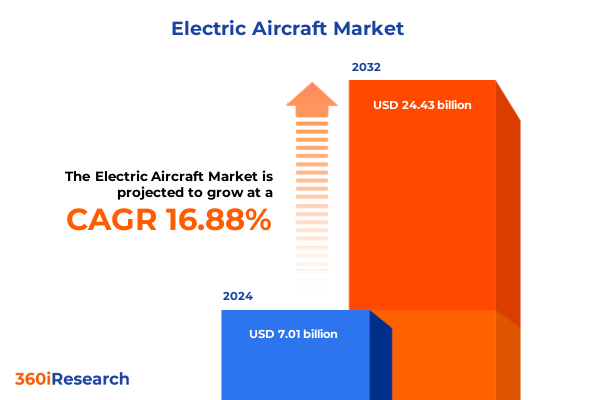

The Electric Aircraft Market size was estimated at USD 8.05 billion in 2025 and expected to reach USD 9.33 billion in 2026, at a CAGR of 17.18% to reach USD 24.43 billion by 2032.

Launching a Sustainable Flight Revolution Through Electrification to Transform Commercial and Military Aircraft Performance and Connectivity

A profound transition is underway as the aviation industry embraces electric propulsion to meet the imperatives of decarbonization, noise reduction, and operational efficiency. Once the realm of experimental prototypes and visionary concepts, electric and hybrid aircraft have swiftly advanced to full-scale demonstrators, supported by breakthroughs in battery energy density, electric motor power-to-weight ratios, and digital systems integration. At the same time, governments and regulatory bodies around the globe have signaled strong commitments to cut greenhouse gas emissions, providing financial incentives, setting aggressive carbon targets, and streamlining certification pathways for zero-emission flight. Consequently, industry stakeholders from OEMs to suppliers and service providers are realigning strategies to capitalize on this accelerating momentum and to navigate the complex interplay of technological, regulatory, and market forces.

In parallel, the competitive landscape has expanded to include a spectrum of new entrants-ranging from well-established aerospace conglomerates to deep-tech startups-each racing to validate novel architectures such as distributed electric propulsion and vertical take-off and landing platforms. Venture capital inflows and strategic partnerships have surged, underscoring the belief that sustainable flight will redefine value propositions across passenger transport, cargo logistics, and defense applications. Yet alongside these opportunities, companies confront persistent challenges including battery lifecycle management, electric grid compatibility, supply chain resilience, and evolving safety standards.

Against this backdrop, a cohesive strategic framework is essential to guide decision-makers through the uncertainties and promising avenues that define the electric aircraft market. This executive summary distills the key drivers, disruptive shifts, policy impacts, segmentation insights, and regional dynamics shaping the sector today, equipping stakeholders with the actionable intelligence necessary to lead in this new era of aviation.

Exploring Radical Technological Advancements and Market Dynamics Driving the Next Generation of Fully Electric and Hybrid Aircraft Ecosystems

The electric aircraft landscape has undergone seismic transformation over the past decade, propelled by converging advancements in materials science, propulsion technologies, and digital systems. High-strength lightweight composites now feature in airframes, enabling optimized aerostructures that offset battery weight and deliver superior aerodynamic efficiency. At the same time, the maturation of high-efficiency electric motors with integrated power electronics has unlocked power densities once thought unattainable, while solid-state battery prototypes promise greater energy density, faster charging, and enhanced safety compared to traditional lithium-ion formulations.

Moreover, the integration of sophisticated avionics and software architectures has redefined aircraft control and maintenance paradigms. Predictive analytics powered by machine learning algorithms facilitate real-time health monitoring, enabling operators to anticipate component wear, schedule preemptive maintenance, and reduce operational disruptions. In parallel, modular electric power systems allow for scalable configuration, simplifying certification pathways for aircraft variants tailored to distinct mission profiles.

These technological leaps have coincided with evolving market dynamics. Legacy aerospace players have forged alliances with battery developers and electric motor specialists to hedge technology risks and accelerate time to market. Meanwhile, governmental and nonprofit initiatives have seeded demonstration programs for urban air mobility, regional electric shuttles, and advanced prototype evaluation. Collectively, these initiatives have fostered an innovation ecosystem in which early-stage successes feed back into regulatory learning cycles, driving faster approval of safety protocols and airworthiness criteria. In light of these transformative shifts, organizations must maintain agility in technology roadmapping and collaboration strategies to fully capture the promise of electrified flight.

