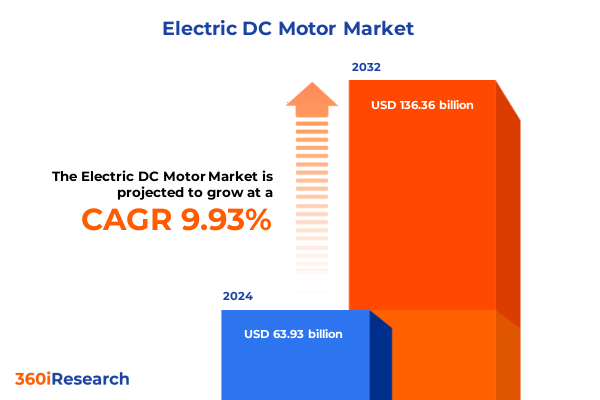

The Electric DC Motor Market size was estimated at USD 70.17 billion in 2025 and expected to reach USD 77.03 billion in 2026, at a CAGR of 9.95% to reach USD 136.36 billion by 2032.

Comprehensive Overview of Electric DC Motor Market Foundations and Trends Guiding Technological Advances and Operational Efficiencies Across Industries

Comprehensive Overview of Electric DC Motor Market Foundations and Trends Guiding Technological Advances and Operational Efficiencies Across Industries

Electric DC motors have emerged as indispensable components in a broad array of sectors, underpinning advancements in electric vehicles, industrial automation, robotics, and consumer electronics. These motors convert electrical energy into mechanical motion with remarkable precision, offering high torque at low speeds and exceptional controllability. As industries pursue greater energy efficiency, reliability, and performance, the relevance of DC motors has grown, positioning them at the forefront of innovation efforts.

Within the automotive landscape, electric DC motors drive propulsion systems in battery electric vehicles, hybrid applications, and start-stop modules, playing a central role in the transition away from internal combustion engines. In manufacturing, precision DC motor drives power robotic arms and CNC machinery, enabling smaller production tolerances and higher throughput. Consumer appliances also benefit from brushless DC motors’ compact form factors and reduced maintenance requirements, aligning with emerging preferences for quieter and more efficient home equipment.

Moreover, the broader push toward sustainability amplifies the importance of energy-efficient motor technologies. Regulatory pressures encourage manufacturers to optimize drive systems and incorporate advanced control algorithms, while end users seek to lower total cost of ownership through minimized downtime and reduced energy consumption. Consequently, electric DC motors represent not only a mature technology but also a dynamic field ripe for continuous improvement and strategic investment.

Exploring Paradigm Shifts in Electric DC Motor Technologies and Industry Dynamics Revolutionizing Performance Efficiency and Market Competition

Exploring Paradigm Shifts in Electric DC Motor Technologies and Industry Dynamics Revolutionizing Performance Efficiency and Market Competition

The electric DC motor landscape is undergoing profound transformation driven by converging technological innovations and shifting market demands. One of the most significant shifts derives from the widespread adoption of digital controls and Internet of Things (IoT) connectivity, enabling real-time performance monitoring and predictive maintenance. By embedding sensors and leveraging cloud analytics, motor manufacturers and end users can optimize operational parameters, detect anomalies before failures occur, and reduce unplanned downtime.

Material science breakthroughs are also reshaping motor design. High-strength, rare earth permanent magnets allow for more compact rotor assemblies and improved torque density, while advanced insulating materials support higher operating temperatures. Simultaneously, additive manufacturing techniques facilitate rapid prototyping of complex motor geometries, accelerating development cycles and unlocking novel winding configurations that were previously unachievable with conventional processes.

In tandem, environmental regulations and corporate sustainability goals are increasing the emphasis on lifecycle impacts. Motor producers are exploring recycled magnetic materials and low-carbon steel alternatives, striving to lower embodied emissions without compromising performance. Consequently, markets are rewarding manufacturers that integrate eco-design principles and circular economy practices, signaling a competitive edge for those prioritizing end-of-life recyclability and resource conservation.

