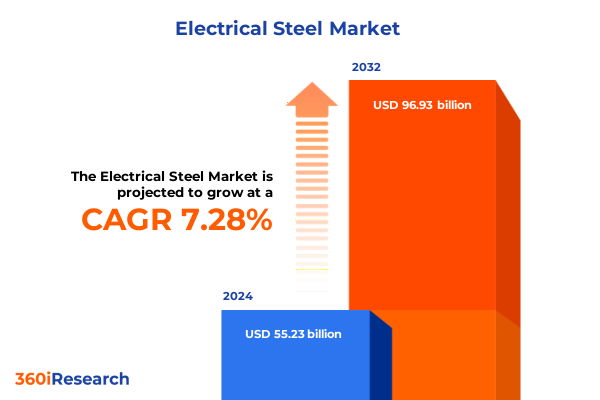

The Electrical Steel Market size was estimated at USD 59.15 billion in 2025 and expected to reach USD 63.35 billion in 2026, at a CAGR of 7.31% to reach USD 96.93 billion by 2032.

Unveiling the Critical Role of Electrical Steel in Advancing Global Power Infrastructure and Energizing Modern Industry with High-Performance Magnetic Materials

Electrical steel stands at the heart of modern power generation and distribution, serving as the foundational magnetic material in transformers, motors, and generators worldwide. Historically, its introduction revolutionized grid efficiency by significantly reducing core losses, thereby enabling the rapid expansion of electrical networks in the twentieth century. Today, as global energy systems undergo profound transformations driven by decarbonization targets and electrification initiatives, the role of electrical steel has become even more critical in supporting renewable energy integration and advanced mobility solutions.

The material’s unique magnetic properties differentiate it into two primary families: those optimized for directional magnetization and those engineered for isotropic performance. These material distinctions underpin diverse end-use applications, from high-voltage transformers in centralized power stations to compact electric motor cores for automotive and industrial purposes. As demand surges for higher efficiency, lighter weight, and lower operational losses, producers and end-users alike are channeling investments into premium variants that meet stringent performance and sustainability standards.

Despite its indispensable status, the electrical steel sector faces mounting pressures from supply chain bottlenecks, raw material cost volatility, and evolving regulatory landscapes across major consuming regions. Technological advancements in steelmaking, coating formulation, and lamination processes are rapidly reshaping competitive dynamics and enabling novel product designs. However, aligning production capabilities with fluctuating market demands remains a persistent challenge requiring strategic foresight and agile response mechanisms.

This executive summary synthesizes the pivotal trends, regulatory shifts, segmentation insights, regional patterns, and leading company strategies that define the current electrical steel ecosystem. By examining these dimensions in concert, decision-makers will gain a cohesive understanding of market drivers and actionable pathways to optimize product portfolios, fortify supply chains, and leverage emerging opportunities in the next chapter of global electrification.

Examining Unprecedented Technological and Market Dynamics That Are Redefining Electrical Steel Applications in Renewable Energy and Electric Mobility

Over the last decade, transformative shifts in end-use markets have reoriented the strategic trajectory of electrical steel. Central to this transformation is the unprecedented acceleration of renewable energy deployments such as wind and solar farms, which demand high-efficiency transformer cores capable of operating under variable load conditions with minimal losses. Concurrently, the rapid adoption of electric vehicles has driven substantial growth in motor and generator production, creating new performance benchmarks for magnetic materials where weight reduction and thermal management are paramount.

In tandem with market diversification, technological innovations in steel chemistry and processing methods are enabling the development of ultra-low loss variants. Enhanced grain refining techniques have yielded materials with superior magnetic permeability and reduced hysteresis, while advanced coating chemistries are improving electrical insulation and corrosion resistance at the lamination level. These technical strides are fostering product differentiation, compelling producers to invest in research collaboration and intellectual property development to safeguard competitive advantage.

Regulatory and policy landscapes have also contributed to the sector’s evolving complexion. Stricter energy efficiency directives in major economies and incentives for localized manufacturing have intensified focus on certification standards and geopolitical supply considerations. Companies are increasingly prioritizing digital integration across their operations, utilizing sensor-enabled quality controls and predictive analytics to optimize production yields and inventory management.

As stakeholders navigate this era of rapid change, understanding the confluence of market demand drivers, manufacturing innovations, and policy frameworks is essential. These transformative shifts are not isolated developments but interconnected forces that collectively reshape the operational, strategic, and investment imperatives for electrical steel producers and end users.

