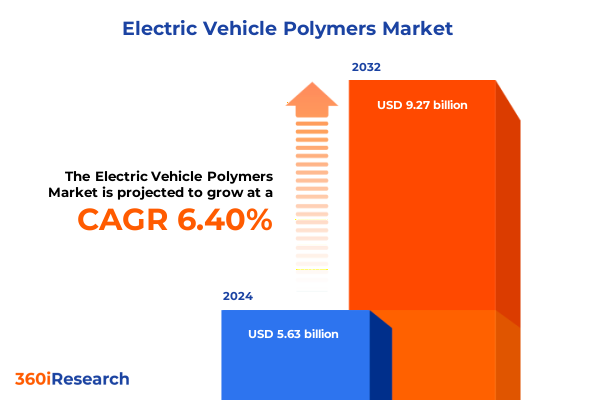

The Electric Vehicle Polymers Market size was estimated at USD 5.97 billion in 2025 and expected to reach USD 6.34 billion in 2026, at a CAGR of 6.46% to reach USD 9.27 billion by 2032.

Harnessing the Power of High Performance Polymers to Drive Sustainable Innovation Safety and Efficiency in Electric Vehicle Design

Polymers are at the heart of the electric vehicle revolution, offering the unique combination of lightweight strength and design flexibility that automakers demand. By replacing heavy metal components with advanced polymer formulations, manufacturers achieve significant weight reduction, which in turn enhances vehicle range and energy efficiency. At the same time, innovations in polymer chemistry deliver the thermal stability and chemical resistance required for high-voltage battery environments, ensuring both performance and safety are maintained under demanding operating conditions.

As sustainability becomes a top priority, the development of bio-based and recyclable polymers is accelerating, enabling circular economy approaches that reduce environmental impact across the vehicle lifecycle. Material scientists are collaborating closely with OEM engineering teams to tailor polymer blends for specific functions-ranging from high-temperature battery housings to impact-resistant exterior panels-while balancing cost, manufacturability, and longevity. This convergence of chemistry, engineering, and sustainability is reshaping how vehicles are designed and produced, positioning polymers as a strategic enabler of next-generation mobility.

Looking ahead, the capacity for polymers to integrate multiple functions-such as structural support, thermal management, and aesthetic finishing-within single components will become even more critical. As electric mobility scales to meet global climate targets, the role of polymers will expand beyond traditional applications to encompass multifunctional composite systems and smart materials. This introduction sets the stage for exploring the pivotal shifts, regional developments, and strategic imperatives that define the electric vehicle polymers landscape today.

Disruptive Technological Advancements and Regulatory Dynamics Combined with Global Supply Chain Realignments Reshaping the Electric Vehicle Polymers Ecosystem

The electric vehicle polymers ecosystem is undergoing disruptive transformation driven by converging forces of technological innovation and evolving regulatory frameworks. On the technology front, advances in polymer composite manufacturing-such as automated fiber placement and additive manufacturing-are enabling complex geometries and optimized material distributions that were previously unachievable. These techniques are not only elevating structural performance and crashworthiness but also reducing scrap and rework by enabling more precise control over material usage.

Concurrently, global supply chain realignments are reshaping how raw materials flow into automotive manufacturing hubs. Heightened emphasis on supply resilience has spurred nearshoring strategies and the diversification of feedstock sources, prompting polymer producers to establish new regional production facilities and joint ventures. Regulatory dynamics have intensified in parallel, with stricter emissions standards and chemical safety regulations mandating transparent supply chain traceability and stricter controls on hazardous additives. These criteria are compelling polymer suppliers to innovate rapidly, adopting greener chemistries and lifecycle assessment tools to ensure compliance and maintain market access.

Together, these shifts are redefining competitive advantage in the electric vehicle market. Manufacturers that can integrate next-generation polymer technologies with agile, compliant supply networks are poised to lead in a sector where performance, sustainability, and regulatory alignment converge. The following sections will explore how these transformative dynamics are interacting with tariff landscapes, segmentation strategies, and regional growth patterns to shape the future of electric vehicle polymers.

