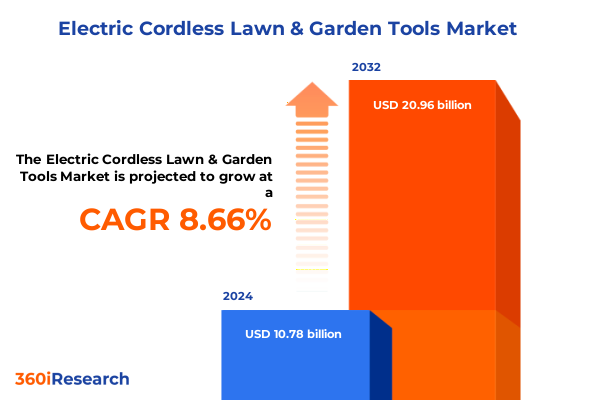

The Electric Cordless Lawn & Garden Tools Market size was estimated at USD 11.70 billion in 2025 and expected to reach USD 12.70 billion in 2026, at a CAGR of 8.68% to reach USD 20.96 billion by 2032.

Revolutionizing Outdoor Maintenance with Cordless Technology: The Emergence of Electric Lawn and Garden Equipment Shaping Sustainable Practices

The shift from traditional gasoline-powered equipment to electric cordless lawn and garden tools marks a defining moment in the evolution of outdoor maintenance solutions. With consumers and professionals alike prioritizing environmental sustainability and operational convenience, battery-operated alternatives have moved from niche offerings to mainstream essentials. Recent data indicate that over 68 percent of end users now weigh sustainability and noise reduction as critical factors in purchasing garden equipment, while approximately 74 percent of urban households favor battery-operated tools for their lower maintenance demands and enhanced portability.

Technological breakthroughs have been pivotal in driving this transformation. Fast-charging lithium-ion battery cells paired with advanced brushless motor designs have closed the performance gap, delivering run times and torque outputs that rival those of their gas-powered predecessors. In 2023, the United States alone recorded shipments exceeding 5.8 million lithium-ion battery–powered outdoor power units, with lawn mowers representing more than 35 percent of total volume, underscoring the rapid adoption of cordless solutions across residential and commercial segments.

This executive summary unfolds across a comprehensive analysis of the trends, regulatory influences, market segmentation, regional dynamics, competitive forces, and strategic imperatives defining the electric cordless lawn and garden tools sector. It offers decision-makers an authoritative synthesis of current developments as well as forward-looking insights to inform strategic planning and investment decisions.

Beyond Batteries and Motors: Unpacking the Technological, Environmental, and Regulatory Forces Transforming the Cordless Lawn and Garden Equipment Sector

The cordless lawn and garden equipment landscape is being radically reshaped by an intersection of hardware innovation and digital integration. Next-generation lithium-ion battery architectures now deliver extended run times and rapid recharge cycles while reducing the frequency of battery replacements. Concurrently, brushless motor platforms have emerged as a performance catalyst, enhancing torque delivery and energy efficiency to levels once exclusive to gasoline-powered machines. Such advancements are fundamentally redefining user expectations and performance benchmarks in everything from grass trimmers to hedge shears.

Parallel to hardware acceleration, embedded sensors, Bluetooth connectivity, and app-based interfaces offer real-time diagnostics on battery health, tool usage, and maintenance schedules. This digital overlay empowers end users to proactively manage equipment lifecycle and operational efficiency, fostering a new paradigm of connected, data-driven landscaping practices.

In addition, escalating environmental regulations and consumer sentiment toward sustainability have prompted manufacturers to adopt recycled materials and implement end-of-life battery recycling initiatives. Noise ordinances in urban areas further incentivize the transition away from fuel-powered equipment, amplifying demand for quieter, zero-emission alternatives. Together, these drivers are catalyzing a comprehensive reimagination of cordless outdoor power equipment.

Assessing the Far-Reaching Consequences of U.S. Section 301 Tariffs in 2025 on the Cordless Outdoor Power Equipment Supply Chain

The implementation of Section 301 tariff increases by the U.S. Trade Representative has introduced significant cost headwinds for cordless equipment manufacturers. As of August 1, 2024, tariffs on Chinese-origin lithium-ion batteries rose to 25 percent, covering an estimated $13.2 billion in imports and directly affecting the primary power source for cordless tools.

Complementing battery duties, steel and aluminum components-integral to structural frames and housings-began incurring 25 percent levies from September 27, 2024. Meanwhile, certain electric motor assemblies and semiconductor elements face duties ranging from 25 percent to 50 percent under staggered enforcement dates through 2025, further elevating input costs across the value chain.

These combined tariff measures are exerting upward pressure on production expenses, particularly for brands reliant on Asian manufacturing hubs. As procurement costs escalate, manufacturers must navigate potential margin compression or consider passing additional charges to consumers, which could dampen adoption in price-sensitive segments.

