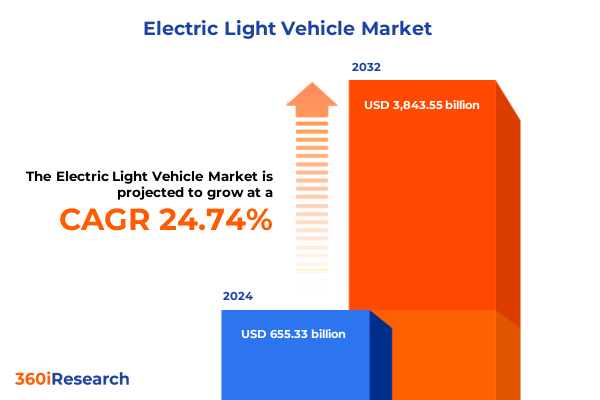

The Electric Light Vehicle Market size was estimated at USD 821.05 billion in 2025 and expected to reach USD 1,007.98 billion in 2026, at a CAGR of 24.67% to reach USD 3,843.55 billion by 2032.

A Comprehensive Overview of the Electric Light Vehicle Sector Highlighting Key Drivers and Emerging Opportunities in Urban Mobility

The electric light vehicle sector is rapidly redefining the contours of urban and last-mile mobility, driven by technological breakthroughs and evolving consumer expectations. As city centers prioritize low-emission solutions, these compact vehicles have emerged as pivotal agents of change, offering scalable alternatives to traditional transportation modes. The introduction of advanced battery chemistries has enhanced range and reliability, while modular designs have expanded use cases from individual commuters to small-scale logistics providers. Swift policy shifts across key markets have further propelled adoption, incentivizing zero-emission fleets and facilitating pilot programs that demonstrate tangible benefits in cost efficiency and environmental impact.

Against this backdrop, stakeholders are navigating a landscape characterized by both opportunity and complexity. Innovation is not limited to propulsion; it extends to digital connectivity, enabling real-time fleet management and predictive maintenance. Meanwhile, consumer expectations are shaped by seamless user experiences that blend convenience, affordability, and sustainability. This executive summary unpacks the critical drivers, regulatory influences, and competitive dynamics that define the sector today. By examining current trends and strategic imperatives, the overview sets the stage for deeper analysis into how transformative shifts, trade policies, segmentation insights, regional variations, and corporate strategies coalesce to influence the trajectory of electric light vehicles.

Exploring Revolutionary Technological, Regulatory, and Market Dynamics Redefining Electric Light Vehicle Adoption

Over the past few years, the convergence of digital innovation and environmental stewardship has triggered transformative shifts within the electric light vehicle arena. Breakthroughs in battery energy density and rapid-charging technologies have addressed the historical constraints of range anxiety, while developments in lightweight materials have optimized vehicle efficiency. Regulatory landscapes have matured concurrently, with urban centers in Europe and leading North American cities implementing low-emission zones that effectively elevate the value proposition of electric light vehicles.

In tandem, consumer preferences are evolving beyond mere price considerations; they now prioritize integrated mobility solutions enabled by IoT connectivity, shared-platform access, and customizable services. These shifts are further magnified by collaborations across automotive, technology, and energy sectors, fostering ecosystems that blend infrastructure deployment, digital platforms, and asset-light ownership models. As a result, the traditional paradigm of one-size-fits-all vehicle offerings is giving way to modular portfolios tailored to diverse use cases-from rapid delivery services in dense urban cores to personal urban commuters seeking cost-effective alternatives to conventional cars. Ultimately, the alignment of policy, technology, and consumer behavior is charting a new course for sustainable mobility on a global scale.

Analyzing the Far-Reaching Effects of 2025 United States Tariffs on Electric Light Vehicle Supply Chains and Pricing

In 2025, the United States enacted a series of tariffs targeting imported components and finished electric light vehicles, aiming to bolster domestic manufacturing and preserve strategic supply chains. The increased duties on battery cells and electric drivetrains have elevated production costs for companies reliant on international suppliers, prompting a reassessment of sourcing strategies. While domestic capacity expansion efforts are underway, these investments require lead times for scaling production facilities and securing raw material supplies.

Moreover, the tariff regime has had ripple effects throughout the ecosystem, affecting aftermarket parts, maintenance services, and even the pricing structures offered to end users. Firms dependent on cost-competitive imports have experienced margin compression, leading some to accelerate joint ventures with local manufacturers to mitigate the financial impact. Conversely, domestic producers have gained relative pricing advantages, strengthening their position in regional tender processes for municipal and commercial fleets. Despite short-term adjustments in procurement and distribution, the tariff policy is driving a gradual supply chain localization trend that may yield long-term resilience, provided that capacity and innovation investments keep pace with rising demand.

