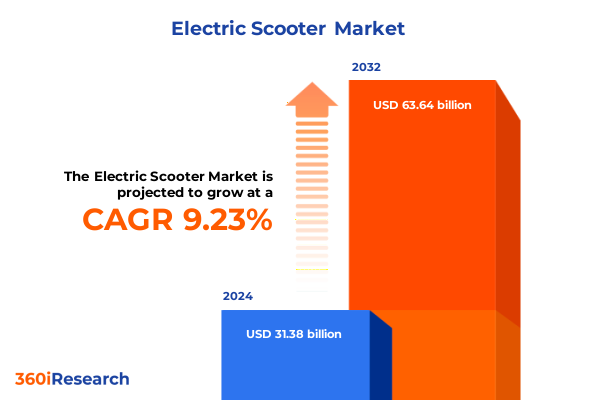

The Electric Scooter Market size was estimated at USD 34.35 billion in 2025 and expected to reach USD 37.13 billion in 2026, at a CAGR of 9.20% to reach USD 63.64 billion by 2032.

Setting the Stage for the Electric Scooter Revolution in Urban Mobility by Exploring Core Industry Drivers Shaping Future Innovations

Urban centers worldwide are experiencing a rapid shift toward compact, sustainable modes of transportation, and electric scooters have emerged at the forefront of this micro-mobility revolution. Shared and personal e-scooter services have proliferated across major metropolitan areas, transforming short-distance travel by offering an efficient alternative to cars and public transit. In the United States, over 65 million shared electric scooter trips were recorded in 2023, reflecting the technology’s integration into daily commuting patterns and its growing acceptance among consumers seeking both convenience and environmental benefits.

As urban planners grapple with congestion, air quality, and infrastructure constraints, policymakers and private operators are increasingly collaborating to embed e-scooters into smart mobility ecosystems. Innovative pilot programs in Europe and North America have demonstrated how dynamic micromobility services can lower the cost of transportation network expansion and improve curb-to-curb connectivity without extensive new road construction. Reinforced by investments in charging infrastructure and app-based fleet management platforms, electric scooters are redefining first- and last-mile solutions, accelerating a migration away from carbon-intensive travel toward zero-emission urban mobility.

Decoding the Transformative Shifts Disrupting the Electric Scooter Landscape Across Technology, Consumer Behavior, and Policy Frameworks

The landscape of electric scooters is being reshaped by a confluence of technological breakthroughs, shifting consumer behaviors, and evolving policy frameworks. Battery technology has advanced rapidly, with swappable lithium-ion modules and fast-charging systems extending range while reducing downtime, prompting many manufacturers to integrate convenient exchange solutions into their product portfolios. At the same time, IoT-enabled platforms are empowering operators to optimize fleet distribution, monitor vehicle health in real time, and personalize rider experiences through data-driven applications.

Consumer preferences have also undergone a marked transformation. Urban commuters and younger demographics now prioritize portability, seamless app-based access, and integrated mobility subscriptions that bundle e-scooters with other transport services. These preferences have driven a wave of shared-mobility partnerships between e-scooter fleets and public transit agencies, yielding co-branded passes and frictionless transfers that cater to a more connected, sustainability-minded user base.

Finally, regulators have taken a more proactive stance toward micromobility. Over 28 U.S. states and Washington, D.C., have enacted or updated e-scooter legislation addressing age restrictions, speed limits, and vehicle standards to manage safety concerns and integrate scooters harmoniously with pedestrian and automotive traffic. This regulatory maturation is fostering greater industry confidence and encouraging broader deployment of standardized vehicles in both private and shared-fleet models.

Examining the Cumulative Impact of 2025 United States Tariff Measures on Electric Scooter Supply Chains and Cost Structures

In 2025, the United States implemented substantial tariff increases on electric two-wheeler imports, reshaping supply chain economics and cost structures for scooter manufacturers and assemblers. The Biden administration’s decision to maintain and extend steep duties on Chinese-made electric vehicles and battery components has led to import levies exceeding 100 percent for certain product categories, aiming to bolster domestic manufacturing capacity.

These elevated tariffs have pressured suppliers that historically relied on Chinese battery packs, motors, and controllers, triggering a strategic pivot toward alternative sourcing destinations such as Vietnam, Cambodia, and select Southeast Asian hubs. At the same time, U.S. producers with domestic assembly capabilities have begun re-negotiating supplier contracts and exploring joint ventures to mitigate tariff exposure, though the scarcity of local high-performance battery cell production remains an ongoing barrier.

Consumers and fleet operators may experience notable price adjustments as companies weigh the choice between absorbing higher import costs or passing them through to end users. Industry voices warn that without coordinated policy incentives or tariff relief mechanisms, reduced affordability could hinder adoption, undercutting progress toward cleaner transportation objectives and potentially slowing electric scooter market expansion in critical regions.

Unveiling Key Segmentation Patterns Revealing Diverse Electric Scooter Preferences Across Product Types, Battery Technologies, Power Ratings, and Distribution Channels

Electric scooter demand can be better understood through distinct product type categories, where seated and stand-up models address different rider priorities. Stand-up scooters have captured the attention of urban commuters seeking portability and minimal storage footprint, while seated scooters appeal to users desiring enhanced comfort over longer distances. This dual-product framework underscores how ergonomic design and user experience are pivotal in positioning brands for targeted consumer segments.