To mitigate these risks, industry participants are exploring strategic sourcing diversification, enhanced supply chain localization, and engineering innovations that optimize material efficiency. Such actions will be instrumental in preserving growth trajectories and sustaining competitive positioning amidst tariff-driven market volatility.

Illuminating Market Structure Through Product, End User, Battery, Motor, Voltage, Capacity, and Distribution Channel Dimensions

The electric cordless lawn and garden tools market spans a broad range of product categories, including chainsaws, edgers, grass trimmers, hedge trimmers, lawn mowers, leaf blowers, leaf vacuums and mulchers, as well as tillers and cultivators. Lawn mowers themselves bifurcate into walk-behind models and riding platforms, the latter further delineated into residential riding and zero-turn configurations, thereby addressing a spectrum of use-case scenarios from small yard maintenance to expansive commercial turf management.

End-user segmentation underscores distinct usage patterns and purchasing rationales: commercial landscaping professionals demand robust, high-duty-cycle battery systems with rapid swap-and-go capabilities, whereas residential users often prioritize ergonomic design, noise reduction, and simplified charging for intermittent tasks.

Power solutions are dominated by lithium-ion battery technology, prized for high energy density and accelerated recharge rates, although nickel-cadmium cells remain in play for select entry-level tools where cost considerations prevail. Distribution pathways include direct sales channels catering to institutional clients, offline specialty retailers offering hands-on expertise, and online platforms that provide extensive assortments, convenience, and after-sales support.

Motor choices polarize between cost-effective brushed units-prevalent in basic light-duty models-and advanced brushless architectures that deliver superior efficiency, reduced maintenance, and extended service life, driving a clear premiumization trend in performance-oriented categories.

Battery voltage classifications further stratify the market into sub-20 volt platforms suited for ultra-light tasks, 20-40 volt systems segmented into 20-30 volt and 30-40 volt variants balancing power and weight, and high-voltage above-40 volt solutions engineered for heavy-duty applications. Complementing voltage tiers, battery capacity divisions span below 2 ampere-hours for brief uses, 2-5 ampere-hours-subdivided into 2-3 ampere-hour and 3-5 ampere-hour packs-for standard runtimes, and above 5 ampere-hour modules delivering extended autonomy favored in commercial contexts.

This comprehensive research report categorizes the Electric Cordless Lawn & Garden Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Battery Type

- Motor Type

- Battery Voltage

- Distribution Channel

- End User

Regional Dynamics Driving Adoption: Contrasting Consumer and Regulatory Landscapes Across the Americas, EMEA, and Asia-Pacific

The Americas region stands at the forefront of electric cordless lawn and garden tool adoption, driven by strong environmental regulations, widespread consumer awareness campaigns, and robust retail networks. In the United States, over 5.8 million lithium-ion outdoor power units were shipped in 2023, with lawn mowers alone accounting for more than one-third of total volume. Accessibility to financing options and rebate programs has further accelerated uptake among both residential and professional user segments.

In Europe, Middle East, and Africa, municipal noise and emissions standards have catalyzed a wave of replacement contracts, with over 500 public landscaping fleets transitioning to battery-powered equipment in 2023. Urban noise ordinances in major cities and sustainability directives at the EU level continue to amplify demand, while retail channel expansion in specialty outlets bolsters consumer confidence in cordless alternatives.

Over in the Asia-Pacific corridor, rapid urbanization, rising disposable incomes, and tightening air quality regulations have driven significant penetration gains in metropolitan markets. Key economies including Japan, Australia, and South Korea are introducing incentives for adopting low-emission tools, while e-commerce platforms leverage efficient logistics to meet the needs of time-pressed homeowners and small-scale contractors alike.

This comprehensive research report examines key regions that drive the evolution of the Electric Cordless Lawn & Garden Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Leadership in Cordless Tools: How Major Brands Are Shaping Market Trajectories Through Innovation and Strategic Positioning

Competitive dynamics within the cordless outdoor equipment market have become increasingly pronounced, with legacy power tool brands and pure-play battery innovators vying for leadership. Ryobi has solidified its position through a broad cordless portfolio that achieved a 37 percent retail unit share in walk-behind mower categories in 2024, while also maintaining a top position across handheld tools.

Emerging specialists such as EGO Power+ and Greenworks have captured share by emphasizing high-voltage, fast-charging battery platforms and modular cross-tool compatibility, resonating with both residential and small-commercial users. EGO’s 56 volt system and Greenworks’ 60 volt ecosystem exemplify the power-sharing trend that fosters user loyalty and simplifies battery management across multiple devices.

Conversely, traditional gas-centric brands like Craftsman and Husqvarna have witnessed marked declines in market share as consumer preference shifts toward zero-emission alternatives. Strategic partnerships between cordless tool manufacturers and battery technology specialists are emerging as a pivotal competitive lever, enabling differentiated product offerings and accelerated innovation cycles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Cordless Lawn & Garden Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ariens Company

- Briggs & Stratton, LLC

- Deere & Company

- Einhell Germany AG

- Emak S.p.A.

