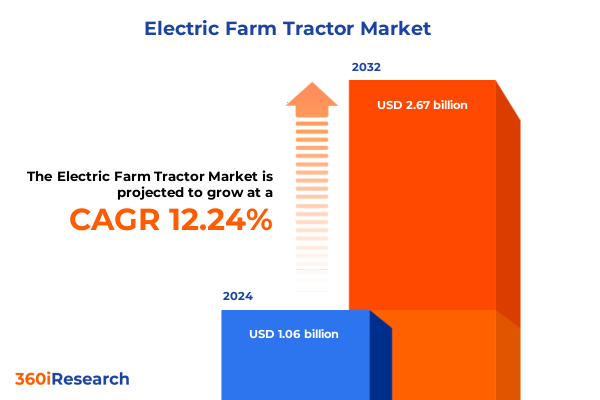

The Electric Farm Tractor Market size was estimated at USD 1.06 billion in 2024 and expected to reach USD 1.18 billion in 2025, at a CAGR of 12.24% to reach USD 2.67 billion by 2032.

Explore the Rising Influence of Electric Farm Tractors as They Enhance Sustainable Agriculture, Improve Performance, and Drive Operational Efficiency

The rapid transition to electric farm tractors represents one of the most significant shifts in agricultural mechanization in recent history. As the industry strives to reduce carbon emissions, comply with tightening environmental regulations, and enhance operational efficiencies, electric tractors have emerged as a credible alternative to combustion-powered machinery. Early adopters report benefits spanning lower maintenance requirements, reduced noise pollution, and improved energy management. In parallel, the maturation of battery technologies and the expansion of charging infrastructure have addressed historical concerns around range and refueling downtime.

Moreover, industry stakeholders recognize that electrification aligns with broader sustainability mandates pursued by both governmental bodies and leading agribusinesses. Investments in renewable energy integration, smart grid compatibility, and automated control systems further solidify the electric tractor’s role in precision farming. By understanding the drivers behind this electrification wave-ranging from total cost of ownership considerations to corporate social responsibility goals-agricultural leaders can better position themselves to leverage the transformative potential of electric farm tractors.

Uncover the Key Technological Advancements and Regulatory Developments That Are Accelerating the Transformation of Agricultural Machinery Toward Full Electrification

Innovation in propulsion systems and evolving regulatory landscapes are fundamentally altering the design and deployment of farm tractors. Advances in battery chemistry, notably the shift from lead acid to lithium ion, have unlocked higher energy densities, faster charging cycles, and extended service lives. These technological strides enable battery electric variants to tackle tasks once deemed impractical without traditional fuel. Simultaneously, hybrid configurations-whether parallel setups that deliver instant electric torque assistance or series architectures that optimize generator output-offer transitional solutions that blend established diesel efficiency with emerging electric benefits.

Concurrently, governmental frameworks in key territories are incentivizing zero-emission equipment through tax credits, rebates, and direct grants. As a result, equipment manufacturers are accelerating their electrification roadmaps, seeking to capitalize on both regulatory compliance advantages and growing consumer demand for greener operations. In addition, integration of telematics and automated control capabilities is crafting a more connected and efficient ecosystem, wherein tractors not only reduce environmental impact but also deliver actionable performance data, further reinforcing the shift away from legacy powertrains.

Assessing How the Recent United States Tariffs Have Reshaped Import Dynamics and Cost Structures Within the Electric Farm Tractor Sector

In early 2025, the United States introduced a new tariff structure targeting imported agricultural equipment components. These measures have prompted recalibrations across global supply chains, particularly affecting battery cells, electric drive units, and specialized power electronics sourced from international suppliers. Manufacturers reliant on overseas production hubs have encountered elevated landed costs, which in turn have influenced pricing strategies, sourcing decisions, and end-user investment timelines.

Nevertheless, this tariff landscape has also fostered a resurgence of localized production initiatives. In response, key players have accelerated domestic partnerships and onshore assembly programs, leading to enhanced supply chain resilience and reduced lead times. Consequently, the industry is witnessing a subtle redistribution of manufacturing footprints, with certain high-voltage electrical components now being developed closer to end markets. By navigating these tariff-induced dynamics, stakeholders are optimizing their cost structures and ensuring continuity in agricultural operations that depend on reliable electric tractor deployment.

Extracting Critical Insights From Propulsion, End User, Power Output, Farm Size, and Application Segmentation to Inform Electric Tractor Strategies

Segmenting the electric farm tractor landscape by propulsion reveals distinct performance and cost profiles. Battery electric variants leveraging lead acid chemistries typically serve lower-duty applications, while lithium ion systems deliver the extended runtime and rapid recharge capabilities demanded by high-intensity operations. The parallel hybrid segment, in contrast, provides immediate power assistance, enabling efficient tasks under variable load conditions, whereas series hybrid configurations excel in steady-state operations by optimizing generator-motor coupling.

