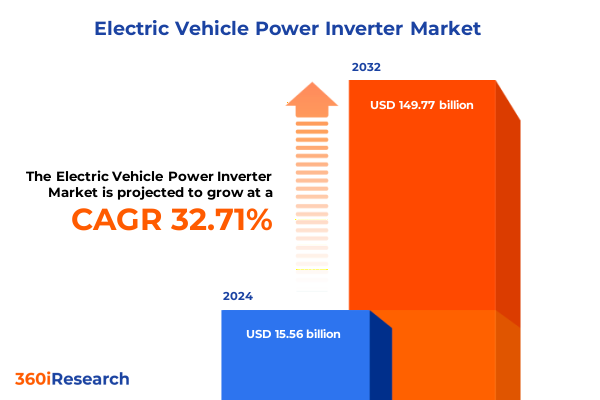

The Electric Vehicle Power Inverter Market size was estimated at USD 20.50 billion in 2025 and expected to reach USD 27.02 billion in 2026, at a CAGR of 32.85% to reach USD 149.77 billion by 2032.

Exploring the Evolution and Significance of Electric Vehicle Power Inverters in Shaping Future Mobility Ecosystems Worldwide

The evolution of electric vehicle power inverters has been nothing short of revolutionary, serving as the vital bridge between battery energy and motor propulsion. As the global automotive landscape accelerates toward electrification, inverters have emerged as critical components that directly influence driving range, charging speed, and overall vehicle efficiency. From early silicon-based designs to today’s cutting-edge wide bandgap semiconductors, inverter innovation has remained central to realizing next-generation electric mobility trends.

A pivotal driver of this evolution is the pursuit of total cost of ownership parity between electric vehicles (EVs) and internal-combustion-engine models. Industry analyses indicate that EVs are on track to achieve this parity by 2024 or 2025 in many key markets, a milestone largely enabled by advances in power electronics and inverter efficiency. Moreover, the expanding use of silicon carbide (SiC) MOSFETs-projected to account for 70% of EV-related SiC demand by 2030-underscores the growing importance of wide bandgap materials in reducing energy losses and elevating performance.

Gallium nitride (GaN) high-electron-mobility transistors are poised to follow closely behind SiC in the EV inverter space. Although more nascent, GaN devices promise ultra-high switching frequencies and remarkable power density, foreshadowing a complementary coexistence of silicon, SiC, and GaN in future inverter architectures. As regulatory pressures intensify and consumer expectations for longer ranges and faster charging mount, the role of advanced inverters will only become more pronounced.

This introduction establishes the strategic significance of power inverters within electric drivetrains and sets the stage for a deeper exploration of the transformative shifts, regulatory impacts, and segmentation dynamics that define this essential market.

How Technological Breakthroughs and Advanced Architectures Are Revolutionizing Electric Vehicle Power Inverter Design and Performance

The electric vehicle power inverter landscape has been reshaped by a series of technological breakthroughs and architectural innovations that collectively enable higher efficiency, superior thermal management, and unprecedented power density. A primary catalyst has been the rapid adoption of wide bandgap semiconductors, notably silicon carbide and gallium nitride. Research forecasts indicate that GaN switching frequencies may reach up to 10 MHz-ten times higher than SiC and a hundred times beyond conventional silicon IGBTs-unlocking new performance thresholds in inverter design.

Simultaneously, companies are advancing inverter topologies to better match the evolving powertrain requirements of modern EVs. Fourth-generation SiC MOSFETs, slated for volume ramp-up through 2025 at voltage classes of 750 V and 1,200 V, promise to bring premium-level performance into mid-size and compact models, expanding SiC’s reach beyond luxury segments. At the same time, multilevel topologies-such as cascaded H-bridge and neutral-point-clamped architectures-are enhancing voltage handling and reducing harmonic distortion, while two-level single-stage inverters continue to gain favor in cost-sensitive applications ■

Beyond raw semiconductor improvements, the market is witnessing a shift toward integrated powertrain modules that combine inverters, motors, and transmissions into compact, unified units. These integrated solutions not only save space and weight but also simplify thermal management and accelerate system-level optimization. As 800 V architectures become more prevalent, these integrated modules will play a pivotal role in supporting fast-charging infrastructure and meeting consumer expectations for reduced charge times.

