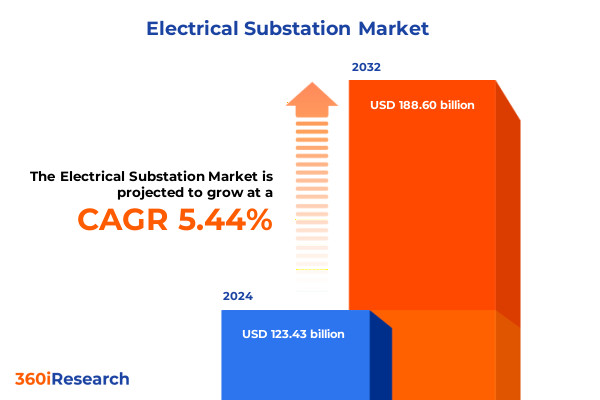

The Electrical Substation Market size was estimated at USD 130.04 billion in 2025 and expected to reach USD 136.67 billion in 2026, at a CAGR of 5.45% to reach USD 188.60 billion by 2032.

Embracing the Critical Role of Electrical Substations in Fortifying Grid Resilience and Enabling Next-Generation Energy Distribution Networks

Electrical substations serve as the linchpin of modern power systems, providing crucial functions of transforming voltage levels, routing power flows, and ensuring system reliability. By stepping down high-voltage transmission to distributable levels or facilitating bulk transfer between grid segments, substations underpin the stability of electricity networks that power economies and daily life. Within this dynamic landscape, aging infrastructure and escalating demand stress existing assets and compel utilities to pursue strategic upgrades and expansions.

Regulatory imperatives and corporate decarbonization commitments are driving accelerated investment in substation modernization programs. Stakeholders are navigating an environment where operational performance must be enhanced while integrating renewable energy sources, accommodating electrification trends, and mitigating environmental impact. Consequently, industry participants are collaborating to deploy advanced technologies, streamline asset management, and bolster resilience against physical and cyber threats.

Urbanization and the proliferation of distributed energy resources are adding complexity to substation operations. The growing penetration of electric vehicles, energy storage systems, and microgrids introduces bidirectional flows and variable load profiles that challenge conventional grid designs. To manage these complexities, utilities are adopting modular substation architectures and prefabricated designs that reduce installation lead times and minimize site disruption. These initiatives reflect a paradigm shift toward agile infrastructure that can scale with emerging demand patterns and support the decarbonization of power systems worldwide.

In this executive summary, we explore the critical factors shaping the electrical substation market today, highlight transformative shifts, analyze the cumulative impact of recent tariff measures, and provide actionable recommendations to guide strategic decision-making. By profiling key segmentations, regional dynamics, leading companies, and methodological approaches, we offer a holistic view to drive informed investments and operational excellence in substation development and management.

Unveiling Revolutionary Trends Shaping Electrical Substation Operations with Digitalization Decarbonization and Agile Modular Infrastructure Breakthroughs

Digital transformation is rapidly redefining substation operations through the integration of intelligent field devices, edge computing, and standardized communication protocols. Next-generation substations now incorporate microprocessor-based relays, phasor measurement units, and IEC 61850-compliant architectures to facilitate seamless interoperability and real-time data exchange across assets. By leveraging edge computing capabilities, substations can process critical operational data locally, reducing latency and enhancing responsiveness to grid disturbances, while cloud-based analytics platforms enable system-wide visibility and predictive maintenance across diverse networks.

Concurrent with digitalization, there is a pronounced shift toward environmentally sustainable insulative and switching solutions. Research initiatives are exploring SF6 alternatives such as fluoronitrile mixtures and vacuum-interruption technologies to mitigate greenhouse gas emissions and improve safety in gas-insulated systems. At the same time, the substation design is embracing modular and prefabricated architectures that allow for rapid deployment, reduced site footprint, and cost efficiencies. These modular substations are configured off-site and delivered as integrated units, streamlining civil works and electrical commissioning to support accelerated grid expansion and decarbonization objectives.

Assessing the Comprehensive Impact of Emerging United States Tariff Policies on Electrical Substation Equipment Procurement and Deployment Dynamics

Recent U.S. tariff measures have significantly reshaped the procurement landscape for electrical substation equipment. Steel and aluminum imports are subject to 25% duties under Section 232, while additional ad valorem duties have been imposed on power equipment from Mexico, Canada, and China, raising costs for critical components like transformers and high-voltage switches. These duties include a retroactive increase from 7.5% to 35% on Chinese power equipment imports implemented by the U.S. Trade Representative beginning May 1, 2025, affecting hydroelectric generating units, transformers, and switchgear across key HS codes.

The elevated tariffs have driven up capital expenditure requirements and extended lead times, compelling utilities to re-evaluate their supply chains and sourcing strategies. Higher steel and aluminum costs not only inflate the price of U.S.-manufactured transformers but also threaten project timelines amid a national transformer shortage, with Texas utilities among the hardest hit. Moreover, tariff uncertainties have dampened investor confidence in renewable energy and grid modernization projects, as evidenced by industry warnings that these policies could slow the deployment of clean energy infrastructure and compromise grid resilience.