From an end-user standpoint, crop farmers prioritize tractors that balance operational range with precision control for planting and tillage, whereas dairy producers emphasize quiet operation and reliability during tasks such as feeding and manure handling. Livestock farmers, by comparison, value versatility and robustness across variable terrains. When considering power output, sub-50 horsepower units-particularly those in the 20 to 50 horsepower range-were designed for small-scale farms and niche applications, while above-100 horsepower machines cater to large-scale operations, segmented further into 100–150 horsepower and over 150 horsepower categories with tailored drive configurations.

Diving deeper, farm size stratification shows that large-scale operations are rapidly adopting high-power electric models to streamline multi-unit fleets; medium-scale enterprises favor modular hybrid systems to manage capital outlays; and small-scale farms increasingly incorporate compact electric units to minimize overhead. Finally, application segmentation underscores that harvesting demands peak torque delivery and robust battery cycles, planting requires precise speed control and low-noise operation, and tillage benefits from consistent power output and efficient energy replenishment strategies.

This comprehensive research report categorizes the Electric Farm Tractor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion

- Drive Configuration

- Operating Runtime

- Autonomy Level

- Power Output

- Crop Type

- Application

- End User

- Sales Channel

Examining Regional Variations in Adoption, Infrastructure, and Policy Support Across Americas, EMEA, and Asia-Pacific Electric Tractor Landscapes

Regional adoption of electric farm tractors varies according to infrastructure readiness, policy frameworks, and agronomic practices. In the Americas, widespread charging networks supported by agricultural energy cooperatives have stimulated adoption among large-scale operations, particularly in the Midwest and California. These areas benefit from robust renewable generation and, consequently, low-cost electricity for fleet charging. In contrast, certain regions in Latin America are exploring pilot programs that bundle electric tractor leasing with solar microgrid installations to address off-grid challenges.

Across Europe, the Middle East, and Africa, stringent emissions regulations in the European Union have accelerated equipment electrification, prompting manufacturers to align new product launches with zero-emission targets for 2030. Meanwhile, parts of the Middle East are leveraging sovereign wealth to fund agritech initiatives in arid zones, pairing electric tractors with desalination-powered charging stations. Africa presents a unique mix of opportunity and constraint: while infrastructure gaps exist, mobile charging units and decentralized battery-swap models are being tested to extend reach into smallholder farming communities.

The Asia-Pacific region exhibits rapid electrification in countries such as China, Japan, and Australia, where government incentives and local manufacturing capabilities converge. In Southeast Asia, collaborative ventures between OEMs and utility providers are establishing shared charge depots, thereby reducing upfront investment barriers. Each geography’s distinct energy landscape, policy environment, and farm structure informs localized adoption strategies, creating a mosaic of electrification pathways around the globe.

This comprehensive research report examines key regions that drive the evolution of the Electric Farm Tractor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape Through the Strategies, Partnerships, and Innovations of Leading Electric Tractor Manufacturers

Leading manufacturers are forging partnerships, securing investments, and advancing proprietary technologies to establish competitive differentiation. One global OEM has integrated advanced lithium ion modules with cloud-based telematics to deliver real-time diagnostics and predictive maintenance, significantly reducing unplanned downtime. Another key player introduced a modular hybrid powertrain that seamlessly transitions between electric and diesel modes, enabling a phased approach to fleet electrification for cost-sensitive operators.

Strategic collaborations are also on the rise, with technology firms and equipment producers jointly developing battery management systems tailored to agricultural load profiles. Some companies are pursuing vertical integration by acquiring cell manufacturing assets, thereby controlling critical supply-chain components and mitigating tariff impacts. Investors are channeling capital into startups focused on rapid-swap battery solutions, acknowledging that reduced charging times can make electric tractors competitive with diesel counterparts in high-utilization scenarios.

Moreover, regional OEMs in emerging markets are customizing entry-level electric models to meet the unique terrain and farm scale requirements of local producers. By leveraging joint ventures and licensing agreements, these firms are scaling production and driving down costs. Through these multifaceted strategies-ranging from R&D alliances to supply-chain restructuring-industry leaders are charting the course for the next generation of agricultural machinery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Farm Tractor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- Agri-eve by EVE S.r.l.

- Alkè s.r.l.

- Amos Power, Inc.

- Argo Tractors S.p.A.

- Autonxt Automation Pvt. Ltd.

- CNH Industrial N.V.

- Deere & Company

- EOX Tractors B.V.

- HAV HYBRID AGRI VEHICLE by PROXECTO ENGINEERING SERVICES

- Kubota Corporation

- LS MTRON LTD.

- MAX GREEN TRACTORS & AGRO EQUIPMENT PVT. LTD.

- Montra Electric

- Motivo Engineering

- Sabi Agri

- Shree Marut E‑Agrotech Private Limited

- Solectrac Inc. by Ideanomics

- Sonalika Group

- Sukoon Solution

- TADUS GmbH

- Tilmor LLC

- Tractors and Farm Equipment Limited

- VARDEN

- Yanmar Holdings Co. Ltd.

- Zimeno Inc.

- Ztractor Inc.

