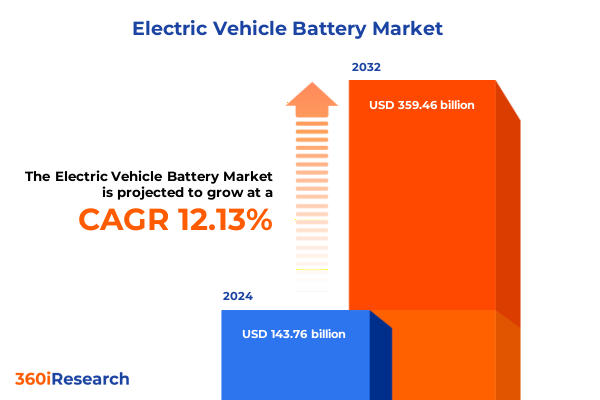

The Electric Vehicle Battery Market size was estimated at USD 160.52 billion in 2025 and expected to reach USD 179.24 billion in 2026, at a CAGR of 12.20% to reach USD 359.46 billion by 2032.

Setting the Stage for Electric Vehicle Battery Market Evolution in a Rapidly Decarbonizing and Technology-Driven Automotive Landscape

Setting the context for the rapid electrification of transportation, the electric vehicle battery market stands at the crossroads of technological breakthroughs, environmental imperatives, and shifting consumer preferences. Over the past decade, a confluence of factors such as climate policy commitments, corporate decarbonization targets, and heightened consumer awareness has propelled battery technology from niche applications to the mainstream. This introduction synthesizes the forces shaping the sector’s trajectory and highlights the pivotal role batteries will play in the broader energy transition.

At the heart of this evolution lies the marriage of energy density improvements with cost reductions driven by economies of scale and manufacturing innovations. Advances in materials science have yielded higher nickel-content cathodes and stabilized solid-state designs, while process refinements have pushed giga-factories into new markets. Meanwhile, governmental incentives and regulatory frameworks have created fertile ground for growth, prompting legacy automakers and new entrants to overhaul supply chains and invest in next-generation chemistries.

As stakeholders across the value chain-from raw material suppliers to OEMs and technology providers-grapple with these dynamics, a keen understanding of market drivers, emerging challenges, and strategic imperatives becomes essential. This section lays the groundwork for exploring transformative shifts, tariff impacts, segmentation nuances, regional variations, competitive landscapes, and actionable recommendations that follow

How Recent Technological Breakthroughs and Policy Interventions Are Reshaping the Electric Vehicle Battery Landscape with Unprecedented Speed

The landscape of electric vehicle batteries is undergoing seismic transformation fueled by breakthroughs in chemistry, manufacturing scale, and policy incentives. Materials innovation, particularly the widespread shift toward nickel-manganese-cobalt formulations with optimized design ratios, has enabled dramatic enhancements in energy density and cycle life. Concurrently, the rise of lithium iron phosphate alternatives has democratized entry-level and commercial vehicle segments, offering safety and cost advantages. These parallel streams of development are redefining the competitive playing field.

Manufacturing footprints are also shifting as governments deploy subsidies and tax credits to attract giga-factory investments. Regions once peripheral to the automotive supply chain are emerging as critical hubs, spurred by local content requirements embedded in incentive programs. This realignment has catalyzed strategic partnerships among battery makers, automakers, and component suppliers, fostering integrated ecosystems that accelerate scale-up while mitigating geopolitical risk.

On the policy front, stringent emissions targets and lifecycle carbon accounting are elevating batteries from commodity components to strategic assets. This shift is driving early adoption of recycling frameworks and second-life applications, with circularity strategies emerging as a competitive differentiator. Together, these technological and regulatory currents are forging a radically new paradigm for electric mobility, demanding agility and foresight from every participant in the value chain

Evaluating the Comprehensive Implications of 2025 United States Tariff Measures on Supply Chains Manufacturing and Competitiveness in EV Batteries

When examining the cumulative implications of the latest U.S. tariff measures introduced in early 2025, it becomes clear that manufacturers and supply chain stakeholders are recalibrating strategies to balance cost pressures against the imperative of local sourcing. Tariffs targeting imported battery cells and precursor materials have elevated the importance of domestic production capacity and have incentivized joint ventures to expedite knowledge transfer and scale operations on home soil.

These measures have also reshaped procurement strategies for raw material miners and refiners, prompting a shift toward localized processing facilities for key metals such as lithium, nickel, and cobalt. As import duties apply full value to finished cells, many battery producers are exploring vertical integration models that bring raw material processing, electrode production, and cell assembly under one roof. This trend has ripple effects across logistics, capital investment, and risk management frameworks.

On the demand side, OEMs have begun adjusting vehicle pricing and contract structures to reflect the incremental tariff-driven cost. Long-term supply agreements now often include clauses for tariff adjustments or rebate mechanisms, highlighting the need for flexible commercial terms. Although short-term cost headwinds have been significant, the tariffs are accelerating a strategic pivot toward domestic ecosystems, fostering resilience and technological sovereignty in the U.S. battery industry

Unveiling Critical Market Dynamics Through End Use Application Capacity Form Factor and Chemistry-Based Segmentation Perspectives

A nuanced view of the battery market emerges through a layered segmentation framework. The analysis differentiates between replacement and original equipment channels, tracing demand patterns driven by vehicle age, warranty policies, and service network density. It then parses the spectrum of applications from high-capacity buses and commercial fleets-subdivided into heavy and light duty-to private passenger automobiles and agile two-wheeler segments that include both electric bicycles and scooters.

