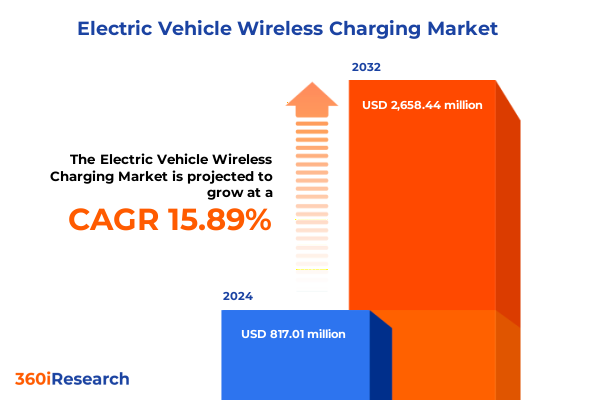

The Electric Vehicle Wireless Charging Market size was estimated at USD 1.36 billion in 2025 and expected to reach USD 1.53 billion in 2026, at a CAGR of 12.58% to reach USD 3.13 billion by 2032.

Setting the Foundation for a Rapidly Evolving Electric Vehicle Wireless Charging Ecosystem Through Innovative Technologies and Market Drivers

The rapid evolution of electric mobility has elevated wireless charging from a futuristic concept to a critical enabler of seamless vehicle electrification. As urbanization intensifies and vehicle fleets expand, stakeholders across the automotive, energy, and infrastructure sectors are accelerating the adoption of contactless charging technologies. In this shifting paradigm, wireless systems promise to eliminate driver inconvenience associated with plug-in connectors, reduce mechanical wear, and support dynamic charging scenarios that extend vehicle range during operation. Consequently, an ecosystem is emerging in which OEMs, infrastructure providers, standardization bodies, and regulators converge to unlock next-generation charging experiences.

Moreover, the competitive landscape is being reshaped by breakthroughs in power electronics, magnetic resonance, and energy management software. Research and development efforts are honing system efficiency, alignment tolerance, and electromagnetic compatibility to meet the stringent performance requirements of passenger cars, commercial fleets, and public transit vehicles. Meanwhile, pilot deployments on highways, public parking zones, and depot environments are generating real-world insights into operational safety, grid integration, and user acceptance. In light of these accelerating trends, this executive summary presents an in-depth exploration of the forces transforming the wireless EV charging market, synthesizing the strategic implications for industry leaders seeking to capitalize on this technological revolution.

Identifying Key Transformational Shifts in the Electric Vehicle Wireless Charging Landscape That Propel Market Adoption and Infrastructure Integration

In recent years, the wireless EV charging landscape has undergone multiple transformative shifts that are collectively rewriting the rules of electric mobility. First, the convergence of standardized interoperability protocols, such as the latest industry guidelines for magnetic resonance alignment, has paved the way for multi-vendor ecosystems. This move toward harmonized technical frameworks is reducing deployment risk and fostering collaboration between automakers, infrastructure operators, and technology specialists. At the same time, digitalization of charging networks is enabling remote diagnostics, predictive maintenance, and dynamic load balancing-measures that enhance reliability and reduce downtime in high-utilization environments.

Furthermore, the maturation of dynamic charging solutions, which embed transmitter coils beneath road surfaces, is transitioning from proof-of-concept demonstrations to commercial pilot corridors. These trials are compelling city planners and highway authorities to rethink infrastructure investment, as vehicles can top up their batteries in transit rather than relying solely on stationary hubs. Parallel advances in power packaging and thermal management have increased per-unit power output, making it feasible to serve heavy-duty fleets and long-haul corridor applications. Consequently, the competitive frontier is shifting toward players that can deliver end-to-end integration-from system design and installation to ongoing operational services.

As a result, strategic alliances are emerging between automotive OEMs, utility companies, and construction firms to expedite large-scale deployments. These partnerships, buttressed by public-private funding initiatives, are accelerating the path from pilot to mainstream and ensuring that wireless charging is viewed not as an optional convenience but as a scalable, interoperable solution essential to future transport infrastructure.

