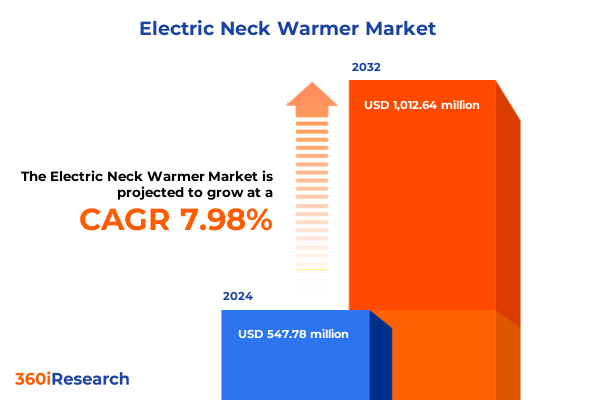

The Electric Neck Warmer Market size was estimated at USD 581.88 million in 2025 and expected to reach USD 621.56 million in 2026, at a CAGR of 8.23% to reach USD 1,012.64 million by 2032.

Unveiling How Electric Neck Warmers Are Redefining Personalized Wellness by Delivering Targeted Thermal Relief through Cutting-Edge Portable Heating Solutions

The electric neck warmer category has emerged as a versatile solution at the intersection of comfort, wellness, and portable heating technology, addressing growing consumer expectations for personalized thermal relief. Driven by rising awareness of self-care practices and the integration of wellness into everyday routines, these devices offer a targeted approach to alleviating neck tension and improving circulation without compromising on convenience or aesthetics. Incorporating lightweight materials and slimline designs, electric neck warmers blend fashion with function, enabling users to experience therapeutic warmth in diverse settings, from office workstations to outdoor activities.

Recent innovations in ergonomic shaping and intuitive temperature controls have elevated the category’s appeal, allowing for seamless integration into both professional and leisure contexts. Enhanced battery lives and modular power options, including AC adapters and USB connectivity, cater to users’ evolving demands for all-day use, whether at home or on the move. The proliferation of smart features-such as app-based heat presets and adaptive heating algorithms-demonstrates the industry’s commitment to delivering highly customized experiences that resonate with tech-savvy consumers. As comfort meets connectivity, electric neck warmers are redefining the boundaries of portable therapy, positioning themselves as indispensable companions for modern wellness journeys.

Looking ahead, the continued convergence of health-focused design, sustainability considerations, and digital integration points to a dynamic growth trajectory for electric neck warmers. This introduction lays the groundwork for a deeper exploration of the transformative forces reshaping the market, the impacts of recent trade policy shifts, and the nuanced segmentation and regional insights that will inform strategic decision-making for stakeholders seeking to capitalize on this burgeoning category.

Highlighting Key Technological Innovations, Changing Consumer Behaviors, and Evolving Distribution Dynamics Driving the Next Generation of Electric Neck Warmer Solutions

The electric neck warmer landscape is undergoing profound transformation, catalyzed by a wave of technological breakthroughs and shifting consumer expectations. Pioneering materials science has introduced high-efficiency heating elements-ranging from infrared panels to advanced PTC ceramics-that deliver faster heat-up times and more uniform warmth distribution. These innovations are complemented by ongoing miniaturization of batteries and control modules, enabling sleeker form factors without compromising performance. As wearable technology converges with wellness, the traditional paradigm of bulky, static heating pads is giving way to stylish, lightweight solutions that integrate seamlessly into contemporary lifestyles.

Simultaneously, consumer behaviors are evolving in favor of personalized health experiences and at-home therapy options, fueled by digital health trends and remote work dynamics. Users now demand intelligent features such as adaptive temperature regulation and usage tracking, which create feedback loops that inform both product design and post-purchase engagement strategies. In parallel, distribution channels are morphing to support omnichannel experiences: direct-to-consumer platforms are expanding subscription models, while brick-and-mortar retailers enhance in-store demonstrations to drive trial and impulse purchases. Collaboration between wellness influencers and brands further amplifies visibility, fostering community-driven referrals that accelerate adoption.

Taken together, these shifts are reshaping competitive dynamics, pushing manufacturers to innovate beyond core functionality toward integrated ecosystems that address broader health and lifestyle aspirations. As the industry adapts, the next generation of electric neck warmers will likely capitalize on converging trends in smart connectivity, sustainable design, and immersive consumer experiences.

Examining the Cumulative Effects of Recent United States Tariffs Imposed in 2025 on Supply Chain Costs, Pricing Strategies, and Competitive Dynamics in the Electric Neck Warmer Sector

The United States’ tariff measures enacted in early 2025 have introduced new complexities into the electric neck warmer supply chain, particularly for components sourced from regions subject to increased duties. Textiles imported from certain Asian manufacturing hubs have seen hikes under Section 301 provisions, while electronic heating elements and battery modules have encountered elevated rates under revised Harmonized Tariff Schedule entries. These duty increases have reverberated through production costs, prompting many suppliers to reassess their procurement strategies and negotiate long-term contracts to stabilize input pricing.