Unpacking the Compound Effects of 2025 United States Tariff Policies on Supply Chains, Cost Structures, and Strategic Sourcing in Electric Aviation

In 2025, a landmark adjustment to United States tariff policies introduced new levies on select imported components critical to electric aircraft production, marking a pivotal moment for supply chain and cost management strategies. Key targets included electric motor assemblies, advanced power electronics, and specialty battery cells, each subject to tariffs designed to incentivize domestic manufacturing and safeguard national economic interests. While these measures support the scaling of local production capacity and bolster innovation hubs, they also impose a cumulative cost burden on manufacturers reliant on global procurement networks.

The dual effect of higher component costs and shifting sourcing requirements has led many original equipment manufacturers to re-evaluate supplier contracts, adopt near-shoring tactics, and invest in domestic research partnerships. In some cases, these adaptations have spurred the formation of vertically integrated operations, with design, production, and testing brought under a single roof to streamline workflows and mitigate tariff exposure. Conversely, suppliers outside the United States have pursued tariff avoidance strategies by establishing joint ventures or assembly lines within the country, thereby maintaining access to key markets while aligning with new trade policies.

Importantly, these tariff-driven dynamics extend beyond immediate cost implications, influencing longer-term technology adoption patterns. Increased domestic investment in battery research centers and electric motor fabrication facilities has accelerated iterative design cycles and localized innovation. At the same time, strategic sourcing shifts have heightened collaboration between airlines, defense integrators, and manufacturers to share risks and pool resources for next-generation prototypes. As tariffs continue to reshape the economics of electric aviation, stakeholders must adopt integrated cost modeling and flexible supply chain designs to sustain momentum without compromising on technical performance or market responsiveness.

Delving into Core Segmentation Drivers by Aircraft Type, System Component, Technology Mode, Flight Range, and Application Use Cases to Reveal Market Nuance

The electric aircraft ecosystem exhibits substantial heterogeneity when examined through core segmentation lenses, each revealing unique performance requirements, investment priorities, and competitive pressures. By type, fixed wing platforms currently dominate demonstration and early commercial deployments, leveraging proven aerodynamic efficiencies for regional passenger and cargo services, while hybrid aircraft enable extended range and payload flexibility through combined powertrain architectures. Rotary wing configurations are emerging as critical enablers for urban air mobility, delivering vertical access solutions for dense metropolitan corridors but facing distinct challenges in energy management and regulatory certification.

Examining system type highlights further nuance: aerostructures must balance structural integrity with weight reduction targets, avionics require seamless integration of flight control software and battery management systems, and electric motors demand breakthroughs in thermal management and power density. The power system segment, encompassing both lithium-ion formulations and next-generation solid-state batteries, underpins all mission profiles, dictating endurance, recharge cycles, and safety margins, while specialized software suites orchestrate power distribution, predictive maintenance, and autonomous flight functions.

Technology modes introduce an additional dimension: conventional take-off and landing platforms benefit from established runway infrastructure and certification protocols, short take-off and landing designs unlock operations at smaller airfields with moderate power requirements, and vertical take-off and landing vehicles aim to revolutionize last-mile connectivity but must overcome energy efficiency and noise constraints. Range-based segmentation further delineates market focus, with long-range designs enabling intercity connections beyond 200 kilometers, medium-range concepts addressing commuter routes between 50 and 200 kilometers, and short-range models serving sector lengths under 50 kilometers. Finally, application contexts split between commercial aviation-spanning cargo carriers and passenger services-and military operations, each demanding tailored performance, reliability, and mission endurance. Understanding these intersecting segmentation drivers is essential for aligning R&D investments, regulatory strategies, and go-to-market plans in the evolving electric aircraft arena.

This comprehensive research report categorizes the Electric Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- System Type

- Technology

- Range

- Application

Identifying Distinct Regional Growth Patterns and Investment Opportunities Across the Americas, Europe Middle East Africa, and Asia Pacific Aviation Markets

Regional landscapes in electric aviation manifest distinct growth trajectories shaped by policy frameworks, infrastructure readiness, and stakeholder collaboration. In the Americas, substantial government incentives and private capital flows have coalesced around the development of next-generation battery manufacturing and powertrain facilities. The United States leads with a robust network of test corridors, state-level tax credits for zero-emission flights, and defense research funding that accelerates dual-use applications. Meanwhile, Canada’s focus on cold-weather performance testing and indigenous supply chain integration underscores the importance of environmental and logistical considerations unique to North America.

