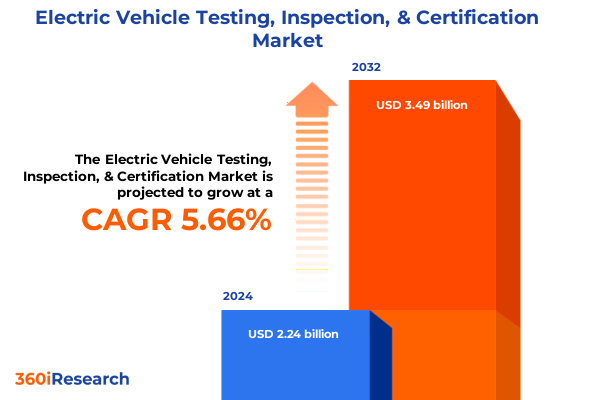

The Electric Vehicle Testing, Inspection, & Certification Market size was estimated at USD 2.36 billion in 2025 and expected to reach USD 2.49 billion in 2026, at a CAGR of 5.72% to reach USD 3.49 billion by 2032.

Pioneering a New Era of Robust Electric Vehicle Validation through Integrated Testing Inspection and Certification Initiatives

As the electric vehicle sector accelerates toward mass adoption, the imperatives of rigorous testing, inspection, and certification have never been more critical. Manufacturers and regulators alike face mounting pressure to ensure that battery systems deliver reliable range performance, that vehicle components meet stringent safety thresholds, and that electromagnetic compatibility aligns with evolving global standards. This section introduces the multifaceted context in which industry stakeholders operate, highlighting how advances in battery testing protocols, environmental resilience assessments, and crashworthiness evaluations collectively underpin consumer confidence and regulatory compliance.

With market leaders investing heavily in next-generation testing infrastructure, the introduction explores how collaborative frameworks between OEMs, third-party laboratories, and certification bodies are reshaping the value chain. It underscores the growing role of digital twins and data analytics platforms in simulating real-world stress scenarios, thereby accelerating validation cycles without compromising on accuracy. By illustrating the synergies between testing modalities-such as thermal stability analysis, performance benchmarking, and safety assessments-this introduction establishes the foundation for understanding the transformative shifts that follow.

How Technological Advancements and Regulatory Convergence are Redefining Electric Vehicle Testing Inspection and Certification Standards

In recent years, the electric vehicle testing and certification landscape has undergone transformative shifts driven by technological breakthroughs and regulatory evolution. Advances in battery chemistry have introduced high-nickel cathodes and solid-state formulations, necessitating novel capacity and cycle life protocols to accurately assess degradation dynamics. Concurrently, the expansion of connected car features has heightened the importance of EMC testing to prevent interference with critical vehicle control systems. These technological imperatives have prompted laboratories to adopt modular, scalable test rigs capable of accommodating both legacy platforms and emerging architectures.

On the regulatory front, governments worldwide are harmonizing standards to facilitate cross-border vehicle approvals and streamline market entry. This convergence has motivated service providers to develop unified certification frameworks that reconcile international performance thresholds and safety criteria. Moreover, the integration of sustainability benchmarks-such as lifecycle carbon footprint assessments for battery manufacturing-has expanded the scope of testing services. As a result, the industry is pivoting from isolated validation exercises toward holistic quality assurance ecosystems, where digital integration and real-time data exchange underpin strategic decision-making across the product lifecycle.

Assessing the Ripple Effects of New United States Tariffs on Raw Materials and Equipment Costs Across the Validation Ecosystem

The imposition of new United States tariffs in early 2025 on imported raw materials and key testing equipment has reverberated through the electric vehicle validation ecosystem. By increasing duties on lithium carbonate precursors and specialized test instrumentation, these tariffs have directly elevated the cost of conducting comprehensive battery performance and safety evaluations domestically. As laboratories contend with higher capital expenditures for equipment procurement, many have accelerated investments in localized manufacturing of test cells and modular rigs to mitigate exposure to import duties.

Simultaneously, service providers have restructured fee models to distribute incremental costs across larger client portfolios, incentivizing long-term testing partnerships and bundled service agreements. Although short-term profit margins have experienced pressure, the tariffs have spurred innovation in test facility design to enhance throughput and reduce per-test overhead. In tandem, collaborative alliances between U.S.-based laboratories and regional component suppliers have emerged, fostering resilience by onshoring critical testing assets and securing supply chains. These strategic responses underscore a collective industry effort to absorb tariff impacts while maintaining the integrity of safety, environmental, and performance assessments.