Evaluating the Aggregate Consequences of Newly Enforced United States Tariffs on Electric Vehicle Polymers in 2025 and Sector Economics Implications

In 2025, newly enforced United States tariffs on imported polymer materials have introduced a layer of complexity for electric vehicle component manufacturers. These tariffs, which target a broad array of elastomers, thermoplastics, and thermosets, were implemented in response to national security and trade balance considerations. As a result, the cost of key polymer feedstocks has risen, prompting automakers and suppliers to reevaluate sourcing strategies and engage in cost mitigation measures.

This tariff regime has had a cumulative impact, driving a wave of nearshoring initiatives as companies seek to reduce exposure to import duties and ensure more predictable lead times. Investments in domestic polymer production capacity have accelerated, with several North American facilities expanding their output to serve the EV sector’s growing demand for silicone elastomers and high-temperature epoxy resins. At the same time, research partnerships between industry and government labs are exploring alternative feedstocks and process efficiencies to buffer against ongoing tariff volatility.

Despite these disruptions, the tariff environment has also accelerated innovation. By internalizing material development and strengthening regional supplier ecosystems, manufacturers are achieving greater integration across the value chain. This shift supports more collaborative product development cycles, enabling polymer chemists and vehicle engineers to optimize formulations for performance attributes like thermal conductivity and mechanical resilience, all while managing cost pressures imposed by the 2025 tariff landscape.

Comprehensive Multi Dimension Segmentation Reveals Critical Opportunities Across Material Type Application and Vehicle Categories

A deep dive into segmentation unveils how the electric vehicle polymers market is structured to address diverse performance requirements and application scenarios. When assessing material type, elastomers lead with tailored sealing and vibration-damping solutions, further differentiated into acrylate elastomers prized for chemical resistance in battery cooling systems, silicone elastomers delivering temperature stability under hood, and styrene-butadiene rubber offering cost-effective durability for weather-sealing applications. Thermoplastics play a central role in interior and exterior components, where acrylonitrile butadiene styrene provides impact resistance for body panels, polypropylene enables lightweight structural elements in bumpers and trunk lids, and polyvinyl chloride is leveraged in cable insulation for powertrain wiring harnesses. Meanwhile, thermosets such as epoxy resins are critical for robust battery module encapsulation, phenolic resins underpin high-heat brake components, and polyurethane formulations are formulated for protective surface coatings.

Moving to application segmentation, exterior components like body panels are increasingly reengineered with glass fiber–reinforced plastics to balance form and crash performance, while bumpers and trunk lids utilize polymer blends to integrate energy-absorption zones and aesthetic finishes. Interior components reflect a growing preference for polymer foams and composites in dashboard assemblies and headliners, enhancing cabin comfort through noise dampening and weight reduction, and seating systems adopt advanced elastomeric skins for durability and design flexibility. Powertrain systems demand polymers that can withstand rigorous thermal cycles, with battery housings relying on flame-retardant thermosets, cooling pipes engineered from corrosion-resistant elastomers, and transmission systems incorporating polymer-based gear assemblies to reduce friction and noise.

Vehicle type segmentation underscores distinct requirements between commercial and passenger platforms. Heavy commercial vehicles benefit from specialized elastomeric compounds that endure high load cycles and extended service intervals, whereas light commercial segments demand a balance of weight reduction and cost efficiency. Passenger vehicles prioritize lightweight materials that improve range without compromising comfort or safety. Distribution channels shape market dynamics as well, with offline channels dominating OEM procurement for large-volume applications, while online platforms are gaining traction in aftermarket sales for replacement seals, gaskets, and interior retrofits. End-use segmentation further distinguishes between aftermarket demand for maintenance and repair polymers and OEM integration of advanced materials directly into new vehicle platforms, highlighting the importance of tailored go-to-market strategies for each segment.

This comprehensive research report categorizes the Electric Vehicle Polymers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application

- Vehicle Type

- Distribution Channel

- End-Use

Regional Dynamics Unveiled Highlighting Growth Patterns and Challenges Across Americas EMEA and Asia Pacific Markets

Regional dynamics in the electric vehicle polymers market reveal differentiated growth trajectories and strategic imperatives. In the Americas, government incentives and infrastructure investments have accelerated adoption rates, driving heightened demand for high-performance thermoplastics and advanced elastomers. North American polymer producers are capitalizing on this momentum by expanding domestic capacity and forging collaborative partnerships with major automakers to co-develop next-generation materials optimized for cold-climate performance and extended durability.