Delving deeper, capacity tiers reveal divergent use cases and cost structures. Entry-level configurations with less than 50 kilowatt hours, further categorized into systems between 20 and 50 and ultra-compact packs below 20 kilowatt hours, cater to micro-mobility and urban runabout models. Mid-range modules spanning 50 to 100 kilowatt hours, in segments of 50–75 and 75–100 kilowatt hours, address mainstream passenger and light commercial applications. Meanwhile, high-capacity solutions above 100 kilowatt hours-divided into 100–150 and more than 150-serve long-haul transport and premium electric vehicles.

Further distinction is drawn by cell form factor, contrasting cylindrical, pouch and prismatic designs for their respective benefits in energy density, thermal management and manufacturing efficiency. Chemistry analysis encompasses lithium iron phosphate, lithium titanate, nickel cobalt aluminum, and multiple nickel-manganese-cobalt iterations-NMC 111, 532, 622 and 811-alongside emerging solid state technologies. This holistic segmentation illuminates the unique value propositions and growth vectors that shape investment and product roadmaps

This comprehensive research report categorizes the Electric Vehicle Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Capacity

- Cell Form Factor

- Battery Chemistry

- End Use

- Application

Decoding Geographical Variations in Electric Vehicle Battery Adoption Across Americas EMEA and Asia Pacific Markets

Geographic analysis highlights divergent trajectories across major global regions. In the Americas, accelerated adoption hinges on pro-electrification policies, robust charging infrastructure build-out, and legacy automaker transitions to electric platforms. North America’s growing network of battery manufacturing facilities underscores a strategic shift toward localized supply chains, while Latin American nations explore opportunities in mineral-rich economies to capture upstream value.

In Europe, the Middle East and Africa, regulatory rigor and sustainability mandates are converging to enforce circularity and recycling imperatives. European Union directives on carbon accounting and second-use programs are driving collaboration between OEMs and specialized recyclers. Meanwhile, Middle Eastern stakeholders are investing in gigafactory developments to diversify energy portfolios, and select African markets are emerging as critical sources of battery-grade minerals.

Asia-Pacific remains the largest and most mature region, propelled by established manufacturers, integrated supply chains, and supportive industrial policy frameworks. China’s dominance in cell production continues, but emerging markets in Southeast Asia and India are making strategic moves to capture manufacturing capacity and downstream application opportunities. Across the region, incentives target not only production scale but also innovation ecosystems, ensuring a steady pipeline of next-generation battery advancements

This comprehensive research report examines key regions that drive the evolution of the Electric Vehicle Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Breakthroughs in Battery Technology and Market Expansion Strategies

A competitive landscape featuring both established energy giants and agile disruptors underscores the dynamism of the battery sector. Leading players have rapidly scaled up giga-factory capacities, leveraging decades of electrochemistry expertise while forming strategic alliances with automakers to secure long-term offtake agreements. At the same time, new entrants specializing in solid state research or advanced cathode formulations are carving out niches by de-risking supply chains and demonstrating performance advantages in cycle life and safety.

Collaboration has become a hallmark of market strategy, with consortiums uniting upstream miners, chemical producers, and cell manufacturers under shared R&D initiatives. This ecosystem-driven approach facilitates iterative innovation while distributing capital intensity across partners. It also accelerates time-to-market for breakthroughs such as silicon-dominant anodes and high-voltage electrolytes. Furthermore, service providers focused on battery management systems and digital twins are establishing themselves as linchpins for optimization and lifecycle management.

As patent portfolios expand and trade secret defenses intensify, companies are increasingly relying on geographic diversification and co-investment to mitigate geopolitical risk. The most successful organizations exhibit a balanced portfolio that spans commodity-grade chemistries for cost-sensitive segments and premium formulations for high-performance applications, positioning themselves for resilience amid evolving policy landscapes and technology transitions

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Vehicle Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A123 Systems, LLC

- Amperex Technology Ltd.

- BYD Company Limited

- China Aviation Lithium Battery Co., Ltd.

- Contemporary Amperex Technology Co., Limited

- Electrovaya, Inc.

- Envision AESC Group Co., Ltd.

- Envision AESC Group Ltd.

- Farasis Energy (Ganzhou) Co., Ltd.

- Farasis Energy, Inc.

- GS Yuasa Corporation

- Hefei EVE Energy Co., Ltd.

- Hitachi, Ltd.

- LG Energy Solution, Ltd.

- Microvast, Inc.

- Northvolt AB

- Panasonic Corporation

- Romeo Power, Inc.

- SAFT Groupe S.A.

- Samsung SDI Co., Ltd.

- SK On Co., Ltd.

- Sunwoda Electronic Co., Ltd.

- Tesla, Inc.