Uncovering Growth Drivers by Examining Diverse Testing Inspection and Certification Segments Across the Electric Vehicle Supply Chain

Insights into market segmentation reveal differentiated growth dynamics across testing, inspection, and certification services. When examining testing services, the prominence of battery testing is unmistakable, with capacity measurements taking center stage as manufacturers strive to validate extended range targets. Concurrently, thermal stability evaluations and cycle life tests have gained equal footing to ensure batteries withstand diverse operating conditions. In parallel, safety assessments extending beyond cell-level analysis to encompass comprehensive battery safety assessment frameworks and component evaluations are redefining risk mitigation strategies.

Turning to inspection services, the dichotomy between commercial and passenger vehicle testing has become increasingly salient. Heavy commercial vehicles undergo rigorous load and durability inspections to meet fleet reliability benchmarks, while light commercial vehicle protocols emphasize maneuverability and emissions compliance. Passenger vehicles, in contrast, are subject to holistic inspection regimens that integrate crash test data with component-level safety evaluations. Certification services likewise demonstrate nuance, as battery electric vehicles require different compliance deliverables compared to hybrid electric and plug-in hybrid models, reflecting the unique performance profiles and statutory obligations tied to each powertrain architecture. These segmentation insights illuminate how value pools are distributed and where service providers can refine their offerings to align with client-specific validation needs.

This comprehensive research report categorizes the Electric Vehicle Testing, Inspection, & Certification market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Propulsion Component

- Testing Level

- Vehicle Category

Revealing Contrasting Validation Market Dynamics Across Americas Europe Middle East and Africa and Asia Pacific Regions

Regional analysis of the electric vehicle validation market highlights distinctive trajectories across the Americas, Europe Middle East and Africa, and Asia Pacific regions. In the Americas, concerted efforts to onshore battery production and testing infrastructure have accelerated the expansion of domestic laboratories, fostering a robust ecosystem that prioritizes rapid turnarounds and localized compliance services. This regional momentum is further bolstered by federal incentives aimed at sustainable supply chains and accelerating EV adoption.

In Europe, the Middle East, and Africa, stringent regulatory regimes such as the EU’s Battery Regulation and type-approval directives have driven service providers to enhance interoperability and compliance assurance across multiple jurisdictions. Collaborative testing consortia are facilitating data standardization, enabling manufacturers to streamline certification processes across diverse national frameworks. Meanwhile, in the Asia Pacific, burgeoning EV sales volumes and aggressive electrification targets have catalyzed investments in high-throughput testing centers and automated inspection lines. Strategic partnerships between regional OEMs and third-party certification bodies are establishing centers of excellence that integrate environmental testing with accelerated performance benchmarking, reflecting the region’s focus on scale and operational efficiency.

This comprehensive research report examines key regions that drive the evolution of the Electric Vehicle Testing, Inspection, & Certification market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Leading Laboratories and Specialized Firms Are Shaping the Future of Electric Vehicle Validation Services

Leading service providers in the electric vehicle testing and certification arena are leveraging their core competencies to capture emerging opportunities. Established global laboratories are differentiating through end-to-end digital platforms that integrate test result management, certification workflow automation, and real-time analytics dashboards. These innovations are streamlining client engagement by reducing administrative overhead and enhancing transparency throughout the verification process.

At the same time, specialized niche players have carved out value propositions around advanced battery safety assessments and high-precision environmental simulations. By investing in proprietary sensor arrays and thermal chamber technologies, these agile firms are delivering bespoke test protocols for novel chemistries and vehicle architectures. Complementing this, certification bodies are evolving to offer hybrid service models that blend in-person audits with remote witnessing of test procedures, preserving rigor while increasing geographic reach and scheduling flexibility. This dynamic competitive landscape underscores the importance of technological differentiation and strategic alliances in maintaining relevance amid intensifying market demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Vehicle Testing, Inspection, & Certification market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apave Group

- Applus Services, S.A

- AVL List GmbH

- British Standards Institution

- Bureau Veritas Group

- Caltest Instruments Ltd.

- Chroma ATE Inc.

- DEKRA SE

- Det Norske Veritas Holding AS

- EM Topco Limited

- Emerson Electric Co.

- Eurofins Group

- HORIBA, Ltd.

- iASYS Technology Solutions

- Intertek Group PLC

- LHP, Inc.

- Link Engineering Company

- MET Laboratories, Inc.