Analyzing the Compound Effects of the Latest United States Tariff Measures in 2025 on Electric Vehicle Wireless Charging Supply Chains and Competitiveness

The introduction of new United States tariffs in 2025 has generated a complex matrix of impacts across the wireless EV charging value chain. Measures targeting imported charging components and related electronics-particularly those sourced from regions with previously lower duty rates-have driven up input costs for transmitter coil assemblies and power conversion modules. This change is compelling manufacturers to reevaluate global sourcing strategies, with many now exploring nearshore production in North America to mitigate tariff exposure and shorten lead times. Consequently, supply chain resilience is becoming a core competitive differentiator, as firms with diversified manufacturing footprints can better absorb duties and offer more stable pricing to end customers.

In addition, the tariffs have reshaped procurement dynamics for infrastructure developers. Higher landed costs for imported coil hardware have shifted investment toward domestically produced alternatives, prompting several original equipment suppliers to expand local assembly lines. These strategic shifts are occurring concurrently with federal incentives for domestic semiconductor fabrication, creating a policy environment that rewards regional manufacturing but also introduces a degree of pricing volatility during the transition period. As a result, cost structures for system integrators have been under pressure, forcing them to reassess project budgets or negotiate long-term component contracts to lock in more favorable rates.

Moreover, the new duty regime has had ripple effects on end users in both public and private segments. Fleet operators and transit agencies are weighing the total cost of ownership more closely, factoring in higher upfront equipment expenses against long-term operational savings from wireless convenience. Simultaneously, a growing number of original equipment manufacturers are forging strategic partnerships with domestic suppliers to secure preferential pricing and minimize disruption. In this evolving tariff landscape, agility in supply chain planning and close collaboration across the value chain are essential for maintaining technological leadership and cost competitiveness.

Revealing Critical Segmentation Insights That Illuminate Diverse Dynamics Across Power Output Levels Vehicle Types Charging Modes and Application Use Cases

Insight into the segment-level dynamics of wireless EV charging reveals differentiated growth trajectories shaped by technical capabilities, use cases, and end-user demands. High-power configurations, capable of delivering output levels in excess of 50 kilowatts, are gaining traction in commercial fleet depots and highway corridors, where rapid turnaround times and minimal dwell periods are paramount. Meanwhile, medium-power solutions occupy a middle ground by balancing cost and performance, appealing to mixed commercial and private installations such as residential townhomes serving multiple dwellings. At the lower end of the power spectrum, systems optimized for slower charge rates are finding a foothold in single-family garages and urban street furniture applications that prioritize space efficiency over throughput.

From a technology standpoint, inductive coupling architectures are established for their mature safety protocols and reliable energy transfer, whereas resonant inductive approaches deliver greater alignment tolerance and potentially longer coil separation distances. Consequently, resonant systems are emerging in dynamic charging trials, enabling vehicles to maintain higher speeds over embedded roadway coils without precision parking. This technological divergence is driving a bifurcation in supplier roadmaps, with some concentrating on ruggedized inductive platforms for public transit vehicles and others perfecting resonant modules for high-speed bus routes and light rail auxiliary charging.

Charging mode segmentation also reveals strategic differences: stationary installations dominate current deployments by leveraging existing parking infrastructure, but dynamic implementations are attracting significant R&D investment and public sector interest. In vehicle classification, passenger cars and light commercial vans account for the majority of retrofit and OEM integration projects, yet heavy-duty commercial vehicles are rapidly adopting wireless solutions to minimize downtime during scheduled unloading and loading operations. Finally, applications vary widely between private fleet depots and residential garages, and on the public side between managed commercial parking facilities with dedicated charging zones and highway electrification projects that enable in-motion charging along intercity corridors. Each segment presents distinct technical, regulatory, and economic considerations, underscoring the need for tailored strategies by industry participants.

This comprehensive research report categorizes the Electric Vehicle Wireless Charging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offerings

- Technology Type

- Charging Type

- Power Output Level

- Vehicle Type

- Application

- Installation Type

Highlighting Pivotal Regional Insights That Demonstrate How Market Dynamics Vary Across Americas Europe Middle East Africa and Asia Pacific Territories

Regional market dynamics for wireless EV charging are shaped by disparate regulatory frameworks, infrastructure maturity, and funding incentives. In the Americas, aggressive national targets for zero-emission vehicles and substantial federal grants under recent climate and infrastructure programs have spurred deployment of both stationary and dynamic charging networks. Major urban centers are collaborating with utilities to pilot curbside installations, while highway agencies are testing inductive coils embedded within express lanes to support long-haul trucking electrification. This dual push of public and private sector investment is positioning the region at the forefront of large-scale commercialization.

