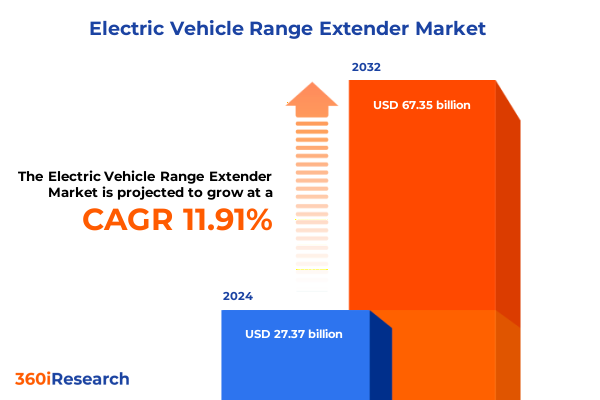

The Electric Vehicle Range Extender Market size was estimated at USD 30.60 billion in 2025 and expected to reach USD 34.23 billion in 2026, at a CAGR of 11.92% to reach USD 67.35 billion by 2032.

Navigating the Evolution of Electric Vehicle Range Extenders with an Insightful Overview of Core Drivers, Challenges, and Opportunities

Electric vehicle (EV) range extenders have emerged as a pivotal technology in bridging the gap between consumer expectations for long-distance travel and the current limitations of battery-only electric powertrains. As electrification accelerates across the automotive industry, range anxiety remains a significant barrier to broader adoption. Range extenders offer a practical solution by seamlessly integrating supplementary power sources-such as internal combustion engines or hydrogen fuel cells-to sustain vehicle operation once the primary battery is depleted. The result is a compelling combination of zero-emission driving complemented by enhanced operational range that appeals to a growing segment of eco-conscious consumers, fleet operators, and commercial stakeholders.

Against this backdrop, a confluence of macroeconomic, environmental, and technological forces is driving renewed interest in range extender solutions. Regulatory mandates worldwide are mandating stricter emissions thresholds, incentivizing developments beyond traditional battery configurations. Meanwhile, infrastructure deficits-particularly in rural and long-haul corridors-further underscore the need for hybrid approaches that extend driving range without reliance solely on charging networks. As a result, automotive OEMs and energy companies are investing heavily in refining range extender architectures, signaling a transformative shift in the paradigm of electric mobility.

Unraveling the Transformative Shifts Reshaping the Electric Vehicle Range Extender Arena from Regulatory Mandates to Breakthrough Technological Advancements

The landscape of electric vehicle range extenders is undergoing radical transformation driven by converging regulatory, technological, and market forces. On the regulatory front, regional governments have enacted aggressive emissions reduction targets, compelling OEMs to explore alternative power architectures beyond conventional internal combustion engines. Incentive programs and subsidy schemes for hydrogen infrastructure and advanced battery systems are catalyzing research into proton exchange membrane fuel cells as a viable extension technology that marries high energy density with rapid refueling capabilities. Concurrently, advancements in solid oxide fuel cell materials are unlocking potential for compact, high-efficiency units that can operate on diverse fuel inputs, including biogas and ammonia, expanding the ecosystem of renewable energy carriers.

Technological momentum is further bolstered by breakthroughs in digital control systems and materials science. Integrated vehicle management platforms now leverage real-time telematics and predictive analytics to optimize extender activation cycles, thereby minimizing fuel consumption and emissions. Meanwhile, lightweight composite materials and modular powertrain designs are reducing system mass, enhancing vehicle performance and payload capacity. These innovations underscore the shift from one-size-fits-all solutions toward highly adaptable range extender modules tailored to specific vehicle segments and duty cycles, reshaping the competitive landscape and unlocking new pathways for market entrants.

