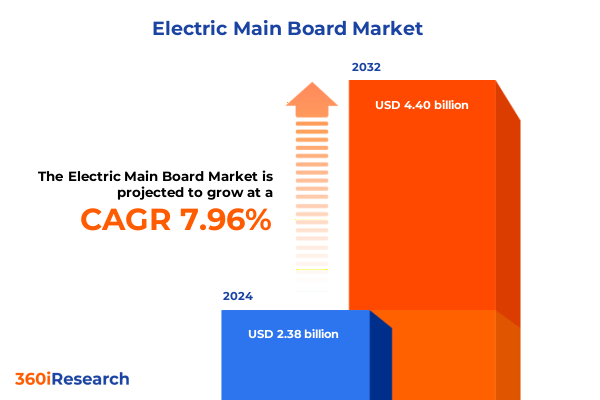

The Electric Main Board Market size was estimated at USD 2.55 billion in 2025 and expected to reach USD 2.76 billion in 2026, at a CAGR of 8.10% to reach USD 4.40 billion by 2032.

Setting the Stage for a Resilient and Innovative Electric Main Board Ecosystem Amidst Rapid Infrastructure Modernization and Digital Transformation

Electric main boards have become the keystone of modern power distribution networks, ensuring safe and reliable delivery of electricity across residential, commercial, and industrial sectors. As digital ecosystems expand, the importance of resilient distribution solutions has never been greater; for instance, leading industrial groups such as Schneider Electric, Siemens AG, ABB, and Legrand have collectively seen their portfolios surge by more than €150 billion, driven in part by escalating demand for data center infrastructure and AI applications.

Concurrently, stakeholders in the United States electroindustry have committed over $12 billion since 2021 to bolster domestic production of clean energy–focused electrical equipment, reflecting a broader shift toward reshoring and supply chain resilience in the face of geopolitical and market uncertainties.

Against this backdrop of technological acceleration, sustainability mandates, and policy imperatives, electric main boards stand at the intersection of infrastructure modernization and digital transformation. This section lays the groundwork for a detailed exploration of the market’s transformative shifts, regulatory impacts, segmentation drivers, regional dynamics, competitive landscape, and actionable recommendations.

Navigating the Transformative Shift in the Electric Main Board Landscape Driven by Smart Grids Integration and Renewable Energy Demands

The electric main board landscape is undergoing a profound metamorphosis as utilities and industrial operators embrace smart grid architectures and distributed energy resources. Recent industry dialogues at Distributech 2025 spotlighted a decisive pivot toward AI, advanced analytics, and industrial internet of things (IIoT) connectivity to proactively manage grid reliability and respond to the complexities introduced by renewable integration and bidirectional power flows.

Similarly, utilities in the United States are adopting AI-driven predictive maintenance tools and machine learning algorithms to anticipate equipment failures, optimize response times, and fortify grid resilience against climate-driven risks. Companies such as Duke Energy and Rhizome leverage real-time sensor networks and generative AI assistants to monitor transformer health and mitigate outage scenarios, underscoring a shift from reactive operations to predictive asset management.

Moreover, technological advancements in dynamic line ratings, edge computing devices, and 5G-enabled monitoring systems are enabling higher throughput on existing transmission assets and enhancing situational awareness at the distribution level. These innovations collectively signal a new era where main boards evolve into intelligent nodes, capable of orchestration and real-time adaptation to evolving demand patterns.

Assessing the Cumulative Effects of United States Section 301 Tariff Increases on Imported Electric Main Board Components Entering into Force in 2025

In 2025, the United States finalized significant modifications to Section 301 tariffs on certain imports from China, with many additional duties taking effect on January 1. While the revised schedules target strategic equipment categories such as semiconductors, battery components, and renewable energy hardware, imported electric main board assemblies classified under HTS 8537 often incur an extra 25 percent levy on top of existing general duties, heightening cost pressures for end users reliant on Chinese-origin components.

Simultaneously, the USTR extended exclusions for critical electroindustry machinery through mid-2025 to facilitate transitional sourcing strategies; nevertheless, the reinstatement of duties on numerous product lines underscores the imperative for manufacturers to diversify supply chains and evaluate nearshoring opportunities.