Conversely, in Europe, the Middle East, and Africa, regulatory harmonization efforts spearheaded by European aviation authorities have cultivated a coordinated approach to certification and airspace integration for electric and hybrid platforms. European Union research consortia continue to push the boundaries of high-power electrical distribution and hydrogen-electric synergies, while Middle Eastern hubs invest heavily in urban air mobility infrastructure and smart city pilot programs. Across Africa, the emphasis falls on leveraging electric rotorcraft to address remote connectivity challenges, with partnerships between aerospace firms and development agencies fostering localized assembly and maintenance capabilities.

Asia Pacific exhibits perhaps the most rapid commercialization pace, driven by national strategies in China, Japan, and Australia that prioritize electrified flight as a cornerstone of future mobility ecosystems. Substantial state funding has underwritten large-scale prototypes and dedicated electric air taxi corridors, while domestic OEMs cultivate partnerships with global suppliers to secure critical battery and avionics components. These regional distinctions underscore the necessity for companies to tailor entry strategies, alliance networks, and regulatory roadmaps to the specific dynamics of the Americas, Europe Middle East & Africa, and Asia-Pacific markets.

This comprehensive research report examines key regions that drive the evolution of the Electric Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Innovations Shaping the Development of Electric Propulsion and Aircraft Solutions Worldwide

Innovation leadership in electric aviation hinges on the ability of established aerospace conglomerates, emerging technology startups, and specialized component suppliers to collaborate and compete on multiple fronts. Leading aircraft manufacturers have staked their positions through targeted acquisitions of electric motor and battery technology firms, embedding in-house R&D teams dedicated to next-gen propulsion architectures. At the same time, vertically integrated powertrain developers have emerged as pivotal partners, offering turnkey solutions that reduce development timelines and de-risk certification hurdles.

Concurrently, software enterprises providing flight-control algorithms, digital twins, and battery management platforms are reshaping the operational paradigms of electric aircraft, enabling operators to optimize energy consumption, predict maintenance needs, and coordinate autonomous mission profiles. Component specialists in aerostructures and avionics play a critical role by innovating lightweight composite materials and high-performance electrical distribution systems that meet stringent safety and weight requirements. In the aftermarket, maintenance decision-support providers are pioneering remote diagnostics services that preserve asset value and uptime, closing the loop on lifecycle management.

Increasingly, cross-sector partnerships unite industrial players with energy utilities, academic research centers, and government labs to co-develop charging infrastructure, standardize interoperability protocols, and validate sustainable power sources. This confluence of expertise accelerates technology transfer and ensures that companies with entrenched market presence and agile startups alike can drive toward commercial viability. As competition intensifies, strategic alliances and sustained investment in core competencies will distinguish those organizations that successfully commercialize reliable, efficient, and scalable electric aircraft solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroVironment, Inc.

- Airbus SE

- Ampaire Inc.

- Archer Aviation Inc.

- BETA Technologies, Inc.

- Bye Aerospace

- Dovetail Electric Aviation

- EHang Holdings Limited

- Electric Aviation Group (EAG) Ltd.

- ELECTRON Holding B.V

- Elroy Air, Inc.

- Embraer S.A.

- Eviation Aircraft Inc.

- Faradair Aerospace Limited

- Joby Aviation, Inc.

- LIFT Aircraft Inc.

- Lilium N.V.

- Pipistrel d.o.o by Textron Inc.

- SkyDrive Inc.

- Supernal, LLC

- Vertical Aerospace Ltd.

- Volocopter GmbH

Delivering Strategic, Practical Steps for Industry Leaders to Capitalize on Electrification Trends and Mitigate Emerging Operational and Regulatory Challenges

To seize emerging opportunities and navigate complex regulatory landscapes, industry leaders should prioritize collaborative innovation models that integrate suppliers, research institutions, and end-users. Fostering open standards for power electronics interfaces and battery communication protocols will reduce integration risk and streamline certification processes, while targeted R&D consortia can share the burden of high-cost development cycles. Strategic alliances with utilities and infrastructure providers ensure that charging networks scale in tandem with aircraft deployments, mitigating potential bottlenecks in ground operations.

Furthermore, companies must adopt agile supply chain strategies that balance near-shoring of critical components with global diversification to withstand tariff shifts and geopolitical disruptions. Investing in modular powertrain designs and flexible manufacturing practices positions organizations to respond rapidly to evolving customer requirements and regulatory changes. Concurrently, engaging proactively with aviation authorities to co-create certification guidelines for novel technologies accelerates market entry and reduces uncertainty.

