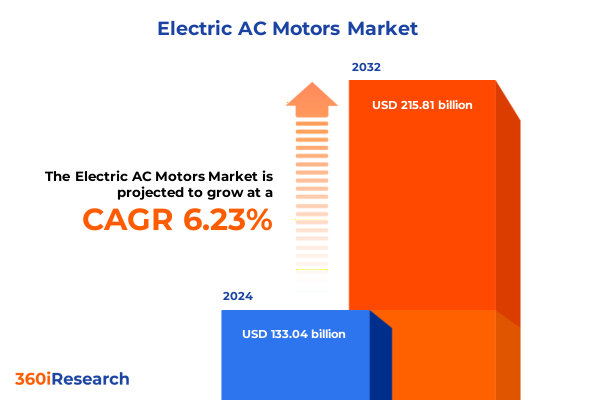

The Electric AC Motors Market size was estimated at USD 140.77 billion in 2025 and expected to reach USD 149.16 billion in 2026, at a CAGR of 6.29% to reach USD 215.81 billion by 2032.

Pioneering Advances in Electric AC Motor Technology Propel Unprecedented Industrial and Commercial Transformation Across Diverse Global Markets

The electric alternating current (AC) motor stands at the forefront of modern industrial advancement, powering a vast array of applications from heavy-duty manufacturing lines to intelligent building systems. Its robust design, scalability, and efficiency have established it as an indispensable component of global infrastructure, enabling businesses to meet escalating productivity and sustainability demands while simultaneously reducing operational costs. Recent innovations in materials science, manufacturing processes, and digital control systems have further elevated the performance thresholds of these motors, fostering unprecedented levels of reliability, energy efficiency, and lifecycle optimization. As industries embrace the dual imperatives of decarbonization and digital transformation, electric AC motors continue to evolve as a linchpin technology that ensures machines remain agile, responsive, and aligned with organizational goals.

Against this dynamic backdrop, executives and technical leaders require a clear, comprehensive perspective on the shifting currents that drive motor selection, deployment, and aftermarket strategies. This report delivers an in-depth exploration of the critical trends, regulatory influences, and competitive forces shaping the electric AC motor landscape through mid-2025. The analysis synthesizes qualitative insights from industry experts with rigorous secondary research to illuminate emerging growth avenues and potential headwinds. By bridging high-level strategic imperatives with practical considerations for product design, procurement, and service delivery, this executive summary equips decision-makers with the knowledge needed to navigate an increasingly complex ecosystem and capitalize on the opportunities presented by the next generation of electric AC motor technologies.

Emergence of Digitalization and Sustainability Trends Reshaping Competitive Dynamics and Innovation Trajectory in Electric AC Motor Landscape

A confluence of digitalization, sustainability priorities, and market consolidation is reshaping the electric AC motor sector into a more agile, data-driven ecosystem. The proliferation of industrial Internet of Things platforms has introduced real-time condition monitoring and predictive maintenance capabilities, enabling manufacturers to shift from reactive to proactive service models. This digital overlay not only extends motor lifespans but also unlocks new revenue streams through subscription-based diagnostics and remote performance optimization. Simultaneously, the push for carbon neutrality has accelerated the adoption of high-efficiency motor designs, including permanent magnet synchronous and reluctance variants. These innovations deliver superior torque-to-weight ratios and reduced energy consumption, addressing the twin imperatives of operational excellence and environmental stewardship.

Moreover, strategic partnerships and mergers among key players are driving economies of scale and fostering cross-pollination of intellectual property. Established motor manufacturers are aligning with software and service providers to broaden their portfolios and enhance digital service offerings. Such collaborative endeavors are particularly evident in the automotive and renewable energy segments, where demand for lightweight, high-torque motors is surging. This transformative shift demands that stakeholders reassess traditional value chains, integrate advanced materials and power electronics, and cultivate a culture of continuous improvement to maintain a competitive edge.