These cumulative tariff measures-part of a broader policy framework aimed at securing domestic manufacturing and safeguarding intellectual property-have compelled main board producers and integrators to reassess their global procurement models, invest in alternative supplier networks, and explore localized assembly to mitigate the impact of elevated import duties.

Unveiling Key Segmentation Insights to Decode Demand Patterns Across Application Environments Phase Configurations Certification Standards Product Types Mounting Methods and End User Verticals

The electric main board market’s complexity is illuminated when segmented by functional application, phase configuration, product characteristics, and end-user demands. Indoor deployments in commercial, industrial, and residential facilities necessitate tailored designs that account for varying load profiles and safety standards, whereas outdoor solutions for infrastructure and remote sites demand ruggedization and advanced environmental protections.

Phase type segmentation further differentiates offerings between single-phase solutions optimized for smaller installations and three-phase architectures that support high-capacity industrial and utility applications. Certification standards-whether ANSI-compliant for North American markets or IEC-certified for international interoperability-underscore the importance of regulatory alignment in product development and market entry.

Product classifications across high-voltage, medium-voltage, and low-voltage categories reveal divergent technology roadmaps, with high-voltage boards focusing on robust insulation and switchgear integration, and low-voltage systems emphasizing compactness and digital monitoring capabilities. Mounting preferences also vary, transitioning from wall-mounted or floor-mounted units in space-constrained settings to free-standing assemblies in large-scale installations.

End-user verticals, encompassing commercial segments such as hospitality, offices, and retail, through industrial domains like manufacturing, mining, and oil & gas, to residential and utility sectors, shape demand dynamics and influence feature requirements-ranging from aesthetic integration to seamless utility grid interfacing.

This comprehensive research report categorizes the Electric Main Board market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Phase Type

- Certification Standard

- Product Type

- Mounting Type

- Application

- End User

Examining the Unique Regional Dynamics Shaping Electric Main Board Demand and Deployment Across the Americas EMEA and Asia-Pacific Markets

Across the Americas, the electric main board market benefits from substantial infrastructure renewal programs and energy transition initiatives in both established and emerging economies. North American operators emphasize grid reliability and digital modernization, while Latin American markets pursue rural electrification and renewable grid integration, driven by public-private partnerships and multilateral development funding.

In Europe, Middle East & Africa, stringent regulatory frameworks and decarbonization targets are catalysts for deploying advanced distribution solutions that facilitate two-way power flows and distributed generation. The region’s mature utility players prioritize retrofitting legacy networks with intelligent switchgear and digital control platforms to align with ambitious net-zero roadmaps.

Asia-Pacific stands out for its rapid urbanization and large-scale industrial expansion, which fuel continuous investments in power transmission and distribution infrastructure. Strategic partnerships, such as the $1.5 billion collaboration between Singapore’s Keppel Corporation and the Asian Infrastructure Investment Bank to support sustainable grid projects, exemplify the region’s focus on green infrastructure and smart electrification initiatives. These regional dynamics collectively underscore the need for tailored market approaches that account for local regulatory environments, financing models, and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Electric Main Board market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Corporations Driving Innovation Operational Excellence and Strategic Growth in the Global Electric Main Board Sector

Major players are intensifying R&D efforts and forging strategic alliances to sustain competitive advantage in the electric main board arena. Schneider Electric leverages its ComPact NSX circuit breaker line and Azure-powered predictive monitoring to deliver integrated digital distribution platforms. Siemens AG’s SIVACON S8 portfolio underscores its focus on modular, scalable switchgear solutions tailored for both legacy upgrades and greenfield projects.

ABB’s digital circuit breaker systems capitalize on connectivity and diagnostic capabilities to enable real-time asset monitoring, while Eaton’s HiZ Protect wildfire prevention system demonstrates the application of AI for rapid fault detection and grid resilience, developed in collaboration with the U.S. Army Corps of Engineers and NREL. Concurrently, Legrand’s expansion into smart building infrastructures and EV charging integration highlights the convergence of distribution boards with broader digital building management ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Main Board market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- CG Power and Industrial Solutions Limited

- Chint Group Corporation

- Eaton Corporation plc

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- General Electric Company

- Hager Group

- Hitachi, Ltd.

