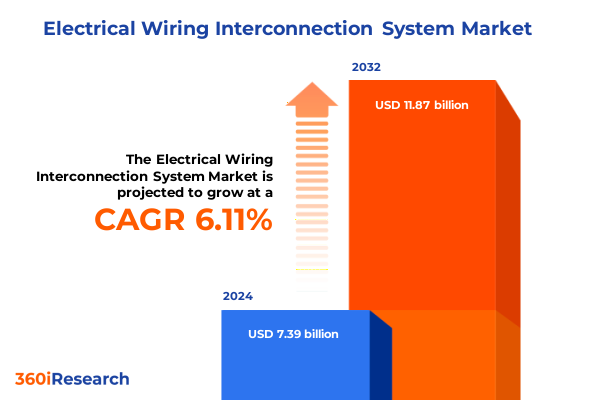

The Electrical Wiring Interconnection System Market size was estimated at USD 7.84 billion in 2025 and expected to reach USD 8.28 billion in 2026, at a CAGR of 6.09% to reach USD 11.87 billion by 2032.

Discover the Foundational Dynamics Shaping the Global Electrical Wiring Interconnection System Landscape and Its Emerging Opportunities

The global electrical wiring interconnection system landscape is undergoing a rapid metamorphosis as industries demand greater connectivity, reliability, and efficiency from foundational cabling and connector technologies. In recent years, digitalization across sectors such as automotive, aerospace, telecommunications, and energy has driven unprecedented growth in complex wiring architectures. As vehicles adopt electrification and software-defined functions, wiring harnesses and connectors must balance miniaturization with high-voltage performance, while data networks pursue ever-faster signal transmission.

Simultaneously, the expansion of renewable energy infrastructure and smart grid initiatives has intensified requirements for durable, weather-resistant wiring assemblies capable of sustaining extreme environmental stresses. Looking ahead, integration of fiber optic interconnects and hybrid cabling solutions will redefine system architectures, enabling seamless convergence of power and data. This introduction outlines the foundational dynamics shaping the wiring interconnection ecosystem, setting the stage for a deeper exploration of transformative technological shifts, tariff influences, market segmentation, regional drivers, and competitive strategies.

Navigating the Paradigm Shift Driven by Technological Advancements Regulatory Changes and Sustainability Trends Reshaping the Wiring Interconnection Domain

Technological innovation is redefining the wiring interconnection landscape, as smart systems demand not only robust electrical conductivity but also intelligent monitoring and control. The advent of embedded sensors and predictive diagnostics within connectors and harnesses is facilitating real-time performance tracking, enabling proactive maintenance and minimizing downtime. Concurrently, high-speed data transmission requirements have spurred the adoption of fiber optic connectors in applications once dominated by copper conductors, marking a decisive shift toward hybrid cabling solutions.

Regulatory frameworks and sustainability mandates are further catalyzing evolution. Manufacturers are embracing eco-friendly insulation materials and recyclable components to meet circular economy goals, while end-of-life considerations are influencing design-for-disassembly practices. Within automotive and aerospace sectors, stringent safety certifications are accelerating the development of lightweight, flame-retardant jacketing and advanced polymer insulations. Moreover, the emergence of digital twin technology is empowering design teams to simulate electromagnetic interference and thermal behaviors within complex assemblies, reducing prototyping cycles and speeding time to market.

Taken together, these trends constitute a transformative trajectory for the wiring interconnection domain, compelling suppliers and end users alike to innovate across materials, form factors, and information-enabled functionality.

Evaluating How United States Tariffs Implemented in 2025 Are Reshaping Supply Chains Cost Structures and Strategic Positioning in the Wiring Systems Market

United States tariff measures introduced throughout 2025 are exerting profound effects on cost structures and supply chain configurations in the wiring interconnection sector. Broad-based duties on steel and aluminum under Section 232, coupled with targeted levies on Chinese electrical components via Section 301, have elevated raw material and subcomponent expenses across the value chain. As a result, manufacturers have been compelled to reconfigure procurement strategies, seeking alternative regional suppliers in Mexico and Southeast Asia to mitigate duty burdens and maintain margin stability.