Across Europe, Middle East, and Africa, stringent chemical regulations under frameworks like REACH and localized content requirements have intensified the focus on sustainable polymer solutions. European suppliers are investing heavily in recycled and bio-based polymers to meet regulatory thresholds, while the Middle East is leveraging its petrochemical feedstock advantage to produce competitively priced virgin polymers for both local automotive OEMs and export markets. In Africa, nascent EV adoption is prompting strategic infrastructure projects that will create future demand for polymer-based fast-charging and battery enclosure solutions.

Asia-Pacific stands as the largest and most dynamic market, led by China’s robust production ecosystem for elastomers and thermoplastics. Chinese suppliers are at the forefront of cost-effective mass production, supporting domestic EV makers with integrated supply chains that span raw materials to finished components. Meanwhile, Japan and South Korea focus on high-performance niche polymers, particularly high-temperature resins for battery safety systems. Southeast Asian nations are emerging as flexible manufacturing hubs, attracting investment to service both local assembly plants and global export requirements. Each region’s unique regulatory, economic, and supply chain context shapes the evolution of polymer innovation and deployment strategies.

This comprehensive research report examines key regions that drive the evolution of the Electric Vehicle Polymers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves by Industry Leaders Illustrate Competitive Positioning and Innovation Imperatives in Electric Vehicle Polymers

Industry leaders in the electric vehicle polymers space are executing diverse strategies to strengthen their market positions and accelerate innovation. One leading materials company has broadened its thermoplastic portfolio by introducing a new line of flame-retardant polyamides designed specifically for battery module enclosures, elevating fire safety without adding excess weight. Another global specialty chemicals provider has invested in large-scale production of silicone elastomers with enhanced thermal conductivity, targeting the cooling needs of next-generation battery systems and power electronics.

Strategic collaborations are also reshaping competitive dynamics. A major petrochemical conglomerate has formed a joint venture with an advanced composites firm to co-develop fiber-reinforced thermoplastics tailored for structural EV applications. Meanwhile, several chemical suppliers are partnering with automotive OEMs on pilot programs that integrate bio-based polyurethanes in interior components, testing new circular economy models that reclaim and recycle end-of-life materials at scale.

To differentiate further, companies are enhancing their digital capabilities, deploying simulation and modeling tools that accelerate material formulation cycles and reduce time-to-market. Data analytics platforms are being used to monitor performance in real-world conditions, feeding insights back into R&D pipelines for continuous improvement. These multifaceted strategic moves underscore how leading players are aligning product portfolios, partnerships, and digital innovations to capture growth opportunities in the fast-evolving electric vehicle polymers market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Vehicle Polymers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Addiplast SA

- Aearo Technologies

- AlphaGary Corporation

- Arkema S.A.

- Arlanxeo

- Asahi Kasei Corporation

- Ascend Performance Materials Holdings Inc.

- BASF SE

- Celanese Corporation

- Chi Mei Corporation

- Covestro AG

- Croda International PLC

- Daikin Industries Ltd.

- DIC Corporation

- DuPont de Nemours, Inc

- Evonik Industries AG

- JSR Corporation

- LG Chem Ltd.

- LyondellBasell Industries Holdings

- Mitsubishi Chemical Corporation

- Saudi Basic Industries Corporation

- Solvay S.A.

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- The Dow Chemical Company

- Toray Industries, Inc.

Actionable Strategies for Manufacturers and Suppliers to Capitalize on Emerging Trends Regulatory Shifts and Sustainability Imperatives in Polymer Markets

Manufacturers and suppliers can capitalize on the evolving electric vehicle polymers landscape by embracing a portfolio of actionable strategies. First, prioritizing investment in research and development of bio-based and recyclable polymer chemistries will help meet both regulatory demands and consumer expectations for sustainability. By piloting closed-loop recycling initiatives and leveraging renewable feedstocks, companies can reduce environmental impact while securing supply chain resilience.

Second, diversifying sourcing and strengthening regional production networks are crucial to mitigating tariff exposure and logistical disruptions. Establishing joint ventures with local polymer producers or investing in greenfield manufacturing facilities in key regions will enable more agile responses to market fluctuations. At the same time, forging strategic alliances with automotive OEMs through co-development agreements can align innovation roadmaps and accelerate adoption of advanced materials.