Comprehensive Assessment of United States Tariff Adjustments in 2025 and Their Multifaceted Implications for Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariff modifications targeting imported electric AC motors under the ongoing effort to strengthen domestic manufacturing competitiveness. These adjustments have reverberated through supply chains, compelling OEMs and distributors to reevaluate sourcing strategies and inventory buffers. Increased import duties have elevated landed costs for standard induction and synchronous motor shipments, prompting many end users to explore near-shoring and vertical integration opportunities. Suppliers with domestic production capabilities have thus gained a strategic advantage, as they can offer more predictable lead times and insulated pricing structures.

However, the tariffs have also introduced complexities in project budgeting and aftermarket service planning. Companies reliant on specialized motor variants have encountered limited alternatives within the domestic market, resulting in extended qualification cycles and potential project delays. To mitigate these challenges, many stakeholders have intensified investments in flexible manufacturing systems capable of supporting mixed-volume production and rapid retooling. Concurrently, there has been a discernible uptick in collaborative initiatives between motor manufacturers and component suppliers aimed at developing modular designs that can be produced domestically without extensive reengineering. As a result, the industry is experiencing a strategic recalibration where cost optimization, supply chain resilience, and design flexibility have emerged as primary competitive levers.

Deep Dive into Electric AC Motor Market Segmentation Reveals Critical Type, Voltage, Output Power, Control, Application, End-Use and Distribution Channel Drivers

Insights into market segmentation reveal that motor types serve distinct strategic roles across industries. Induction motors, particularly three-phase variants, dominate heavy industries and utilities due to their proven reliability and cost efficiency, whereas single-phase induction options remain prevalent in residential and light commercial appliances. Synchronous motor categories are bifurcated by excitation method: DC-excited machines cater to high-precision drives, while non-excited designs-encompassing permanent magnet synchronous and reluctance motors-are increasingly prized for their compact form factors and superior energy performance at scalable torque levels. Stepper motors, with their precise positional control, underpin automation applications such as robotics and semiconductor manufacturing, while universal motors retain a niche in portable consumer tools where variable speed control at low cost is paramount.

Voltage segmentation highlights that low-voltage motors are ubiquitous in HVAC systems, pumps, and small-scale manufacturing setups, medium-voltage machines are integral to energy generation and large industrial drives, and high-voltage platforms address heavy mining, oil & gas, and infrastructure projects requiring high power outputs. Within output power categories, motors rated between 0.5 and 10 horsepower account for the bulk of commercial and light industrial usage, whereas sub-0.5 horsepower units power precision instruments, and those exceeding 10 horsepower drive bulk material handling and process equipment. The evolution of control types shows a clear pivot toward automatic control architectures integrated with variable frequency drives for energy savings, although manual control systems persist in legacy installations or cost-sensitive scenarios.

Applications span compressors, conveyor systems, cranes and hoists, electric vehicles, fans, mixers and agitators, and pumps-each demanding tailored specifications in torque, efficiency, and environmental sealing. End-use industries range from automotive and manufacturing automation to energy and power, food and beverage, healthcare, construction, mining, and oil and gas, each exerting unique requirements for motor design and certification. Distribution channels bifurcate into offline and online routes; traditional specialty stores and departmental sales channels continue to facilitate large purchase decisions, whereas digital platforms and company websites are accelerating small-volume orders and aftermarket replacements through streamlined e-commerce experiences.

This comprehensive research report categorizes the Electric AC Motors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Motor Type

- Output Power

- Voltage Class

- Control Type

- Phase

- Speed Control

- Application

- Distribution Channel

- End-Use

Unearthing Regional Nuances in Electric AC Motor Demand to Forecast Opportunities and Challenges Across Americas, EMEA, and Asia-Pacific Zones

Regional dynamics in the electric AC motor market underscore the necessity of tailored strategies for each geographic cluster. In the Americas, the United States leads with robust demand driven by industrial automation investments and the accelerated rollout of electric vehicle manufacturing. Rising capital expenditures on infrastructure modernization and renewable energy integration further bolster motor sales, while Canada’s specialized sectors in mining and oil & gas contribute significant volumes of heavy-duty motor applications. Latin American markets, although smaller in scale, are gaining momentum as manufacturing capabilities expand in Mexico and Brazil, where local content requirements and government incentives promote onshore production.

