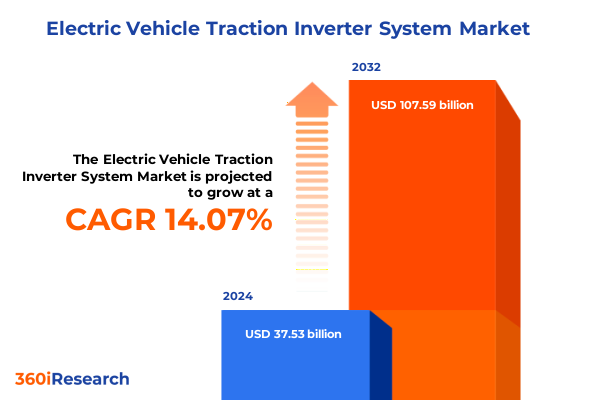

The Electric Vehicle Traction Inverter System Market size was estimated at USD 42.72 billion in 2025 and expected to reach USD 48.63 billion in 2026, at a CAGR of 14.10% to reach USD 107.59 billion by 2032.

Exploring the Critical Role and Evolution of Electric Vehicle Traction Inverter Systems Within the Global Automotive Electrification Movement

Electric vehicle traction inverter systems serve as the vital interface between onboard battery energy storage and the electric motor, translating direct current into precisely controlled alternating current. This critical function not only determines drivetrain performance and energy recovery potential but also directly influences vehicle efficiency, driving range, and thermal management strategies. In the broader context of automotive electrification, traction inverters have emerged as a cornerstone technology that supports the shift from internal combustion engines to zero-emission powertrains.

Our analysis embarks on a comprehensive examination of the evolution, core components, and operational principles underpinning modern inverter designs. It delves into the technological undercurrents reshaping the market, from emerging semiconductor materials to novel power architectures and digital control systems. By establishing this foundational perspective, readers gain clarity on how inverter systems integrate with battery management, motor control, and vehicle-level energy optimization. Through this introduction, we set the stage for deeper insights into market dynamics, segmentation nuances, and strategic implications, equipping decision-makers with the knowledge required to navigate an increasingly competitive landscape.

Identifying Transformative Technological and Market Shifts Redefining Efficiency and Performance Standards in Modern Electric Vehicle Traction Inverter Systems

Recent years have witnessed a convergence of technological breakthroughs and market forces that are redefining the performance benchmarks of electric vehicle traction inverters. Key developments include the maturation of wide-bandgap semiconductors, such as silicon carbide and gallium nitride, which enable higher switching frequencies, reduced thermal losses, and more compact module designs. These advances elevate power density and efficiency while driving down system-level size and weight, a transformative shift compared to legacy silicon insulated gate bipolar transistor solutions.

Alongside semiconductor innovation, inverter topology has evolved from traditional two-level full-bridge designs to multilevel and modular architectures. These new structures, including T-type and cascade H-bridge configurations, offer enhanced voltage handling, improved electromagnetic compatibility, and smoother current waveforms, resulting in lower harmonic distortion and superior motor control. Simultaneously, integrated power electronics, where control logic, sensors, and power modules coalesce in unified housings, are gaining traction. This integration streamlines manufacturing, reduces wiring complexity, and improves reliability under harsh operating conditions.

Moreover, digital control strategies leveraging real-time motor torque estimation, adaptive thermal management, and predictive diagnostic algorithms are transforming reliability and user experience. Taken together, these trends are not merely incremental-they represent a paradigmatic shift that positions next-generation traction inverters as enablers of higher efficiency, extended range, and advanced vehicle functionalities.

Analyzing the Collective Impact of United States Tariff Adjustments on Electric Vehicle Traction Inverter Components and Supply Chain Dynamics

In 2025, the United States implemented revised tariff schedules impacting a broad array of critical components within electric vehicle traction inverter assemblies. These measures targeted certain semiconductor categories, power modules, and related raw materials, altering cost structures across global supply chains. Manufacturers and suppliers have since grappled with a recalibrated import duty landscape that directly affects procurement lead times, inventory strategies, and overall project economics. Many organizations have responded by exploring alternative sourcing options or modifying bill-of-materials specifications to mitigate duty exposure.

