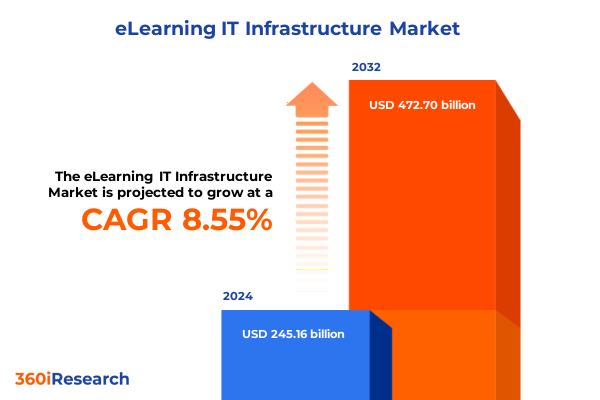

The eLearning IT Infrastructure Market size was estimated at USD 265.08 billion in 2025 and expected to reach USD 286.64 billion in 2026, at a CAGR of 8.61% to reach USD 472.70 billion by 2032.

Harnessing the Power of Modern IT Infrastructure to Elevate eLearning Experiences Across Diverse Organizational Environments

The contemporary educational environment is defined by its reliance on robust digital platforms and an unwavering demand for seamless, scalable, and secure learning experiences. As organizations across sectors increasingly embrace remote and hybrid learning models, the foundational IT infrastructure supporting eLearning systems emerges as a strategic imperative rather than a commoditized service. This transformation requires institutions to reassess legacy architectures, integrate modern networking capabilities, and prioritize cybersecurity protocols to protect sensitive learner and administrative data. In parallel, the quest for high availability and minimal downtime compels IT leaders to explore resilient multi-tenant cloud solutions, edge computing architectures, and containerized application deployments that can adapt to unpredictable usage patterns.

Amid these shifts, the alignment between technology investments and pedagogical goals has never been more critical. A well-orchestrated infrastructure strategy ensures that instructional designers, content creators, and administrators can deliver engaging multimedia courses without compromising performance or security. Decision-makers must balance cost efficiency with innovation, harmonizing on-premise resources with cloud-based services to achieve optimal flexibility. With this context in mind, this executive summary outlines the transformative forces reshaping eLearning infrastructure, the external economic pressures at play, and the strategic levers available to organizations aiming to stay ahead in a dynamic digital learning landscape.

Unveiling the Pivotal Technological and Pedagogical Transformations Redefining eLearning Infrastructure for Next Generation Education Delivery

Over the past few years, the eLearning domain has witnessed a profound intersection of emerging technologies and pedagogical approaches that together redefine the notion of digital education. Leaders are leveraging virtualization platforms and software-defined networking constructs to decouple hardware dependencies, enabling rapid provisioning of learning environments that accommodate fluctuating learner populations. Concurrently, the rise of microservices architectures and container orchestration tools has facilitated modular course delivery, where individual learning modules can be updated, scaled, or secured independently. This modularity accelerates time-to-market for new curricula while maintaining system reliability and minimizing maintenance overhead.

Beyond infrastructure paradigms, artificial intelligence and machine learning capabilities are being integrated into eLearning platforms to deliver personalized learning paths, automate administrative workflows, and predict system loads before they occur. These intelligent systems rely on high-speed data pipelines and real-time analytics frameworks that challenge traditional database and storage infrastructures. To accommodate these demands, organizations are adopting hybrid cloud models, dynamically shifting workloads between private data centers and public cloud services based on performance, compliance, and cost criteria. Edge computing initiatives, in turn, bring content caching and basic processing closer to end users, reducing latency and enhancing the quality of live virtual classrooms even in bandwidth-constrained regions.

Security protocols have evolved in lockstep with these infrastructure innovations. Zero-trust frameworks and adaptive access controls are becoming standard practice, driven by the imperative to safeguard confidential information such as student records and examination materials. Concurrently, the implementation of robust encryption schemes, next-generation firewalls, and intrusion detection systems ensures that eLearning ecosystems remain resilient against an increasingly sophisticated threat landscape. Together, these technological and pedagogical transformations establish a new baseline for what constitutes a best-in-class eLearning infrastructure.