Assessing the Cumulative Impact of New 2025 United States Tariffs on Electric DC Motor Supply Chains Costs and Competitive Strategies

Assessing the Cumulative Impact of New 2025 United States Tariffs on Electric DC Motor Supply Chains Costs and Competitive Strategies

The introduction of 2025 tariff measures by the United States has imposed a multifaceted burden on electric DC motor supply chains, compelling both manufacturers and OEMs to recalibrate cost structures. Leading automotive suppliers such as General Motors have already reported how tariffs contributed to a 35% quarterly profit decline, attributing roughly $1.1 billion of additional expenses to the levies in the first half of the year. In parallel, LG Energy Solution cautioned that elevated duties could dampen EV battery demand into early 2026, underscoring the downstream effects on motor producers reliant on integrated propulsion systems.

These new tariffs primarily target imported rare earth magnets, steel, aluminum, and semiconductor components essential to DC motor manufacturing. Rare earth magnets, accounting for a significant share of rotor cost, now face a 25% duty, compelling many producers to absorb higher input expenses or pass them through to end customers. In response, some North American motor manufacturers are advancing domestic magnet processing facilities under federal incentives, while others are forging strategic partnerships with suppliers in Southeast Asia and Mexico to circumvent elevated tariff rates.

Over the entire 2025 cycle, tariff-related costs for major OEMs are projected to reach as high as $5 billion, according to recent industry commentary. These levies have heightened pressure on R&D budgets, prompting a shift in investment priorities toward non-rare earth motor architectures, such as switched reluctance designs, which mitigate dependence on imported magnetic materials. Moreover, the structural realignment has accelerated friend-shoring initiatives, with companies relocating critical component production to allied nations to preserve supply continuity and safeguard profit margins.

Unveiling Segmentation Insights Into Brushless and Brushed DC Motor Categories Highlighting Sensor and Wound Field Variations Driving Market Differentiation

Unveiling Segmentation Insights Into Brushless and Brushed DC Motor Categories Highlighting Sensor and Wound Field Variations Driving Market Differentiation

Within the brushless DC motor category, the market divides into sensored and sensorless architectures, each delivering distinct performance profiles. Sensored brushless motors embed either encoder sensors or Hall effect sensors to provide precise rotor position feedback, enabling tight speed and torque control suitable for robotics and automotive traction applications. Sensorless brushless designs, by contrast, rely on back-EMF detection for position estimation, reducing component count and cost, and are well suited for lower-power applications like consumer appliances and small automation systems.

Brushed DC motors, while representing a mature technology, continue to exhibit robust demand in cost-sensitive segments. Permanent magnet brushed motors furnish a simple, reliable solution for handheld power tools and automotive auxiliary drives, whereas wound field brushed motors-encompassing compound wound, series wound, and shunt wound variants-offer tunable performance characteristics. Compound wound configurations blend the high starting torque of series windings with the speed stability afforded by shunt windings, while series wound types deliver maximum torque surge. Shunt wound motors maintain consistent speed under varying loads, making them ideal for conveyor systems and industrial drives.

Recognizing these nuanced sub-segments allows manufacturers and system integrators to tailor product specifications precisely, aligning motor selection with application requirements and cost constraints. Consequently, product roadmaps increasingly reflect hybrid designs that combine desirable attributes from both brushless and brushed technologies, underscoring the importance of segmentation-driven strategy.

This comprehensive research report categorizes the Electric DC Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Motor Type

- Voltage Rating

- Application Category

- End Use Industry

Analyzing Regional Dynamics Shaping the Electric DC Motor Market Performance Across Americas Europe Middle East Africa and Asia Pacific

Analyzing Regional Dynamics Shaping the Electric DC Motor Market Performance Across Americas Europe Middle East Africa and Asia Pacific

In the Americas, strong momentum in electric vehicle adoption and robust industrial automation investments have spurred heightened demand for both high-torque brushless motors and compact brushed variants. Federal incentives for clean energy technologies, particularly tax credits under the Inflation Reduction Act, have further stimulated onshore manufacturing of critical motor components. At the same time, North American OEMs are bolstering resilience by diversifying supplier networks beyond traditional Asian hubs.