The cumulative effect of these tariffs has spurred an acceleration of nearshoring and reshoring initiatives, with several leading inverter producers evaluating domestic fabrication partnerships. This trend seeks to balance higher labor and overhead costs with tariff savings, improved logistics resilience, and strengthened intellectual property safeguards. Furthermore, collaborative efforts between OEMs and government agencies have intensified, aiming to secure tariff exemptions for strategic green-technology projects under special trade programs.

Despite the near-term pressure on component pricing and supplier margins, the tariff environment is catalyzing innovation in supply chain design and manufacturing flexibility. By strategically aligning production footprints with regulatory incentives and investing in localized technical support, industry participants are turning tariff challenges into opportunities to build more responsive and scalable operations.

Unveiling Key Market Segmentation Insights Across Vehicle Formats Semiconductor Materials Topologies Power Ratings and Sales Channels to Inform Decisions

Electric vehicle traction inverter markets exhibit distinct profiles when examined through the lens of vehicle formats, semiconductor material choices, inverter topologies, power rating categories, and sales channels. Among vehicle formats, battery electric vehicles dominate discussions, with commercial variants demanding robust high-power inverters and passenger cars prioritizing compact form factors and efficiency. Two-wheelers require miniaturized solutions, while hybrid electric variants-both passenger and two-wheeler types-balance cost and performance in mid-range applications. Plug-in hybrids emphasize interoperability between electric drive and internal combustion components, influencing inverter control strategies and thermal design.

In terms of semiconductor materials, the shift toward silicon carbide and gallium nitride underscores the industry’s quest for higher switching speeds and lower conduction losses. Each material segment extends across discrete devices and power modules, signaling diverse integration paths depending on cost, modularity, and performance objectives. Legacy insulated gate bipolar transistors remain relevant within specific power classes, particularly where unit economics outweigh marginal efficiency gains.

Topology decisions further refine system performance, as designers choose between two-level bridges for proven simplicity, three-level clamped-neutral designs for voltage scalability, or multilevel flying-capacitor arrangements for ultra-low harmonic distortion. Power ratings span up to 50 kilowatts in compact applications, scale through 150 kilowatts for mainstream passenger cars, and climb above 200 kilowatts for heavy-duty commercial and high-performance EV segments. Finally, sales channels bifurcate into original equipment manufacturer engagements and aftermarket opportunities, where replacement modules and upgrade solutions cater to fleet owners, retrofit programs, and service providers. Each segmentation axis carries unique technical, economic, and regulatory considerations that guide strategic decision-making.

This comprehensive research report categorizes the Electric Vehicle Traction Inverter System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Semiconductor Material

- Vehicle Format

- Inverter Topology

- Power Rating

- Sales Channel

Highlighting Regional Dynamics for Electric Vehicle Inverter Systems Across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics for electric vehicle traction inverter systems vary significantly across the Americas, Europe Middle East Africa, and Asia-Pacific. In the Americas, policy incentives and a strong domestic automotive manufacturing base have fostered rapid adoption of advanced inverters, particularly in passenger car and commercial truck segments. Local content requirements and emerging tariff frameworks encourage regional component sourcing, prompting collaboration between OEMs and semiconductor suppliers.

Conversely, the Europe Middle East Africa region prioritizes high efficiency and multi-voltage compatibility to support diverse infrastructure conditions and renewable energy integration. Regulatory emphasis on greenhouse gas reductions drives demand for sophisticated inverter control features, while trade relationships with semiconductor manufacturing hubs introduce both opportunities and strategic dependencies.

