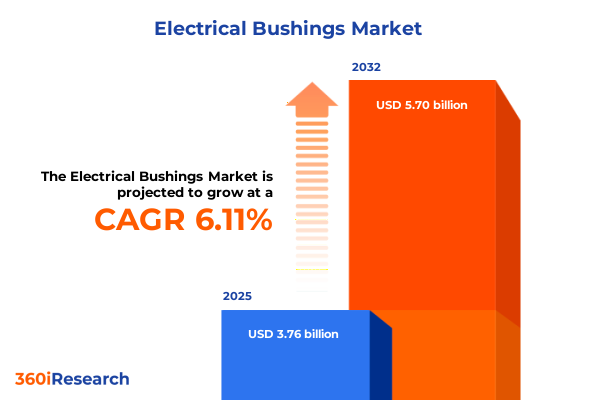

The Electrical Bushings Market size was estimated at USD 3.76 billion in 2025 and expected to reach USD 3.98 billion in 2026, at a CAGR of 6.11% to reach USD 5.70 billion by 2032.

Setting the Stage for the Electrical Bushings Market Amidst Rapid Grid Modernization, Renewable Integration, and Growing Demand for Uninterrupted Power Flow

The electrical bushings sector forms the critical interface between electrical equipment and transmission lines, enabling safe and efficient power flow within high-voltage systems. In recent years, surging energy demand, accelerated aging of existing infrastructure, and the integration of renewable energy sources have intensified the focus on reliable insulating solutions. As utilities pursue grid modernization projects and invest in expanding transmission capacity, the role of bushings has gained prominence both in developing regions and in regions with established grids seeking enhancement. Transition to digital substations and smart grid frameworks further underscores the need for high-performance bushings capable of withstanding dynamic loading and environmental stresses.

Beyond technical requirements, regulatory scrutiny and environmental mandates have shaped bushing designs toward more sustainable materials and manufacturing processes. This backdrop sets the stage for the subsequent analysis of transformative shifts, regional drivers, tariff impacts, and industry strategies, offering stakeholders an informed perspective on navigating the evolving landscape of electrical bushings.

Navigating Industry Transformations as Renewable Integration and Digital Monitoring Redefine Bushing Performance and Reliability

The landscape of electrical bushings is undergoing profound transformation as utilities embrace renewable integration, digital monitoring technologies, and heightened performance expectations. Clean energy targets have accelerated the deployment of wind, solar, and storage assets, necessitating upgrades to transmission and distribution networks to handle variable power flows. This shift has spurred demand for bushings designed for enhanced dielectric strength and faster response to transient overvoltages, reflecting broader industry ambitions for resilience and sustainability.

Simultaneously, the proliferation of condition-based maintenance solutions, equipped with sensors and real-time diagnostics, is redefining reliability standards. Manufacturers are integrating advanced polymeric composites and nanomaterial-infused resins to achieve slimmer profiles and superior hydrophobicity compared with conventional porcelain or oil-impregnated paper constructions. The convergence of digital substations and Internet of Things platforms enables continuous health monitoring of bushings, facilitating predictive maintenance and reducing unplanned outages. These paradigm shifts converge to create a bushing market oriented toward innovation, flexibility, and environmental compliance.

Assessing the Ongoing Influence of United States Trade Measures on Costs, Sourcing, and Competitive Dynamics in 2025

In 2025, the United States continues to enforce tariffs on critical electrical components, affecting the supply chain dynamics of bushings that rely on imported steel, aluminum, and specialized resins. Section 232 duties on aluminum and steel, first enacted in 2018, remain in force, thereby increasing the landed cost of metallic housing and core conductor materials used in high-voltage bushing assemblies. The sustained tariff regime has compelled OEMs to reevaluate procurement strategies, accelerate local sourcing initiatives, and pass through increased manufacturing costs to end users.

Moreover, Section 301 tariffs imposed on certain categories of Chinese-made electrical apparatus introduce another layer of cost complexity. Even as some tariff lines have seen exemptions or temporary relief for grid security projects, manufacturers navigate a fluctuating policy environment, managing inventory hedges and renegotiating supplier contracts. These measures cumulatively elevate capital expenditures for utilities and industrial buyers and create headwinds for new installations. However, they also present an opportunity for domestic producers to scale capacity, invest in advanced manufacturing, and collaborate with government incentive programs that promote onshore fabrication and supply chain resilience.