Strategic Initiatives and Best Practices for Industry Leaders to Capitalize on the Electric Tractor Revolution and Strengthen Their Competitive Edge

Industry leaders must prioritize three strategic initiatives to capitalize on the accelerating shift toward electric farm machinery. First, investing in flexible powertrain platforms that can accommodate both battery electric and hybrid configurations will enable rapid response to evolving customer demands and regulatory changes. By adopting modular architectures, manufacturers can streamline production, reduce development cycles, and offer tailored solutions for diverse farm profiles.

Second, forging alliances with energy providers and agritech firms will be critical to establishing robust charging infrastructure and integrated smart-farm ecosystems. Partnerships that bundle equipment financing with on-farm renewable energy installations can lower adoption barriers for end users. Collaborative pilots that demonstrate total cost savings, operational reliability, and carbon footprint reductions will further build confidence and drive scale.

Finally, leaders should enhance after-sales service capabilities by deploying remote monitoring and predictive analytics platforms. Proactive maintenance programs can extend equipment lifecycles, optimize energy utilization, and ensure uptime during peak seasonal demands. Investing in technical training for dealership networks will also support seamless customer experiences and foster long-term brand loyalty. Through these interconnected measures, stakeholders can secure competitive advantage and effectively guide the industry’s electrification trajectory.

Detailed Overview of the Research Framework, Data Collection Techniques, and Analytical Methods Underpinning the Electric Farm Tractor Study

This study employs a hybrid research framework that integrates primary and secondary data sources to deliver comprehensive insights into the electric farm tractor landscape. Primary data collection involved in-depth interviews with OEM executives, component suppliers, and end-user focus groups across key agricultural regions. These discussions provided qualitative context on technology adoption drivers, operational pain points, and procurement strategies.

Secondary research encompassed the evaluation of industry reports, regulatory filings, patent databases, and technical journals. Comparative analysis of public financial disclosures and corporate presentations helped identify strategic investments, partnership models, and innovation roadmaps. Quantitative modeling was conducted to assess cost components, energy consumption patterns, and fleet utilization scenarios under varying operational conditions.

Analytical approaches included segmentation mapping based on propulsion type, end-user application, power output class, farm size, and operational use case. Geospatial analysis techniques were applied to correlate electrification trends with regional infrastructure metrics. Triangulation methodologies ensured data integrity by cross-verifying findings from multiple sources. This robust research design underpins the validity of the insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Farm Tractor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Farm Tractor Market, by Propulsion

- Electric Farm Tractor Market, by Drive Configuration

- Electric Farm Tractor Market, by Operating Runtime

- Electric Farm Tractor Market, by Autonomy Level

- Electric Farm Tractor Market, by Power Output

- Electric Farm Tractor Market, by Crop Type

- Electric Farm Tractor Market, by Application

- Electric Farm Tractor Market, by End User

- Electric Farm Tractor Market, by Sales Channel

- Electric Farm Tractor Market, by Region

- Electric Farm Tractor Market, by Group

- Electric Farm Tractor Market, by Country

- United States Electric Farm Tractor Market

- China Electric Farm Tractor Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2544 ]

Summarizing the Crucial Takeaways on Electrification Trends, Market Drivers, and Strategic Imperatives Within the Electric Tractor Landscape

The rise of electric farm tractors marks a pivotal juncture in agricultural mechanization, driven by technological innovation, regulatory pressure, and shifting sustainability priorities. Propulsion advancements-from lead acid to lithium ion and from hybrid to full battery electric systems-are redefining performance benchmarks and operational economics. Tariff-driven supply-chain realignments are catalyzing onshore manufacturing and local partnerships, enhancing resilience and fostering new industry ecosystems.

Regional landscapes illustrate that there is no one-size-fits-all path to electrification; local infrastructure capabilities, policy incentives, and farm characteristics shape adoption trajectories. Meanwhile, leading manufacturers are deploying a blend of strategic alliances, vertical integration, and targeted R&D to carve out competitive positions. To thrive in this evolving environment, stakeholders must embrace modular powertrain designs, cultivate energy infrastructure partnerships, and leverage predictive analytics for superior after-sales support.

In sum, electric farm tractors offer more than emission reductions; they unlock new dimensions of connectivity, data-driven decision-making, and operational agility. As the sector continues to mature, the companies and producers that proactively align with these trends will establish a foundation for sustainable growth and industry leadership.

Contact the Associate Director of Sales & Marketing to Secure Your Comprehensive Electric Farm Tractor Research Report and Drive Strategic Decisions

To explore the full breadth of insights and unlock detailed analyses on propulsion preferences, end-user behaviors, power output dynamics, regional variances, and competitive strategies shaping the electric farm tractor industry, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing. His deep understanding of agricultural electrification trends, combined with access to the comprehensive research report, will empower you to make data-driven decisions that drive operational efficiency and sustainable growth. Connect directly to arrange a tailored demonstration of the report’s findings, discuss licensing options, and secure exclusive executive summaries and supplemental data sets. Reach out today to transform your strategic planning and accelerate your entry into the next generation of agricultural machinery.

- How big is the Electric Farm Tractor Market?

- What is the Electric Farm Tractor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?