Deriving Strategic Insights from Multifaceted Segmentation of Electrical Substation Components Voltage Levels Insulation Types and End User Applications

Segmenting by component type reveals the diverse equipment categories that underpin substation functionality, from circuit breakers-encompassing air circuit breakers, SF6 circuit breakers, and vacuum circuit breakers-to protection and control systems, which include automation systems, relay schemes, and SCADA systems. By further distinguishing between air-insulated and gas-insulated switchgear, as well as distribution, instrument, and power transformers, market participants can pinpoint investment priorities and technology requirements across different asset classes.

Examining voltage levels provides insights into the engineering and regulatory considerations of extra high voltage, high voltage, and medium voltage applications. Each voltage tier demands specialized design parameters, insulation standards, and safety protocols, influencing procurement cycles and vendor qualification processes.

Evaluating insulation type segmentation illuminates the trade-offs between air-insulated, gas-insulated, and oil-insulated substations, where factors such as environmental footprint, operational reliability, and maintenance complexity drive stakeholder preferences.

Analysis by end user categorizes substation deployment across commercial, industrial, and utility sectors, highlighting varying performance expectations, lifecycle considerations, and strategic objectives. Commercial installations often prioritize compact footprints for urban settings, while industrial and utility projects emphasize scalability and resilience.

Substation type segmentation-encompassing collector, distribution, and transmission substations-identifies the role of offshore and onshore collector stations, indoor and outdoor distribution facilities, and indoor and outdoor transmission hubs, each subject to distinct environmental, logistical, and grid integration challenges.

Finally, the installation mode dimension differentiates between conventional field-erected substations and modular prefabricated or skid-mounted solutions, illuminating the balance between customization flexibility, deployment speed, and cost efficiency across diverse project scopes.

This comprehensive research report categorizes the Electrical Substation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Voltage Level

- Insulation Type

- End User

- Substation Type

- Installation Mode

Unraveling Key Regional Dynamics and Emerging Trends Driving Electrical Substation Development across the Americas EMEA and Asia Pacific Energy Markets

Across the Americas, infrastructure modernization is propelled by federal funding initiatives, state-level grid resiliency programs, and the integration of renewables and battery storage. The U.S. Inflation Reduction Act and the bipartisan Infrastructure Investment and Jobs Act have catalyzed accelerated substation retrofits and the rollout of digital protection devices, while Canadian utilities are aligning with net-zero goals through targeted substation expansions in response to growing energy demands.

In Europe, the Middle East, and Africa, energy transition objectives and supportive regulatory frameworks are driving substation upgrades designed to integrate offshore and onshore renewable assets into transmission networks. The European Green Deal’s clean energy mandate and MENA countries’ diversification strategies are spurring investments in gas-insulated substations to address space constraints and improve environmental performance, while African grid operators seek modular solutions to enhance access and reduce system losses in rapidly expanding urban centers.

In the Asia-Pacific region, urbanization, industrial growth, and renewable energy deployment are fostering robust demand for both conventional and digital substations. Markets such as China, India, and Southeast Asia are investing heavily in high-voltage and extra high-voltage substations to support cross-border power interconnections and large-scale solar and wind integration, while Japan and Australia focus on smart grid pilots and the adoption of advanced grid control technologies to optimize network efficiency and reliability.

This comprehensive research report examines key regions that drive the evolution of the Electrical Substation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Major Industry Players Shaping Electrical Substation Innovation across Power Infrastructure through Strategic Partnerships and Technological Leadership

Major industry players are leveraging global footprints and technological portfolios to drive innovation in substation solutions. ABB and Siemens Energy have rolled out integrated digital substation platforms that combine intelligent control, cybersecurity frameworks, and predictive analytics to reduce outage risks and optimize asset utilization. Schneider Electric is advancing modular substation designs that expedite deployment and minimize environmental impact through factory-integrated assemblies.

Transformer manufacturers such as Hitachi Energy and Mitsubishi Electric are focusing on low-loss designs, SF6 alternative development, and improved thermal management to meet stringent efficiency and emission targets. Switchgear specialists like Eaton and GE Grid Solutions are incorporating vacuum interrupters and digital sensor integration to deliver compact, high-performance switchgear systems with remote monitoring capabilities.

In the services domain, companies like Hexing and Omicron are expanding their diagnostics and testing offerings, supported by AI-driven analytics that enable condition-based maintenance and rapid fault location. Startups and consortium initiatives such as the Open Power AI Consortium are collaborating with established firms to pilot AI applications, digital twin simulations, and advanced workforce tools that accelerate substation lifecycle management and workforce safety.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrical Substation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Bharat Heavy Electricals Limited

- CG Power and Industrial Solutions Ltd

- Crompton Greaves Limited

- Eaton Corporation plc

- General Electric Company

- Hitachi Energy Ltd

- Hyundai Electric & Energy Systems Co., Ltd.

- MingYang Electric Co., Ltd

- Mitsubishi Electric Corporation

- Nari Group Corporation

- Nissin Electric Co., Ltd

- Schneider Electric SE

- Siemens AG

- Sunten Electric Equipment Co., Ltd

- Toshiba Corporation

- WEG S.A.