Assessing the Multifaceted Consequences of 2025 United States Steel Tariff Adjustments on Supply Chains, Pricing Structures, and Industry Competitiveness

The cumulative impact of United States tariffs implemented through 2025 has introduced notable complexities in the sourcing and pricing of electrical steel for both domestic and multinational manufacturers. Initiated under trade measures designed to protect national steel producers, these tariffs have progressively increased the cost basis for importers of finished and semi-finished steel laminations. As a result, original equipment manufacturers have faced upward pressure on production expenses, which in many cases have been passed through to end customers in the power generation, automotive, and industrial sectors.

In response to elevated import duties, a strategic realignment of supply chains has emerged. Major equipment producers have sought to diversify their procurement strategies by forging alliances with domestic steel mills capable of meeting stringent material specifications. Simultaneously, regional sourcing partnerships have grown in prominence, as firms leverage tariff exemptions and preferential trade agreements within the Americas to mitigate duty costs. This reorientation has bolstered domestic capacity expansion but has also led to intermittent raw material shortages as mills balance increased local orders with existing contractual obligations.

Downstream, the higher cost of electrical steel has incentivized design optimization efforts. Engineers are revisiting lamination geometries and core stacking techniques to minimize material usage without compromising performance. At the same time, price sensitivity has accelerated the adoption of alternative materials and hybrid core architectures in niche applications where ultra-high efficiency is less critical. While such adaptations offer short-term relief, the long-term competitiveness of U.S. manufacturers will depend on sustaining investment in advanced metallurgical technologies and process automation to offset tariff-induced cost burdens.

Overall, the 2025 tariff landscape has catalyzed both challenges and opportunities. By compelling industry stakeholders to reevaluate sourcing frameworks and innovate product designs, these measures have underscored the importance of supply chain resilience and strategic flexibility in an era of shifting trade policies.

Deriving Strategic Insights from Comprehensive Product, Thickness, Coating, and Application Segmentation to Optimize Electrical Steel Offerings

A comprehensive examination of electrical steel market segmentation across product, thickness, coating, and application dimensions reveals nuanced strategic levers for growth. Within the primary classification, grain oriented variants serve as the material of choice for transformer cores due to their directional magnetic properties and minimal core losses, whereas non grain oriented grades fulfill the demands of motors and generators where isotropic performance and mechanical robustness are critical. This fundamental distinction informs targeted product development and application alignment across end-use sectors.

When viewed through the lens of thickness categories ranging from sub-0.23 millimeter foils to laminations exceeding 0.40 millimeter, it becomes clear that mid-range gauges between 0.30 and 0.40 millimeter strike an optimal balance between manufacturability and magnetic efficiency. Thinner laminations offer reduced eddy current losses but require more intricate handling and processing, while thicker sheets provide economic advantages in heavy electrical machinery. Manufacturers seeking to differentiate their offerings must therefore calibrate production workflows to the precise thickness requirements of key customers.

Coating type further differentiates competitive positioning, as insulated surfaces address electrical insulation and corrosion mitigation concerns. Inorganic coatings, typically applied through chemical vapor deposition, deliver high temperature stability and long-term durability, whereas organic polymer coatings offer cost-effective insulation with simplified processing. In contrast, non insulated materials are often preferred in applications where external insulating structures or impregnation processes fulfill dielectric requirements more effectively.

Application segmentation in inductors and chokes, motors and generators-including both generator and motor assemblies-and transformer cores underscores the diverse performance demands placed on electrical steel. Inductor and choke applications benefit from specialized grade formulations that prioritize low frequency stability, while motor and generator cores require blends of high permeability and mechanical resilience. Transformers continue to dominate consumption volumes but also drive the most stringent efficiency standards under new regulatory mandates. By mapping product characteristics to end-use performance criteria, suppliers can refine their value propositions and optimize resource allocation in research and production.

This comprehensive research report categorizes the Electrical Steel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Thickness

- Coating Type

- Application

Unpacking Distinct Regional Patterns in the Americas, Europe Middle East and Africa, and Asia-Pacific That Shape Demand and Innovation in Electrical Steel

Examining regional dynamics reveals distinct consumption patterns and innovation drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific markets. In the Americas, growth has been underpinned by infrastructure modernization programs and renewed investment in grid resiliency. The United States, in particular, is pursuing advanced transformer upgrades to support distributed generation and microgrid initiatives, while Brazil’s expanding industrial base continues to fuel demand for robust motor and generator cores.