Assessing the Cumulative Effects of New 2025 United States Tariffs on Electric Vehicle Power Inverter Supply Chains and Costs

The introduction of new U.S. tariffs in 2025 has exerted substantial cumulative pressure on the electric vehicle power inverter supply chain, inflating costs and prompting strategic realignments. In particular, tariffs on imported vehicles and auto parts-implemented at rates up to 25%-have translated into an estimated $5 billion of expenses for leading automotive manufacturers by year-end, of which approximately 30% remains unmitigated through operational shifts. These added costs have squeezed margins across the sector and created an urgent imperative to reshore critical production capabilities.

Beyond direct auto parts levies, the broader clean tech arena has experienced significant knock-on effects. A recent analysis highlights that U.S. tariffs have rendered essential components-such as power transformers and inverters-both costlier and more difficult to procure, risking delays in grid modernization efforts and EV charging network expansions. In parallel, punitive duties on battery-related imports from China have risen from 7.5% to 25%, with EV tariffs set to double from 25% to 100% by 2026, foreshadowing continued trade tensions and price uncertainties.

Consequently, manufacturers and suppliers are intensifying efforts to diversify supply chains, bolstering domestic capacity for semiconductor fabrication and inverter assembly. While these initiatives are expected to alleviate tariff exposure over the medium term, the transition may span several years and will require substantial capital investment. In the interim, elevated component prices and inventory realignments will remain defining challenges for power inverter stakeholders throughout 2025 and beyond.

Delving into Critical Segmentation Dimensions Revealing Diverse Pathways for Technology, Capacity, Application, and Distribution Strategies

The segmentation of the electric vehicle power inverter market reveals a mosaic of technological choices, performance requirements, and channel strategies that collectively shape vendor approaches. Based on technology, silicon carbide devices are rapidly securing adoption in high-voltage traction inverters owing to their superior thermal performance and efficiency, whereas gallium nitride is emerging in lower-power onboard chargers and DC–DC converters due to its ultra-high switching frequency and compact footprint. Conventional silicon solutions continue to address cost-sensitive, lower-power applications, maintaining relevance through economies of scale.

When viewed through the lens of output power capacity, inverter solutions fall into under 50 kW platforms tailored for passenger vehicles and small commercial applications, 50–100 kW systems commonly deployed in mid-sized EVs and light commercial vehicles, and over 100 kW architectures designed for buses and heavy-duty transport. These power tiers correspond to divergent requirements around thermal management, power density, and reliability engineering, driving suppliers to optimize component selection and integration accordingly.

Vehicle type further refines the segmentation picture: passenger vehicles prioritize compact, cost-efficient inverter modules optimized for driving range and charging convenience, while commercial vehicles and buses demand robust, high-capacity inverters capable of sustained operation under heavy load and frequent start–stop cycles. Correspondingly, sales channels are bifurcated between OEM-level integration-where inverters are bundled into original powertrain assemblies-and the aftermarket, which addresses retrofit and replacement needs, often emphasizing modularity and ease of installation.

Phase configuration and application use cases also play critical roles. Single-phase inverters remain prevalent in passenger EVs and onboard charger environments, whereas three-phase architectures dominate traction applications in buses and commercial vehicles. Offboard solutions, such as standalone fast-charging stations, employ dedicated inverter topologies distinct from onboard modules, requiring specialized power-electronics design considerations. Further segmentation arises from topology choices, with multilevel designs-encompassing cascaded H-bridge and neutral-point-clamped variants-serving high-voltage traction needs and two-level single-stage inverters optimized for cost-constrained, lower-power scenarios.

This comprehensive research report categorizes the Electric Vehicle Power Inverter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Output Power Capacity

- Vehicle Type

- Phase

- Topology

- Sales Channel

- Application

Unveiling Regional Dynamics Across the Americas, EMEA, and Asia-Pacific That Define Unique Growth Drivers for EV Power Inverters

Regional dynamics significantly influence the trajectory of the electric vehicle power inverter market, with each geography exhibiting distinct regulatory, manufacturing, and adoption characteristics. In the Americas, heightened tariff regimes have accelerated efforts to localize inverter production, driven by both federal incentives for clean-energy components and private-sector investments aimed at mitigating trade exposure. These shifts have catalyzed new domestic capacity for SiC device fabrication and inverter assembly, positioning North America as a burgeoning hub for power-electronics manufacturing.