Battery technology further delineates market offerings, distinguishing between legacy lead acid configurations and modern lithium-ion power sources. Lithium-ion adoption has surged on the strength of higher energy density, reduced weight, and rapid charge cycles, enabling longer ranges and smarter battery management solutions. Conversely, lead acid batteries persist in entry-level models and cost-sensitive applications, sustained by their lower upfront capital requirements despite shorter lifespan and heavier mass.

Battery capacity ranges have likewise emerged as a critical dimension, ranging from sub-500 Wh packs for micro-mobility portability to mid-tier 500–1000 Wh systems balancing range and agility, up to heavy-duty modules exceeding 1000 Wh tailored for commercial deliveries or extended urban tours. These capacity bands reflect divergent use cases, where compact commuters prioritize lightweight convenience and logistics operators require robust endurance.

Motor power classifications-from up to 250 W for neighborhood jaunts to 251–500 W for mixed-terrain versatility and above 500 W for performance or cargo applications-enable companies to calibrate ride dynamics, speed profiles, and regulatory compliance to local e-scooter statutes. Lastly, distribution channels span offline and online ecosystems, with brick-and-mortar electronics retailers, specialty stores, and supermarkets coexisting alongside direct-to-consumer e-commerce sites and branded company websites. This omni-channel approach ensures market reach across both impulse purchase environments and considered evaluation journeys.

This comprehensive research report categorizes the Electric Scooter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Battery Type

- Battery Capacity

- Motor Power

- Distribution Channel

Harnessing Regional Variations to Navigate Electric Scooter Adoption Trends Spanning Americas, EMEA and Asia-Pacific Growth Hotspots

Regional dynamics significantly influence electric scooter adoption, with the Americas exhibiting a blend of mature shared-mobility ecosystems and nascent personal ownership models. In North America, sustained urbanization and environmental policy targets have encouraged municipal partnerships with fleet operators, integrating e-scooters into broader Mobility as a Service frameworks, even as state-level regulations continue to crystallize around safety and infrastructure requirements.

Across Europe, the Middle East, and Africa, regulatory archetypes vary from inclusive support to localized restrictions. Western European cities have prioritized dedicated micromobility lanes and streamlined permitting, while some regions in the Middle East are scaling pilot programs in high-density districts. Africa’s market is still at an emergent stage, where local governments explore small-scale deployments alongside public transit enhancements, driven by the need to address urban congestion and expand access to reliable, low-cost transport solutions.

In Asia-Pacific, the electric scooter sector benefits from a unique convergence of high population density, government incentive programs, and established manufacturing capabilities. Countries such as India continue to promote buyer subsidies to reduce carbon emissions in two-wheeler markets, while China’s once-bustling EV incentive schemes are evolving to manage budgetary constraints. Southeast Asian nations are also emerging as alternative production bases, as global brands seek to diversify supply chains beyond traditional hubs.

This comprehensive research report examines key regions that drive the evolution of the Electric Scooter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gleaning Strategic Insights from Leading Electric Scooter Companies Driving Innovation, Partnerships, and Competitive Differentiation in the Market

The competitive electric scooter landscape features both global conglomerates and agile startups differentiated by scale, technology priorities, and go-to-market strategies. Established players like Yadea and Ninebot command extensive distribution networks and R&D investments, consistently introducing next-generation models and securing partnerships with shared-mobility fleets. Gogoro’s battery-swap infrastructure in Asia-Pacific has set a precedent for alternative energy ecosystems, demonstrating how modular power can underpin rapid deployments.

Meanwhile, Bird and Lime have accelerated urban penetration through flexible rental schemes augmented by data analytics, navigating diverse municipal regulations to maintain high utilization rates and fleet availability. On the performance end, BMW Motorrad International and Yamaha are experimenting with premium e-scooter concepts, aiming to merge brand heritage with electric drive trains and advanced connectivity features.

Homegrown innovators like Aventon in the United States have responded to tariff and supply-chain disruptions by relocating production to Southeast Asia, absorbing cost pressures to stabilize pricing for consumers. Similarly, Spark Cycleworks has illustrated the limits of domestic assembly, confronting the need for battery and motor component diversification as tariffs push costs upward. This blend of multinational scale and boutique engineering underpins the rapidly evolving competitive ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Scooter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aima Technology Group Co Ltd

- Ather Energy Pvt Ltd

- Bajaj Auto Ltd

- Energica Motor Company SpA

- Gogoro Inc

- Govecs AG

- Hero Electric Vehicles Pvt Ltd

- Honda Motor Co Ltd

- Jiangsu Xinri E-Vehicle Co Ltd

- Mahindra & Mahindra Ltd

- NIU Technologies

- Okinawa Autotech Pvt Ltd

- Ola Electric Mobility Pvt Ltd

- Piaggio & C SpA

- PURE EV

- Revolt Intellicorp Pvt Ltd

- Riese & Müller GmbH

- Segway-Ninebot Inc

- Suzhou Fuji-Ta Bicycle Industrial Co Ltd

- TVS Motor Company Limited

- Vmoto Limited

- Walberg Urban Electrics GmbH

- Yadea Group Holdings Ltd

- Yamaha Motor Co Ltd

- Zero Motorcycles Inc

Translating Market Intelligence into Actionable Recommendations Empowering Industry Leaders to Capitalize on Electric Scooter Opportunities and Navigate Regulatory Headwinds