Asia-Pacific remains the most dynamic market, combining large-scale production capacity with strong consumer EV uptake, especially in the two-wheeler and passenger car categories. State-backed programs in key economies incentivize domestic innovation in wide-bandgap material processing and inverter module assembly. Moreover, expanded transmission and charging infrastructure investments accelerate demand for high-power, reliable traction inverters, as well as streamlined aftermarket services. Across all regions, local regulations, incentive structures, and infrastructure maturity shape distinct adopter profiles and competitive landscapes.

This comprehensive research report examines key regions that drive the evolution of the Electric Vehicle Traction Inverter System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Presenting Key Company Insights Showcasing Leadership Innovation Strategic Collaborations Defining the Electric Vehicle Traction Inverter Landscape

Leading companies across the electric vehicle traction inverter space demonstrate diverse strategies centered on vertical integration, semiconductor partnerships, and advanced system design. Global chipmakers have moved aggressively to secure power device roadmaps that align with inverter module requirements, forging co-development agreements to tailor gallium nitride and silicon carbide offerings to automotive specifications. Simultaneously, inverter OEMs have invested in proprietary thermal management solutions, leveraging novel cooling architectures to enhance reliability under high ambient temperatures and heavy load cycles.

Strategic collaborations between semiconductor foundries and power electronics engineers have accelerated time-to-market for next-generation inverter assemblies. These alliances focus on co-optimizing power module substrates, control firmware, and electromagnetic interference mitigation techniques. At the same time, certain players have prioritized expanding aftermarket service networks, providing plug-and-play inverter upgrades and replacement modules for fleets seeking performance improvements without full vehicle retrofits.

Innovation in sensor integration, machine-learning-based fault detection, and over-the-air software update capabilities further differentiates the competitive field. By combining hardware expertise with robust digital toolchains, these companies are shaping a landscape in which inverter performance, scalability, and continuous improvement become critical markers of market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Vehicle Traction Inverter System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- BorgWarner Inc.

- Continental AG

- DENSO Corporation

- Fuji Electric Co., Ltd.

- Hitachi Astemo, Inc.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Marelli Corporation

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Semikron International GmbH

- STMicroelectronics N.V.

- Valeo SA

- Vitesco Technologies Group AG

- ZF Friedrichshafen AG

Delivering Actionable Strategic Recommendations to Propel Competitive Advantage and Operational Excellence in Electric Vehicle Traction Inverter Development

Industry leaders can capitalize on evolving market dynamics by pursuing a multi-pronged approach that aligns R&D investment, supply chain agility, and regulatory engagement. First, prioritizing the development of silicon carbide and gallium nitride based modules will unlock breakthroughs in efficiency and power density. These materials demand targeted process innovations and collaborative testing frameworks to ensure automotive-grade reliability under wide temperature ranges.

Second, establishing flexible manufacturing partnerships-both regionally and across supply tiers-will mitigate tariff impacts and foster resilience. Nearshoring module assembly in proximity to key vehicle manufacturing hubs can reduce lead times and enable faster iteration cycles. Concurrently, forging strategic alliances with semiconductor vendors secures prioritized access to advanced wafers and power substrates.

Third, integrating advanced digital controls with predictive maintenance algorithms will enhance system uptime and lower total cost of ownership. By embedding machine-learning diagnostics within inverter firmware, companies can offer value-added services that extend beyond hardware, fostering recurring revenue opportunities.

Lastly, engaging proactively with regulatory bodies to navigate tariff regimes and incentive programs will safeguard competitiveness. Through consortiums and industry working groups, manufacturers can influence policy frameworks that recognize the environmental benefits of electrification, ensuring continued support for inverter innovation.

Outlining a Rigorous and Transparent Research Methodology Underpinning the Comprehensive Analysis of Electric Vehicle Traction Inverter Market Dynamics

This report’s findings rest on a robust methodology that integrates primary interviews, secondary research, and data triangulation processes. Primary consultations with inverter engineers, semiconductor experts, and OEM procurement specialists provided direct insights into design challenges, sourcing strategies, and regulatory considerations. These interviews were conducted under confidentiality agreements to ensure candid perspectives from thought leaders across the value chain.