Shifting focus to Europe Middle East & Africa, regulatory frameworks have been the primary catalyst for market evolution. Stringent energy efficiency directives in the European Union have elevated the adoption of high-performance grain oriented materials, while Middle Eastern initiatives aiming to diversify energy portfolios have stimulated sizable transformer and motor procurement for petrochemical and utility applications. In Africa, nascent electrification efforts and rural grid expansion are gradually increasing the uptake of medium-voltage electrical steel solutions.

Within the Asia-Pacific region, capacity growth and technological leadership converge. China remains the single largest producer and consumer of electrical steel, driven by vast renewable energy rollouts and electric vehicle manufacturing ecosystems. Japan’s long-standing tradition of steelmaking excellence continues to generate cutting-edge low loss variants, and India’s burgeoning manufacturing sector is ramping up both domestic production and imports to satisfy rising demand for industrial motors and infrastructure projects.

Understanding these regional nuances is essential for stakeholders aiming to align supply chain investments, R&D initiatives, and market entry strategies with the specific priorities and regulatory landscapes of each geography.

This comprehensive research report examines key regions that drive the evolution of the Electrical Steel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Strategies and Technological Advances Employed by Leading Companies to Sustain Growth in the Electrical Steel Sector

Leading companies in the electrical steel domain are forging competitive advantages through integrated strategies that span upstream production to downstream lamination processes. Prominent global steel producers are investing heavily in state-of-the-art melt shop and hot rolling capabilities to ensure consistent alloy chemistries, while specialized laminators are advancing heat treatment and grain orientation techniques to achieve ultra-low loss metrics. Collaboration between these entities has become increasingly common, as joint ventures and equity partnerships facilitate technology transfer and expand geographic reach.

In response to mounting customer demand for tailored solutions, several key players have launched modular production platforms that streamline grade customization and accelerate product introduction cycles. By leveraging digital twins and real-time process analytics, they can optimize rolling schedules and lamination protocols to meet exacting dimensional tolerances and magnetic performance criteria. This digital integration not only enhances quality control but also reduces lead times, reinforcing supplier reliability in critical infrastructure projects.

Environmental sustainability has emerged as a central pillar of corporate strategy, prompting top companies to adopt closed-loop scrap recycling programs and invest in low-carbon steelmaking technologies. Energy-efficient electric arc furnaces and hydrogen-based direct reduction units are being piloted to lower greenhouse gas footprints, aligning with customer commitments to carbon neutrality. These initiatives differentiate leading suppliers in tenders where life-cycle emissions and circular economy principles are weighted alongside cost and technical specifications.

By advancing process innovation, digitalization, and sustainability, these companies are articulating clear value propositions that resonate with both industrial conglomerates and public sector utilities. Their strategic priorities offer a blueprint for emerging players seeking to challenge incumbents and capture growth in high-performance electrical steel applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrical Steel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AK Steel Corporation

- Ansteel Group Corporation Limited

- Aperam S.A.

- ArcelorMittal S.A.

- Baoshan Iron & Steel Co., Ltd.

- Baowu Steel Group Corporation Limited

- Benxi Steel Group Co., Ltd.

- CSC Steel Sdn. Bhd.

- Essar Steel India Limited

- JFE Steel Corporation

- Jindal Steel & Power Limited

- JSW Steel Limited

- Nippon Steel Corporation

- NLMK Group

- Outokumpu Oyj

- POSCO Corporation

- Shougang Group Co., Ltd.

- Steel Authority of India Limited

- Steel Dynamics, Inc.

- Tata Steel Europe

- Tata Steel Limited

- thyssenkrupp Steel Europe AG

- VIZ‑Stal

- Voestalpine AG

- Wuhan Iron & Steel Corporation

Outlining Actionable Strategic Initiatives to Enhance Supply Chain Resilience, Technological Innovation, and Market Positioning in Electrical Steel

To navigate evolving market conditions and capitalize on emerging opportunities, industry stakeholders should pursue a multi-pronged strategic agenda. Initially, diversifying raw material sourcing through regional partnerships and tariff-optimized procurement frameworks will enhance supply chain resilience and mitigate exposure to trade policy fluctuations. Concurrently, investing in advanced metallurgical research to refine grain size control and alloy composition will support the development of next-generation low loss materials that meet increasingly stringent efficiency standards.

Equally important is the adoption of digital manufacturing practices. Integrating sensor networks, predictive maintenance algorithms, and process analytics within rolling mill and lamination operations can dramatically improve yield rates and reduce downtime. These digital tools should be complemented by employee upskilling programs to ensure operational teams can leverage data-driven insights for continuous improvement.

