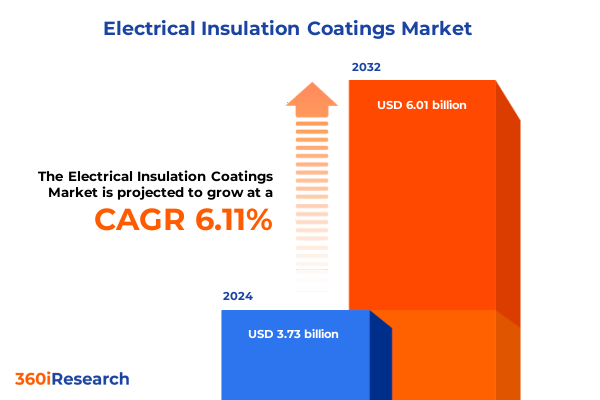

The Electrical Insulation Coatings Market size was estimated at USD 3.95 billion in 2025 and expected to reach USD 4.18 billion in 2026, at a CAGR of 6.17% to reach USD 6.01 billion by 2032.

Unveiling the Growing Dynamics of Electrical Insulation Coatings and Their Strategic Importance Across Diverse High-Performance Industrial Sectors Globally

The global business environment for electrical insulation coatings has reached a pivotal juncture, propelled by a convergence of technological advancements, regulatory pressures, and shifting end-user demands. As industries from aerospace and automotive to power generation intensify their focus on efficiency, reliability, and sustainability, the coatings that provide vital insulation for critical electrical components are garnering unprecedented attention. Innovations in formulation-ranging from high-performance fluoropolymers to low-emission water-based systems-are reshaping traditional manufacturing practices and elevating performance benchmarks.

Against this backdrop, key market participants are re-evaluating their strategic priorities to address evolving customer requirements, supply chain complexities, and the imperative for eco-friendly processes. Moreover, the rapid growth of renewable energy installations and electric transportation is amplifying demand for coatings capable of withstanding higher voltages, extended operational lifespans, and more rigorous environmental exposures. As a result, stakeholders throughout the value chain are exploring novel partnerships, materials science breakthroughs, and digital solutions to optimize product development and application processes.

By understanding the underlying drivers of this transformation, executives and decision-makers can better align their long-term plans with emerging opportunities. This introduction sets the stage for a detailed examination of the dynamic market forces at play and the strategies necessary to navigate an increasingly competitive and innovation-driven landscape.

Navigating the Wave of Technological, Regulatory, and Sustainability-Driven Transformative Shifts Reshaping the Electrical Insulation Coatings Landscape

The landscape of electrical insulation coatings has undergone transformative shifts driven by three primary forces: evolving technology paradigms, heightened sustainability mandates, and deepening digital integration. Technologically, the maturation of UV-curable and powder-based formulations has enabled faster cure times and reduced volatile organic compound emissions, offering manufacturers a path to more efficient production cycles. Concurrently, advances in resin science-particularly within acrylics, epoxies, and silicone systems-have yielded materials with superior dielectric strength and thermal stability.

In parallel, regulatory frameworks across major markets are enforcing stricter environmental standards that compel producers to reformulate legacy solvent-based coatings. These sustainability-driven requirements have accelerated the adoption of water-based and electron beam curing methods, reducing hazardous emissions and energy consumption. As a result, companies are investing heavily in green chemistry and life-cycle assessments to demonstrate compliance and secure market access.

Digital transformation is also reshaping industry paradigms, with smart manufacturing platforms enabling real-time monitoring of coating application parameters and predictive maintenance of equipment. Internet of Things–enabled sensor networks provide critical data on temperature, humidity, and curing progress, ensuring consistent application quality. Moreover, artificial intelligence and machine learning tools are being leveraged to optimize formulation blends and predict performance under diverse service conditions. Taken together, these shifts underscore a broader move toward integration of advanced materials and digital solutions, positioning the market for sustained innovation and enhanced operational resilience.

Assessing the Cumulative 2025 United States Tariff Implications on Electrical Insulation Coatings Supply Chains, Cost Structures, and Competitive Dynamics

In 2025, the United States implemented a series of tariffs targeting specialty chemicals and coatings sourced from select import markets, impacting the electrical insulation coatings supply chain in multifaceted ways. First, the increased duties have driven up landed costs for powder-based and fluoropolymer resin imports, prompting manufacturers to reevaluate supplier agreements and in some cases dual-source critical raw materials domestically. Consequently, procurement teams have intensified efforts to negotiate volume-based contracts and explore localized production alternatives.