- Fiskars Corporation

- Greenworks Tools

- Honda Motor Co., Ltd.

- Husqvarna AB

- Makita Corporation

- MTD Products Inc.

- Positec Tool Corporation

- Robert Bosch GmbH

- Stanley Black & Decker, Inc.

- STIHL Holding AG & Co. KG

- Techtronic Industries Company Limited

- The Scotts Miracle-Gro Company

- The Toro Company

Strategic Roadmap for Industry Stakeholders: Data-Driven Recommendations to Accelerate Growth in the Electric Cordless Garden Tools Market

To navigate a landscape defined by rapid technological change and evolving regulatory parameters, industry stakeholders should prioritize supply chain resilience through diversified sourcing and strategic manufacturing alliances. Establishing regional assembly facilities or partnering with local OEMs can mitigate tariff exposure and reduce lead times for critical components.

Investment in next-generation battery research and development, including solid-state cell prototypes and enhanced thermal management systems, will be fundamental to sustaining performance leadership. Concurrently, brands should expand digital service offerings-such as predictive maintenance apps and over-the-air firmware updates-to deepen customer engagement and create recurring revenue streams.

Further, aligning product road maps with regional sustainability mandates can unlock incentive programs and bolster brand reputation among environmentally conscious consumers. Tailoring marketing initiatives and distribution strategies to address divergences in end-user needs-such as emphasizing lightweight ergonomics in residential channels and maximizing uptime for commercial fleet operators-will enhance market penetration and customer loyalty.

Robust Methodological Framework: Integrating Primary Interviews, Secondary Data, and Advanced Analytics to Uncover Market Intelligence

This analysis synthesizes insights derived from a structured research methodology combining primary and secondary data sources. Stakeholder interviews with industry executives, distributors, and end users provided qualitative perspectives on product performance, purchasing criteria, and market barriers.

Extensive secondary research, including regulatory filings, industry publications, and corporate financial reports, was conducted to quantify technology adoption, tariff impacts, and competitive positioning. Data triangulation methods were employed to cross-validate information across multiple sources, ensuring robustness and accuracy in the findings.

Analytical frameworks such as scenario planning and cost-benefit modeling were utilized to assess the potential outcomes of tariff scenarios and technology shifts. Market segmentation analyses were informed by volumetric shipment data and buyer behavior studies, delivering a granular understanding of demand drivers across product, end user, and regional dimensions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Cordless Lawn & Garden Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Cordless Lawn & Garden Tools Market, by Product Type

- Electric Cordless Lawn & Garden Tools Market, by Battery Type

- Electric Cordless Lawn & Garden Tools Market, by Motor Type

- Electric Cordless Lawn & Garden Tools Market, by Battery Voltage

- Electric Cordless Lawn & Garden Tools Market, by Distribution Channel

- Electric Cordless Lawn & Garden Tools Market, by End User

- Electric Cordless Lawn & Garden Tools Market, by Region

- Electric Cordless Lawn & Garden Tools Market, by Group

- Electric Cordless Lawn & Garden Tools Market, by Country

- United States Electric Cordless Lawn & Garden Tools Market

- China Electric Cordless Lawn & Garden Tools Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Converging Insights: Synthesizing Market Evolution, Technological Trends, and Policy Impacts in the Electric Cordless Lawn and Garden Sector

In summary, the electric cordless lawn and garden equipment sector is experiencing a rapid convergence of advanced battery systems, brushless motor technologies, and digital integration, all within a regulatory environment that increasingly favors clean, low-noise solutions. Section 301 tariff adjustments have introduced cost pressures, yet strategic supply chain adaptations and local manufacturing investments can alleviate these challenges and sustain growth.

The comprehensive segmentation by product type, end user, battery chemistry, motor architecture, voltage range, capacity tier, and distribution channel offers a roadmap for stakeholders to tailor offerings to distinct market needs. Regional insights reveal that while the Americas lead in volume, the EMEA and Asia-Pacific regions present high-growth opportunities driven by regulatory mandates and urbanization trends.

Competitive intensity is escalating, with established brands and emerging players leveraging differentiated value propositions to capture market share. The strategic recommendations outlined herein equip industry participants to refine product road maps, optimize supply chains, and enhance customer engagement, ensuring resilience and prosperity in a dynamic marketplace.

Secure Your Competitive Edge with Exclusive Market Intelligence: Connect with Ketan Rohom Today to Access the Comprehensive Research Report

Leverage this unparalleled research to stay ahead in the dynamic electric cordless lawn and garden equipment market by contacting Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive copy of the full report. Discover actionable insights, in-depth analysis, and strategic recommendations tailored to your business objectives. Connect now to empower your organization with critical market intelligence and strategic foresight needed to outpace competitors and capitalize on emerging opportunities.

- How big is the Electric Cordless Lawn & Garden Tools Market?

- What is the Electric Cordless Lawn & Garden Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?