Europe, Middle East, and Africa (EMEA) markets are characterized by stringent efficiency regulations and ambitious net-zero targets, driving the adoption of advanced motor systems with integrated power electronics. Manufacturers in this region prioritize compliance with the latest Ecodesign Directive and leverage government subsidies for energy-efficient equipment. Meanwhile, emerging economies in the Middle East and Africa increasingly deploy electric motor solutions in water treatment and renewable power projects, catalyzed by infrastructure modernization programs.

Asia Pacific remains the largest production center for electric DC motors, with established manufacturing bases in China, Japan, and South Korea. Competitive labor costs and vertically integrated supply chains contribute to rapid scale-up of motor output. Yet, regional tensions and rising labor costs are prompting prime movers to invest in automation and robot-driven assembly lines, enhancing productivity and offsetting wage inflation. Additionally, proactive government policies in Southeast Asia, including investment incentives for specialized motor hubs, are reshaping the regional production landscape.

This comprehensive research report examines key regions that drive the evolution of the Electric DC Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Electric DC Motor Manufacturers and Innovators Steering Technological Developments Through Strategic Partnerships in a Competitive Landscape

Highlighting Leading Electric DC Motor Manufacturers and Innovators Steering Technological Developments Through Strategic Partnerships in a Competitive Landscape

Key players within the electric DC motor arena are advancing a spectrum of innovations, from high-efficiency magnet materials to modular motor architectures that simplify customization. Japanese firms such as Nidec maintain leadership in micro and precision motors, while companies like ABB and Siemens leverage global footprints to offer integrated drive systems for heavy industrial applications. In North America, Allied Motion and Ametek have intensified focus on sensor-integrated motor designs, catering to specialized medical and aerospace segments.

Strategic partnerships have emerged as a pivotal growth strategy. Portescap’s collaboration with energy storage system integrators highlights how teamwork accelerates product adoption in niche markets. Similarly, Bosch’s joint ventures with semiconductor manufacturers ensure priority access to next-generation inverters and control chips that elevate motor performance. Acquisition activity has also intensified, as evidenced by large conglomerates integrating specialized motor start-ups to broaden product portfolios and infuse digital control capabilities.

Through a blend of organic R&D and M&A, these leading companies are shaping market trajectories by addressing evolving customer needs. Their initiatives in advanced materials research, software-driven servo control, and circular manufacturing practices position them to meet the twin imperatives of performance excellence and sustainability, setting benchmarks for the broader industry to emulate.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric DC Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Baldor Electric Company

- Brook Crompton Holdings Ltd

- Denso Corporation

- Emerson Electric Co.

- Faulhaber Group

- Franklin Electric Co., Inc.

- General Electric Company

- Johnson Electric Holdings Limited

- Mabuchi Motor Co., Ltd.

- MinebeaMitsumi Inc.

- MinebeaMitsumi Inc.

- Mitsubishi Electric Corporation

- Nidec Corporation

- Oriental Motor Co., Ltd.

- Parker-Hannifin Corporation

- Porter-S.A.

- Regal Rexnord Corporation

- Schneider Electric SE

- Siemens AG

- TECO Electric & Machinery Co., Ltd.

- Toshiba Corporation

- WEG S.A.

- WEG S.A.

Actionable Strategic Recommendations for Industry Leaders to Enhance Electric DC Motor Innovation Supply Chain Resilience and Operational Excellence

Actionable Strategic Recommendations for Industry Leaders to Enhance Electric DC Motor Innovation Supply Chain Resilience and Operational Excellence

Industry leaders should prioritize diversification of raw material sourcing to mitigate geopolitical and tariff-related risks. Establishing additional supply agreements with alternative rare earth producers and leveraging local processing incentives can safeguard continuity and stabilize input costs. In parallel, investing in R&D for magnet-free motor architectures, such as switched reluctance and inductance-based designs, offers a strategic hedge against material scarcity and tariff escalation.

Operational efficiency can be propelled by integrating IoT-enabled maintenance platforms across motor fleets. By deploying cloud-connected sensors, manufacturers and end users can shift from time-based maintenance cycles to condition-based interventions, reducing unplanned downtime and extending equipment life. At the same time, embracing digital twins for motor design and testing accelerates development timelines, enabling virtual stress testing and thermal analysis without the need for extensive physical prototyping.