- Nemko Group

- PCB Piezotronics, Inc.

- SGS Group

- Tata Elxsi Limited

- TÜV Rheinland Group

- UL LLC

Implementing Forward-Looking Infrastructure Alliances and Digital Ecosystems to Secure Long-Term Leadership in EV Validation

Industry leaders must adopt a proactive approach to navigating the evolving electric vehicle testing, inspection, and certification landscape. First, investing in modular, upgradeable test infrastructure will ensure adaptability to emerging battery chemistries and evolving EMC requirements, thus safeguarding long-term capital efficiency. Second, forging strategic alliances with local component manufacturers and test equipment vendors can alleviate supply chain vulnerabilities and buffer against tariff fluctuations.

Moreover, service providers should prioritize the development of integrated digital ecosystems that unify data streams from diverse testing modalities, enabling predictive analytics to pre-empt potential failures. By offering value-added advisory services-such as regulatory gap analyses and design-for-compliance workshops-organizations can deepen client relationships and create recurring revenue streams. Finally, engaging in cross-industry consortia focused on harmonizing global testing standards will position leaders at the forefront of shaping future regulatory frameworks, ensuring their methodologies remain authoritative benchmarks.

Ensuring Robustness Through an Integrated Primary Secondary and Triangulated Analytical Approach to Market Insights

This research employed a rigorous multi-methodology approach to ensure the integrity and comprehensiveness of insights. Primary data collection involved structured interviews with key stakeholders across OE manufacturers, test laboratories, and regulatory agencies, capturing nuanced perspectives on emerging testing protocols and certification hurdles. Concurrently, secondary research synthesized information from public regulatory filings, technical whitepapers, and industry consortium publications to map prevailing standards and technological benchmarks.

To validate findings, the team conducted triangulation by cross-referencing interview feedback with empirical data from pilot test programs and field trials. Qualitative analysis of thematic trends informed the identification of transformative drivers, while quantitative cross-sectional assessments across service segments illuminated relative growth dynamics. This robust methodology underpins the actionable recommendations and strategic insights presented, ensuring that conclusions are grounded in both stakeholder expertise and empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Vehicle Testing, Inspection, & Certification market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Vehicle Testing, Inspection, & Certification Market, by Service Type

- Electric Vehicle Testing, Inspection, & Certification Market, by Propulsion Component

- Electric Vehicle Testing, Inspection, & Certification Market, by Testing Level

- Electric Vehicle Testing, Inspection, & Certification Market, by Vehicle Category

- Electric Vehicle Testing, Inspection, & Certification Market, by Region

- Electric Vehicle Testing, Inspection, & Certification Market, by Group

- Electric Vehicle Testing, Inspection, & Certification Market, by Country

- United States Electric Vehicle Testing, Inspection, & Certification Market

- China Electric Vehicle Testing, Inspection, & Certification Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesizing Industry Developments and Strategic Pathways to Drive Next-Generation Electric Vehicle Validation Excellence

In summary, the electric vehicle testing, inspection, and certification market is at a pivotal juncture, propelled by technological innovation and regulatory convergence. The introduction of new battery chemistries and connected vehicle functionalities demands agile testing protocols, while recent tariff shifts underscore the need for resilient supply chain strategies. Segmentation analysis highlights where growth is concentrated across testing, inspection, and certification services, and regional dynamics reveal contrasting approaches to infrastructure scale and regulatory alignment.

Moving forward, service providers that embrace modular infrastructure investments, digital data integration, and strategic partnerships will be best positioned to capture emerging opportunities. By contributing to global standard harmonization efforts and expanding value-added advisory services, industry leaders can not only mitigate current challenges but also drive the next wave of validation excellence. The findings herein offer a comprehensive blueprint for stakeholders seeking to navigate this complex ecosystem with confidence and authority.

Unlock Strategic Opportunities with Expert Consultation to Access Comprehensive Electric Vehicle Testing and Certification Market Intelligence

To explore how strategic insights into the electric vehicle testing, inspection, and certification market can empower your organization’s growth trajectory, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can help tailor a comprehensive research package that aligns with your unique business objectives and addresses key challenges in areas spanning battery performance validation to regulatory compliance. Take the next step today by reaching out to Ketan Rohom to secure exclusive access to the full market research report and schedule a personalized consultation on harnessing data-driven intelligence for competitive advantage.

- How big is the Electric Vehicle Testing, Inspection, & Certification Market?

- What is the Electric Vehicle Testing, Inspection, & Certification Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?