Assessing the Compounding Effects of 2025 United States Tariffs on eLearning IT Infrastructure Procurement and Operational Agility in Education Sectors

In 2025, the United States introduced a series of tariffs affecting a broad spectrum of IT hardware components critical to eLearning infrastructure, including networking equipment, servers, and storage arrays. These measures have injected a new layer of complexity into procurement strategies, as educational institutions and corporate training organizations grapple with fluctuating hardware costs and extended vendor lead times. To mitigate budgetary pressures, many have turned to diversified supplier networks, leveraging regional vendors and second-source agreements to maintain project timelines without sacrificing performance or support agreements.

These tariffs have also accelerated the shift toward cloud-based deployment models, as organizations seek to offset capital expenditure increases with operational expenditure predictability. By migrating workloads to managed cloud platforms, decision-makers can capitalize on pay-as-you-go pricing structures and global data center footprints that sidestep certain import duties. At the same time, robust service-level agreements and data residency guarantees have become non-negotiable elements of cloud contracts, reflecting heightened sensitivity to compliance mandates and continuity requirements.

Furthermore, the tariff-induced supply chain disruptions have underscored the importance of infrastructure resilience. Learning platforms are being architected with redundant interconnections, automated failover mechanisms, and cross-regional replication to ensure uninterrupted service delivery. The ripple effects of these policy shifts extend beyond hardware, catalyzing innovation in software-defined security and network virtualization, which together offer flexible alternatives to traditional physical appliance deployments. As a result, the eLearning sector is evolving toward more agile and software-driven infrastructure paradigms, better equipped to navigate geopolitical headwinds.

Illuminating Critical Segmentation Perspectives to Drive Targeted Strategies Across Components, Deployment Models, Organizational Scales, and Vertical Applications

A nuanced analysis of eLearning infrastructure adoption reveals distinct patterns when viewed through multiple segmentation lenses. Within the component domain, networking solutions lead the charge as institutions prioritize high-throughput connectivity, while next-generation security appliances receive increasing attention for their ability to enforce granular microsegmentation and threat intelligence. Server architectures, meanwhile, are shifting toward modular hyperconverged systems that integrate compute and storage to reduce rack space and power consumption. Storage arrays are also undergoing a transformation, with an emphasis on flash-based tiers and software-defined solutions that optimize performance for multimedia-rich content delivery.

Examining deployment models, public and private cloud offerings continue to gain momentum, driven by their inherent scalability and managed service benefits. However, on-premise infrastructures remain vital in scenarios demanding stringent data sovereignty controls or ultra-low latency, particularly in regions with robust data localization regulations. This blend of cloud and on-premise deployments enables organizations to design tailored architectures that align with their security postures, budget constraints, and performance expectations.

When considering organizational size, large enterprises leverage centralized infrastructure hubs to support global learning initiatives, capitalizing on their scale to negotiate favorable vendor agreements and build expansive redundancy frameworks. In contrast, small and medium enterprises adopt leaner configurations, focusing on out-of-the-box cloud solutions that minimize administrative overhead and accelerate time-to-value. Vertical-specific insights further illuminate differentiated requirements: financial services institutions emphasize encryption and compliance auditing, educational institutions prioritize interactive content servers and virtual lab environments, government agencies demand rigorous access controls, healthcare organizations invest heavily in fault-tolerant systems for telemedicine and research applications, and retail enterprises integrate omnichannel training platforms spanning brick-and-mortar and e-commerce operations.