Second, the shifting cost structures have influenced competitive dynamics, as domestic producers of water-based and solvent-based formulations seek to capitalize on relative pricing advantages. Companies that had previously relied on low-cost imports are now reorienting their product portfolios to feature more in-house sourced materials and formulations amenable to domestic supply. This realignment has spurred strategic collaborations between resin producers and coatings formulators aimed at vertically integrating segments of the value chain.

Finally, the cumulative effect of these tariffs has underscored the importance of supply chain agility and risk mitigation. Manufacturers are increasingly incorporating scenario planning and tariff impact modeling into their strategic roadmaps. Furthermore, the heightened cost pressures have accelerated investments in process optimization-such as electron beam and ultraviolet curing systems-to offset material cost increases with energy efficiency gains. As a result, the 2025 tariff implementation has served as a catalyst for both supply chain reinvention and operational innovation across the electrical insulation coatings industry.

Uncovering Critical Segmentation Insights Across Product, Resin, Industry, Application, Voltage Level, and Curing Method Dimensions Driving Market Nuances

An in-depth evaluation of market segmentation reveals intricate performance variations driven by product, resin, end-use industry, application, voltage level, and curing method dimensions. Based on product type, coatings such as high solid, powder based, solvent based, UV curable, and water based each exhibit distinct adoption patterns, with water-based systems gaining momentum in regions enforcing stringent VOC regulations, while powder and UV curable formulations lead in high-throughput manufacturing environments. Meanwhile, resin type segmentation shows that acrylic, epoxy, fluoropolymer, polyurethane, and silicone resins each deliver tailored balances of dielectric strength, adhesion, and temperature resistance, influencing formulators’ choices based on end-use requirements.

Considering end-use industries, aerospace and defense coatings-further divided into commercial aircraft and military aircraft segments-demand rigorous qualification and certification protocols to meet safety standards, whereas the automotive sector’s commercial vehicles and passenger vehicles segments pursue fast-drying and lightweight solutions to support assembly line efficiency and fuel economy targets. In construction, commercial and residential projects prioritize coatings that can endure environmental stressors and building code requirements, while telecommunications and consumer electronics in the electronics segment require ultra-thin layers and precise dielectric constants. Marine coatings address challenges in commercial shipping and leisure vessels with high-salinity resistance, and power generation end uses-renewable energy and utilities-seek materials that maintain performance under fluctuating loads and outdoor exposure.

Application-based segmentation underscores the need for specialized formulations in generator insulation, motor insulation, switchgear insulation, transformer insulation, and wire and cable coatings. Within motor insulation, further distinctions among rotor insulation, slot lines, and stator insulation reflect the necessity for coatings that can withstand mechanical stresses and thermal cycling. Voltage level segmentation indicates that high voltage systems demand premium insulating properties and arc resistance, medium voltage applications balance cost with performance, and low voltage iterations focus on flexibility and ease of application. Lastly, curing method segmentation-encompassing electron beam curing, moisture curing, thermal curing, and UV curing-highlights the trade-offs between capital investment, throughput, and environmental impact, guiding end users in aligning manufacturing capabilities with performance targets.

This comprehensive research report categorizes the Electrical Insulation Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Resin Type

- Voltage Level

- Curing Method

- Application

- End Use Industry

Exploring Key Regional Insights Highlighting Growth Drivers, Challenges, and Opportunities for Electrical Insulation Coatings Across Global Geographies

Regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific regions illustrate divergent growth drivers and market challenges influenced by regulatory environments, industrial end-user concentration, and infrastructure investments. In the Americas, increasing utility grid modernization initiatives and electric vehicle infrastructure rollouts are fueling demand for advanced coatings with robust high-voltage insulation properties. Brazil and Mexico are also emerging markets where expanding automotive and aerospace manufacturing hubs present new growth avenues. However, supply chain disruptions and raw material price volatility remain challenges for regional manufacturers endeavoring to maintain competitive cost structures.