Secondary research encompassed a systematic review of publicly available patents, technical white papers, industry conference proceedings, and trade association publications. This effort ensured comprehensive coverage of emerging semiconductor developments, inverter topologies, and cooling system breakthroughs. Proprietary patent landscaping tools and academic journal databases further enriched the analysis of innovation trajectories.

Quantitative data was corroborated through cross-referencing multiple sources to validate trend consistency and identify potential anomalies. Our approach emphasized data quality and relevance, focusing exclusively on peer-reviewed or verified corporate disclosures. Through iterative validation rounds, we refined segmentation logic and thematic frameworks to accurately reflect market realities.

This rigorous methodology underpins every insight in the report, delivering a transparent and defensible foundation for strategic decision-making in the electric vehicle traction inverter domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Vehicle Traction Inverter System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Vehicle Traction Inverter System Market, by Semiconductor Material

- Electric Vehicle Traction Inverter System Market, by Vehicle Format

- Electric Vehicle Traction Inverter System Market, by Inverter Topology

- Electric Vehicle Traction Inverter System Market, by Power Rating

- Electric Vehicle Traction Inverter System Market, by Sales Channel

- Electric Vehicle Traction Inverter System Market, by Region

- Electric Vehicle Traction Inverter System Market, by Group

- Electric Vehicle Traction Inverter System Market, by Country

- United States Electric Vehicle Traction Inverter System Market

- China Electric Vehicle Traction Inverter System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Drawing Conclusive Insights and Strategic Imperatives to Navigate Future Opportunities Within the Electric Vehicle Traction Inverter Ecosystem

Having examined technological advancements, tariff impacts, segmentation nuances, regional dynamics, and competitive strategies, we draw several overarching conclusions. First, wide-bandgap semiconductor adoption and advanced topology integration are set to redefine efficiency and performance benchmarks. Second, the recent tariff realignments in the United States have catalyzed supply chain innovation, driving localization and collaborative risk management practices.

Third, segmentation insights across vehicle formats, power classes, and sales channels underscore the importance of tailored solutions-from compact two-wheeler inverters to high-power commercial modules. Regional contrasts further highlight that market entry and expansion strategies must align with local policy incentives, infrastructure maturity, and consumer preferences.

Finally, leadership hinges on fostering deep semiconductor partnerships, investing in digital control capabilities, and actively engaging in regulatory forums. By embracing these strategic imperatives, industry participants can position themselves to capture emerging opportunities, overcome supply chain uncertainties, and deliver next-generation inverter solutions that meet the evolving demands of the global electrification agenda.

Engage with Ketan Rohom for Custom Insights and Access to the Comprehensive Market Research Report Empowering Strategic Decisions in Electric Vehicle Inverter

We invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure customized insights tailored to your strategic priorities and access the comprehensive market research report on electric vehicle inverter systems. Ketan Rohom offers expert guidance on navigating the complex dynamics of component selection, tariff impacts, and regional variations, ensuring that your organization makes informed decisions with confidence. By partnering with him, you gain direct access to in-depth analyses, proprietary data interpretations, and bespoke consultations that align with your unique business objectives.

Take the next step toward mastering the electric vehicle traction inverter market by contacting Ketan Rohom. His expertise will empower your team to address technical challenges, anticipate regulatory changes, and optimize supply chain strategies. Schedule a consultation to discuss how our findings can translate into actionable intelligence for product development, competitive positioning, and investment planning. Let Ketan Rohom facilitate your journey from insight to impact, delivering the clarity you need to drive innovation and profitability in the rapidly evolving electric vehicle ecosystem.

- How big is the Electric Vehicle Traction Inverter System Market?

- What is the Electric Vehicle Traction Inverter System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?