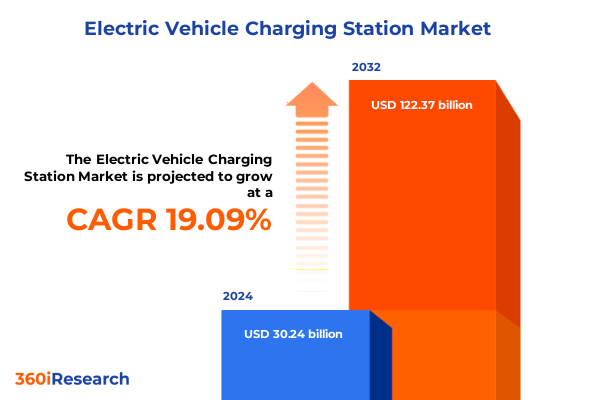

The Electric Vehicle Charging Station Market size was estimated at USD 35.60 billion in 2025 and expected to reach USD 42.04 billion in 2026, at a CAGR of 19.28% to reach USD 122.37 billion by 2032.

Pioneering the Future of Mobility by Examining the Strategic Role and Emerging Dynamics of Electric Vehicle Charging Stations in Modern Infrastructure

The evolution of electric mobility has catalyzed an unprecedented focus on charging infrastructure as a cornerstone of modern transportation ecosystems. As electric vehicle adoption accelerates, charging stations have become pivotal enablers of convenience, range confidence, and mass market acceptance. This shift transcends mere convenience; it represents a fundamental reconfiguration of energy distribution, urban planning, and consumer behavior. Stakeholders across the public and private sectors are investing in networks that must balance reliability, accessibility, and cost efficiency to support sustained growth in vehicle electrification.

Navigating this evolving landscape requires a clear understanding of the interplay between technological innovation, regulatory frameworks, and user expectations. Advances in connector standards, charging speeds, and digital management platforms are redefining how drivers interact with charge points and how operators optimize utilization. Concurrently, government incentives, utility company partnerships, and environmental mandates continue to shape roll-out strategies, driving providers to adopt agile business models that can respond to shifting policy and market dynamics.

This executive summary distills core developments in the charging station arena, highlighting transformative trends, tariff-related impacts, segmentation insights, regional variations, and leading company strategies. It culminates in targeted recommendations designed to empower decision makers in designing and deploying charging infrastructure that meets both current demands and future uncertainties. By offering a clear roadmap of these critical factors, this report equips leaders with the strategic clarity needed to capitalize on the rapidly evolving electric vehicle charging opportunity.

Understanding the Multifaceted Transformations Reshaping Electric Vehicle Charging Station Deployment and Consumption Patterns across the Industry Landscape

The landscape of electric vehicle charging is undergoing profound change as technological advancements and stakeholder priorities converge to reshape deployment and utilization. Fast-charging capabilities once reserved for niche applications are now integral to mainstream networks, driven by continuous improvements in power electronics, thermal management, and grid integration. At the same time, the proliferation of digital platforms has introduced real-time monitoring, dynamic pricing, and predictive maintenance, enabling operators to maximize uptime and optimize energy flow within local distribution systems.

Beyond technology, emerging partnerships are redefining industry boundaries. Automakers, utilities, and retail operators are collaborating to embed charging points into destination locations, leveraging retail foot traffic and energy infrastructure to enhance revenue streams. Meanwhile, utility-scale renewable energy projects are increasingly paired with charging hubs, reflecting a growing emphasis on sustainability and decentralized power generation. This convergence of clean energy assets and vehicle electrification underscores a holistic vision where charging stations act as both energy consumers and grid-resilient assets, supporting load balancing and peak demand management.

Consumer expectations are evolving alongside these shifts. The modern driver demands seamless interoperability across networks, transparent pricing models, and minimal wait times. To address these demands, operators are deploying interoperable payment systems, reservation functionalities, and intelligent load-balancing solutions that adapt to fluctuating grid conditions. This confluence of technological innovation and user-centric design is forging a charging ecosystem that not only supports current adoption rates but also lays the groundwork for widespread integration of electric transportation into daily life.

Analyzing the Comprehensive Influence of 2025 United States Tariff Policies on the Supply Chain Economics and Technology Adoption in Charging Networks

The introduction of new tariff measures by the United States in 2025 has injected a critical variable into the economics of electric vehicle charging network expansion. Tariffs on imported charging equipment and key components have elevated the cost base for charging station operators, prompting a reevaluation of supply chain strategies. This policy shift has had the effect of incentivizing domestic manufacturing initiatives while simultaneously driving some providers to explore alternative sourcing agreements in regions unaffected by the new duties.

