately, the strategic imperatives identified in this report provide a roadmap for stakeholders to navigate volatility, capitalize on emerging opportunities, and support healthy aging at scale. By leveraging the insights and recommendations herein, industry participants can craft differentiated offerings, strengthen competitive advantage, and contribute meaningfully to improving the health outcomes of the aging global population.

Engage with Associate Director Ketan Rohom to Secure Your Comprehensive Elderly Nutrition Market Research Report and Gain Critical Strategic Insights

If you’re ready to transform your strategy and stay ahead in the rapidly evolving elderly nutrition sector, reach out today to Associate Director, Sales & Marketing Ketan Rohom. Leverage personalized guidance to unlock nuanced insights and accelerate your competitive positioning. Secure your comprehensive market research report to gain the critical data and strategic recommendations essential for driving sustainable growth and innovation in elderly nutrition.

- How big is the Elderly Nutrition Market?

- What is the Elderly Nutrition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?