To capture emerging opportunities, it is essential to pursue collaborative partnerships across the value chain. Joint R&D ventures with semiconductor and battery technology providers can unlock synergies in powertrain integration, while alliances with recyclers and material recovery specialists underpin circular economy objectives. Finally, instituting robust scenario planning exercises ensures that corporate strategy remains adaptive to regulatory shifts and evolving customer preferences, positioning organizations for long-term resilience and growth.

Research Methodology Emphasizing Data Collection Validation Analytical Techniques and Expert Insights Underpinning Electric DC Motor Market Analysis

Research Methodology Emphasizing Data Collection Validation Analytical Techniques and Expert Insights Underpinning Electric DC Motor Market Analysis

This report is grounded in a rigorous research framework combining qualitative and quantitative techniques. Primary research included in-depth interviews with senior executives at motor manufacturers, system integrators, and component suppliers. These discussions provided firsthand perspectives on technology roadmaps, market challenges, and strategic priorities. Simultaneously, secondary research encompassed a comprehensive review of industry publications, patent filings, regulatory documents, and company disclosures, ensuring a holistic understanding of market dynamics.

Data validation was achieved through triangulation, where insights from primary interviews were cross-verified against publicly available financial reports and trade data. Quantitative analysis leveraged statistical modeling to identify trends in production volumes, end-use adoption rates, and regional capacity shifts. Sensitivity testing under varying tariff and material price scenarios enhanced the robustness of conclusions. Additionally, expert advisory panels reviewed key findings to refine interpretations and validate assumptions, ensuring that the analysis reflects current realities and anticipates emerging inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric DC Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric DC Motor Market, by Motor Type

- Electric DC Motor Market, by Voltage Rating

- Electric DC Motor Market, by Application Category

- Electric DC Motor Market, by End Use Industry

- Electric DC Motor Market, by Region

- Electric DC Motor Market, by Group

- Electric DC Motor Market, by Country

- United States Electric DC Motor Market

- China Electric DC Motor Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Insights Synthesizing Key Findings Implications and Strategic Direction for Stakeholders in the Evolving Electric DC Motor Ecosystem

Concluding Insights Synthesizing Key Findings Implications and Strategic Direction for Stakeholders in the Evolving Electric DC Motor Ecosystem

The electric DC motor sector is poised for accelerated evolution as technological innovations intersect with shifting regulatory landscapes and global trade complexities. Sensor integration and digitalization are unlocking new performance benchmarks, while sustainability imperatives drive material innovation and circular practices. Concurrently, the imposition of 2025 U.S. tariffs has underscored the need for supply chain agility and strategic diversification, prompting a wave of reshoring and friend-shoring initiatives.

Segmentation analysis reveals tailored pathways for brushless and brushed motor categories, highlighting how nuanced product variants address distinct application requirements. Regional dynamics further underscore the importance of local market strategies, with Americas, EMEA, and Asia Pacific each presenting unique opportunities and challenges. Leading companies are responding through collaborative ventures, targeted M&A, and accelerated R&D pipelines, setting the stage for competitive differentiation.

For stakeholders across the value chain, these insights point to a clear set of imperatives: embrace supply chain resilience, invest in next-generation motor architectures, and deploy data-driven maintenance strategies. By synthesizing these strategic directions, industry participants can navigate uncertainty, capitalize on emerging trends, and achieve sustained growth in the years ahead.

Engage with Ketan Rohom to Secure Your Comprehensive Electric DC Motor Market Research Report and Empower Strategic Decision Making

To explore these comprehensive insights and secure a tailored market research report that illuminates the complex dynamics of the electric DC motor industry, reach out directly to Ketan Rohom. As the Associate Director of Sales & Marketing, Ketan brings deep expertise in guiding industry leaders to actionable intelligence. Engaging with Ketan ensures you receive a bespoke analysis that addresses your strategic priorities, from supply chain optimization to technology adoption pathways. Don’t miss the opportunity to leverage this critical resource for informed decision-making and sustained competitive advantage. Contact Ketan Rohom today to purchase the definitive electric DC motor market research report.

- How big is the Electric DC Motor Market?

- What is the Electric DC Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?