At the component level, higher import levies on power electronics, connectors, and cable assemblies have narrowed margins for station installers, in many cases eroding the cost benefits achieved through economies of scale. Industry participants are responding by negotiating long-term agreements with domestic suppliers, forging joint ventures for local production, and investing in advanced automation to reduce labor-dependent costs. These strategic shifts are reshaping vendor relationships and accelerating the localization of manufacturing capabilities.

Despite the immediate cost pressures, the tariff framework aligns with broader national objectives to enhance resilience and stimulate domestic industry. Government incentives under complementary policies such as tax credits and infrastructure grants are helping to offset incremental expenses, further stimulating local capacity expansion. As a result, while end users may experience modest increases in charging fees, the long-term effect is a more diversified and robust supply chain capable of supporting large-scale deployment goals.

Dissecting Critical Market Segments to Reveal Charging Type Connector Preferences Operational Models Business Approaches and End Use Demands

Segmentation by charging type reveals a foundational dichotomy between alternating current (AC) and direct current (DC) charging, each serving distinct user requirements. AC charging, encompassing both Level 1 and Level 2 systems, continues to dominate residential and workplace installations due to its compatibility with existing electrical infrastructure and lower upfront costs. Level 1 setups offer simple overnight charging solutions, while Level 2 stations emerge as the standard for multifamily housing complexes and on-site employee charging environments where moderate power levels meet daily commuting needs.

Connector standards have become a pivotal distinguishing factor in network interoperability. The Combined Charging System (CCS) has achieved broad adoption in North America and Europe, driven by OEM endorsements and a growing public network footprint. Conversely, CHAdeMO retains a niche presence among legacy vehicle fleets and regions with established infrastructure. This bifurcation in connector preference highlights the need for multi-standard installations and adaptable retrofit solutions as fleets evolve.

Operational models further segment the landscape into networked and standalone solutions. Cloud managed platforms offer operators comprehensive remote diagnostics, dynamic load management, and integrated billing features, driving premium subscription revenues. Self managed systems, by contrast, appeal to property owners seeking direct oversight and cost control without recurring service fees. Each model aligns with specific site priorities, from high-traffic convenience centers to privately owned residential complexes.

Business models are likewise diversifying to address varied user expectations. Free charging remains attractive as a value-add for hospitality and retail venues aiming to enhance customer dwell time, whereas pay-per-use schemes align with public roadside networks seeking direct cost recovery. Subscription based offerings are emerging among fleet operators, providing predictable cost structures and dedicated capacity. This flexibility in commercial approach is vital for tailoring services to the unique demands of each location.

End use applications span a spectrum from commercial installations-such as hospitality, retail, and workplace charging-to fleet operations, both commercial and passenger, as well as public roadside hubs and residential points of charge. Each end use brings specific utilization patterns, revenue potential, and integration challenges, underscoring the importance of targeted infrastructure planning to meet the nuanced needs of distinct consumer and business segments.

This comprehensive research report categorizes the Electric Vehicle Charging Station market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Charging Type

- Connector Type

- Operation

- Business Model

- End Use

Exploring Regional Variations in Charging Infrastructure Development and Adoption Trends across the Americas Europe Middle East Africa and Asia-Pacific

The Americas region has positioned itself at the forefront of charging infrastructure innovation, driven primarily by substantial investments in the United States and Canada. National electrification mandates and incentive programs have accelerated network expansion along major transportation corridors and within urban centers. In the U.S., state-level rebate schemes and prorated tax credits are fueling demand for residential and commercial installations, while private enterprise partnerships are underwriting the rapid scaling of fast-charging hubs. Canada’s policy emphasis on sustainable mobility has yielded an integrated grid upgrade strategy, focusing on load balancing and renewable energy tie-ins to support growing charging loads.

Across Europe, the Middle East, and Africa, regulatory frameworks and energy market structures are shaping diverse deployment trajectories. Europe’s stringent emissions targets and harmonized standards have cultivated an interoperable multi-country network, leveraging cross-border interoperability of CCS connectors and unified payment platforms. Middle Eastern nations are leveraging renewable energy surpluses to pilot solar-powered charging stations, aligning with broader decarbonization agendas. African markets, while nascent, are exploring off-grid and microgrid-based charging solutions to circumvent traditional grid limitations, with an emphasis on leapfrog technologies to deliver reliable access in underserved regions.