- Kirloskar Electric Company Limited

- Legrand SA

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Socomec SAS

- Square D Company

- Toshiba Corporation

- WEG S.A.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Enhance Resilience in the Electric Main Board Domain

Industry leaders should prioritize modular, software-defined distribution architectures to accommodate evolving load patterns and DER proliferation, thereby enabling rapid reconfiguration without extensive field retrofits. By adopting open, interoperable communication standards, manufacturers can streamline integration with utilities’ IIoT platforms and cloud-native analytic services to deliver predictive maintenance and grid-interactive functionalities.

To mitigate geopolitical and tariff-related supply chain risks, stakeholder consortia should accelerate the development of localized production clusters and multi-sourcing networks, balancing nearshore assembly with strategic imports. Collaborative R&D partnerships-with academic institutions, technology vendors, and standards bodies-will be essential to advance grid digital twin applications and unified asset management frameworks.

Executives are also advised to engage proactively with regulatory agencies to shape exclusion processes and incentive mechanisms that support domestic manufacturing while safeguarding grid security. Targeted investments in workforce reskilling, particularly in power electronics and cybersecurity, will equip operators and integrators to manage increasingly complex distribution infrastructures.

Outlining a Robust and Transparent Research Methodology Underpinning Comprehensive Analysis of the Electric Main Board Market Landscape

This analysis synthesizes primary interviews with key stakeholders-including utility CTOs, distribution board OEMs, and systems integrators-conducted over Q1 and Q2 2025, alongside a rigorous review of public policy documents, tariff schedules, and technical white papers. Secondary data sources encompass regulatory filings, HTS tariff databases, and industry association reports to ensure comprehensive coverage of the policy landscape and supply chain dynamics.

Market mapping employed a multi-layered segmentation framework, integrating application environments, phase configurations, certification standards, voltage classes, mounting approaches, and end-user verticals to capture nuanced demand drivers. Regional analyses were informed by macroeconomic indicators, infrastructure investment flows, and case studies of strategic partnerships across the Americas, EMEA, and Asia-Pacific.

Competitive profiling combined financial disclosures, patent filings, and product roadmaps to evaluate R&D intensity, digitalization strategies, and go-to-market models. This structured methodology underpins the report’s robust insights, ensuring data integrity and strategic relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Main Board market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Main Board Market, by Phase Type

- Electric Main Board Market, by Certification Standard

- Electric Main Board Market, by Product Type

- Electric Main Board Market, by Mounting Type

- Electric Main Board Market, by Application

- Electric Main Board Market, by End User

- Electric Main Board Market, by Region

- Electric Main Board Market, by Group

- Electric Main Board Market, by Country

- United States Electric Main Board Market

- China Electric Main Board Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Critical Insights and Strategic Imperatives for Stakeholders in the Evolving Electric Main Board Ecosystem

Electric main boards are positioned at the nexus of digital transformation, sustainability imperatives, and evolving regulatory frameworks. As smart grid deployments accelerate and distributed energy resources proliferate, the industry must adapt through modular design, open architectures, and advanced analytics to maintain reliability and operational efficiency.

Tariff pressures and supply chain realignments underscore the importance of diversified manufacturing footprints and strategic collaboration with policymakers to secure exclusion provisions and domestic incentives. Segmentation insights reveal differentiated requirements across application environments, phase types, certification regimes, voltage classes, mounting configurations, and end-user verticals, highlighting areas for targeted innovation and market penetration.

Regional dynamics further emphasize the need for tailored strategies that align with local infrastructure priorities-from digital modernization in North America to decarbonization drives in EMEA and infrastructure build-outs in Asia-Pacific. By leveraging these insights and pursuing the recommended strategic actions, stakeholders can position themselves to thrive in a rapidly evolving electric main board ecosystem.

Connect with Ketan Rohom to Access Comprehensive Electric Main Board Market Research and Drive Informed Strategic Decisions

To gain full access to the comprehensive analysis, data tables, and strategic insights contained within the electric main board market research report, please connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive industry expertise and can guide you through the report’s scope, deliverables, and customization options to align with your organization’s specific needs. Reach out today to schedule a briefing and secure your copy of this essential resource, empowering your team to make informed strategic decisions in a rapidly evolving power distribution landscape.

- How big is the Electric Main Board Market?

- What is the Electric Main Board Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?