Examining the Far-Reaching Consequences of 2025 United States Tariffs on the Electric Vehicle Range Extender Supply Chain and Cost Structures

In 2025, the United States implemented a series of tariffs targeting imported components critical to electric vehicle range extender systems. These levies, primarily focused on fuel cell catalysts, advanced battery chemistries, and specialized power electronics, have exerted upward pressure on manufacturing costs for both domestic OEMs and Tier 1 suppliers. As component costs rise, stakeholders are reevaluating supply chain strategies, with many accelerating initiatives to localize production and secure alternative material sources. While these tariff measures aim to bolster domestic manufacturing and stimulate investment in homegrown innovation, they have also introduced complexities related to supplier qualification, quality assurance, and lead-time management.

Consequently, organizations are adopting diversified procurement models to mitigate tariff-induced volatility. Some manufacturers are forging strategic partnerships with North American material suppliers, while others are investing in in-house development of proprietary membrane electrode assemblies to circumvent import duties. Although short-term cost fluctuations are inevitable, the long-term effect may drive significant expansion of the domestic industrial base, fostering a more resilient value chain. Ultimately, this reorientation underscores the importance of agility and foresight in navigating policy-driven market shifts, ensuring that range extender solutions remain competitive and accessible.

Delving into Key Market Segmentation Insights for Electric Vehicle Range Extenders Across Extender Types, Fuel Sources, Power Outputs, Applications, and Sales Channels

When evaluating the electric vehicle range extender landscape through the prism of extender type, hydrogen fuel cell solutions are capturing significant attention due to their ability to deliver rapid refueling and extended range profiles. Within this category, proton exchange membrane fuel cells have emerged as the leading architecture for passenger applications, whereas solid oxide fuel cells are gaining traction in heavy-duty segments due to their high operating temperatures and fuel flexibility. Meanwhile, internal combustion engine-based extenders continue to serve as a pragmatic option for retrofit applications, leveraging existing infrastructure to deliver cost-effective range augmentation without major vehicle redesign.

Fuel type segmentation reveals that hydrogen-powered systems are making inroads in both passenger and commercial fleets, driven by government initiatives to expand hydrogen refueling networks. At the same time, traditional fuels such as diesel and gasoline remain prevalent in regions with established energy distribution channels, particularly in light and heavy commercial vehicles. Power output considerations also play a crucial role in technology selection: high-power units above 50 kW are favored in long-haul trucking for their ability to sustain highway speeds, whereas low-power systems under 20 kW are more common in urban and two-wheeler contexts where efficiency and compact packaging are paramount. Medium-power solutions between 20 and 50 kW strike a balance and have found application in mid-size passenger vehicles, offering a versatile compromise between range extension and weight.

Vehicle type further influences extender adoption patterns. Heavy commercial vehicles prioritize robustness and fuel flexibility, while light commercial platforms often balance total cost of ownership with reliability. Passenger cars are increasingly integrating fuel cell modules at the OEM level to differentiate electric models, and two-wheelers are exploring micro-extender systems to overcome battery density constraints in emerging markets. Application-based segmentation underscores a bifurcation between new-build integration, where original equipment manufacturers embed extenders during assembly, and retrofit scenarios, where aftermarket retrofit kits are tailored for legacy vehicles. The aftermarket channel, leveraging both OEM and independent retrofit solutions, is experiencing growth as fleet operators seek incremental improvements, contrasting with the dominance of original equipment manufacturer partnerships in the new vehicle segment.

This comprehensive research report categorizes the Electric Vehicle Range Extender market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Extender Type

- Fuel Type

- Power Output Range

- Vehicle Type

- Application

- Sales Channel

Uncovering Regional Dynamics Driving Adoption and Innovation in Electric Vehicle Range Extenders Across the Americas, EMEA, and Asia-Pacific Markets

Regionally, the Americas are advancing range extender adoption through a combination of policy incentives and private investment. The United States, in particular, has prioritized funding for hydrogen corridor development and pilot programs that integrate fuel cell extenders into public transit fleets. This environment has fostered collaboration between energy utilities, OEMs, and infrastructure providers, resulting in a growing number of demonstration projects in the light and heavy-duty segments. Canada, meanwhile, is leveraging its robust natural gas network to support CNG-based extender deployments, particularly in remote northern territories where grid access is limited.