Meanwhile, Europe, the Middle East and Africa are navigating a landscape defined by stringent emissions mandates in the European Union, heterogeneous grid capacities across member states, and emerging demand in key Middle Eastern markets. Here, public-private partnerships are critical; urban transit authorities in major cities are integrating stationary wireless pads at bus depots, supported by government subsidies that accelerate payback periods. Simultaneously, regulators are advancing harmonized technical standards to ensure interoperability across borders, a factor that is increasingly influencing the design decisions of multinational OEMs and infrastructure providers.

Across the Asia-Pacific region, high population densities and dynamic urban growth are driving demand for residential and commercial parking solutions, particularly in East Asian megacities where land scarcity elevates the value of wireless convenience. In markets such as South Korea and Japan, strong government backing for smart city initiatives is accelerating the installation of dynamic pilot corridors, while Australian and Southeast Asian utilities are evaluating stationary charging clusters to support electrified bus fleets. As each geography confronts unique challenges, ranging from grid resilience to regulatory alignment, tailored approaches to technology adoption and financing are essential for success.

This comprehensive research report examines key regions that drive the evolution of the Electric Vehicle Wireless Charging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Company Profiles and Competitive Advantages That Drive Innovation and Partnerships in Wireless EV Charging Technology Markets Worldwide

Leading players in the wireless EV charging arena distinguish themselves through specialized technology portfolios, strategic partnerships, and expansive intellectual property holdings. One category of innovators focuses on developing high-efficiency coil designs and advanced power electronics, securing patents that protect proprietary magnetic resonance techniques. Concurrently, infrastructure integrators are forging alliances with major automakers to embed vehicle-side receive coils directly into production models, ensuring seamless OEM compatibility and reducing retrofit complexity for fleet operators.

Additionally, collaborations between technology vendors and utility companies are forging new business models that bundle charging services with energy management solutions. This approach not only optimizes grid load during peak hours but also enables ancillary revenue streams through demand response participation. Select companies are further differentiating by offering end-to-end service contracts that encompass site assessment, system installation, ongoing maintenance, and performance analytics.

Investor interest and mergers and acquisitions activity are intensifying as the market consolidates around those with proven scalability and cross-regional deployment capabilities. Strategic acquisitions aimed at bolstering software platforms, expanding geographic reach, or enhancing dynamic charging expertise are forming a competitive landscape in which integrated solution providers hold a distinct advantage. Consequently, market leaders are leveraging their combined hardware, software, and service offerings to secure long-term agreements with municipal transit authorities, commercial fleet operators, and highway infrastructure developers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electric Vehicle Wireless Charging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- WiTricity Corporation

- Electreon Wireless Ltd.

- Siemens AG

- Continental AG

- Nissan Motor Co., Ltd.

- Toshiba Corporation

- Texas Instruments Incorporated

- Delphi Technologies by BorgWarner Inc.

- InductEV Inc.

- ZTE Corporation

- PULS GmbH

- WAVE, LLC

- Alstom SA

- Amphenol Corporation

- Conductix-Wampfler GmbH

- DAIHEN Corporation

- Elix Wireless

- Energous Corporation

- ENRX Group

- Evatran Group LLC

- HEVO Power, Inc.

- Hyundai Motor Company

- Ideanomics, Inc.

- INTIS AUCTIONS PRIVATE LIMITED

- KEBA AG

- Plugless Power LLC

- Toyota Motor Corporation

Delivering Actionable Recommendations to Industry Leaders on Strategic Investments Partnerships and Standardization for Rapid Wireless EV Charging Deployment

To capitalize on emerging opportunities, industry leaders should prioritize the development of high-power wireless charging systems tailored for heavy-duty and commercial applications, ensuring rapid replenishment of energy during minimal idle periods. In tandem, forming consortiums with vehicle OEMs and utilities to establish interoperable frameworks will accelerate standardization and drive down unit costs through economies of scale. Moreover, investing in modular, upgradeable platforms will enable service providers to respond quickly to evolving technical requirements and regulatory demands.

Furthermore, expanding dynamic charging pilot programs in collaboration with transportation authorities and city planners can generate crucial operational data that refines installation practices and user acceptance strategies. Pursuing joint ventures with construction and civil engineering firms allows for seamless integration of beneath-surface coils into road infrastructures, reducing deployment timelines and minimizing traffic disruptions. Companies should also consider deploying digital twin simulations to optimize coil placement, grid interaction, and maintenance scheduling before committing to large-scale rollouts.