The heightened tariff environment has also pressured lead times, prompting OEMs and contract manufacturers to establish dual-sourcing frameworks and buffer inventories. While some businesses have leveraged tariff exclusion petitions to secure temporary relief on specialized alloys and engineered polymers, the administrative complexity has underscored the importance of proactive customs management and scenario planning. Against this backdrop, companies with agile production footprints and vertically integrated operations have gained a competitive advantage, enabling them to absorb duty fluctuations without compromising delivery schedules.

Ultimately, the cumulative impact of 2025 tariffs is reshaping strategic positioning in the electrical wiring interconnection market, driving a shift toward nearshoring, diversified supply networks, and enhanced trade compliance capabilities.

Unveiling How Product Type Wire Type Insulation Material Application and End Use Industries Drive Distinct Dynamics in the Wiring Interconnection Market

A nuanced understanding of market segmentation reveals disparate dynamics across product typologies, insulation materials, application areas, and end-use industries that collectively shape competitive strategies in the wiring interconnection landscape. Within the product type domain, the connectors category-comprising board-to-board variants, circular interfaces, fiber optic junctions, and rectangular configurations-has seen accelerated investment in miniaturized, high-density designs. In parallel, junctions and splices such as busbars, terminal blocks, and wiring harness assemblies are evolving to accommodate increased current densities and modular power distribution architectures. Protective covers are likewise adapting, featuring enhanced UV resistance and integrated sealing solutions to safeguard against environmental ingress. Beyond these, wires and cables-encompassing coaxial lines, multi conductor strands, ribbon assemblies, and shielded constructions-continue to advance via novel conductor alloys and braid geometries that optimize electromagnetic shielding.

Wire type further stratifies the market into multi core cables and single core wires, each with distinct performance and application profiles. Multi core variants blend shielded and unshielded constructions to address complex signal integrity requirements, while single conductor offerings leverage PTFE and PVC insulation compounds to deliver specialized thermal, chemical, and abrasion resistance. Insulation material selection itself underpins critical performance criteria: cross linked polyethylene offers exceptional dielectric strength for high-voltage circuits, polyvinyl chloride balances cost and flexibility, rubber exhibits superior elasticity for dynamic applications, and Teflon provides unmatched thermal stability in extreme environments.

Application-based segmentation underscores three primary end-use scenarios: data communication networks that demand ultrahigh bandwidth, power distribution systems requiring robust current handling, and signal transmission pathways where fidelity is paramount. Finally, end-use considerations delineate maintenance repair and overhaul operations-spanning replacement and retrofit projects-and original equipment manufacturing processes across automotive, construction, energy and power, industrial machinery, and telecommunications sectors. Together, these layered segmentation insights inform tailored product development roadmaps and market entry strategies, enabling stakeholders to align capabilities with specialized customer requirements.

This comprehensive research report categorizes the Electrical Wiring Interconnection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Wire Type

- Insulation Material

- Application

- End Use

- End Use Industry

Illuminating Region-Specific Developments and Demand Drivers Across the Americas Europe Middle East Africa and Asia-Pacific Wiring Ecosystem

Regional dynamics in the wiring interconnection ecosystem vary markedly based on infrastructure priorities, regulatory frameworks, and industrial mix. In the Americas, demand is buoyed by an automotive sector undergoing electrification alongside a robust aerospace industry prioritizing advanced weight-optimized wiring harnesses. Concurrent grid modernization programs across North and South America elevate requirements for high-voltage distribution cabling and smart sensor integration. As manufacturers consolidate production facilities closer to key OEMs and Tier 1 suppliers, local content considerations and logistics efficiencies are further redefining competitiveness in the hemisphere.

