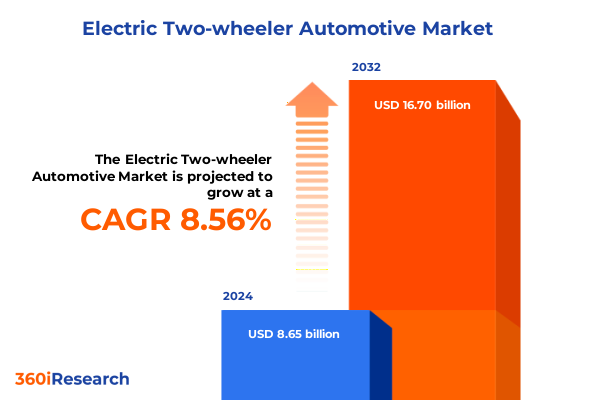

The Electric Two-wheeler Automotive Market size was estimated at USD 9.34 billion in 2025 and expected to reach USD 10.08 billion in 2026, at a CAGR of 8.65% to reach USD 16.70 billion by 2032.

Unveiling the Landscape of Electric Two-Wheel Mobility: Foundational Dynamics, Driving Forces, and Emerging Innovations Shaping the Future Market

Electric two-wheeler mobility is emerging as a cornerstone of sustainable urban transportation, propelled by converging factors of demographic shifts, consumer demand for eco-friendly solutions, and technological breakthroughs. In recent years, rising urbanization and congestion have catalyzed a search for agile, emission-free mobility modes that alleviate traffic pressures while aligning with environmental imperatives. At the same time, shifting consumer preferences, particularly among younger and millennial cohorts accustomed to digital conveniences, have fueled the adoption of connected, app-enabled vehicles that offer both convenience and personalization. According to the U.S. Department of Energy, 1.1 million electric bicycles were sold in the United States in 2022-nearly quadrupling the volume reported in 2019-and signaling a rapid mainstreaming of these vehicles among urban commuters.

Against this backdrop, the electric two-wheeler segment has attracted significant investment from both startups and established automotive players. Advances in battery chemistry, powertrain efficiency, and smart connectivity have unlocked new use cases and performance thresholds, enabling ranges in excess of 200 miles on premium models and instantaneous digital services like remote diagnostics and over-the-air updates. Concurrently, government and municipal programs are evolving to support infrastructure expansion and consumer incentives, laying the foundation for broader adoption. As the industry enters a pivotal phase of scale and maturity, these foundational dynamics will shape competitive strategies, regulatory engagement, and partnership ecosystems, setting the stage for transformative growth in the coming years.

Mapping the Transformative Shifts Redefining Electric Two-Wheeler Markets through Technological Advances Regulatory Evolutions and Consumer Adoption Patterns

Technological innovation has dramatically redefined the competitive landscape of electric two-wheelers, as breakthroughs in solid-state and advanced lithium-ion battery architectures boost energy density and cut charging durations. Premium motorcycles and scooters now routinely deliver 150 to 200 miles of range, while compact urban models achieve rapid charging to 80 percent capacity within an hour, effectively dissolving “range anxiety” for most daily commuters. These hardware advances are paralleled by software innovations: IoT-enabled telematics platforms and AI-driven analytics empower fleet operators and individual riders to optimize performance, maintenance, and route selection, driving efficiencies in both cost and user experience.

Regulatory evolution and policy incentives have also accelerated market transformation. Federal funding under the Inflation Reduction Act has filtered into local grant schemes, such as New Orleans’ allocation of nearly $50 million for infrastructure expansion and e-bike rebate initiatives, underscoring the administration’s commitment to decarbonizing urban mobility. On a macro level, governments are revisiting zoning and traffic regulations to accommodate micromobility lanes, while municipal partnerships with mobility providers are proliferating in major cities. As a result, shared electric bikes and scooters are now a ubiquitous sight on city streets, reshaping the mobility mix and unlocking new last-mile use cases.

Meanwhile, evolving consumer behavior is redefining service models. The rapid growth of shared fleets-evidenced by Lime’s preparation for its anticipated IPO after expanding operations to over 280 cities and achieving $686 million in net revenue in 2024-signals investor confidence and the viability of subscription- and usage-based frameworks that complement traditional ownership models. Taken together, these technological, regulatory, and behavioral shifts are forging a dynamic ecosystem in which agility, digital integration, and stakeholder collaboration will determine competitive leadership.