This comprehensive research report categorizes the eLearning IT Infrastructure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Model

- Organization Size

- End User Vertical

Delineating Regional Dynamics Shaping eLearning IT Infrastructure Adoption Patterns Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on the trajectory of eLearning IT infrastructure adoption, shaping both strategic priorities and operational models. In the Americas, digital education platforms are bolstered by mature networking backbones and a competitive cloud services market, enabling institutions to deploy sophisticated streaming and collaboration tools at scale. The North American market, in particular, champions cross-border content delivery and interoperability standards, driving demand for multi-cloud architectures that ensure resilience and cost efficiency. Latin American organizations, meanwhile, focus on bridging connectivity gaps through satellite and wireless edge solutions that deliver uninterrupted learning in underserved areas.

Across Europe, the Middle East, and Africa, regulatory frameworks play a central role in infrastructure decision-making. The European Union’s stringent data protection regulations necessitate localized cloud regions and tailored compliance features, influencing vendor selection and deployment strategies. In parallel, rapidly growing educational initiatives in the Middle East and African markets spur investments in hybrid edge solutions to address bandwidth constraints and latency challenges, fostering a nexus of public-private partnerships aimed at broadening digital learning access.

Asia-Pacific presents a tapestry of innovation and scale, where established markets like Japan and South Korea push the envelope with AI-driven educational analytics, while emerging markets such as India and Southeast Asia accelerate cloud migrations to support vast student populations. Governments in the region are underwriting digital infrastructure expansion, incentivizing cloud-native deployments and open-source technologies to democratize eLearning access. Collectively, these regional nuances underscore the imperative for tailored infrastructure blueprints that respect local conditions while leveraging global best practices.

This comprehensive research report examines key regions that drive the evolution of the eLearning IT Infrastructure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders’ Strategic Imperatives and Competitive Differentiators in the eLearning IT Infrastructure Ecosystem

An examination of leading technology providers highlights several strategic imperatives driving competitive differentiation in the eLearning IT infrastructure sphere. Network equipment manufacturers are prioritizing the integration of AI-powered monitoring and automated policy enforcement to reduce manual intervention and accelerate incident resolution. Cloud platform vendors are deepening partnerships with content delivery networks and real-time collaboration tool providers to offer end-to-end learning ecosystems that minimize integration complexity. Meanwhile, server and storage suppliers are unveiling hyperconverged offerings with built-in encryption and immutable backup capabilities to meet the dual demands of performance and security.

Simultaneously, cybersecurity firms are carving out a niche in the education sector by offering tailored threat intelligence services and compliance-ready toolkits that address sector-specific attack vectors, including phishing campaigns targeting credential-harvesting within learning management systems. Disaster recovery and business continuity specialists are integrating blockchain-based data verification and decentralized storage architectures to guarantee content integrity and rapid system restoration. Together, these companies are not only advancing the technological frontier but also collaborating across the ecosystem to deliver cohesive solutions that underpin the next wave of eLearning innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the eLearning IT Infrastructure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Amazon Web Services, Inc.

- Apple Inc.

- Blackboard Inc.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Cornerstone OnDemand, Inc.

- D2L Corporation

- Dell Technologies Inc.

- Docebo S.p.A.

- Google LLC

- HP Inc.

- IBM Corporation

- Instructure Inc.

- Intel Corporation

- Lenovo Group Ltd.

- Microsoft Corporation

- Moodle Pty Ltd

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- VMware, Inc.

Driving Sustainable Competitive Advantage Through Proactive eLearning Infrastructure Investment, Optimization, and Collaboration Strategies

Industry leaders must take decisive action to ensure their eLearning infrastructures remain adaptable, secure, and cost-effective in the face of accelerating change. First, organizations should prioritize a holistic infrastructure audit, mapping current assets against future requirements for scalability, security, and interoperability. This audit serves as the foundation for an investment roadmap that balances short-term operational efficiencies with long-term platform modernization goals, enabling a phased transition toward containerized and software-defined architectures.

Next, cross-functional collaboration between IT, instructional design, and compliance teams is essential to align technological capabilities with pedagogical objectives and regulatory mandates. By establishing governance forums and shared KPIs, enterprises can streamline decision-making, rapidly incorporate emerging technologies such as AI-based proctoring systems, and ensure that security policies are enforced consistently across network, compute, and storage layers. Such governance structures also facilitate ongoing vendor performance reviews and cost optimization initiatives.