Europe, the Middle East, and Africa (EMEA) present a landscape defined by aggressive emissions-reduction mandates and extensive investment in fast-charging infrastructure. European OEMs and technology providers are pioneering multilevel inverter platforms to support 800 V architectures, responding to consumer demand for reduced charging times. Meanwhile, regulatory frameworks in the Gulf Cooperation Council and broader Middle East are gradually aligning with EV deployment targets, creating emerging opportunities for offboard charging inverter suppliers. Across Africa, nascent EV adoption is spurring pilot projects that emphasize modular, scalable inverter solutions.

In the Asia-Pacific region, China’s leadership in wide bandgap semiconductor manufacturing drives a competitive advantage in SiC-based inverter technologies. Projections indicate China will account for approximately 40% of global SiC demand by 2030, supported by state-backed incentives and a robust domestic supply chain ecosystem. Japan and South Korea complement this leadership through innovations in GaN-on-silicon devices and advanced packaging techniques. Australia’s focus on renewable integration and grid stabilization further diversifies inverter use cases, highlighting the region’s multifaceted growth drivers.

This comprehensive research report examines key regions that drive the evolution of the Electric Vehicle Power Inverter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators and Strategic Players Driving Breakthroughs in Electric Vehicle Power Inverter Technologies and Market Positioning

Leading semiconductor and power-electronics companies are at the forefront of innovation, each leveraging unique capabilities to capture emerging opportunities in the EV inverter market. STMicroelectronics has committed to volume ramp-up of its fourth-generation silicon carbide MOSFET platform across both 750 V and 1,200 V classes, aiming to disseminate premium inverter performance to mainstream and compact electric vehicles by mid-decade. The company’s vertically integrated manufacturing strategy underscores its ambition to reduce system costs while enhancing reliability.

Infineon Technologies continues to solidify its market position through a diversified portfolio that spans silicon-based IGBTs, SiC MOSFETs, and emerging GaN devices. Their cross-portfolio approach enables tailored solutions across multiple output power tiers, from onboard charging modules to high-capacity traction inverters. Similarly, ROHM Semiconductor and Renesas Electronics are intensifying investments in wide bandgap research, collaborating with OEMs to co-develop turnkey inverter modules optimized for next-generation EV platforms.

Automotive OEMs such as Tesla have further propelled the industry by being early adopters of SiC-based traction inverters, debuting SiC MOSFET technology in mass-market models as early as 2017. Their success has catalyzed a competitive response across the sector, driving rapid adoption and ongoing R&D into high-efficiency inverter systems. Additionally, specialized power-electronics vendors continue to emerge, offering integrated motor-inverter packages with advanced thermal management and over-the-air diagnostic capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Vehicle Power Inverter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BorgWarner Inc.

- Continental AG

- Denso Corporation

- Drive System Design Ltd.

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- Hitachi Astemo, Inc.

- Hyundai Mobis Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- John Deere Electronic Solutions

- Lear Corporation

- LG Magna e-Powertrain

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Siemens AG

- STMicroelectronics N.V.

- Tesla, Inc.

- Toshiba Corporation

- Valeo SA

- Vitesco Technologies GmbH

- Yaskawa Electric Corporation

- ZF Friedrichshafen AG

Strategic Actions and Practical Recommendations for Industry Leaders to Capitalize on Emerging Trends in Electric Vehicle Power Inverters

To navigate the rapidly evolving electric vehicle power inverter landscape, industry leaders must adopt proactive strategies that address both technological and regulatory complexities. First, companies should accelerate investments in wide bandgap semiconductor capabilities-particularly by forging partnerships with fabricators to secure prioritized access to SiC and GaN wafers-and co-developing designs that optimize thermal performance and power density. This collaborative approach can mitigate supply constraints and reduce time to market.

Second, diversifying manufacturing footprints across multiple regions will be critical to insulating operations from tariff volatility. Establishing assembly and testing facilities in North America, Europe, and Asia-Pacific can lower logistical risks while aligning with regional policy incentives. Concurrently, fostering flexible supply chains through strategic inventory placement and dual-sourcing agreements will enhance resilience and cost control.