Finally, supply chain diversification is essential to hedge against geopolitical risks and tariff fluctuations. Establishing regional component manufacturing partnerships and qualifying multiple suppliers for critical coil assemblies and power modules will enhance resilience and preserve competitive pricing, ensuring sustainable long-term growth in this rapidly evolving sector.

Outlining Rigorous Research Methodology with Primary and Secondary Data Collection Expert Interviews and Robust Analytical Frameworks for Credible Insights

This research combines comprehensive secondary analysis of technical standards documents, peer-reviewed publications, and industry whitepapers with targeted primary interviews involving senior executives from automakers, component suppliers, infrastructure integrators, and regulatory agencies. Quantitative data was gathered through proprietary surveys of fleet operators and public transit authorities to capture real-world usage patterns, cost drivers, and performance expectations.

The study employs a multi-tiered analytical framework that triangulates insights from supply chain mapping, patent landscape reviews, and pilot project case studies. Data validation processes include cross-verification of interview responses with actual project documentation and on-site pilot evaluations, ensuring that conclusions rest on verifiable evidence. Advanced statistical techniques have been used to identify correlations between technology attributes and adoption rates, while scenario analysis has explored the potential impact of evolving tariff policies and regulatory shifts.

Throughout the research process, methodological rigor was maintained by adhering to established industry guidelines for data integrity and by engaging an independent panel of subject matter experts to review findings. This approach provides decision-makers with confidence in the robustness and credibility of the insights, enabling informed strategic planning in the wireless EV charging domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electric Vehicle Wireless Charging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electric Vehicle Wireless Charging Market, by Offerings

- Electric Vehicle Wireless Charging Market, by Technology Type

- Electric Vehicle Wireless Charging Market, by Charging Type

- Electric Vehicle Wireless Charging Market, by Power Output Level

- Electric Vehicle Wireless Charging Market, by Vehicle Type

- Electric Vehicle Wireless Charging Market, by Application

- Electric Vehicle Wireless Charging Market, by Installation Type

- Electric Vehicle Wireless Charging Market, by Region

- Electric Vehicle Wireless Charging Market, by Group

- Electric Vehicle Wireless Charging Market, by Country

- United States Electric Vehicle Wireless Charging Market

- China Electric Vehicle Wireless Charging Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Drawing Comprehensive Conclusions That Synthesize Key Market Learnings and Strategic Imperatives in the Evolving Wireless Electric Vehicle Charging Landscape

Wireless charging for electric vehicles stands at a pivotal inflection point, where synergistic advances in technology, policy, and infrastructure are converging to redefine the future of transportation electrification. The transformative shifts in interoperability standards, dynamic charging capabilities, and digitalized network management collectively create pathways for seamless, ubiquitous charging experiences. At the same time, the new tariff environment underscores the imperative for supply chain flexibility and regional manufacturing strategies to maintain cost competitiveness and operational continuity.

Segmentation and regional dynamics reveal that no single solution fits all use cases; instead, tailored approaches based on power output requirements, technology architectures, charging modes, and end-user applications are essential. Leading organizations are leveraging strategic alliances, intellectual property portfolios, and service-oriented business models to carve out competitive advantage. Meanwhile, actionable recommendations focused on standardization, pilot collaborations, and supply chain resilience provide a clear roadmap for stakeholders seeking to accelerate deployment.

In summary, the wireless EV charging market offers significant opportunity for industry participants that can navigate evolving regulatory landscapes, harness technological innovation, and deliver integrated solutions. As the sector transitions from pilot deployments to mainstream adoption, the insights presented here will serve as a strategic guide for decision-makers aiming to lead this next wave of electric mobility transformation.

Inviting Engagement with the Associate Director of Sales and Marketing to Acquire the Definitive Wireless EV Charging Market Research Report for Strategic Edge

Ready to fuel your strategic planning with unparalleled market intelligence, now is the moment to reach out directly to the Associate Director of Sales and Marketing and ensure your organization gains immediate access to the most comprehensive wireless EV charging market research available. The Associate Director provides personalized guidance to align the report’s detailed insights with your unique business objectives and supports seamless procurement, so you can start leveraging the findings without delay. Engage today to secure this critical resource and establish a competitive edge in the rapidly evolving electric mobility sector.

- How big is the Electric Vehicle Wireless Charging Market?

- What is the Electric Vehicle Wireless Charging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?