On the product front, collaborating with key end-user segments such as electric vehicle OEMs, renewable energy developers, and grid operators will enable co-creation of customized solutions that address specific performance requirements. Such partnerships can shorten innovation cycles and foster early adoption of novel materials, thereby establishing first-mover advantages in high-growth applications.

Finally, embedding circular economy principles across the value chain will strengthen environmental credentials and meet sustainability expectations. Implementing robust scrap collection and recycling systems, as well as exploring energy-efficient steelmaking technologies, will not only reduce carbon footprints but also open new cost-optimization pathways. By executing these initiatives cohesively, industry leaders can secure durable competitive positioning and unlock long-term value in the electrical steel landscape.

Detailing Rigorous Quantitative and Qualitative Research Methodologies Underpinning Insights into Electrical Steel Supply Chains and Market Dynamics

The insights presented in this executive summary derive from a rigorous research framework combining both quantitative and qualitative methodologies. Primary research was conducted through in-depth interviews with senior executives, process engineers, and procurement specialists across major steel producers, laminators, and end-user organizations. These conversations provided firsthand perspectives on demand drivers, technology adoption, and supply chain strategies, enriching the context behind statistical observations.

Secondary research encompassed a thorough review of industry journals, white papers, trade association reports, and regulatory publications, ensuring foundational knowledge of material properties, coating technologies, and efficiency directives. By triangulating data from diverse sources-including public filings, patent databases, and customs records-the study established a robust evidence base to characterize regional market dynamics and tariff impacts.

Advanced analytical techniques such as cross-sectional segmentation analysis and scenario modeling were applied to understand the interplay between product attributes, application requirements, and geographic variations. Supply chain mapping tools traced raw material flows from mine to mill to end-use assembly, revealing critical nodes where cost, quality, and geopolitical factors converge. This mapping exercise informed the evaluation of tariff vulnerabilities and sourcing opportunities under different trade policy scenarios.

Quality assurance protocols were incorporated throughout the research process, with peer review sessions and data validation checks ensuring accuracy and consistency. The combination of expert interviews, document analysis, and quantitative modeling underpins the reliability of the insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrical Steel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrical Steel Market, by Product Type

- Electrical Steel Market, by Thickness

- Electrical Steel Market, by Coating Type

- Electrical Steel Market, by Application

- Electrical Steel Market, by Region

- Electrical Steel Market, by Group

- Electrical Steel Market, by Country

- United States Electrical Steel Market

- China Electrical Steel Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Core Findings and Emphasizing Strategic Implications for Stakeholders Engaged in Electrical Steel Development and Deployment

This executive summary has synthesized pivotal trends shaping the electrical steel landscape, from transformative shifts driven by renewable energy and mobility electrification to the cumulative impact of United States tariff policies through 2025. By delving into segmentation nuances across product type, thickness bands, coating technologies, and application categories, the analysis highlights strategic pathways for product optimization and market alignment. Regional insights reveal how Americas, Europe Middle East & Africa, and Asia-Pacific dynamics dictate differing consumption drivers, regulatory imperatives, and innovation priorities. Furthermore, a spotlight on leading companies underscores the importance of integrated value chain strategies, digital transformation, and sustainability commitments.

Strategically, stakeholders are called to build supply chain agility by diversifying sourcing, embracing technical innovation through co-development partnerships, and embedding circular economy practices to meet environmental objectives. The research methodology employed-a blend of primary interviews, secondary document review, and advanced analytical modeling-ensures the robustness of the findings and the credibility of the recommendations.

As the global market for electrical steel continues to evolve under the twin pressures of energy transition and trade policy shifts, decision-makers must leverage these insights to fortify competitive positioning, optimize resource allocation, and drive forward the next generation of high-performance magnetic materials. The strategic implications outlined in this summary provide a comprehensive blueprint for navigating the complexities of the modern electrical steel ecosystem.

Encouraging Industry Leaders to Secure Comprehensive Market Intelligence from Associate Director Sales and Marketing for Informed Strategic Partnerships

To obtain the full depth of analysis and unlock detailed insights for strategic decision-making, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. He can facilitate access to the complete electrical steel market research report, tailored executive briefings, and bespoke consulting sessions to meet the unique requirements of your organization. This exclusive offering is designed to empower industry stakeholders with comprehensive data, strategic guidance, and forward-looking perspectives vital for sustaining competitive advantage in a rapidly evolving market landscape

- How big is the Electrical Steel Market?

- What is the Electrical Steel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?