Europe, the Middle East, and Africa each present a tapestry of diverging growth trajectories. European Union member states emphasize stringent energy efficiency regulations and incentives for green manufacturing, which have accelerated adoption of high-efficiency synchronous and reluctance motor solutions. In the Middle East, petrochemical and oil refining operations continue to underpin demand for robust, high-voltage motors, even as regional diversification initiatives spur project activity in construction and renewables. African markets remain nascent but exhibit considerable potential, with infrastructure development programs and increased industrialization in South Africa and Nigeria poised to drive incremental motor consumption over the coming years.

Asia-Pacific remains the epicenter of both production and consumption. China’s vast manufacturing ecosystem benefits from deep supply chains and rapid technology diffusion, while India’s industrial expansion and government “Make in India” campaigns are stimulating domestic capacity additions. Southeast Asian nations are emerging as key assembly hubs for electronics and automotive sectors, creating demand for compact, high-precision motors. Meanwhile, Australia’s resource-driven economy sustains consistent requirements for large-scale, heavy-duty motor solutions in mining and agricultural processing.

This comprehensive research report examines key regions that drive the evolution of the Electric AC Motors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Electric AC Motor Manufacturers Highlighting Innovation Roadmaps, Collaborative Partnerships, and Competitive Strengths

The competitive landscape of electric AC motor manufacturing is characterized by a blend of global titans and agile regional specialists. Leading conglomerates continue to invest heavily in research and development, methodically rolling out new product lines that leverage advanced materials, integrated power electronics, and smart diagnostics. Strategic alliances between motor OEMs and software providers have become a cornerstone of product roadmaps, facilitating the incorporation of real-time performance monitoring and predictive maintenance platforms. Such digital services not only differentiate offerings but also deepen customer relationships through outcome-based service agreements.

Regional champions and mid-tier players are equally carving out defensible positions by focusing on niche applications and cost-effective solutions. Their strategies often revolve around localized manufacturing to avoid tariff impacts and expedite delivery, as well as customization capabilities that address specific industry standards. Additionally, collaboration with component suppliers and system integrators enables these companies to offer turnkey solutions, especially in market segments such as electric vehicle propulsion, renewable energy projects, and specialized process equipment. The resulting interplay between scale economies and targeted innovation underscores the need for companies to strike a delicate balance between global R&D investments and regional responsiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric AC Motors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Allient Inc.

- Ametek Inc.

- BorgWarner Inc.

- Danfoss A/S

- DENSO Corporation

- Emerson Electric Co.

- Farmtech Industries

- General Electric Company

- Groschopp AG

- Hitachi Ltd.

- Hiwin Corporation

- Johnson Electric Holdings Ltd.

- Kirloskar Electric Company

- Mitsubishi Electric Corporation

- Nidec Motor Corporation

- OMEGA Engineering inc.

- Regal Rexnord Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Schneider Electric SE

- SEW-EURODRIVE GmbH & Co KG

- Siemens AG

- Sinotech

- Toyota Material Handling, Inc.

- Wolong Electric Group

- ZF Friedrichshafen AG

Targeted Strategic Recommendations Empower Industry Leaders to Optimize Production, Supply Chain Efficiency, and Technology Adoption for Future Growth

To maintain and enhance market leadership, industry executives must prioritize a multifaceted approach that aligns operational excellence with forward-looking innovation. Embracing advanced manufacturing techniques such as additive fabrication and modular assembly can significantly reduce lead times and support the production of customized motor variants. Concurrently, embedding predictive analytics into service infrastructures will sharpen asset availability metrics and generate recurring revenue from subscription-based maintenance offerings. Strengthening supplier relationships through joint development programs can also mitigate risks associated with rare earth magnet shortages and raw material price volatility.