In the Europe Middle East & Africa bloc, stringent European Union emissions regulations continue driving a shift toward low-VOC and solvent-free coatings, while substantial defense spending in select Middle East nations supports aerospace-grade formulation adoption. Africa’s nascent power generation projects and telecommunication expansions are creating pockets of opportunity, but inconsistent regulatory frameworks and logistical barriers necessitate careful market entry planning. Furthermore, collaborative research initiatives between European coating producers and regulatory agencies are fostering innovation in bio-based resin development and circular economy practices.

The Asia-Pacific region remains the largest single market by volume, propelled by rapid industrialization, expanding electronics manufacturing clusters, and coastal shipping growth. China and India are witnessing significant infrastructure spending on renewable energy installations, which elevates demand for long-life, weather-resistant insulation coatings. Meanwhile, Southeast Asian nations are gradually enhancing regulatory oversight on VOC emissions, thus gradually shifting preference toward water-based and UV-curable systems. Despite the robust growth outlook, intellectual property protection and regional price sensitivity require strategic partnerships and localized production strategies to capture sustainable market share.

This comprehensive research report examines key regions that drive the evolution of the Electrical Insulation Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Companies’ Strategic Initiatives, Innovation Pipelines, and Collaborative Partnerships Shaping the Competitive Electrical Insulation Coatings Arena

Leading participants within the electrical insulation coatings sector are pursuing multifaceted strategies to reinforce their market positions and drive long-term growth. Several top-tier companies have intensified investment in research and development, channeling resources into next-generation resin chemistries that deliver enhanced dielectric strength and faster cure times. This emphasis on innovation is complemented by strategic acquisitions of specialty chemical firms that bolster proprietary technology portfolios and provide access to new customer segments.

Moreover, collaboration has emerged as a critical competitive lever, with major coatings producers forging partnerships with equipment manufacturers to co-develop integrated application systems optimized for specific end-use requirements. These alliances enable seamless transfer of process data and facilitate co-marketing initiatives that highlight performance benefits. In addition, capacity expansion in emerging regional markets is a common thread, as companies aim to reduce lead times and mitigate tariff exposure through localized manufacturing footprints.

To further differentiate, many of the primary players have introduced service-oriented solutions such as on-site technical support, application training, and predictive maintenance platforms. By offering comprehensive customer engagement models, these firms enhance loyalty and defend against low-cost competitors. Finally, sustainability commitments are woven into broader corporate strategies, with firms publishing environmental impact reports and setting targets for reduced carbon intensity in production, signaling to stakeholders their long-term dedication to responsible innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrical Insulation Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Akzo Nobel N.V.

- Altana AG

- Aremco Products Inc.

- Arkema S.A.

- Axalta Coating Systems, LLC

- BASF SE

- Chase Corporation

- DuPont de Nemours, Inc.

- Evonik Industries AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hexion Inc.

- Jotun A/S

- Kansai Paint Co.,Ltd.

- Mitsui Chemicals, Inc.

- Momentive Performance Materials Inc.

- Nippon Paint Holdings Co., Ltd.

- Parker Hannifin Corporation

- PPG Industries, Inc.

- PTFE Applied Coatings Ltd.

- RPM International Inc.

- SK Formulations India Pvt. Ltd.

- The Dow Chemical Company

- The Sherwin-Williams Company

- Wacker Chemie AG

Implementing Actionable Recommendations to Strengthen Market Position, Drive Innovation, and Enhance Operational Resilience in Electrical Insulation Coatings

Industry leaders seeking to fortify their market position should prioritize a dual focus on sustainable formulation innovation and supply chain diversification. By channeling research efforts toward water-based and UV-curable technologies, executives can meet tightening environmental regulations while delivering performance enhancements valued by end users. Simultaneously, establishing multi-sourcing strategies and cultivating local raw material partnerships will mitigate tariff risks and stabilize production cost structures.

Furthermore, integrating digital process controls and data analytics into application workflows can unlock operational efficiencies, reduce waste, and facilitate real-time quality assurance. Companies that implement closed-loop feedback systems for monitoring curing parameters will achieve higher yield rates and greater consistency across production runs. In parallel, forging closer collaborations with OEMs and specification agencies can accelerate product qualification cycles and unlock long-term supply agreements.