Amid these headwinds, some manufacturers have pursued alternative sourcing routes, shifting fabrication of fabric shells and assembly of electronic modules to jurisdictions with preferential trade agreements to mitigate tariff burdens. Others have absorbed a portion of the increased expenses to preserve retail price points, leading to compressed margins that underscore the need for operational efficiencies. Furthermore, the regulatory landscape has spurred discussions around domestic assembly initiatives and investment incentives aimed at fostering localized manufacturing. This recalibration of supply networks not only addresses immediate cost pressures but also fortifies resilience against future trade volatility, ultimately influencing pricing architectures, inventory management practices, and go-to-market planning across the electric neck warmer sector.

Analyzing Core Segmentation Dimensions Revealing How End User, Channel, Product Type, Power Source, Heating Technology, Material and Pricing Shape Market Opportunities

A nuanced understanding of market segmentation reveals critical pathways for targeting distinct user cohorts and refining product portfolios. Insights based on end user highlight that the healthcare and wellness segment prioritizes therapeutic efficacy and medical-grade performance, while the household segment values ease of use and aesthetic integration into home environments. Sports and outdoor enthusiasts seek durable designs with rapid warm-up capabilities, and travel and leisure customers demand compact, lightweight units that fit seamlessly into luggage or carry-on gear.

Distribution channel segmentation underscores divergent expectations across offline and online retail environments. Within brick-and-mortar settings, retail chains emphasize broad assortment and recognizable brand signage, whereas specialty stores curate premium offerings supported by experiential store layouts. The online retail space bifurcates between brand websites, where companies can control their narrative and foster direct customer relationships, and third-party platforms that deliver extensive reach and competitive price comparisons. Crafting channel-specific value propositions is essential to resonate with consumers navigating these distinct purchasing ecosystems.

Product type delineation-collar, scarf, and wrap-introduces form-factor considerations that influence user comfort and target applications. Power source segmentation, spanning AC-powered units for stationary use, rechargeable battery options for on-the-go convenience, and USB-powered models for integration with common power banks, further dictates portability and use case. Variations in heating technology, from electric resistance coils to infrared emitters and PTC elements, shape performance characteristics such as heat distribution and energy efficiency. Material segmentation across cotton, polyester, and wool balances considerations of texture, weight, and thermal retention. Finally, price range delineation into low, mid, and premium tiers allows brands to align product features with consumer willingness to invest, ensuring there are accessible entry points as well as high-margin flagship offerings.

This comprehensive research report categorizes the Electric Neck Warmer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Heating Technology

- Material

- End User

- Distribution Channel

Exploring Regional Nuances Across the Americas, Europe Middle East Africa, and Asia Pacific to Uncover Growth Drivers, Adoption Patterns, and Strategic Imperatives

Regional dynamics of the electric neck warmer category exhibit pronounced diversity shaped by varying cultural preferences, regulatory frameworks, and climate conditions. In the Americas, consumer demand is buoyed by an established wellness culture and widespread adoption of at-home therapeutic devices, supported by robust distribution infrastructures that blend national retail chains with niche fitness and health-focused outlets. This region’s appetite for innovative features is fueling investments in marketing initiatives that emphasize product efficacy and comfort enhancements.

Europe, Middle East, and Africa present a multifaceted landscape wherein stringent product safety and environmental regulations guide material selection and manufacturing processes. Consumers in Western Europe prioritize eco-friendly materials and certifications, whereas markets in the Middle East demonstrate openness to premium imported solutions that convey luxury and status. In Africa, growing urbanization and expanding middle-class populations are unlocking new opportunities, although infrastructure challenges in logistics and inconsistent power supply in certain areas necessitate design adaptations and localized support strategies.

Asia-Pacific remains a hotbed for manufacturing and market expansion, with significant production capabilities concentrated in East and Southeast Asia, accompanied by accelerating domestic consumption in markets such as Japan, South Korea, and China. Rising disposable incomes, coupled with heightened awareness of self-care practices, are broadening the customer base beyond traditional winter months. Moreover, digital commerce platforms in this region are particularly sophisticated, enabling real-time personalization and rapid scaling for brands that can navigate complex regulatory and distribution environments.

This comprehensive research report examines key regions that drive the evolution of the Electric Neck Warmer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Defining Innovation, Portfolio Diversification, and Market Positioning within the Electric Neck Warmer Category

Leading participants in the electric neck warmer arena are distinguishing themselves through portfolio diversification, technological partnerships, and strategic alliances. Key innovators have collaborated with textile specialists to integrate phase-change materials and smart fabrics that enhance thermal regulation, while also forging relationships with battery manufacturers to extend usage cycles and improve safety profiles. Others have emphasized branding synergies by co-creating limited-edition collections with lifestyle and fitness influencers, thereby tapping into dedicated consumer communities and driving premiumization.

Competitive positioning has also been shaped by mergers and acquisitions, enabling companies to consolidate supply chains and accelerate entry into new geographic markets. This trend is complemented by targeted investments in R&D, where specialized engineering teams are developing next-generation heating elements optimized for rapid response times and energy efficiency. Through these integrated efforts, leading organizations are reinforcing their market footholds and shaping the innovation agenda for the broader electric neck warmer category.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Neck Warmer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Beurer GmbH

- Carex Health Brands, Inc.

