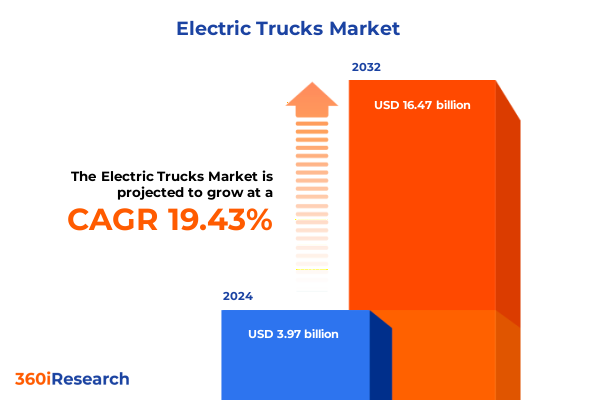

The Electric Trucks Market size was estimated at USD 4.71 billion in 2025 and expected to reach USD 5.59 billion in 2026, at a CAGR of 19.57% to reach USD 16.47 billion by 2032.

Navigating the Emergence of Electric Trucks as a Cornerstone of Sustainable Transportation Driven by Regulatory, Technological, and Market Forces

As global efforts to decarbonize freight transportation intensify, electric trucks are emerging as an essential component of sustainable logistics and supply chain strategies. Fueled by ambitious zero-emission regulations and growing corporate sustainability commitments, electric truck adoption is accelerating across multiple regions. Sales of electric trucks rose 35% in 2023 compared to 2022, surpassing electric buses for the first time with more than 54,000 units delivered worldwide. This milestone underscores the mounting momentum behind zero-emission heavy-duty vehicles and sets the stage for further innovations in battery technology, charging infrastructure, and operational efficiencies.

Unraveling the Transformative Technological, Policy, and Infrastructure Shifts Propelling Electric Truck Market Expansion Worldwide

Rapid advancements in battery energy density and powertrain efficiency have reshaped the technological landscape of commercial vehicles, enabling electric trucks to achieve longer ranges and faster charging times. Coupled with declining battery costs-driven by scaled manufacturing and material innovations-the total cost of ownership for many duty cycles is approaching parity with diesel equivalents. Governments are reinforcing these shifts through stringent emissions regulations and financial incentives. In Europe, CO₂ standards for heavy-duty vehicles aim to reduce emissions by 90% by 2040, while in the United States the newly adopted heavy-duty emissions regulation promises to drive ZEV sales shares up to 60% in certain segments by 2032.

Assessing the Cumulative Ripple Effects of 2025 United States Tariffs on Electric Trucks and Supply Chain Economics

The introduction of 25% tariffs on imported automobiles and auto parts from Canada and Mexico in early 2025 has had profound implications for commercial vehicle supply chains. Since implementation, roughly one-third of US commercial vehicle sales-particularly Class 8 heavy-duty trucks-have faced elevated duties, prompting manufacturers to reevaluate production footprints and localize critical components to mitigate cost pressures. These broad-based trade measures, aimed at bolstering domestic manufacturing, also affect electric truck components, including motors and chassis modules, leading to supply chain reconfigurations and potential delivery delays.

Dissecting Key Electric Truck Market Segmentation Dimensions to Illuminate Opportunities Across Payload, Propulsion, and Application Verticals

Market segmentation by payload capacity reveals distinct growth dynamics across heavy-duty, medium-duty, and light-duty electric trucks. Heavy-duty electric trucks are gaining traction in long-haul logistics, driven by improved battery ranges and dedicated charging corridors, while medium-duty models are increasingly deployed for regional distribution and last-mile delivery. At the same time, light-duty trucks are carving out a niche in urban service applications, benefiting from lower upfront costs and simpler infrastructure requirements.

When analyzed by truck type, Box Trucks and Flatbed Trucks serve as critical workhorses for construction and warehousing, while Dump Trucks address specialized needs in mining and infrastructure projects. Pickup Trucks, long a staple of commercial fleets, are transitioning toward all-electric powertrains to meet sustainability targets, and Refrigerated Trucks are leveraging electric refrigeration units powered by onboard batteries. Utility Trucks and Waste Collection Trucks are also undergoing electrification as municipalities adopt zero-emission mandates for public services, reshaping the operational landscape of urban fleets.

This comprehensive research report categorizes the Electric Trucks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payload Capacity

- Trucks Type

- Propulsion Type

- Battery Capacity

- Application

- Sales Channel

Evaluating Regional Electric Truck Market Dynamics Across Americas, EMEA, and Asia-Pacific to Highlight Differential Growth Drivers

In the Americas, supportive policies such as the Inflation Reduction Act’s commercial vehicle tax credits and state-level zero-emission mandates are catalyzing the deployment of electric trucks for port drayage, municipal services, and regional freight. Californiabased initiatives, backed by multi-billion-dollar grants, are leasing hundreds of electric semis to reduce diesel emissions at major seaports, exemplifying the region’s drive toward sustainable logistics.

Across Europe, the convergence of CO₂ emissions standards for heavy-duty vehicles and advanced clean truck regulations is accelerating adoption, particularly in major logistics hubs. The European market is supported by robust infrastructure investments, public-private partnerships to develop charging corridors, and the European Commission’s commitment to achieving climate neutrality by 2050, creating a collaborative environment for manufacturers and fleet operators to innovate.

