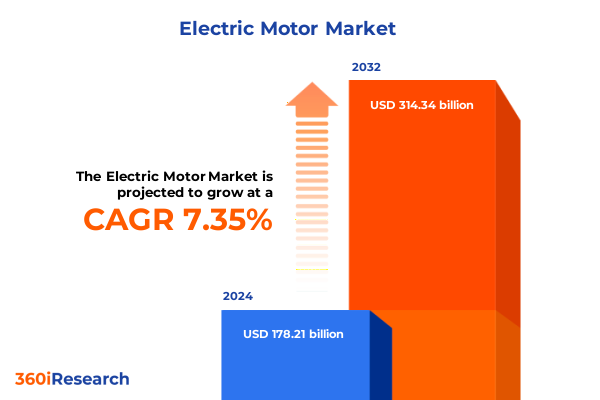

The Electric Motor Market size was estimated at USD 190.88 billion in 2025 and expected to reach USD 204.66 billion in 2026, at a CAGR of 7.38% to reach USD 314.34 billion by 2032.

Unveiling the Critical Role and Evolution of Electric Motors as Cornerstones in Industrial Efficiency and Transportation Electrification

Electric motors are the unsung workhorses powering modern industry, infrastructure, and transportation, converting electrical energy into mechanical motion across thousands of applications. From heavy-duty drives propelling manufacturing robots to fractional horsepower units circulating air in HVAC systems, these machines enable efficiency, precision, and reliability in processes critical to global economic activity. As organizations pursue electrification to decarbonize their operations and governments introduce ambitious emissions targets, the demand for high-performance, energy-efficient motors has surged globally. Underlying this trend is the recognition that industrial motors consume nearly 38% of global electricity, underscoring the central role they play in both energy demand and efficiency initiatives in manufacturing and utilities settings.

Mapping the Pivotal Technological, Regulatory, and Sustainability Shifts That Are Transforming the Electric Motor Industry

The electric motor landscape has undergone a seismic shift driven by digital transformation, sustainability mandates, and changing regulatory frameworks. Smart motors equipped with embedded sensors and connectivity features enable real-time performance monitoring and predictive maintenance, reducing unplanned downtime and extending asset life. These Industry 4.0-enabled solutions are increasingly integrated with digital twins, which simulate motor behavior under variable load conditions, optimizing design and deployment decisions. In parallel, artificial intelligence algorithms analyze operational data to fine-tune motor control parameters, enhancing energy efficiency and load response across diverse applications.

Beyond digitalization, policy incentives such as the U.S. Inflation Reduction Act and Europe’s rising minimum energy performance standards have spurred investment in advanced motor technologies. Subsidies for domestic rare earth processing and the push toward magnet-free synchronous reluctance motors reflect a broader effort to secure supply chains and reduce reliance on geostrategically sensitive materials. Meanwhile, the widespread adoption of electric vehicles, projected to reach over 20 million annual sales in 2025, is driving automakers and tier-1 suppliers to develop specialized traction and auxiliary motors with higher power density and thermal performance.

Assessing the Far-Reaching Consequences of New United States Tariffs on Electric Motor Supply Chains and Manufacturing Costs

In 2025, new U.S. tariffs have introduced significant repercussions for electric motor manufacturers and end users of motor-driven equipment. President Trump’s announcement of a 25% levy on imported cars took effect on April 2, with equivalent duties on auto parts scheduled to commence in May. These measures extend to components integral to traction and powertrain motors, elevating production costs for electric vehicle OEMs and remapping global trade flows in favor of domestic assembly operations.

Simultaneously, the imposition of 25% tariffs on all steel and aluminum imports from March 12 has further impacted motor production economics, given the reliance on high-grade laminations, shafts, and housings. Manufacturers must navigate reporting requirements for material origins and face compressed profit margins as they absorb or pass through elevated input costs. The combined effect of these trade actions has catalyzed a renewed focus on localizing motor component fabrication, securing alternative supply sources, and optimizing designs for material efficiency to mitigate near-term headwinds and maintain competitiveness in a shifting policy environment cite⟂turn0search3⟂turn0search3∘

In-Depth Exploration of Market Segmentation by Motor Type, Power Rating, Industry Applications, Cooling Methods, Phase, Mounting, Frame Composition, and Insulation Classes

The electric motor market is delineated across multiple interlocking dimensions that define product offerings and customer requirements. By type, alternating-current motors form the backbone of industrial applications, with induction designs dominating general-purpose drives and synchronous variants emerging for precision torque control. Direct-current motors, encompassing both brushed and brushless configurations, serve niche demands where speed and control dynamics are paramount. Power ratings further classify motors into low-horsepower units ideal for small appliances, medium tiers for light industrial machinery, high classes serving commercial HVAC and pumping, and ultra-powerful systems driving heavy equipment and traction vehicles.