To thrive amid intensifying competition and policy shifts, electric scooter industry leaders should prioritize supply chain resilience by diversifying manufacturing footprints and cultivating partnerships in tariff-exempt regions. Building flexible sourcing strategies will enable smoother adaptation to evolving trade measures without compromising product quality or time-to-market.

Investment in proprietary battery management and rapid charge or swap networks can deliver tangible user experience advantages while reinforcing brand differentiation. Collaborating with wireless utility providers and urban planners to expand charging infrastructure will further cement market leadership by addressing one of the most persistent customer concerns: range anxiety.

Engaging proactively with regulators and local authorities is equally vital. By participating in pilot safety programs, contributing data-driven insights to public forums, and advocating for balanced policy frameworks, companies can shape the regulatory environment to promote innovation and consumer safety in tandem.

Finally, embracing data analytics and IoT connectivity to refine fleet operations, manage predictive maintenance, and personalize rider offerings will unlock efficiency gains and strengthen loyalty. Companies that leverage holistic digital ecosystems will be best positioned to scale sustainably.

Outlining Rigorous Research Methodologies Employed to Deliver Robust Insights into Electric Scooter Market Dynamics and Segmentation Analysis

This analysis integrates a multi-method research approach combining primary and secondary data collection to ensure comprehensive market coverage. Primary insights were gathered through interviews with industry executives, supply chain experts, and regulatory authorities, providing first-hand perspectives on emerging trends and strategic priorities.

Secondary research involved the systematic review of reputable publications, governmental databases, and industry reports, triangulating data from sources such as trade associations, regulatory filings, and peer-reviewed studies. Each data point was validated through cross-referencing, ensuring both accuracy and consistency across segments.

A detailed segmentation framework was constructed to analyze variations by product type, battery configuration, motor power ratings, and distribution channel performance. Regional overlays were applied to capture the nuances of market maturation and policy regimes across the Americas, EMEA, and Asia-Pacific.

Quantitative and qualitative findings were synthesized using scenario modeling and trend extrapolation techniques, providing a nuanced picture of market momentum without relying on single-point forecasts. This methodological rigor underpins the robustness of the strategic insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Scooter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Scooter Market, by Product Type

- Electric Scooter Market, by Battery Type

- Electric Scooter Market, by Battery Capacity

- Electric Scooter Market, by Motor Power

- Electric Scooter Market, by Distribution Channel

- Electric Scooter Market, by Region

- Electric Scooter Market, by Group

- Electric Scooter Market, by Country

- United States Electric Scooter Market

- China Electric Scooter Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Future Perspectives to Conclude the Electric Scooter Market Overview with Strategic Clarity and Vision

The electric scooter market stands at a pivotal juncture, as technological advancements, regulatory evolution, and shifting consumer expectations converge to redefine micro-mobility. From the rapid adoption of lithium-ion battery systems to the growing sophistication of shared-fleet analytics, the industry is accelerating toward enhanced convenience, safety, and sustainability.

Tariff realignments in 2025 have underscored the importance of supply chain agility, prompting companies to recalibrate sourcing strategies and fortify domestic assembly capabilities. Concurrently, region-specific incentive programs and infrastructure investments continue to shape adoption patterns, with Asia-Pacific, Europe, and North America each exhibiting distinct growth catalysts.

Segmentation analysis highlights the critical interplay between product design, battery performance, and distribution strategies, while competitive reviews reveal a spectrum of global and regional actors innovating across the value chain. As companies navigate this complex environment, actionable priorities-ranging from diversification and regulatory engagement to digital ecosystem development-will determine the leaders of tomorrow.

Looking forward, the integration of autonomous features, advanced energy solutions, and seamless mobility partnerships promises to further elevate the role of electric scooters in urban transportation networks. Stakeholders who proactively adapt to these dynamics will be instrumental in accelerating the transition to efficient, low-carbon mobility.

Connect with Ketan Rohom to Unlock Comprehensive Electric Scooter Market Research Insights and Secure Your Strategic Market Intelligence Today

If you’re seeking authoritative insights and nuanced analyses to inform strategic decisions in the electric scooter market, Ketan Rohom stands ready to guide you toward the most comprehensive market research report available. With his deep understanding of market dynamics, technology trends, and regulatory landscapes, Ketan can help ensure you secure the data and intelligence needed to outpace competitors and capitalize on emerging opportunities. Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to gain direct access to tailored recommendations and full report details. Reach out today to elevate your market positioning and unlock the competitive advantage that in-depth electric scooter research can deliver.

- How big is the Electric Scooter Market?

- What is the Electric Scooter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?