From a financial perspective, aligning investment portfolios with clear milestones-such as technology de-risking phases and prototype validation stages-enhances transparency for stakeholders and supports sustained capital inflows. Finally, embedding customer-centric approaches in product roadmaps, including simulation-driven mission analyses and stakeholder workshops, ensures that offerings align with airline, cargo, and defense mission profiles. By executing these strategic steps, decision-makers will establish resilient foundations for growth while capitalizing on the transformative potential of electric aircraft technologies.

Detailing a Comprehensive, Rigorous Research Framework Combining Primary Expert Interviews and Secondary Data Analysis to Ensure Robust Insights

This analysis rests on a dual-track methodology that combines primary insight generation with rigorous secondary data evaluation. Structured interviews with senior executives from leading aerospace OEMs, electric powertrain specialists, and regulatory authorities provided first-hand perspectives on technology roadmaps, certification hurdles, and strategic priorities. These in-depth conversations, conducted under conditions of confidentiality, yielded qualitative assessments of investment risk, competitive positioning, and stakeholder collaboration models.

Complementing these interviews, extensive secondary research encompassed technical white papers, government policy documents, patent filings, and academic publications to map the trajectory of key innovations including battery chemistries, electric motor architectures, and software-driven avionics systems. Supply chain analyses identified critical component flows and potential single-point vulnerabilities, while case studies of demonstration and pilot programs illuminated practical lessons in infrastructure integration and operational performance.

Data triangulation techniques validated findings by cross-referencing insights across multiple sources, ensuring consistency and accuracy. Scenario planning workshops further stress-tested strategic assumptions under varying regulatory, economic, and technological conditions. This comprehensive framework underpins the actionable intelligence presented throughout the report, providing stakeholders with a robust foundation for informed decision-making in the rapidly evolving electric aircraft sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Aircraft Market, by Type

- Electric Aircraft Market, by System Type

- Electric Aircraft Market, by Technology

- Electric Aircraft Market, by Range

- Electric Aircraft Market, by Application

- Electric Aircraft Market, by Region

- Electric Aircraft Market, by Group

- Electric Aircraft Market, by Country

- United States Electric Aircraft Market

- China Electric Aircraft Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Critical Findings and Visionary Outlook to Map the Road Ahead for Sustainable Electrified Aircraft Adoption and Innovation

The journey toward widespread adoption of electric aircraft is defined by a confluence of technological breakthroughs, policy incentives, and evolving market expectations. Key findings underscore that advances in battery energy density, electric motor efficiency, and digital systems integration are maturing at a pace that aligns with regulatory targets for emissions reduction and noise abatement. Nevertheless, the cumulative impact of trade policies and supply chain realignments introduces both challenges and strategic imperatives for manufacturers and suppliers alike.

Segmentation analysis reveals that distinct aircraft types, system components, technology modes, flight ranges, and application categories each demand tailored approaches to development and commercialization. Regional insights highlight the importance of navigating diverse regulatory frameworks and infrastructure readiness levels, from robust test corridors in North America to harmonized certification efforts in Europe and accelerated commercialization in Asia-Pacific. Moreover, collaboration across ecosystem players-spanning OEMs, powertrain specialists, software developers, and infrastructure providers-is critical to de-risking technology adoption and ensuring scalable deployment.

Looking ahead, the path to electrified flight will require sustained investment in R&D, agile supply chain strategies, and proactive regulatory engagement. Stakeholders who embrace open standards, build strategic alliances, and adopt data-driven decision-making processes will be best positioned to lead the market in this transformative era. The collective pursuit of safer, cleaner, and more efficient aircraft promises not only to redefine commercial and defense mobility but also to chart a sustainable course for aviation’s future.

Engage with Ketan Rohom to Unlock Comprehensive Electric Aviation Market Insights and Propel Strategic Decision Making with Custom Research Solutions

Engaging with our market research team unlocks a direct pathway to shaping your strategic roadmap in electric aviation while ensuring the competitive edge needed in a rapidly evolving industry. By connecting with Ketan Rohom, the Associate Director, Sales & Marketing, you gain personalized support to align our comprehensive data and analysis with your unique business objectives. Whether you aim to refine your product development cycle, secure investment partners, or benchmark against leading innovators, this tailored consultation will place the insights and expertise you need directly at your fingertips. Take this opportunity to secure your copy of the definitive market research report and propel your organization toward sustainable growth and technological leadership in the electric aircraft domain. Contact Ketan Rohom to transform these actionable findings into strategic initiatives that drive performance and resilience in an increasingly electrified aviation landscape.

- How big is the Electric Aircraft Market?

- What is the Electric Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?