Finally, adopting a customer-centric service model that bundles technical consultation, on-site support, and lifecycle maintenance offerings not only enhances revenue streams but also deepens client relationships. By leveraging predictive maintenance platforms and condition monitoring tools, organizations can anticipate service needs, reduce downtime, and cultivate a reputation for reliability. Collectively, these actionable steps will empower industry leaders to drive sustainable growth and reinforce resilience in an increasingly complex market environment.

Detailing the Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data Sources, and Rigorous Analytical Frameworks for Reliability

The methodology underpinning this research report integrates rigorous primary and secondary data collection methods to ensure robust analysis and validated insights. Primary research consisted of in-depth interviews with senior executives, R&D specialists, and procurement managers across key regions, complemented by structured surveys targeting end-use industry stakeholders to capture emerging requirements. These qualitative engagements were triangulated with quantitative datasets drawn from trade associations, government regulatory filings, and proprietary shipment records to establish market trends and demand patterns.

Secondary research encompassed a thorough review of industry publications, technical journals, patent databases, and sustainability reports, enabling comprehensive mapping of competitive landscapes and innovation pipelines. Data points were cross-verified through multiple independent sources to mitigate bias and enhance accuracy. The analytical framework employed scenario planning, SWOT assessment, and Porter’s Five Forces analysis, providing layered perspectives on market attractiveness and strategic challenges.

In addition, advanced statistical techniques, including regression analysis and time-series modeling, were applied to historical data to identify inflection points and forecast potential scenario outcomes. Throughout the process, strict data governance protocols were observed to maintain confidentiality and integrity of proprietary information. This methodological rigor underpins the report’s credibility, empowering stakeholders with trusted insights for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrical Insulation Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrical Insulation Coatings Market, by Product Type

- Electrical Insulation Coatings Market, by Resin Type

- Electrical Insulation Coatings Market, by Voltage Level

- Electrical Insulation Coatings Market, by Curing Method

- Electrical Insulation Coatings Market, by Application

- Electrical Insulation Coatings Market, by End Use Industry

- Electrical Insulation Coatings Market, by Region

- Electrical Insulation Coatings Market, by Group

- Electrical Insulation Coatings Market, by Country

- United States Electrical Insulation Coatings Market

- China Electrical Insulation Coatings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Core Findings and Strategic Imperatives to Provide a Concise Conclusion on the Electrical Insulation Coatings Market Dynamics

In conclusion, the electrical insulation coatings market is positioned at the intersection of innovation, regulation, and evolving end-use demands. Breakthroughs in resin technology and curing processes are enabling higher-performance solutions, while environmental mandates are reshaping the product mix toward low-emission and energy-efficient alternatives. The implementation of tariffs in 2025 has accelerated supply chain realignment and prompted deeper emphasis on operational agility and domestic sourcing.

Segmentation analysis has revealed nuanced performance drivers across product types, resin chemistries, end-use industries, applications, voltage levels, and curing methods, underscoring the importance of targeted strategies. Regional insights further highlight the diversity of market dynamics, with each geography presenting distinct regulatory landscapes and growth catalysts. Leading companies are responding with integrated innovation, strategic partnerships, and service-driven business models that enhance customer value and differentiation.

Looking ahead, industry participants should capitalize on sustainable coatings development, digital process integration, and localized manufacturing strategies to navigate an increasingly competitive and regulated environment. By adopting a comprehensive approach that blends technical excellence with customer-centric solutions, organizations will be well-positioned to capture emerging opportunities and sustain long-term growth.

Engage with Ketan Rohom to Secure Your Customized Market Research Report on Electrical Insulation Coatings and Drive Informed Strategic Decisions Today

To explore tailored insights and actionable intelligence specific to your strategic priorities in electrical insulation coatings, connect with Ketan Rohom, an accomplished Associate Director specializing in Sales and Marketing. Through his expertise, you can secure a comprehensive research report that aligns directly with your organizational objectives and decision-making needs. Engage with his consultative approach to access critical data, uncover emerging trends, and drive more informed investments. By partnering with a dedicated expert focused on translating market intelligence into tangible business outcomes, you will gain a competitive edge and enhance your strategic planning for long-term success.

- How big is the Electrical Insulation Coatings Market?

- What is the Electrical Insulation Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?