Unveiling Deep-Dive Insights into Electric Light Vehicle Market Segmentation across Vehicle Type, Propulsion, Battery Capacity, End User and Channel

Market dynamics in the electric light vehicle realm are greatly influenced by a multifaceted segmentation framework that sheds light on diverse end-user needs and technological adoption patterns. Based on vehicle type, the analysis encompasses bikes, quadricycles, scooters, and tricycles, each addressing distinct operational contexts ranging from recreational urban micro-mobility to structured last-mile logistics. Propulsion typology further refines insights: battery electric vehicles, differentiated into lead acid and lithium ion chemistries, contrast with hybrid electric vehicles, which include parallel, series, and series-parallel configurations to balance efficiency and performance.

Battery capacity also serves as a critical lens, with vehicles segmented into categories under 5 kWh, between 5 kWh and 10 kWh, and above 10 kWh, reflecting divergent use cases from short-range commutes to extended commercial routes. The end-user classification distinguishes between personal owners seeking affordability and ease of use and commercial operators prioritizing uptime and total cost of ownership. Lastly, distribution channels-offline retail networks versus online direct-sales platforms-highlight evolving purchasing behaviors as digital channels gain traction, complementing traditional dealer ecosystems. Together, this segmentation matrix guides strategic decisions on product portfolios, pricing, and go-to-market approaches by aligning offerings with nuanced market demands.

This comprehensive research report categorizes the Electric Light Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Propulsion Type

- Battery Capacity

- End User

- Distribution Channel

Dissecting Regional Variations in Electric Light Vehicle Demand Reveal Divergent Growth Patterns across Americas, EMEA and Asia-Pacific

Regional trajectories of electric light vehicle adoption exhibit pronounced variation driven by policy frameworks, infrastructure development, and consumer readiness. In the Americas, federal initiatives and state-level incentives have catalyzed fleet deployments for delivery services, while metropolitan areas are enhancing charging networks to accommodate growing usage. Private capital is financing pilot programs in smaller cities, demonstrating the viability of zero-emission fleets beyond major urban centers. Shifting consumer attitudes toward sustainability also underpin an increasing appetite for personal electric light vehicles as economical urban mobility solutions.

In the Europe, Middle East & Africa region, regulatory harmonization within the European Union has spurred robust demand for lightweight EVs, particularly in densely populated corridors. Simultaneously, emerging markets in the Gulf Cooperation Council are investing in smart city frameworks that prioritize last-mile electrification, leveraging public–private partnerships to expand charging infrastructure. Sub-Saharan Africa, while still nascent in commercial-scale adoption, is witnessing grassroots initiatives exploring off-grid solar-charged tricycles for rural mobility.

The Asia-Pacific landscape represents the most heterogeneous mix, where mature markets like Japan and South Korea emphasize high-spec lithium-ion battery scooters and bikes, whereas Southeast Asian nations lead in electric tricycle utilization for cargo and passenger transport. China’s expansive manufacturing footprint and aggressive local incentives have accelerated scale-up, influencing cost structures and global supply chains. Together, these regional dynamics underscore the need for localized market entry strategies, tailored product architectures, and adaptive go-to-market models that resonate with regional priorities and operational realities.

This comprehensive research report examines key regions that drive the evolution of the Electric Light Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation Success Strategies and Competitive Positioning in the Electric Light Vehicle Landscape

Several prominent companies are shaping the competitive dynamics of the electric light vehicle market through targeted innovation and strategic partnerships. Leading automakers and specialized EV startups alike are investing heavily in next-generation battery technologies to improve energy density and reduce charging times. Tier-one component suppliers are collaborating with mobility service providers to integrate telematics and predictive maintenance platforms, thereby embedding value-added services into their offerings.

Meanwhile, established players in two- and three-wheel segments are expanding manufacturing footprints and forging alliances to secure raw material access, particularly for critical minerals such as lithium and cobalt. Some firms are pioneering modular chassis designs that allow rapid configuration for diverse payload requirements, appealing to both commercial fleet operators and personal mobility users. In the digital realm, technology giants are leveraging data analytics and cloud platforms to optimize fleet utilization, enabling dynamic routing and real-time performance monitoring. Across these corporate strategies, differentiation hinges on the ability to align product development with evolving regulatory mandates and consumer preferences, positioning market leaders to capture growth as electrification accelerates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Light Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altigreen Propulsion Labs Private Limited

- Ather Energy Private Limited

- Bajaj Auto Limited

- BYD Company Limited

- Hero Electric Vehicles Private Limited

- Hyundai Motor India Limited

- Kinetic Green Energy and Power Solutions Limited

- Lucid Group, Inc.