In the Asia-Pacific, China’s aggressive domestic manufacturing ecosystem and extensive urban charging initiatives have set a global benchmark for station density and cost competitiveness. Japan continues to refine fast-charging standards, with CHAdeMO systems coexisting alongside emerging CCS installations in a hybrid network. South Korea’s network interoperability efforts and public-private partnerships have facilitated a methodical rollout of both AC and DC infrastructure. Meanwhile, Australia’s utility-backed programs are championing residential and regional fast-charging stations, integrating battery storage to manage peak demand and enhance grid stability.

This comprehensive research report examines key regions that drive the evolution of the Electric Vehicle Charging Station market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders to Uncover Strategic Partnerships Technological Innovations and Competitive Positioning in the Charging Ecosystem

Leading charge point operators and equipment manufacturers are driving a wave of strategic alliances and product innovations that underpin the competitive landscape. Firms specializing in turnkey station solutions are integrating advanced power modules, intelligent energy management systems, and proprietary payment gateways to differentiate their offerings in a crowded market. At the same time, emerging software developers are carving out niches in network analytics, offering real-time insights on station performance and user behavior to enhance uptime and revenue optimization.

Major automotive manufacturers are also deepening their commitments to charging networks, either through equity investments or greenfield joint ventures aimed at securing exclusive access for their vehicle fleets. These collaborations are producing brand-aligned fast-charging corridors and in-home charging bundles tailored to proprietary software ecosystems. Concurrently, utilities are launching co-investment models that reward grid-friendly load scheduling, leveraging time-of-use rates and demand response incentives to balance station usage against renewable generation profiles.

New entrants specializing in fleet-oriented charging services are targeting commercial logistics and passenger transport operators, offering scalable solutions that incorporate depot optimization, telematics integration, and fleet management platforms. Their holistic approach addresses both infrastructure and operational efficiency, enabling organizations to transition to electric mobility with minimal disruption. This convergence of station OEMs, software innovators, automotive OEMs, utilities, and fleet specialists is fostering an interconnected ecosystem that supports rapid scaling and continuous improvement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Vehicle Charging Station market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ampcontrol Technologies, Inc.

- Ampeco Ltd

- Blink Charging Co.

- Bolt.Earth

- BP PLC

- BYD Motors Inc.

- ChargeLab Inc.

- ChargePoint, Inc.

- Diebold Nixdorf, Incorporated

- Dover Corporation

- Eaton Corporation PLC

- Electrify America LLC

- Enel X Way USA, LLC

- ENGIE Group

- EVgo Services LLC

- Hitachi, Ltd.

- Leviton Manufacturing Co., Inc.

- Nichicon Corporation

- NovaCHARGE, Inc.

- Pacific Gas and Electric Company

- Panasonic Corporation

- Robert Bosch GmbH

- Royal Dutch Shell PLC

- Schneider Electric SE

- Shell PLC

- Siemens AG

- Signet Systems Inc.

- SparkCharge Network

- Tesla Motors, Inc.

- Touch GmbH

- Toyota Industries Corporation

- Virta (Liikennevirta Oy)

- YoCharge

Formulating Strategic Action Plans for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in the Electric Vehicle Charging Sector

Industry leaders should prioritize the development of resilient supply chains by forging partnerships with domestic manufacturers and exploring localized assembly models. By aligning sourcing strategies with evolving tariff structures and complementary policy incentives, organizations can mitigate cost fluctuations and ensure consistent equipment availability. In parallel, investing in modular station designs will enable faster deployment cycles and simplified maintenance protocols, enhancing network scalability.

Expanding the portfolio of fast-charging hubs along high-traffic corridors is critical for enabling long-distance travel confidence. Strategic site selection based on traffic density analytics and renewable energy availability will not only optimize operational performance but also align charging infrastructure rollout with sustainability objectives. Integrating on-site energy storage systems can further alleviate grid constraints and allow for dynamic load management during peak periods.

Operators should also experiment with diversified revenue models, blending pay-per-use, subscription, and value-added free-charging schemes to capture a broad spectrum of user segments. Subscription offerings can appeal to fleet operators seeking cost predictability, while loyalty-based incentives and time-sensitive promotions can drive consumer engagement at commercial venues. Leveraging data-driven personalization through mobile apps and loyalty integrations will enhance user experience and foster brand loyalty.