Europe, the Middle East, and Africa present a complex tapestry of adoption patterns. European mandates on vehicle emissions and industrial safety certifications are driving uptake of flame-retardant insulation systems and reliability testing protocols that exceed global norms. In the Middle East, large-scale energy projects focused on renewables and petrochemical infrastructure necessitate durable wiring solutions capable of withstanding extreme thermal cycling and corrosive atmospheres. Across Africa, nascent telecommunications rollouts and off-grid power initiatives are expanding market opportunities, though inconsistent regulatory regimes and import tariffs can present operational challenges.

The Asia-Pacific region remains a powerhouse of manufacturing capacity, underpinned by rapid expansion of 5G networks, electric vehicle assembly lines, and renewable energy installations. Cost-competitive production in China, India, and Southeast Asia continues to supply global OEMs, while domestic demand in Japan and South Korea drives specialization in high-precision, miniaturized connector systems. Taken together, these regional insights illuminate how geographical priorities and policy landscapes shape demand trajectories and strategic sourcing decisions in the wiring interconnection market.

This comprehensive research report examines key regions that drive the evolution of the Electrical Wiring Interconnection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Portfolios of Leading Electrical Wiring Interconnection System Providers Driving Sector Growth

Leading players in the electrical wiring interconnection space are leveraging a combination of product innovation, strategic partnerships, and operational scaling to fortify their market positions. One prominent manufacturer has expanded its portfolio of fiber optic connectivity solutions through acquisitions of niche photonics specialists, enabling it to deliver turnkey data communication harnesses. Another key supplier has prioritized digital service offerings by embedding diagnostic sensors within high-voltage cable assemblies, facilitating remote monitoring and predictive maintenance for utility and industrial clients.

Further, several global corporations have established advanced manufacturing centers in emerging economies to capitalize on lower production costs and proximity to fast-growing end markets. Collaborative ventures between connector specialists and materials innovators are accelerating the development of next-generation insulation jackets with enhanced thermal stability and reduced environmental footprint. Meanwhile, a subset of market leaders is exploring additive manufacturing techniques for rapid prototyping of complex junction housings, significantly reducing time to market for custom designs.

Collectively, these company-level strategies underscore a sector in which agility, technical differentiation, and ecosystem partnerships are critical to sustaining growth and delivering value across increasingly demanding applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrical Wiring Interconnection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aernnova Aerospace S.A.

- Airbus SE

- Amphenol Corporation

- Collins Aerospace

- GKN Aerospace Services Limited

- Groupe Latécoère

- Latecoere S.A.

- Leonardo S.p.A.

- Leoni AG

- Mitsubishi Heavy Industries, Ltd.

- PCC Aerostructures

- Safran S.A.

- Senior PLC

- Spirit AeroSystems Holdings, Inc.

- STELIA Aerospace Group

- TE Connectivity Ltd.

- Thales Group

- The Boeing Company

- Zodiac Aerospace

Offering Actionable Strategic Recommendations for Industry Leaders to Enhance Resilience Optimize Operations and Accelerate Innovation in Wiring Interconnection Systems

To navigate the complexities of modern wiring interconnection markets, industry leaders should consider a multifaceted approach that emphasizes supply chain diversification, advanced materials research, and digital transformation. Prioritizing alternative sourcing partnerships-especially in nearshoring locations-can mitigate tariff exposure and enhance delivery predictability. Concurrently, investing in high-performance insulation materials such as advanced fluoropolymers and cross linked elastomers will position product portfolios to meet stringent safety and environmental standards.

In parallel, adopting digital twin and simulation platforms can accelerate design validation, optimize electromagnetic compatibility, and reduce reliance on physical prototypes. Embedding smart sensors within harness assemblies provides an additional layer of value, enabling proactive maintenance and service revenue streams. Moreover, fostering close collaboration with key OEMs and tiered suppliers will streamline customization processes, ensuring rapid iteration on specialized configurations for emerging applications in electric vehicles, renewable energy, and 5G infrastructure.