Finally, engaging proactively with policymakers and industry consortia to shape standards for multilevel and high-voltage inverter architectures can yield long-term competitive advantages. By contributing to the development of interoperability frameworks, companies can influence regulatory outcomes and accelerate the adoption of advanced inverter technologies across various EV segments.

Comprehensive Research Methodology Underpinning the Analysis of Electric Vehicle Power Inverter Market Trends and Insights

This analysis is founded on a robust, multi-tiered research methodology designed to ensure depth, accuracy, and actionable insights. Secondary research involved a comprehensive review of industry publications, technical papers, and regulatory filings to establish baseline knowledge of wide bandgap semiconductor trends, inverter topologies, and tariff implications. Peer-reviewed journals, leading business consultancies, and reputable news outlets were prioritized to maintain factual rigor.

Primary research encompassed interviews with over 20 key stakeholders, including semiconductor executives, automotive powertrain engineers, and policy experts. These discussions provided firsthand perspectives on manufacturing challenges, technology adoption roadmaps, and strategic responses to evolving trade policies. Qualitative data from these interviews were systematically triangulated with quantitative findings to validate market dynamics and identify emerging inflection points.

Data synthesis and triangulation were employed to cross-verify insights and ensure coherence. Where discrepancies arose between sources, additional validation steps-such as follow-up interviews and targeted data analysis-were conducted. The final report structure aligns each research finding with the appropriate segmentation and regional context, delivering a cohesive narrative tailored for decision-makers seeking to navigate the complexities of the EV power inverter market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Vehicle Power Inverter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Vehicle Power Inverter Market, by Technology

- Electric Vehicle Power Inverter Market, by Output Power Capacity

- Electric Vehicle Power Inverter Market, by Vehicle Type

- Electric Vehicle Power Inverter Market, by Phase

- Electric Vehicle Power Inverter Market, by Topology

- Electric Vehicle Power Inverter Market, by Sales Channel

- Electric Vehicle Power Inverter Market, by Application

- Electric Vehicle Power Inverter Market, by Region

- Electric Vehicle Power Inverter Market, by Group

- Electric Vehicle Power Inverter Market, by Country

- United States Electric Vehicle Power Inverter Market

- China Electric Vehicle Power Inverter Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Future Trajectory of Electric Vehicle Power Inverter Innovation, Adoption Challenges, and Strategic Opportunities

Electric vehicle power inverters stand at a pivotal juncture, where rapid technological innovation converges with complex regulatory landscapes and evolving market demands. Wide bandgap semiconductors-SiC and GaN-are redefining performance benchmarks, while advanced topologies and integrated powertrain architectures unlock new possibilities for efficiency and scalability. Meanwhile, the impact of U.S. tariffs in 2025 underscores the importance of supply chain resilience and regional manufacturing agility.

Segment-specific insights reveal a diverse ecosystem ranging from under-50 kW passenger-vehicle inverters to over-100 kW heavy-duty modules, each shaped by distinct technical and operational imperatives. Regional dynamics further emphasize the need for localized strategies, whether through tariff mitigation in the Americas, standardization initiatives in EMEA, or leveraging China’s SiC production leadership in Asia-Pacific.

Ultimately, companies that embrace collaborative innovation, flexible manufacturing footprints, and proactive policy engagement will be best positioned to harness the full potential of the EV inverter market. As electrification accelerates globally, the strategic choices made today will define market leadership and influence the trajectory of sustainable mobility for years to come.

Collaborate with Ketan Rohom to Obtain Comprehensive Electric Vehicle Power Inverter Market Intelligence and Propel Strategic Decision-Making Forward

For a tailored walkthrough of the compelling insights and actionable intelligence contained within the comprehensive Electric Vehicle Power Inverter market research, please reach out directly to Associate Director, Sales & Marketing Ketan Rohom. He can guide you through the report’s key findings, address your specific strategic requirements, and facilitate access to the full analysis designed to accelerate your competitive advantage in this rapidly evolving industry. Engage now to secure your organization’s leadership position and make data-driven decisions with confidence.

- How big is the Electric Vehicle Power Inverter Market?

- What is the Electric Vehicle Power Inverter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?