From a strategic standpoint, companies should target high-growth verticals, including electric vehicle propulsion, renewable energy generation, and data center infrastructure, by tailoring product portfolios to the specific torque, efficiency, and regulatory requirements of each sector. Geographic expansion should focus on markets undergoing robust industrialization or regulatory shifts toward energy efficiency. Finally, cultivating a culture of continuous improvement-reinforced by digital twin simulations and cross-functional collaboration-will empower organizations to adapt swiftly to evolving customer demands and policy environments. These concerted actions will position leaders to capitalize on emergent growth vectors and fortify long-term resilience.

Comprehensive Research Framework Employing Primary and Secondary Techniques to Validate Data Integrity and Insightful Analysis of Electric AC Motor Markets

This study was built upon a meticulously structured research framework combining qualitative and quantitative methodologies to ensure robust, actionable insights. Primary research included in-depth interviews with motor OEM executives, system integrators, distributors, and end-use industry experts, providing firsthand perspectives on technology adoption, procurement challenges, and service expectations. These interviews were supplemented by targeted surveys that captured pricing, lead time, and aftermarket service data across diverse regions and application segments.

Secondary research encompassed analysis of publicly available technical papers, regulatory filings, trade association publications, and industry white papers to map historical trends and benchmark performance metrics. Data integrity was maintained through a rigorous triangulation process, cross-verifying primary inputs against multiple secondary sources to eliminate discrepancies. Segmentation frameworks were validated via iterative consultations with an advisory panel of subject matter experts, ensuring accurate classification of motor types, voltage classes, output power ratings, control architectures, and application domains. The resulting database underpins the insights presented, offering a transparent audit trail of research assumptions and analytical methodologies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric AC Motors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric AC Motors Market, by Motor Type

- Electric AC Motors Market, by Output Power

- Electric AC Motors Market, by Voltage Class

- Electric AC Motors Market, by Control Type

- Electric AC Motors Market, by Phase

- Electric AC Motors Market, by Speed Control

- Electric AC Motors Market, by Application

- Electric AC Motors Market, by Distribution Channel

- Electric AC Motors Market, by End-Use

- Electric AC Motors Market, by Region

- Electric AC Motors Market, by Group

- Electric AC Motors Market, by Country

- United States Electric AC Motors Market

- China Electric AC Motors Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 1908 ]

Synthesized Insights Emphasize Strategic Imperatives and Growth Catalysts Shaping the Future Trajectory of the Electric AC Motor Industry

The electric AC motor sector is undergoing a profound evolution fueled by digitalization, regulatory imperatives, and shifting global trade dynamics. Stakeholders equipped with an integrated understanding of product segmentation, regional idiosyncrasies, and competitive strategies are best positioned to capture emerging opportunities. The convergence of high-efficiency designs with smart control systems heralds a new era of performance and sustainability, while tariff-driven supply chain realignments underscore the value of localized manufacturing and agile sourcing.

Looking ahead, organizations that blend technological innovation with operational adaptability will secure enduring competitive advantages. By concentrating investments on advanced materials, predictive services, and tailored product offerings, they can address the nuanced requirements of diverse end-use industries-from electric vehicle propulsion to energy infrastructure projects. Ultimately, a holistic approach that aligns product roadmaps with regulatory trends and customer priorities will define the winners in this dynamically shifting marketplace.

Connect with Associate Director to Acquire Critical Electric AC Motor Market Research and Accelerate Strategic Decision-Making with Expert Guidance

Ready to elevate your strategic initiatives with comprehensive market intelligence tailored to your organization’s needs? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the in-depth Electric AC Motor Market Research Report. Ketan’s expert guidance will ensure you receive a customized overview of the most critical insights, empowering you to drive innovation, optimize your supply chain, and outpace the competition. Reach out today to explore flexible licensing options and discover how this report can serve as the catalyst for your next wave of success

- How big is the Electric AC Motors Market?

- What is the Electric AC Motors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?