By integrating these strategic imperatives into corporate roadmaps, companies can build resilient, innovation-driven capabilities that align with evolving customer requirements and regulatory landscapes.

Detailing the Rigorous Multi-Source Research Methodology Underpinning the Comprehensive Analysis of the Electrical Wiring Interconnection Market

This analysis is underpinned by a rigorous, multi-layered research methodology designed to deliver robust, validated insights into the electrical wiring interconnection market. Initially, extensive secondary research was conducted across industry publications, patent filings, technical standards repositories, and regulatory documentation to establish a comprehensive knowledge base of sector trends, material technologies, and policy shifts.

Complementing this, primary research engagements were conducted through structured interviews with senior executives, design engineers, procurement specialists, and key opinion leaders spanning manufacturing, OEM, and end-user organizations. Quantitative data collection included detailed supply chain surveys and pricing analyses, triangulated against historical filings, trade databases, and financial disclosures to ensure consistency and accuracy.

Throughout the process, iterative validation workshops and peer reviews were held to reconcile divergent perspectives, refine analytical frameworks, and confirm the reliability of findings. The resulting synthesis reflects a balanced integration of qualitative insights and quantitative evidence, providing a transparent, defensible foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrical Wiring Interconnection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrical Wiring Interconnection System Market, by Product Type

- Electrical Wiring Interconnection System Market, by Wire Type

- Electrical Wiring Interconnection System Market, by Insulation Material

- Electrical Wiring Interconnection System Market, by Application

- Electrical Wiring Interconnection System Market, by End Use

- Electrical Wiring Interconnection System Market, by End Use Industry

- Electrical Wiring Interconnection System Market, by Region

- Electrical Wiring Interconnection System Market, by Group

- Electrical Wiring Interconnection System Market, by Country

- United States Electrical Wiring Interconnection System Market

- China Electrical Wiring Interconnection System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Strategic Perspectives to Conclude the Executive Summary of the Electrical Wiring Interconnection System Analysis

In conclusion, the electrical wiring interconnection sector stands at the intersection of accelerating technological innovation, evolving regulatory imperatives, and shifting trade dynamics. Advances in connector miniaturization, hybrid cabling, and intelligent sensing are driving a new era of integrated power and data solutions, while sustainability mandates and tariff pressures are reshaping supply chain strategies.

Layered segmentation analysis highlights distinct performance requirements across product types, insulation materials, applications, and end-use industries, underscoring the need for tailored development roadmaps. Regionally, the Americas, Europe Middle East Africa, and Asia-Pacific each exhibit unique demand drivers informed by industrial, regulatory, and infrastructure priorities. Within this complex environment, leading companies are differentiating through strategic acquisitions, digital service innovation, and agile manufacturing footprints.

By synthesizing these key findings and strategic perspectives, decision makers can chart a course toward resilient growth, leveraging actionable insights to anticipate market shifts and capitalize on emerging opportunities.

Engage with Ketan Rohom Associate Director Sales Marketing to Access Exclusive Detailed Market Insights and Elevate Your Strategic Decision Making Today

As you navigate critical strategic decisions in the electrical wiring interconnection sector, securing comprehensive, data-rich insights is essential to achieving a competitive edge. Ketan Rohom, Associate Director of Sales & Marketing, invites you to engage directly and access an exclusive, in-depth market research report tailored to your organization’s specific needs. By collaborating with Ketan, you will gain privileged access to granular analysis of industry drivers, segmentation dynamics, tariff impacts, and regional developments, all synthesized into actionable intelligence.

Initiate a dialogue today to explore customized market intelligence solutions that empower your leadership team to optimize supply chain strategies, accelerate product innovation, and anticipate regulatory changes. Contact Ketan Rohom to learn how this report can be integrated into your strategic planning process, enabling you to make confident, forward-looking decisions in a rapidly evolving market landscape.

- How big is the Electrical Wiring Interconnection System Market?

- What is the Electrical Wiring Interconnection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?