- DJO, LLC

- Gerbing’s Innovations, Inc.

- Hotronic GmbH

- Lenz Products AG

- Newell Brands, Inc.

- Omron Healthcare Co., Ltd.

- Ororo Inc.

- Polar Products, Inc.

- Stanley Black & Decker, Inc.

- Sunbeam Products, Inc.

- Techtronic Industries Company Limited

- Therm-ic SA

- Volt Resistance, LLC

- Wahl Clipper Corporation

- Xiaomi Corporation

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends, Optimize Operations, and Drive Growth in the Competitive Electric Neck Warmer Market

To thrive amid intensifying competition and evolving consumer demands, industry leaders should prioritize investments in next-generation heating technologies that deliver rapid, consistent warmth while minimizing energy consumption. Establishing cross-functional R&D initiatives that unite materials scientists, electronic engineers, and user experience designers will be critical for unlocking performance breakthroughs. At the same time, diversifying sourcing strategies by leveraging manufacturing partners in tariff-advantaged regions can mitigate trade risks and preserve margin integrity.

Furthermore, brands should embrace omnichannel strategies that blend immersive in-store experiences with seamless digital touchpoints, ensuring that consumers encounter consistent messaging and service standards at every juncture. Strategic partnerships with wellness platforms and healthcare providers can amplify credibility, while targeted content campaigns that showcase real-world use cases will drive consideration among niche audiences such as athletes, frequent travelers, and elderly users. Finally, integrating sustainable practices-ranging from recyclable materials to extended-life battery programs-will resonate with increasingly eco-conscious buyers and enhance brand equity over the long term.

Outlining the Comprehensive Multi-Phased Research Methodology Integrating Primary Interviews, Secondary Analysis, and Robust Data Validation Processes

This research leverages a multi-phased methodology designed to deliver robust, actionable insights into the electric neck warmer category. In the initial phase, extensive secondary research was conducted to map the competitive landscape, review regulatory developments, and identify emerging technological innovations, drawing on industry publications, government filings, and peer-reviewed studies. Data from trade associations and logistics databases were analyzed to chart supply chain configurations and understand the impact of tariff changes on material flows.

Building on these secondary findings, a comprehensive primary research phase was executed involving in-depth interviews with senior executives at leading manufacturers, distribution partners, and key end users, including healthcare professionals and sports therapists. This phase was complemented by digital consumer surveys designed to capture preferences related to product features, pricing sensitivity, and purchase drivers. Triangulation of primary and secondary data points was achieved through rigorous validation processes, ensuring consistency and reliability of the insights presented. The final analytical layer entailed segmentation and regional analysis, synthesizing qualitative and quantitative evidence to inform strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Neck Warmer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Neck Warmer Market, by Product Type

- Electric Neck Warmer Market, by Power Source

- Electric Neck Warmer Market, by Heating Technology

- Electric Neck Warmer Market, by Material

- Electric Neck Warmer Market, by End User

- Electric Neck Warmer Market, by Distribution Channel

- Electric Neck Warmer Market, by Region

- Electric Neck Warmer Market, by Group

- Electric Neck Warmer Market, by Country

- United States Electric Neck Warmer Market

- China Electric Neck Warmer Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Insights Synthesizing Critical Discoveries and Future Outlook to Empower Stakeholders with Strategic Clarity in the Electric Neck Warmer Market

The investigation into the electric neck warmer market has revealed a confluence of technological, behavioral, and regulatory forces shaping its evolution. Advanced heating technologies and material innovations are elevating user experiences, while shifting trade policies and distribution dynamics are forcing stakeholders to rethink supply chain designs. Segmentation and regional analyses highlight diverse routes to market, pointing to tailored strategies for healthcare, sports, household, and travel applications across distinct geographies.

As the sector continues to innovate, the strategic interplay between product performance, channel execution, and brand positioning will determine the winners and laggards. The insights distilled herein provide a clear roadmap for capitalizing on emerging trends, addressing potential headwinds, and delivering differentiated value propositions. With a holistic understanding of the market’s critical drivers and structural nuances, stakeholders are equipped to make informed decisions that will underpin sustainable growth and competitive advantage.

Engage with Ketan Rohom, Associate Director of Sales & Marketing to Access the Full Electric Neck Warmer Market Research Report and Accelerate Strategic Decision Making

Ready to elevate your understanding of the electric neck warmer market and drive informed strategic initiatives? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure the comprehensive Electric Neck Warmer Market Research Report. This in-depth dossier offers granular insights, competitive benchmarking, and actionable intelligence tailored to your organization’s needs. Reach out now to gain exclusive access to proprietary analysis, metodología details, and expert recommendations that will empower your team to identify emerging opportunities, mitigate risks, and chart a clear path to market leadership. Don’t miss the chance to leverage this essential resource and transform your approach to product development, distribution strategies, and targeted marketing campaigns. Engage with Ketan today and take the first step toward accelerated growth and sustained competitive advantage.

- How big is the Electric Neck Warmer Market?

- What is the Electric Neck Warmer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?