Assessing the Cumulative Impact of United States Tariff Measures in 2025 on Electric Two-Wheeler Supply Chains Manufacturing Costs and Market Competitiveness

The United States’ trade policy landscape in 2025 has introduced a complex layer of cost considerations for electric two-wheeler manufacturers and suppliers. Chief among these are the Section 232 steel and aluminum tariffs, which were elevated from 25 percent to 50 percent on June 4, 2025, following a presidential proclamation aimed at safeguarding national security interests and domestic industry competitiveness. Given that steel and aluminum constitute critical input materials for vehicle frames and structural components, manufacturers report material cost surcharges that strain existing production budgets and compress profit margins.

Complementing these metal tariffs are sweeping Section 301 levies on imports from China, which have persisted since 2018 and impact a broad array of two-wheeler components-ranging from hub motors to battery cells and control electronics. The expiration of tariff exclusion mechanisms has reinstated 25 percent duties on complete electric bicycles and their batteries, further inflating landed costs as manufacturers navigate a narrowing field of low-cost sourcing alternatives. A March 2025 survey by the Motor & Equipment Manufacturers Association highlighted that 78 percent of vehicle suppliers have encountered material supply chain disruptions or cost escalations tied to these tariffs, suggesting persistent headwinds for component availability and pricing stability.

In response, leading OEMs and tier-one suppliers are recalibrating their strategies. Some have embarked on nearshoring initiatives to relocate production closer to end markets, while others are absorbing tariff costs to maintain competitive pricing, albeit at the expense of tighter margins. Notably, major electric bike brands have shifted manufacturing bases to Southeast Asia-investing in Thailand-based assembly facilities-to diversify geopolitical risk and mitigate the immediate impact of 170 percent combined duties on Chinese imports. This strategic realignment underscores the cumulative impact of U.S. tariffs in 2025, pressing industry stakeholders to enhance supply chain resilience and pursue cost-effective localization models.

Distilling Key Insights from Comprehensive Segmentation Analyses Covering Vehicle Type Motor Configuration End User Profiles and Application Domains

Insightful segmentation provides a prism through which diverse electric two-wheeler consumer behaviors and usage patterns can be understood. When examining vehicle distinctions, the landscape encompasses bicycles, motorcycles, and scooters-each serving discrete mobility niches. Within the bicycle cohort, cargo-oriented platforms target delivery services and commercial logistics, while commuter e-bikes emphasize agility and compact design for urban dwellers. The motorcycle segment bifurcates into off-road machines, engineered for rugged terrain and recreational enthusiasts, and on-road models, configured for daily commuting with enhanced comfort and higher-speed capabilities. Scooters further diversify into fully electric variants offering quiet, convenient operation for sporadic urban trips, and hybrid systems that blend combustion and electric power to extend operational range and flexibility.

Motor configuration merits its own analysis. Hub motors, prized for their simple architecture and integration at the wheel, deliver low maintenance and ease of installation, making them ubiquitous in entry-level models. Mid-drive motors, placed near the crankshaft, optimize weight distribution and torque delivery, appealing to performance-focused riders and steep-terrain applications. Rear-wheel motors, though less common, accommodate specialized designs by delivering direct power to the back wheel and enabling slim frame profiles.

End-user preferences delineate two principal cohorts. Casual riders seek dependable, cost-effective solutions for short commutes, last-mile trips, and leisure excursions, placing a premium on user-friendly controls and minimal maintenance demands. In contrast, performance enthusiasts prioritize advanced features, extended range, higher top speeds, and customization options that reflect a sports-oriented riding ethos.

Finally, application contexts frame commercial and private use cases differently. Commercial operators leverage two-wheelers for fleet-based services such as delivery, rental, and shared mobility, emphasizing durability, serviceability, and total cost of ownership metrics. Personal mobility use caters to individual ownership, where aesthetic design, connectivity features, and brand positioning shape purchase decisions. Rental services, whether station-based or dockless, emphasize high utilization rates, rugged hardware capable of frequent turnover, and integrated telematics for fleet management. These multidimensional segmentation insights reveal the tailored value propositions that players must develop to resonate with targeted market segments.

This comprehensive research report categorizes the Electric Two-wheeler Automotive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Motor Type

- End User

- Application

Illuminating Regional Dynamics Driving Electric Two-Wheeler Adoption Patterns Across the Americas Europe Middle East Africa and the Asia-Pacific

Regional dynamics play a defining role in the global electric two-wheeler narrative, with each geography charting a distinctive trajectory of adoption and innovation. In the Americas, federated policy frameworks and state-level incentives have catalyzed adoption in metropolitan corridors. The U.S. leads the region, as evidenced by the rapid scaling of shared micromobility platforms; Lime’s network spans over 280 cities and reported a 32 percent increase in net revenue to $686 million in 2024, reflecting robust urban uptake and investor optimism. Urban centers such as New York, Austin, and San Francisco are deploying dedicated micro-mobility lanes and rebate programs that bolster both consumer purchase and public fleet expansion.