Finally, adopting digital tools for material simulation, lifecycle assessment, and quality monitoring will enhance operational efficiency and decision-making. Companies should integrate data analytics platforms that capture performance metrics from field applications, enabling continuous optimization of formulations. In parallel, active engagement with regulatory bodies and participation in industry consortia will ensure early alignment on evolving standards, enabling smoother market entry for new polymer solutions.

Rigorous Research Framework Combining Primary Expert Interviews Secondary Industry Data and Robust Triangulation to Ensure Analytical Precision

This research is grounded in a rigorous framework that blends qualitative insights from expert interviews with quantitative analysis of industry data. Primary research involved in-depth discussions with polymer scientists, automotive engineers, and supply chain executives to understand real-world challenges and emerging priorities. These conversations provided granular perspectives on performance requirements, manufacturing constraints, and innovation roadmaps.

Secondary research incorporated a comprehensive review of patent filings, trade association reports, and technical publications to map out technology trends and regulatory developments. Data from customs databases and industry publications were analyzed to track shifts in import patterns and tariff impacts. Market segmentation and regional analysis were validated through triangulation, cross-referencing multiple data sources to ensure accuracy and consistency.

Throughout the study, iterative validation workshops were conducted with stakeholders to refine assumptions and confirm key findings. Advanced analytical tools, including material performance simulation and supply chain risk models, augmented our qualitative insights, resulting in a holistic view of the electric vehicle polymers landscape. This methodological approach ensures that the conclusions and recommendations presented are underpinned by robust evidence and reflective of current industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Vehicle Polymers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Vehicle Polymers Market, by Material Type

- Electric Vehicle Polymers Market, by Application

- Electric Vehicle Polymers Market, by Vehicle Type

- Electric Vehicle Polymers Market, by Distribution Channel

- Electric Vehicle Polymers Market, by End-Use

- Electric Vehicle Polymers Market, by Region

- Electric Vehicle Polymers Market, by Group

- Electric Vehicle Polymers Market, by Country

- United States Electric Vehicle Polymers Market

- China Electric Vehicle Polymers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesis of Key Findings Underscoring the Transformative Role of Polymers in Accelerating Electric Vehicle Adoption Worldwide

The analysis reveals that polymers are not merely supplementary materials in electric vehicles but foundational enablers of the sector’s growth and sustainability agenda. High performance elastomers, thermoplastics, and thermosets each play distinct roles across vehicle architectures, from sealing and suspension components to structural panels and battery enclosures. Regulatory and tariff dynamics have introduced new complexities, yet they simultaneously catalyze regional supply chain innovation and nearshoring strategies.

Segmentation insights demonstrate the multiplicity of opportunities available to material suppliers and automotive manufacturers, with distinct performance requirements emerging across applications and vehicle types. Regional analyses underscore how differing regulatory contexts and infrastructure investments shape market priorities in the Americas, EMEA, and Asia-Pacific. Meanwhile, company strategies exemplify the importance of targeted R&D, strategic partnerships, and digital transformation in maintaining competitive advantage.

Collectively, the findings emphasize that success in the electric vehicle polymers market depends on a balanced approach-integrating advanced material development, supply chain resilience, and sustainability imperatives. Stakeholders that embrace holistic strategies, grounded in robust insights and collaboration, will be best positioned to unlock the full potential of polymers in driving the next wave of electric mobility adoption.

Engage with Associate Director Sales and Marketing to Access the In Depth Market Research Report and Drive Data Driven Strategic Decisions

For a deeper dive into the comprehensive analysis of electric vehicle polymers and to leverage these insights for your strategic planning, we invite you to connect with Associate Director, Sales and Marketing, Ketan Rohom. Ketan can provide tailored guidance on how this report aligns with your organization’s priorities and can facilitate access to the full suite of findings. Reach out to explore customized solutions, subscription options, and exclusive advisory services that will empower your team to make data driven decisions in the rapidly evolving electric vehicle polymers landscape.

- How big is the Electric Vehicle Polymers Market?

- What is the Electric Vehicle Polymers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?