End-user segmentation spans sectors from aerospace and automotive to energy utilities and manufacturing. Cooling options, such as open drip proof and totally enclosed fan-cooled, address environmental exposure and thermal management requirements. Single-phase and three-phase designs cater to residential versus large-scale installations, while application-specific pumps, fans, conveyors, and compressors integrate specialized motor variants. Mounting configurations and frame materials reflect installation and durability needs, and insulation classes dictate thermal resilience for high-temperature operations. Together these segmentation axes generate a matrix of tailored solutions, enabling suppliers to target precise performance, efficiency, and regulatory compliance profiles.

This comprehensive research report categorizes the Electric Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Power Output

- Cooling Type

- Phase

- Mounting Type

- Frame Material

- Insulation Class

- Voltage

- Application

- End-User Industry

- Sales Channel

Analyzing Distinct Market Drivers and Growth Opportunities across the Americas, EMEA Regions, and Asia-Pacific Economies

Regional dynamics underscore distinctive growth trajectories and investment priorities across the Americas, Europe-Middle East-Africa, and Asia-Pacific markets. In North America, federal incentives and tariff policies have accelerated domestic motor assembly investments, particularly in the Midwest’s emerging electric vehicle hubs. Manufacturers are capitalizing on Inflation Reduction Act tax credits to establish rare earth magnet and stator winding facilities, enhancing supply chain resilience. Latin American markets, buoyed by rising industrial automation and renewable energy adoption, are unlocking demand for premium efficiency motors, supported by government electrification programs.

Across EMEA, stringent energy efficiency directives and CO2 emission regulations are driving retrofits of legacy motor fleets, enabling OEMs and energy service providers to capture new upgrade projects. Incentives in the European Green Deal and Middle East decarbonization strategies are fostering deployment of advanced synchronous reluctance and permanent magnet solutions. Meanwhile, Asia-Pacific remains the largest revenue generator, with rapid industrialization in China and Southeast Asia propelling demand for cost-optimized motor solutions. Government subsidies for home appliances and electric vehicles further stimulate low-end and traction motor volumes, even as raw material constraints drive diversification of supply bases.

This comprehensive research report examines key regions that drive the evolution of the Electric Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders and Innovators Shaping Competitive Strategies and Technological Leadership in the Electric Motor Industry

Leading players have crystallized competitive positions through broad technology portfolios, global footprints, and strategic acquisitions. Siemens AG, headquartered in Munich and Berlin, reported €75.93 billion in revenue for 2024 and employs over 327,000 professionals worldwide, offering a comprehensive suite of industrial automation and drive technologies tailored for digital factories. ABB Ltd., the Swedish–Swiss multinational, merges industrial motors with digital solutions under its Motion and Digital Industries divisions, generating US $32.2 billion in revenue in 2023 and pioneering magnet-free synchronous reluctance motors to address raw material concerns.

Nidec Corporation of Kyoto leads precision and automotive electric motor segments, operating globally with a vertically integrated model that spans small HDD spindle units to high-power EV traction systems, and has ambitious targets to capture 40% of the global e-motor market. WEG S.A., founded in Brazil in 1961, employs over 40,000 staff and manufactures more than 16 million motors annually across 140 countries, emphasizing energy efficiency and localized service offerings. Regal Rexnord Corporation, born from the Regal Beloit and Rexnord merger, supplies premium brushless DC and NEMA motors through its Genteq and Marathon brands, supported by 29,000 employees and extensive North American manufacturing capacity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AMETEK, Inc.

- Anhui Wannan Electric Machine Co., Ltd.

- Brook Crompton Holdings Ltd.

- Emerson Electric Co.

- Franklin Electric Co., Inc.

- Hitachi Ltd.

- Jiangsu Electric Motor Co., Ltd.

- Johnson Electric Holdings Limited

- Kirloskar Electric Company Ltd.

- Mitsubishi Electric Corporation

- Nidec Corporation

- Ningbo Fenghua Motor Co., Ltd.

- Oriental Motor Co., Ltd.

- Panasonic Corporation

- Regal Rexnord Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Shanghai Electric Group Company Limited

- Shanghai Electric Motor Co., Ltd.

- Shenzhen Inovance Technology Co., Ltd.