- Wilson Transformer Company Pty Ltd

- Wuzhou Transformers Co., Ltd.

- Xi’an Electric Engineering Co., Ltd.

Empowering Industry Leaders with Actionable Recommendations to Optimize Electrical Substation Performance Enhance Resilience and Accelerate Sustainable Energy Integration

Industry leaders should prioritize the integration of digital control systems and advanced analytics to transform substation operations from reactive to predictive. By deploying IEC 61850-compliant architectures and edge computing platforms, utilities can enhance situational awareness, automate routine maintenance tasks, and reduce unplanned outages.

To mitigate tariff-induced cost pressures, organizations must diversify sourcing strategies by qualifying multiple regional suppliers, negotiating long-term agreements, and exploring domestic manufacturing partnerships. A proactive approach to supply chain resilience will help ensure continuity of critical component availability and contain capital expenditures.

Modular substation solutions offer an agile deployment model that can compress project schedules and reduce site-level risks. By incorporating prefabricated and skid-mounted assemblies, project teams can optimize civil and electrical integration, accelerate commissioning, and respond swiftly to shifting load growth and regulatory requirements.

Sustainability considerations should be embedded across substation lifecycles through the selection of SF6 alternatives, energy-efficient transformer technologies, and low-carbon construction practices. Collaboration with research institutions and participation in industry standards forums will enable organizations to drive environmental performance while maintaining reliability and safety.

Detailing Rigorous Research Methodology Leveraging Expert Interviews Data Triangulation and Industry Benchmarking for Robust Insights on Electrical Substation Infrastructure

This research employs a hybrid methodology combining qualitative interviews with industry experts, engineers, and regulators, alongside comprehensive secondary research encompassing technical standards, white papers, and governmental publications. Primary insights were gathered through in-depth discussions with utility executives, equipment manufacturers, and service providers to capture nuanced perspectives on technological adoption, regulatory impacts, and operational challenges.

Secondary research involved systematic review of policy directives, technology roadmaps, and academic and trade publications to corroborate primary findings. A rigorous data-triangulation process was utilized to align information across disparate sources, ensuring the validation of equipment specifications, tariff rates, and regional deployment trends. Expert workshops and peer reviews provided an additional layer of quality assurance.

Segmentation analyses were developed through a bottom-up synthesis of component categories, voltage tiers, insulation technologies, end-user profiles, substation typologies, and installation modes, enabling granular insights into market drivers and barriers. Regional profiles were constructed based on geopolitical factors, regulatory frameworks, and infrastructure investment patterns.

Key company assessments integrated an evaluation of product pipelines, strategic partnerships, and R&D initiatives, with performance metrics benchmarked against publicly available disclosures and expert estimates. The methodology emphasizes transparency, repeatability, and alignment with best practices in energy infrastructure research.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrical Substation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrical Substation Market, by Component Type

- Electrical Substation Market, by Voltage Level

- Electrical Substation Market, by Insulation Type

- Electrical Substation Market, by End User

- Electrical Substation Market, by Substation Type

- Electrical Substation Market, by Installation Mode

- Electrical Substation Market, by Region

- Electrical Substation Market, by Group

- Electrical Substation Market, by Country

- United States Electrical Substation Market

- China Electrical Substation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concluding Reflections on Evolving Electrical Substation Paradigms Emphasizing Strategic Insights Action Plans and Future Pathways for Energy Network Evolution

In summary, the electrical substation sector is at a pivotal juncture, shaped by converging imperatives of grid modernization, decarbonization, and enhanced resilience. The evolution toward digital substations and modular frameworks underscores a broader shift toward agile, data-driven infrastructure capable of accommodating renewable integration and evolving load dynamics.

Tariff escalations have introduced headwinds that necessitate proactive supply chain strategies, yet they also create incentives for domestic manufacturing investments and innovation in high-performance materials and equipment. Stakeholders who adeptly navigate these complexities will secure strategic advantages in cost management and project delivery.

Segmentation-based insights reveal nuanced opportunities across component types, voltage levels, and substation configurations, guiding targeted investments and technology deployments. Regional dynamics vary significantly, with Americas, EMEA, and Asia-Pacific markets exhibiting distinct regulatory drivers and capital allocation preferences.

Leading companies are deploying advanced analytics, AI, and enhanced modular solutions to differentiate their offerings and support utility partners in meeting ambitious reliability and sustainability goals. By adhering to the actionable recommendations outlined, industry leaders can harness emerging technologies to optimize substation performance and deliver long-term operational excellence.

Secure Essential Electrical Substation Market Intelligence by Connecting with Ketan Rohom to Elevate Decision Making and Achieve Strategic Energy Infrastructure Objectives

Ready to unlock a comprehensive view of the electrical substation landscape and gain a strategic edge? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure essential market intelligence tailored to your needs. Discover how our in-depth analysis and insights can elevate your decision-making, streamline project planning, and support your organization’s infrastructure objectives. Reach out today to procure the definitive market research report and propel your energy strategy forward.

- How big is the Electrical Substation Market?

- What is the Electrical Substation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?