- Mahindra Electric Mobility Limited

- MG Motor India Private Limited

- NIO Inc.

- Okinawa Autotech Private Limited

- Ola Electric Mobility Private Limited

- Piaggio Vehicles Private Limited

- Polestar Automotive Holding UK PLC

- Revolt Intellicorp Private Limited

- Rivian Automotive, Inc.

- Tata Motors Limited

- Tesla, Inc.

- TVS Motor Company Limited

Strategic Action Plans for Industry Leaders to Capitalize on Electric Light Vehicle Growth with Resilient Supply Chain and Innovation Focus

Industry leaders aiming to capitalize on electric light vehicle momentum should adopt a multi-pronged strategy that prioritizes systemic resilience and customer-centric innovation. First, diversifying supply chains through regional partnerships can mitigate exposure to tariff disruptions and raw material shortages, while fostering collaborative R&D to accelerate next-generation battery breakthroughs. Simultaneously, investment in scalable manufacturing platforms-capable of agile volume adjustments-will be crucial to respond to fluctuating demand across segments and geographies.

Furthermore, embedding digital services into vehicle offerings, from usage-based insurance to predictive maintenance, can unlock recurring revenue streams and deepen customer engagement. Strategic alliances with energy providers and infrastructure developers will also be essential, ensuring ubiquitous charging access where and when end users need it. On the regulatory front, active participation in policy forums and industry associations can position companies to shape incentive structures and standards that support sustainable growth. By balancing operational agility with strategic foresight, industry leaders can translate emerging trends into competitive advantages and long-term market success.

Detailing a Rigorous Multi-Source Research Methodology Ensuring Robust Insights and Credible Analysis for Electric Light Vehicle Trends

The research underpinning this executive summary integrates rigorous primary and secondary methodologies to ensure comprehensive and credible insights. Primary research involved structured interviews with key stakeholders across the value chain, including vehicle manufacturers, component suppliers, policymakers, and fleet operators. These dialogues provided real-world perspectives on technology adoption, cost pressures, and regulatory impacts. Secondary research drew from reputable industry publications, policy documents, academic studies, and corporate filings to contextualize trends and verify data points.

Quantitative data were triangulated using multiple sources to enhance accuracy, while qualitative insights were analyzed through thematic coding to identify recurring patterns and strategic imperatives. Segmentation matrices and regional analyses were validated by cross-referencing market intelligence reports and expert consultations. Finally, the research team employed a multi-layered review process to ensure analytical rigor, including peer reviews and consistency checks. This methodological framework delivers robust findings that cater to the strategic needs of decision-makers, providing a solid foundation for informed actions in the electric light vehicle domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Light Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Light Vehicle Market, by Vehicle Type

- Electric Light Vehicle Market, by Propulsion Type

- Electric Light Vehicle Market, by Battery Capacity

- Electric Light Vehicle Market, by End User

- Electric Light Vehicle Market, by Distribution Channel

- Electric Light Vehicle Market, by Region

- Electric Light Vehicle Market, by Group

- Electric Light Vehicle Market, by Country

- United States Electric Light Vehicle Market

- China Electric Light Vehicle Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Key Takeaways Emphasizing the Strategic Implications and Future Outlook of the Electric Light Vehicle Industry

The electric light vehicle industry stands at the nexus of innovation, regulation, and shifting consumer priorities, presenting both challenges and opportunities for stakeholders. Technological advancements in battery chemistry and digital integration are unlocking new use cases, while regulatory incentives and urban policies are catalyzing adoption across diverse markets. At the same time, supply chain disruptions and tariff environments underscore the need for strategic agility and localized manufacturing approaches.

Segmentation and regional insights reveal that success hinges on nuanced market understanding, as vehicle types, propulsion systems, and end-user requirements vary significantly by geography. Corporate competitiveness will be determined by the ability to innovate continuously, forge strategic partnerships, and align offerings with evolving policy landscapes. By synthesizing the critical themes outlined in this summary, decision-makers gain a clear perspective on how to navigate the path ahead. Embracing resilience in supply chains, agility in product development, and customer-centric service models will be key to securing leadership in this dynamic sector.

Secure Your Edge in the Electric Light Vehicle Market Contact Ketan Rohom for Exclusive Research Insights and Purchasing Opportunities

If you are ready to explore the insights that will shape your strategies for the coming decade, connect with Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to receive tailored guidance and discover how this comprehensive executive summary can empower your decision-making. Reach out today to secure your copy of the full market research report and stay ahead in the dynamic electric light vehicle industry.

- How big is the Electric Light Vehicle Market?

- What is the Electric Light Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?