Finally, engaging proactively with regulatory bodies and utility partners will be essential for shaping demand response programs, time-of-use rate structures, and grid modernization efforts. By contributing to standards development and pilot initiatives, charging network stakeholders can influence policy outcomes that support efficient, reliable, and sustainable electrification at scale.

Illuminating the Rigorous Research Framework Employed to Analyze Market Dynamics and Ensure the Integrity of Electric Vehicle Charging Station Insights

This analysis synthesizes insights from an integrated research framework combining primary interviews with industry executives, technical specialists, and policy stakeholders alongside a comprehensive review of public filings, regulatory documents, and proprietary databases. Secondary research encompassed examination of equipment specifications, deployment case studies, and open-source energy market data to map historical trends and technology adoption patterns.

Quantitative data points were validated and triangulated across multiple sources, ensuring accuracy in characterizing tariff impacts and segmentation dynamics. Expert consultations contributed qualitative context, shedding light on strategic motivations behind partnership announcements, business model shifts, and regional policy adaptations. Detailed company profiling leveraged financial disclosures and press releases to identify competitive positioning and innovation trajectories.

Segmentation analysis was underpinned by a structured categorization methodology that delineates charging type, connector standards, operational modalities, business models, and end use applications. Regional insights were derived by overlaying macroeconomic indicators on infrastructure roll-out statistics, while supply chain dynamics were examined through trade data and tariff schedules. This layered approach ensures that findings reflect both the granular drivers of station deployment and the broader forces shaping industry evolution.

All research processes adhered to rigorous standards of data integrity and confidentiality. Insights were subjected to peer review by domain experts to validate interpretations and minimize bias. Ultimately, this methodology delivers a holistic and trustworthy foundation for strategic decision making in the electric vehicle charging station arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Vehicle Charging Station market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Vehicle Charging Station Market, by Charging Type

- Electric Vehicle Charging Station Market, by Connector Type

- Electric Vehicle Charging Station Market, by Operation

- Electric Vehicle Charging Station Market, by Business Model

- Electric Vehicle Charging Station Market, by End Use

- Electric Vehicle Charging Station Market, by Region

- Electric Vehicle Charging Station Market, by Group

- Electric Vehicle Charging Station Market, by Country

- United States Electric Vehicle Charging Station Market

- China Electric Vehicle Charging Station Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings to Emphasize Key Takeaways and the Strategic Imperative of Advancing Electric Vehicle Charging Infrastructure

The confluence of technological innovation, evolving policy frameworks, and strategic partnerships is propelling the electric vehicle charging station sector into a new era of maturity. From the accelerating shift toward fast-charging networks to the emergence of innovative business models, the infrastructure that supports vehicle electrification is becoming more sophisticated, interconnected, and resilient. Stakeholders must remain attentive to tariff developments, regional policy variations, and shifting consumer preferences to capitalize on growth opportunities and maintain competitive advantage.

Segmentation nuances-from charging type and connector standards to operational and commercial approaches-underscore the importance of tailored strategies that address specific customer needs and site characteristics. Regional dynamics further amplify this complexity, as regulatory incentives and energy mix considerations vary dramatically across the Americas, Europe, Middle East, Africa, and Asia-Pacific landscapes. Leading companies are leveraging these variables to carve out differentiated service offerings and forge collaborations that enhance network coverage and reliability.

As the sector advances, the imperative for robust supply chain management, modular design, and data-driven operations becomes increasingly pronounced. By adopting the actionable recommendations outlined in this report, industry players can accelerate deployment, optimize asset utilization, and cultivate positive user experiences. Ultimately, success in this rapidly evolving arena will hinge on the ability to integrate technological prowess with strategic foresight, ensuring that electric vehicle charging infrastructure remains a cornerstone of sustainable mobility ecosystems.

Engage with Ketan Rohom to Access the Complete Electric Vehicle Charging Station Study and Unlock Strategic Market Intelligence for Informed Decision Making

To explore the full depth of insights on electric vehicle charging station dynamics and secure the comprehensive market intelligence that drives strategic decision making, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the report’s unique offerings and facilitate access to a tailored package that aligns with your organizational objectives. Don’t miss the opportunity to leverage this in-depth research for your next strategic initiative-contact Ketan today to unlock the expertise you need to stay ahead of the curve.

- How big is the Electric Vehicle Charging Station Market?

- What is the Electric Vehicle Charging Station Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?