In the Europe, Middle East, and Africa region, stringent carbon reduction targets set by the European Union have catalyzed significant funding for research into both battery and hydrogen-based extenders. Germany and France are at the forefront with coordinated efforts to create comprehensive hydrogen value chains, including production, transport, and refueling stations. The Middle East is exploring green hydrogen projects backed by renewable power, positioning certain Gulf Cooperation Council states as emerging supply hubs. Across Africa, interest is growing in diesel-electric hybrid systems for commercial vehicles that operate in regions with sporadic charging infrastructure.

Asia-Pacific presents a diverse mosaic of market dynamics. China’s rapid electrification agenda has predominantly focused on battery-electric vehicles; however, pilot programs in hydrogen fuel cell trucks and buses are gaining momentum in key logistics corridors. Japan and South Korea maintain a technological edge in fuel cell research, led by corporate and governmental partnerships that aim to scale proton exchange membrane electrolyzers. India, recognizing the potential for retrofitting legacy fleets, is evaluating cost-effective internal combustion engine extenders compatible with local fuel standards, thus demonstrating the adaptability of range extender solutions to varied regional requirements.

This comprehensive research report examines key regions that drive the evolution of the Electric Vehicle Range Extender market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Company Movements and Innovations Driving Competition and Collaboration within the Electric Vehicle Range Extender Industry

The competitive landscape for electric vehicle range extenders is characterized by strategic alliances, technological differentiation, and vertical integration. Established automotive suppliers are leveraging decades of powertrain expertise to optimize internal combustion and fuel cell architectures for hybridized operations. New entrants specializing in hydrogen electrochemistry are forging partnerships with OEMs to co-develop next-generation proton exchange membrane stacks, targeting long-haul freight and mass transit applications. In parallel, companies focused on advanced materials are collaborating with energy firms to refine membrane durability and reduce precious metal loading, thereby driving down per-unit costs.

Partnerships between energy utilities and component manufacturers are also emerging as a critical vector for market entry, enabling seamless integration of extender hardware with fueling infrastructure. These cross-sector alliances facilitate end-to-end solutions that encompass vehicle hardware, on-site fueling systems, and digital service platforms. Meanwhile, software providers are assembling modular control suites that can adapt to multiple extender types, ensuring interoperability across fuel cell, internal combustion, and battery-only powertrains. This confluence of strategic moves underscores a trend toward ecosystem-driven innovation, where value is created not through standalone hardware components but via integrated solutions that address both mobility and energy requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Vehicle Range Extender market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AVL List GmbH

- BorgWarner Inc.

- Capstone Turbine Corporation

- Continental AG

- Cummins Inc.

- General Motors Company

- IAV GmbH

- Mahle GmbH

- Ricardo plc

- Siemens AG

- Springer Nature Switzerland AG,

- Valeo SA

- Volvo Car Corporation

- Weichai Power Co., Ltd.

- Wrightspeed Inc.

Proposing Actionable Strategic Recommendations for Industry Leaders to Capitalize on Growth Opportunities in the Electric Vehicle Range Extender Sector

To capitalize on the evolving range extender landscape, industry leaders should prioritize vertical integration strategies that mitigate the impact of supply chain disruptions. By investing in domestic manufacturing capabilities for critical components-such as fuel cell membranes and high-performance power electronics-organizations can insulate themselves against tariff volatility while accelerating time to market. Concurrently, establishing collaborative innovation hubs that bring together OEMs, technology providers, and energy stakeholders will foster rapid prototyping and validation of new extender architectures.