Finally, leaders should embrace strategic partnerships with cloud service providers, managed security vendors, and specialized integration partners to augment internal skill sets and accelerate time-to-value. Co-innovation programs and joint pilot projects can uncover novel use cases-such as immersive VR training simulations or decentralized credentialing ecosystems-while shared risk models help manage budgetary uncertainties. By taking these proactive steps, industry stewards can fortify their digital education infrastructures, deliver transformative learner experiences, and maintain a competitive edge in an increasingly crowded market.

Outlining a Rigorous, Multi-Phase Research Methodology Integrating Qualitative and Quantitative Approaches for Holistic Market Insight

This research integrates a rigorous, multi-phase methodology designed to deliver comprehensive insights into the eLearning IT infrastructure market. The process commenced with an extensive secondary research phase, encompassing scholarly publications, industry whitepapers, vendor technical briefs, and regulatory documentation. This foundational analysis established a robust contextual framework for understanding technology trends, policy developments, and emerging pedagogical models.

Building on secondary insights, our primary research efforts engaged senior executives and IT decision-makers across educational institutions, corporate training departments, and government agencies through in-depth interviews and structured surveys. These interactions provided nuanced perspectives on real-world challenges, procurement drivers, and adoption barriers. Quantitative data were validated through triangulation, leveraging multiple data sources and cross-functional expert reviews to ensure accuracy and objectivity. Finally, iterative workshops with domain specialists refined key findings and recommendations, resulting in actionable intelligence tailored to the strategic needs of industry leaders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our eLearning IT Infrastructure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- eLearning IT Infrastructure Market, by Component

- eLearning IT Infrastructure Market, by Deployment Model

- eLearning IT Infrastructure Market, by Organization Size

- eLearning IT Infrastructure Market, by End User Vertical

- eLearning IT Infrastructure Market, by Region

- eLearning IT Infrastructure Market, by Group

- eLearning IT Infrastructure Market, by Country

- United States eLearning IT Infrastructure Market

- China eLearning IT Infrastructure Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Converging Insights to Chart the Future of Resilient, Scalable eLearning IT Infrastructure for Agile Education Innovation

The evolution of eLearning IT infrastructure is unmistakably intertwined with broader technological breakthroughs, economic shifts, and regional dynamics. From the migration to hybrid cloud architectures that optimize performance and cost, to the deployment of AI-driven security frameworks that safeguard digital learning environments, the sector is poised for sustained innovation. The cumulative impact of policy measures, such as the 2025 United States tariffs, underscores the need for agile procurement strategies and software-centric alternatives to traditional hardware-centric models.

Leaders who embrace detailed segmentation and regional analysis gain a strategic edge, enabling them to tailor infrastructure investments in alignment with specific organizational scales, deployment preferences, and local regulatory landscapes. By learning from the competitive moves of industry frontrunners, stakeholders can adopt best practices in automation, collaboration, and resilience, ensuring that their eLearning platforms deliver uninterrupted, engaging experiences. Ultimately, the future of digital education hinges on the ability to integrate emerging technologies with sound operational frameworks, laying the groundwork for scalable, secure, and learner-centric ecosystems that drive measurable outcomes.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive eLearning Infrastructure Insights and Advance Strategic Decision Making

To gain a deeper understanding of the evolving eLearning IT infrastructure landscape and empower your strategic decisions, reach out to Ketan Rohom, Associate Director of Sales & Marketing at our research firm. His expert guidance will clarify how our comprehensive market research report can address your unique challenges, from optimizing network performance to securing sensitive learner data. Collaborating with him ensures you receive tailored insights, actionable intelligence, and premium-sourced data that align with your organization’s objectives. Contact Ketan to arrange a personalized briefing, explore targeted research add-ons, or discuss volume licensing options for your team. Engage today to secure the competitive advantage your institution or enterprise requires for transformative digital education initiatives.

- How big is the eLearning IT Infrastructure Market?

- What is the eLearning IT Infrastructure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?