Europe, the Middle East, and Africa collectively showcase an ecosystem shaped by stringent emissions targets and integrated urban planning. The European Union’s Fit for 55 agenda and national directives, such as Germany’s e-mobility subsidies and the Netherlands’ extensive charging infrastructure investments, have positioned Western Europe as a mature market where average ownership rates of electric scooters exceed 10 per 1,000 inhabitants. Simultaneously, Gulf states are piloting public rental schemes to reduce oil dependency and enhance tourism experiences, while South African cities integrate e-bikes into commuting solutions to mitigate congestion and air pollution.

Asia-Pacific remains the vanguard of production and consumption. China commands the lion’s share of manufacturing capacity and home-market volumes, supported by local champions and aggressive industrial policies. Elsewhere, Southeast Asian nations are rapidly scaling battery-swapping infrastructure, with market leaders like Gogoro expanding services beyond Taiwan into Singapore and Kathmandu, underpinned by strategic investments such as Castrol’s $50 million stake in Gogoro’s battery-swapping ecosystem. Governments across India, Japan, and Australia are promulgating incentive schemes and local content mandates to nurture domestic assembly hubs, ensuring the region’s continued dominance in both supply and demand.

This comprehensive research report examines key regions that drive the evolution of the Electric Two-wheeler Automotive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players in Electric Two-Wheelers Highlighting Strategic Initiatives Partnerships and Innovations Shaping Industry Competition

Leading corporations are executing differentiated strategies to secure competitive advantage in electric two-wheeler markets. NIU Technologies, a trailblazer in smart urban mobility, dramatically expanded its U.S. presence by launching electric scooters and e-bikes in over 800 Best Buy stores nationwide in mid-2024, furthering brand accessibility and elevating on-the-ground consumer engagement. These omnichannel initiatives, complemented by a 57 percent year-over-year surge in first quarter 2025 global e-scooter sales, underscore NIU’s effective blend of product innovation and strategic retail partnerships.

Gogoro has differentiated itself through its proprietary battery-swapping ecosystem and strategic alliances. In June 2024, lubricant powerhouse Castrol invested $50 million in Gogoro’s Smartscooter platform, signaling broad industrial support for electric two-wheeler refueling infrastructures and reinforcing Gogoro’s position as a technology leader in key APAC markets. Concurrent pilot launches in Singapore, Nepal, and the Philippines demonstrate Gogoro’s replicable hub-and-spoke model for rapid network build-out and urban integration.

Aventon, a prominent U.S. electric bike brand, has proactively reconfigured its supply chain by shifting all production to Thailand, absorbing a 10 to 15 percent cost premium to shield consumers from immediate tariff-related price inflation. This strategic absorption underscores the brand’s commitment to price accessibility while preserving margin stability amid evolving trade policies.

Lime’s pursuit of a U.S. IPO with backing from Goldman Sachs and JPMorgan Chase reflects growing investor confidence in scalable micromobility models. The company’s financial resilience, evidenced by positive free cash flow in 2024 and a 32 percent net revenue uptick, positions Lime as a bellwether for public market receptivity to electric two-wheeler service providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Two-wheeler Automotive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aima Technology Group Co. Ltd.

- AOSTIRMOTOR

- Ather Energy Private Limited

- BAJAJ AUTO LIMITED

- BMW AG

- Ducati Motor Holding S.p.A by Volkswagen AG

- Energica Motor Company SpA by Ideanomics, Inc.

- Giant Manufacturing Co.

- Gogoro Inc

- Hero Electric Vehicles Private Limited

- Hyundai Motor Group

- Jiangsu Xinri E-Vehicle Co. Ltd.

- Kalkhoff Werke Gmbh

- Kinetic Green Energy & Power Solutions Ltd

- MAHINDRA ELECTRIC AUTOMOBILE LIMITED

- Merida Industry Co., Ltd.

- MV Agusta Motor S.p.A by PIERER Mobility AG

- Okinawa Autotech Internationall Private Limited

- Ola Electric Mobility Limited

- Revolt Intellicorp Pvt. Ltd. by RattanIndia Enterprises Ltd

- Riese & Müller GmbH

- Santa Cruz Bicycles, Inc

- The Ford Motor Company

- Trek Bicycle Corporation

- TVS Motor Company Limited

- Vmoto Soco Italy S.R.L.

- Yadea Technology Group Co.,Ltd.

Articulating Actionable Strategic Recommendations Empowering Electric Two-Wheeler Industry Leaders to Navigate Disruption and Capitalize on Emerging Opportunities

Industry leaders should prioritize a diversified supply chain strategy to mitigate geopolitical risks and cost volatility. By cultivating manufacturing partnerships in Southeast Asia and exploring domestic assembly opportunities, stakeholders can reduce dependency on single-source regions while tapping into regional trade agreements and local incentives. Complementary joint ventures with local partners can expedite market entry and foster tailored product development aligned with regional regulations and consumer preferences.