Uncovering Strategic Demand Drivers through Multi-Dimensional Segmentation Spanning Type Material Voltage Industry Application and Channel Preferences

Segmentation analysis reveals distinct demand profiles that shape strategic priorities across product and material portfolios. Based on bushing type, legacy Oil Impregnated Paper models remain prevalent where proven longevity is critical, while Resin Impregnated Paper options gain traction in retrofit installations that prioritize lower maintenance. When examining material type, glass is increasingly selected for indoor switchgear applications due to its transparency and reduced maintenance footprint, whereas polymeric composites offer weight savings and enhanced pollution resistance in coastal and industrial zones; porcelain continues to serve heavy industrial transformers under extreme thermal conditions.

Voltage rating segmentation underscores that high voltage applications above 230 kV drive investment in robust, weather-resistant outdoor bushings to support expanding transmission corridors, while medium voltage systems in the 37 kV to 230 kV range balance cost and performance for substation upgrades. Low voltage bushings up to 36 kV find usage in distribution switchgear and industrial power centers. Looking at end-use sectors, utilities remain the largest adopters owing to grid extension and refurbishment programs, commercial installations focus on compact solutions for urban developments, and industrial end users demand specialized bushings for power generation and processing plants. Application segmentation highlights that transformers represent the single largest destination for bushings, closely followed by switchgear, generators, and circuit breakers, each with unique dielectric and mechanical load requirements. The installation type distinction between new installations and retrofit projects informs service offerings and aftermarket support models, whereas distribution channel segmentation shows that offline direct sales and distributors remain dominant for large-volume orders, with online channels emerging for standardized, lower-voltage product lines.

This comprehensive research report categorizes the Electrical Bushings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Design

- Insulation Type

- Conductor Type

- Voltage Rating

- External Insulation Material

- Installation Environment

- Application

- End-User Industry

- Distribution Channel

Examining Regional Infrastructure Investments and Renewable Trends Driving Demand for Diverse Bushing Solutions across the Globe

Regional dynamics in the Americas reflect significant investment in grid hardening and renewable interconnection at the federal and state levels, propelling demand for both domestic and imported bushings. North American utilities focus on replacing aging infrastructure and deploying high-voltage DC links for cross-border and interregional power transfers. Latin American markets witness growth powered by hydropower expansions and mining electrification, although import constraints and currency volatility shape procurement decisions.

In Europe, the Middle East, and Africa, a blend of legacy networks and ambitious renewable targets spurs bushing replacement and upgrade cycles. Western Europe’s shift to offshore wind and high-capacity interconnectors calls for high-performance outdoor bushings that resist salt-laden environments. Meanwhile, Middle Eastern grid expansions to support industrial cities demand robust polymeric and porcelain designs for extreme heat. African markets show nascent but growing adoption in urban electrification projects, with a preference for cost-effective oil-impregnated designs in large transformer installations.

The Asia-Pacific region commands the largest share of new transmission projects globally, driven by expanding electrification in China, India, and Southeast Asia. Rapid industrialization and urbanization fuel investments in high-voltage networks, with domestic manufacturers in China and India scaling polymeric bushing production to meet local content mandates. Pacific island nations and Australia integrate bushings into renewable microgrids, valuing lightweight, low-maintenance solutions that align with decentralized energy strategies.

This comprehensive research report examines key regions that drive the evolution of the Electrical Bushings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating How Market Leaders and Niche Players Are Competing through Innovation, Supply Chain Resilience, and Service Differentiation

The competitive landscape features a mix of global conglomerates and specialized niche players each vying for market share through differentiated capabilities. Major OEMs leverage expansive R&D facilities to introduce polymeric insulators with embedded smart sensors, whereas regional manufacturers focus on cost-competitive porcelain and OIP products tailored to local grid specifications. Strategic partnerships between technology providers and utilities are accelerating pilot projects for digital monitoring and lifecycle analytics, positioning innovators as preferred suppliers for long-term service agreements.

Companies with vertically integrated supply chains benefit from material sourcing agility, enabling them to respond faster to tariff fluctuations and raw material shortages. Conversely, firms with strong aftermarket service networks capitalize on retrofit demand, offering turnkey installation, condition-based monitoring, and repair services that extend product lifecycles. Leadership in compliance with evolving environmental regulations and demonstration of sustainability credentials also differentiate the most successful companies in the mindshare of project developers and public utility commissions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrical Bushings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Siemens AG

- GE Vernova

- Eaton Corporation PLC

- Hitachi Energy Ltd

- Nexans S.A.

- Pfisterer Holding AG

- CG Power & Industrial Solutions Ltd.

- Hubbell Incorporated

- Bharat Heavy Electricals Limited

- Schneider Electric SE

- TE Connectivity Ltd.

- NGK INSULATORS, LTD.

- Megger Group

- WEG S.A.

- Weidmann Electrical Technology AG

- Maschinenfabrik Reinhausen GmbH

- Jiangxi Johnson Electric Co., Ltd

- Sieyuan Electric Co., Ltd.