- Toshiba Corporation

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends and Navigate Challenges in the Electric Vehicle Battery Sector

Industry leaders must adopt a multi-pronged strategy to capitalize on technological trends while navigating policy and supply chain complexities. A primary focus should be vertical integration efforts that secure upstream access to critical minerals and enable seamless transition from precursor material to cell assembly. Strengthening supplier relationships and pursuing equity stakes in mining operations can enhance cost efficiency and supply assurance.

Simultaneously, investment in modular and scalable manufacturing architectures will be crucial to manage demand volatility and rapidly pivot to new cell chemistries. Companies should establish flexible production lines capable of accommodating emerging formats such as solid state designs. Parallel to this, deploying robust battery management systems and digital analytics platforms will optimize performance, extend lifespan, and support recycling initiatives.

On the market front, proactive engagement with regulators and participation in circular economy forums can help shape pragmatic recycling mandates and incentive structures. Strategic partnerships to develop second-life applications-ranging from stationary storage to grid balancing-can unlock additional revenue streams. Finally, executing targeted talent development programs will ensure that organizations possess the specialized skills required to sustain innovation in materials science, process engineering and system integration

Exploring the Rigorous Research Approach Underpinning Insights Through Data Collection Validation and Analytical Frameworks

This comprehensive analysis is built upon a robust research framework that integrates primary interviews with battery technologists, automotive engineers and policy experts alongside extensive secondary research from academic journals, industry white papers and public filings. Data triangulation ensures consistency by cross-referencing manufacturer disclosures, patent databases and regulatory agency publications. Primary qualitative insights were gathered through structured discussions with executives and lead scientists to validate technical feasibility and market adoption timelines.

Quantitative elements derive from a curated compilation of production and trade statistics, supply chain cost models and historical shipment data provided by reputable trade associations. All data points undergo rigorous validation through a multi-level review process that examines source credibility, methodology transparency and temporal relevance. This approach mitigates bias while ensuring that emerging dynamics-such as novel chemistry breakthroughs or tariff shifts-are captured in real time.

Analytical outputs leverage custom-built frameworks to map value chain dependencies, assess competitive intensity and forecast technology maturation curves. The methodology balances depth and breadth by focusing on critical inflection points without overstating speculative scenarios. A continuous feedback loop with subject-matter experts allows for iterative refinement, ensuring that conclusions and recommendations remain grounded in the latest industry developments

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Vehicle Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Vehicle Battery Market, by Battery Capacity

- Electric Vehicle Battery Market, by Cell Form Factor

- Electric Vehicle Battery Market, by Battery Chemistry

- Electric Vehicle Battery Market, by End Use

- Electric Vehicle Battery Market, by Application

- Electric Vehicle Battery Market, by Region

- Electric Vehicle Battery Market, by Group

- Electric Vehicle Battery Market, by Country

- United States Electric Vehicle Battery Market

- China Electric Vehicle Battery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Consolidating Core Insights and Future Perspectives to Illuminate the Path Forward for Electric Vehicle Battery Innovation and Deployment

Bringing together the insights across technology, policy, segmentation, regional dynamics and competitive strategies reveals a coherent narrative of transformation within the electric vehicle battery industry. Technological innovation is converging with strategic policy interventions to accelerate the transition toward cleaner mobility, while segmentation analysis highlights the diverse pathways through which market participants can create value.

Regional distinctions underscore the importance of localized solutions, whether through U.S. reshoring efforts, Europe’s sustainability mandates or Asia-Pacific’s integrated manufacturing networks. Competitive profiling further illustrates how collaboration and adaptability serve as critical differentiators in an environment defined by rapid change. Actionable recommendations emphasize the necessity of integrated supply chains, flexible production platforms and circular economy strategies to drive cost efficiencies and resilience.

Ultimately, the path forward demands a balanced approach that marries aggressive innovation with pragmatic risk management. Organizations that can navigate the complex interplay of tariffs, incentives and technological shifts will be best positioned to lead the next wave of growth in electric vehicle batteries and contribute meaningfully to decarbonization goals

Engage with Associate Director of Sales and Marketing to Unlock Comprehensive Electric Vehicle Battery Market Research Report and Drive Informed Decisions

For organizations seeking to harness the full power of this in-depth analysis and transform strategic initiatives into tangible outcomes, direct engagement with Ketan Rohom (Associate Director, Sales & Marketing) will ensure a tailored approach aligned with your specific goals. His expertise in translating complex market insights into actionable business plans offers a seamless pathway to leveraging this comprehensive report. By collaborating closely with Ketan, decision-makers can gain clarity on critical opportunities, navigate evolving regulatory landscapes, and adopt best practices that underpin sustainable growth.

Initiate a conversation today to explore customized research packages, exclusive briefings, or extended support services designed to amplify your competitive edge. With expert guidance on emerging battery chemistries, supply chain optimization, and policy impacts, your team will be equipped to make informed, forward-looking decisions. Reach out to Ketan Rohom to secure your access and embark on a journey toward pioneering breakthroughs in the electric vehicle battery sector.

- How big is the Electric Vehicle Battery Market?

- What is the Electric Vehicle Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?