Investment in advanced battery technologies and modular powertrain architectures will be critical to sustain performance leadership and cost competitiveness. Engaging in pre-competitive consortia and co-development initiatives can accelerate R&D timelines and drive economies of scale. Simultaneously, companies must remain vigilant to emerging solid-state chemistries, AI-driven battery management systems, and second-life material recycling frameworks to realize both environmental and economic benefits.

From a go-to-market perspective, embedding digital services and subscription models that blend ownership and usage paradigms will cater to changing consumer behaviors. Leveraging data analytics for dynamic pricing, predictive maintenance, and personalized customer engagement will differentiate service offerings and enhance lifetime value. Rigorous pilot programs and responsive feedback loops will ensure product-market fit and foster sustained loyalty.

Engagement with policymakers and regulatory bodies is equally vital. Proactive advocacy for supportive infrastructure policies, streamlined vehicle approval processes, and balanced safety regulations will enable scalable deployment. Collaboration through industry associations and public-private partnerships can amplify collective voice and accelerate the establishment of dedicated micromobility lanes, charging standards, and rebate programs.

Outlining Robust Research Methodology Integrating Primary Expert Engagement Secondary Data Triangulation and Comprehensive Analytical Frameworks for Rigorous Market Intelligence

This research integrated a meticulous blend of primary and secondary methodologies to ensure comprehensive market coverage and analytical rigor. Primary engagements consisted of in-depth interviews with senior executives across OEMs, component specialists, infrastructure providers, and regulatory stakeholders, enabling nuanced understanding of strategic imperatives and operational realities. These insights were triangulated with responses from structured surveys targeting fleet operators, retail partners, and consumer cohorts, yielding quantitative validation of market trends and segment behaviors.

Secondary research encompassed a thorough review of publicly available company reports, fact sheets, press releases, and trade data sourced from government agencies and reputable news outlets. Proprietary databases and industry publications provided granular information on tariffs, trade flows, and material cost shifts. Additionally, patent analyses and technology roadmaps were examined to gauge innovation trajectories in battery chemistry, power electronics, and connectivity platforms.

Rigorous data cleansing and normalization protocols were applied to harmonize disparate data sets, followed by multi-variable scenario modeling to assess sensitivity to regulatory changes, tariff adjustments, and consumer adoption curves. Cross-validation against third-party forecasts and peer benchmarks ensured consistency and minimized bias. This multidimensional research framework underpinned the robustness of our findings and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Two-wheeler Automotive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Two-wheeler Automotive Market, by Vehicle Type

- Electric Two-wheeler Automotive Market, by Motor Type

- Electric Two-wheeler Automotive Market, by End User

- Electric Two-wheeler Automotive Market, by Application

- Electric Two-wheeler Automotive Market, by Region

- Electric Two-wheeler Automotive Market, by Group

- Electric Two-wheeler Automotive Market, by Country

- United States Electric Two-wheeler Automotive Market

- China Electric Two-wheeler Automotive Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Synthesis Emphasizing Key Takeaways Strategic Imperatives and Future Trajectories Poised to Drive Growth in Electric Two-Wheeler Markets

The electric two-wheeler landscape stands at an inflection point, driven by synergistic advances in materials, electrification architectures, and digital connectivity. While the industry is buoyed by strong consumer momentum and supportive policy frameworks, it faces tangible headwinds from evolving trade policies and input cost pressures. Strategic agility-encompassing supply chain diversification, technology co-development, and digital service integration-will define industry leaders capable of converting disruption into opportunity.

Segmentation analysis underscores the necessity of tailored value propositions that resonate with commercial operators, urban commuters, and performance-oriented riders alike. Regional insights illuminate the differentiated maturity trajectories and policy enablers across the Americas, EMEA, and Asia-Pacific, affirming that localized execution and strategic partnerships are indispensable to capturing growth niches.

As the competitive arena intensifies and stakeholders vie for market share, actionable recommendations grounded in supply chain resilience, technological innovation, and ecosystem collaboration will be paramount. The window for decisive action is now, with market positions and brand allegiances crystallizing ahead of the next wave of scale deployments and regulatory milestones.

Seize the chance to collaborate with Ketan Rohom and acquire definitive market research insights to accelerate your electric two-wheeler strategy

Are you ready to turn these insights into strategic advantage? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure the comprehensive electric two-wheeler market research report and equip your organization with actionable intelligence for sustained growth and competitive differentiation.

- How big is the Electric Two-wheeler Automotive Market?

- What is the Electric Two-wheeler Automotive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?