- Beijing Sanhe Power Technology Group Co., Ltd.

- HSP Hochspannungsgeräte GmbH

- Nanjing Electric Technology Group Co., Ltd.

- Nanjing Rainbow Electric Co.,Ltd.

- PFIFFNER International AG

- Polycast International Limited

- Power Grid Components Inc.

- PREIS Group

- Radiant Enterprises

- RHM International, LLC

- Transformers and Rectifiers (India) Limited

- Webster Wilkinson Ltd.

- Yash Highvoltage Limited

Implementing Strategic Innovation, Localized Manufacturing, and Digital Service Models to Strengthen Market Leadership and Customer Value

Industry leaders should prioritize investment in advanced resin composites and sensor-embedded designs to meet the evolving reliability and digitalization demands of modern grids. Collaboration with utilities to co-develop pilot programs can validate performance under real-world stressors and build reference cases for broader adoption. Furthermore, establishing regional manufacturing or assembly operations in tariff-sensitive markets will mitigate the impact of trade measures, reduce lead times, and enhance customer responsiveness.

Companies must also expand aftermarket service capabilities, deploying condition-based maintenance platforms that integrate seamlessly with utility asset management systems. Training initiatives for field technicians and virtual reality tools can streamline installation and troubleshooting, reducing operational downtime. In addition, pursuing sustainability certifications and public-private partnerships for domestic content incentives will align corporate strategies with government priorities, securing long-term contracts and reputational benefits.

Outlining a Rigorously Validated Hybrid Research Framework Combining Primary Utility Interviews and Secondary Trade and Technical Data

This research employs a hybrid methodology combining primary interviews with utility executives, OEM product managers, and regional distributors, alongside secondary data from publicly available regulatory filings, trade databases, and technical publications. Data triangulation ensures robustness by cross-validating findings from multiple sources, while quantitative analysis of procurement patterns and installation projects identifies emerging trends and investment hotspots.

Segmentation analysis is conducted through a bottom-up approach, incorporating detailed sales records and project tender data to map demand across product types, materials, voltage classes, end-use industries, applications, installation types, and distribution channels. Regional insights draw on import-export statistics, government infrastructure investment reports, and on-site vendor assessments. Competitive benchmarking leverages patent filings, R&D expenditure disclosures, and service portfolio reviews. The research framework is designed for reproducibility, enabling stakeholders to update the model with new data points and adjust assumptions as market conditions evolve.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrical Bushings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrical Bushings Market, by Product Design

- Electrical Bushings Market, by Insulation Type

- Electrical Bushings Market, by Conductor Type

- Electrical Bushings Market, by Voltage Rating

- Electrical Bushings Market, by External Insulation Material

- Electrical Bushings Market, by Installation Environment

- Electrical Bushings Market, by Application

- Electrical Bushings Market, by End-User Industry

- Electrical Bushings Market, by Distribution Channel

- Electrical Bushings Market, by Region

- Electrical Bushings Market, by Group

- Electrical Bushings Market, by Country

- United States Electrical Bushings Market

- China Electrical Bushings Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2067 ]

Synthesizing Innovation, Policy, and Service Imperatives to Guide Strategic Direction in the Evolving Electrical Bushings Sector

In a market defined by accelerating grid modernization, renewable integration, and stringent environmental regulations, electrical bushings have emerged as strategic enablers of reliable power transmission. The interplay of transformative materials innovations, digital monitoring capabilities, and evolving tariff landscapes underscores the complexity and opportunity inherent in this segment. Segmentation and regional analyses reveal differentiated demand profiles that companies must navigate with tailored product development, localized operations, and comprehensive service offerings.

As industry leaders refine their strategies to address rising performance expectations and supply chain uncertainties, the ability to leverage actionable data, deploy advanced technologies, and forge collaborative partnerships will be pivotal. The insights herein provide a robust foundation for shaping strategic roadmaps, optimizing investments, and achieving sustainable growth in the dynamic electrical bushings market.

Connect with Ketan Rohom to Acquire Exclusive Strategic Insights and the Full Electrical Bushings Market Research Study

Engaging directly with Ketan Rohom presents an opportunity to gain unparalleled insights into the electrical bushings market dynamics and to secure the comprehensive market research report that will drive informed investment and strategic decisions. By reaching out, stakeholders will benefit from tailored guidance that aligns with their specific operational needs and market entry strategies and ensure they stay ahead in a rapidly evolving industry. Ketan’s expertise in sales and marketing guarantees a seamless process in acquiring the research dossier, equipping organizations with the data and intelligence necessary to capitalize on emerging opportunities and mitigate potential risks.

- How big is the Electrical Bushings Market?

- What is the Electrical Bushings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?