In the Asia-Pacific region, China remains the dominant market, accounting for approximately 70% of global electric truck sales in 2023. Aggressive subsidies and expedited approval processes for zero-emission vehicles have enabled rapid scale-up, while other markets such as Japan and South Korea are integrating hydrogen fuel cell electric trucks into their decarbonization roadmaps. Meanwhile, emerging markets in Southeast Asia are piloting medium-duty electric fleets for urban delivery, supported by international infrastructure coalitions and climate finance programs.

This comprehensive research report examines key regions that drive the evolution of the Electric Trucks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Electric Truck Manufacturers and Tier-One Suppliers Shaping Innovation, Production, and Competitive Positioning

Tesla’s vertically integrated production model and localized battery supply chain have insulated its electric truck program from tariff shocks, positioning it as a structural winner in the evolving trade environment. In contrast, legacy OEMs such as General Motors and Ford are balancing their commitments to electric models with investments to expand gasoline truck production, reflecting broader strategic recalibrations within the industry. German manufacturers like Daimler Truck and Volvo Trucks are leveraging modular platforms and joint ventures to enhance regional agility, while startups such as Rivian and Nikola focus on niche applications, including last-mile delivery and hydrogen-powered long-haul solutions. These competitive dynamics underscore the importance of production footprint, supplier partnerships, and regulatory alignment in shaping market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Trucks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo

- Ashok Leyland Limited

- Bollinger Motors, Inc.

- BYD Company Limited

- Eicher Motors Limited

- Ford Motor Company

- Freightliner Trucks by Daimler AG

- General Motors Company

- GreenPower Motor Company Inc.

- Hyundai Motor Company

- Hyzon Motors Inc.

- Iveco S.p.A.

- Lion Electric Company

- Nikola Corporation

- PACCAR Inc.

- Piaggio Vehicles Pvt. Ltd.

- Rivian Automotive, Inc.

- Stellantis N.V.

- Tata Motors Limited

- Tesla, Inc.

- TRATON SE by Volkswagen Group

- Volta Trucks AB

- Workhorse Group Inc.

Actionable Strategies for Industry Leaders to Accelerate Electric Truck Adoption, Optimize Supply Chains, and Mitigate Regulatory Risks

Industry leaders seeking to excel in the electric truck market should prioritize end-to-end electrification strategies that include supply chain resilience, charging infrastructure partnerships, and digital fleet management tools. Establishing strategic alliances with utilities and infrastructure providers can expedite depot electrification while leveraging mobile and smart charging technologies can optimize energy costs and reduce downtime. Concurrently, investing in localized component manufacturing and modular designs will mitigate tariff exposure and enhance production flexibility. Finally, companies should engage proactively with regulators to help shape pragmatic implementation timelines for zero-emission mandates and coordinate pilot programs that demonstrate total cost of ownership advantages to risk-averse fleet operators.

Outlining a Robust Multi-Source Research Methodology Combining Primary Interviews, Secondary Data, and Quantitative Analysis

This research integrates both primary and secondary methodologies to ensure robust, validated insights. Primary research includes structured interviews with senior executives from OEMs, fleet operators, infrastructure developers, and policy experts, conducted between Q1 and Q2 2025. Secondary research sources encompass regulatory publications, industry association reports, technical white papers, peer-reviewed journals, and reputable news outlets, all cross-verified to eliminate bias and maintain objectivity. Quantitative data was subjected to triangulation, leveraging multiple sources to reconcile discrepancies. Data modeling incorporated sensitivity analyses to assess various policy and technological scenarios. The resultant framework provides a comprehensive, actionable view of electric truck market dynamics under differing regulatory and economic conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Trucks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Trucks Market, by Payload Capacity

- Electric Trucks Market, by Trucks Type

- Electric Trucks Market, by Propulsion Type

- Electric Trucks Market, by Battery Capacity

- Electric Trucks Market, by Application

- Electric Trucks Market, by Sales Channel

- Electric Trucks Market, by Region

- Electric Trucks Market, by Group

- Electric Trucks Market, by Country

- United States Electric Trucks Market

- China Electric Trucks Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Insights on Electric Trucks to Chart a Path Forward Amidst Policy Volatility and Technological Disruption

In summary, the electric truck market is at an inflection point, propelled by synergistic advances in battery technology, charging infrastructure, and supportive policy frameworks. While the 2025 United States tariffs introduce complexity into global supply chains, they also accelerate localization and innovation within manufacturing ecosystems. Segmentation analyses reveal differentiated opportunities across payload classes, truck types, and propulsion systems, underscoring the need for tailored go-to-market strategies. Regional dynamics vary widely, with the Americas leading deployment via incentive programs, Europe advancing through regulatory mandates, and Asia-Pacific scaling rapidly under government subsidies. Key industry players are adapting their portfolios and partnerships to maintain competitive advantage amidst this dynamic landscape. By embracing strategic investments, collaborative ecosystem engagement, and proactive regulatory dialogue, stakeholders can navigate the challenges and capitalize on the transformative potential of electric trucks.

Empower Your Strategic Decisions with Tailored Electric Truck Market Intelligence—Connect with Our Sales & Marketing Leader Today

To obtain an in-depth market research report tailored to your strategic goals and to gain unparalleled insights into the electric truck market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the comprehensive data, detailed analyses, and customizable options that will empower your organization to stay ahead of emerging trends and capitalize on growth opportunities. Contact him today to secure your copy of the report and unlock the actionable intelligence you need to drive success in this rapidly evolving industry.

- How big is the Electric Trucks Market?

- What is the Electric Trucks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?