- Siemens AG

- Taizhou Dongchun Motor Co., Ltd.

- TECO Electric & Machinery Co., Ltd.

- Toshiba Corporation

- WEG S.A.

- Wolong Holding Group Co., Ltd.

- Yaskawa Electric Corporation

- Zhejiang Jinlong Electrical Co., Ltd.

Strategic Imperatives for Industry Leaders to Harness Digitalization, Mitigate Trade Headwinds, and Advance Sustainable Motor Technologies

Companies must double down on digital integration to capture efficiency gains and product differentiation. Embedding advanced analytics and predictive maintenance capabilities into motor control systems can reduce lifecycle costs and unlock new service-based revenue streams. Firms should also expand modular platform development to flexibly address diverse applications, from HVAC to e-mobility, while leveraging AI-driven design optimization to minimize material use and weight.

To counter tariff-driven cost pressures, organizations should forge partnerships with domestic component suppliers and capitalize on government incentives under the Inflation Reduction Act. Building rare earth processing capacity within allied markets and diversifying magnet sourcing can mitigate geopolitical risks. Furthermore, establishing regional assembly hubs in North America, Europe, and Asia-Pacific will help circumvent import duties and tailor offerings to local regulatory landscapes.

Robust Multi-Source Research Methodology Employing Expert Interviews, Data Triangulation, and Rigorous Validation to Ensure Accurate Market Insights

This research synthesizes insights from a rigorous mixed-methodology framework. Primary research involved in-depth interviews with industry executives, including R&D leaders and supply chain managers at motor OEMs, distributors, and end-user organizations across key geographies. Secondary sources encompassed company annual reports, regulatory filings, and reputable news outlets to validate market dynamics and tariff regulations.

Quantitative analysis was underpinned by data triangulation, cross-referencing trade statistics, patent filings, and performance benchmarks to ensure robust segmentation and competitive profiling. Expert validation workshops with domain specialists were conducted to refine assumptions and corroborate findings. This multi-layered approach guarantees reliable, actionable insights tailored for decision-makers in the electric motor ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Motor Market, by Type

- Electric Motor Market, by Power Output

- Electric Motor Market, by Cooling Type

- Electric Motor Market, by Phase

- Electric Motor Market, by Mounting Type

- Electric Motor Market, by Frame Material

- Electric Motor Market, by Insulation Class

- Electric Motor Market, by Voltage

- Electric Motor Market, by Application

- Electric Motor Market, by End-User Industry

- Electric Motor Market, by Sales Channel

- Electric Motor Market, by Region

- Electric Motor Market, by Group

- Electric Motor Market, by Country

- United States Electric Motor Market

- China Electric Motor Market

- Competitive Landscape

- List of Figures [Total: 23]

- List of Tables [Total: 3657 ]

Synthesizing Key Findings on Market Transformations, Segmentation Dynamics, and Strategic Outlook for Electric Motor Stakeholders

The electric motor landscape is in the midst of a profound transformation, propelled by electrification mandates, digitalization imperatives, and shifting trade policies. Technological advancements in smart, high-efficiency motor designs intersect with sustainability goals to create a fertile environment for innovation. However, tariff regimes in the United States and material supply challenges introduce near-term headwinds that industry stakeholders must navigate through strategic localization and diversification.

Segmentation insights reveal nuanced customer requirements across type, power rating, application, and industry verticals, underscoring the need for tailored solutions and flexible manufacturing platforms. Regional analyses highlight distinct drivers in the Americas, EMEA, and Asia-Pacific, while the landscape of leading players illustrates the competitive interplay of global incumbents and agile innovators. Moving forward, the ability to integrate digital services, secure resilient supply chains, and launch next-generation motor technologies will define market leadership.

Empower Your Strategic Decisions by Partnering with Ketan Rohom to Access In-Depth Electric Motor Market Intelligence

To explore the comprehensive electric motor market research report and secure a competitive advantage, reach out to Ketan Rohom (Associate Director, Sales & Marketing). Engage in a detailed discussion to understand how the report’s insights can inform your strategic planning, drive market entry, and optimize investment decisions in a rapidly evolving landscape. By partnering with an experienced industry expert, you will gain tailored guidance on interpreting data, benchmarking performance, and identifying high-impact opportunities. Contact Ketan to schedule a personalized consultation and obtain full access to the report’s in-depth analysis, proprietary case studies, and executive briefings designed to empower your organization’s growth trajectory.

- How big is the Electric Motor Market?

- What is the Electric Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?