Expanding the service ecosystem is equally vital. Implementing predictive maintenance algorithms and remote diagnostics can enhance uptime for commercial fleets, driving additional revenue streams through performance-based contracts. Additionally, engaging proactively with policymakers to shape regulatory frameworks around hydrogen fueling standards and retrofit approval processes will ensure that industry requirements are reflected in emerging legislation. Finally, tailoring product portfolios to diverse applications-ranging from compact two-wheeler kits in high-density urban areas to high-power units for long-haul logistics-will enable companies to address specific customer needs and capture incremental value across the value chain.

Outlining a Robust Research Methodology Employing Comprehensive Primary and Secondary Research to Deliver Accurate Electric Vehicle Range Extender Market Insights

This analysis is founded on a rigorous research methodology that integrates both primary and secondary data sources to deliver robust, evidence-based insights. Secondary research encompassed the examination of government policy documents, industry white papers, technical journals, and credible news outlets to identify macroeconomic trends, regulatory developments, and emerging technological breakthroughs. Publicly available corporate filings and patent databases were also reviewed to map competitive activity and innovation trajectories.

Primary research involved structured interviews with C-level executives, product development engineers, fleet operators, and energy infrastructure experts. These consultations provided firsthand perspectives on key challenges, adoption barriers, and commercial success factors across different market segments. Quantitative data points were triangulated against multiple sources to validate accuracy and minimize bias. This mixed-methods approach ensured a comprehensive understanding of the electric vehicle range extender ecosystem, enabling a nuanced interpretation of the market’s current state and future direction.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Vehicle Range Extender market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Vehicle Range Extender Market, by Extender Type

- Electric Vehicle Range Extender Market, by Fuel Type

- Electric Vehicle Range Extender Market, by Power Output Range

- Electric Vehicle Range Extender Market, by Vehicle Type

- Electric Vehicle Range Extender Market, by Application

- Electric Vehicle Range Extender Market, by Sales Channel

- Electric Vehicle Range Extender Market, by Region

- Electric Vehicle Range Extender Market, by Group

- Electric Vehicle Range Extender Market, by Country

- United States Electric Vehicle Range Extender Market

- China Electric Vehicle Range Extender Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing the Critical Findings and Insights Shaping the Future Trajectory of the Electric Vehicle Range Extender Market Landscape

Electric vehicle range extenders stand at the nexus of evolving energy paradigms and automotive innovation. The confluence of stringent emissions regulations, emerging fuel infrastructures, and rapid advances in powertrain control systems has elevated extenders from niche add-ons to strategic enablers of sustainable mobility. Segment-level insights reveal that hydrogen fuel cells and internal combustion engines each hold distinct advantages aligned to specific vehicle classes and duty cycles, while regional dynamics underscore the importance of localized strategies and regulatory alignment.

Furthermore, the implementation of targeted tariffs in the United States has catalyzed supply chain realignment, driving investments in domestic manufacturing and material science. Leading companies are responding through strategic partnerships and ecosystem integration, signaling a shift toward holistic solutions that encompass hardware, software, and service offerings. As the market matures, stakeholders that combine technological agility with policy engagement and operational excellence will be best positioned to shape the future trajectory of electric vehicle range extender technologies.

Driving Informed Decisions with Direct Engagement: Contact Associate Director Ketan Rohom to Secure Full Electric Vehicle Range Extender Market Intelligence Today

To embark on a strategic journey that positions your organization at the forefront of electric vehicle range extender innovation, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His deep understanding of evolving industry dynamics, combined with the comprehensive insights within our full market research report, will equip you with the actionable intelligence needed to outpace competitors and capitalize on emerging opportunities. Engage with an expert who can tailor data-driven solutions to your unique business challenges and guide you through the nuances of technological advancements, regulatory landscapes, and commercial strategies. By partnering with Ketan, you gain direct access to an unparalleled depth of analysis and a commitment to supporting your strategic objectives. Don’t miss the chance to harness the latest intelligence on electric vehicle range extenders-empower your decision-making today by contacting Ketan Rohom to secure your copy of the complete report.

- How big is the Electric Vehicle Range Extender Market?

- What is the Electric Vehicle Range Extender Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?