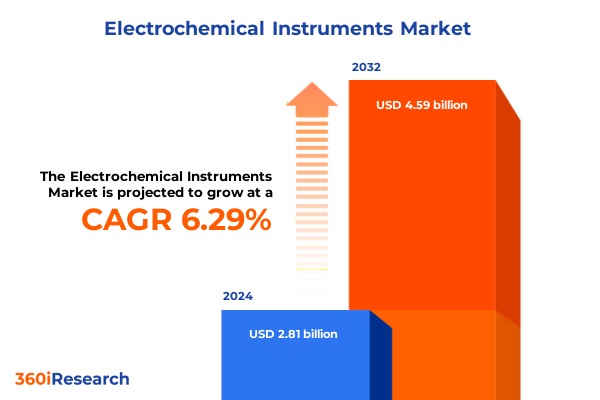

The Electrochemical Instruments Market size was estimated at USD 2.99 billion in 2025 and expected to reach USD 3.18 billion in 2026, at a CAGR of 6.31% to reach USD 4.59 billion by 2032.

Exploring the Expanding Role of Electrochemical Instruments in Driving Innovation Across Laboratory Research Environmental Monitoring and Industrial Processes

Electrochemical instrumentation serves as the foundational pillar for precise measurement and control in applications ranging from academic research to industrial process management. These sophisticated tools harness fundamental electrochemical principles to quantify parameters such as pH, conductivity, dissolved oxygen, and ion concentration with exceptional accuracy. Over time, their capabilities have expanded beyond traditional laboratory confines, enabling seamless integration into manufacturing lines, environmental monitoring stations, and quality control laboratories. As stakeholders increasingly prioritize data fidelity and real-time insights, the evolution of this instrumentation has become critical for maintaining competitive advantage in both research and operational environments.

In recent years, stakeholders have witnessed a convergence of advanced materials, miniaturization, and user-centric software interfaces that have redefined instrument usability and performance. No longer are users relegated to complex setup procedures or manual data logging; instead, modern platforms offer plug-and-play connectivity, cloud-based analytics, and automated calibration routines. This transformation has accelerated adoption across pharmaceutical development programs, petrochemical analysis, water treatment facilities, and educational institutions. Furthermore, the proliferation of portable and handheld devices has democratized access to real-time measurements, empowering field operators and quality assurance teams to make informed decisions on the spot.

Moving forward, the continued refinement of sensor technology, coupled with enhanced digital frameworks and regulatory harmonization, will drive further value for end users. This introduction sets the stage for a deeper exploration of the disruptive shifts, policy impacts, segmentation insights, and strategic imperatives that shape the electrochemical instrumentation ecosystem today.

Unveiling the Technological Disruptions Shaping the Electrochemical Instruments Landscape Through Digital Integration Sustainability and Smart Connectivity

The electrochemical instrumentation landscape is undergoing transformative change as emerging technologies and evolving user requirements converge to redefine performance benchmarks. A growing emphasis on modular architectures now allows end users to tailor system configurations to specific applications, whether in high-throughput academic laboratories or continuous process monitoring in manufacturing plants. As a result, adaptability has become a key criterion for instrument developers, prompting a shift away from monolithic hardware designs toward platform-based solutions that support a wide range of sensor types and analytical modules.

Meanwhile, digital integration stands as a pivotal catalyst for innovation. Connectivity protocols such as Ethernet, Wi-Fi, and Bluetooth are now standard features, enabling instruments to stream data directly into laboratory information management systems and cloud repositories. This seamless data flow enhances traceability, streamlines compliance with regulatory mandates, and unlocks advanced analytics powered by machine learning. In parallel, mobile applications and web portals provide remote access to real-time dashboards, empowering researchers and plant managers to monitor system health and analytical results from any location.

Sustainability considerations and resource conservation have also emerged as driving forces behind new instrument designs. Manufacturers are introducing low-power sensors, recyclable components, and energy-efficient operation modes to meet stricter environmental regulations and corporate sustainability targets. Coupled with the rising use of additive manufacturing for custom sensor housings, these trends underscore a broader move toward lightweight, durable, and eco-friendly platforms. Collectively, these transformative shifts are reshaping how electrochemical instruments are designed, deployed, and maintained across end-user segments worldwide.

Analyzing the Far Reaching Effects of New United States Tariff Measures on Global Supply Chains Pricing Strategies and Manufacturing Dynamics in 2025

The introduction of new United States tariffs in early 2025 has reverberated across the global supply chain for electrochemical instrumentation components and raw materials. Manufacturers reliant on imported electrodes, specialized polymers, and electronic modules have faced increased input costs, prompting an urgent reassessment of sourcing strategies. With duties applied to a broad array of analytical components, OEMs have sought to mitigate margin erosion by renegotiating supplier contracts, diversifying procurement channels, and exploring nearshore manufacturing alternatives.

These measures, however, have not been without challenges. Supply chain reconfiguration has introduced longer lead times and heightened logistical complexity, particularly for companies operating just-in-time inventory models. In response, many instrument producers are accelerating investments in domestic production capabilities and strategic partnerships with local fabricators. While initial capital expenditures have risen, the shift toward onshore assembly lines has improved supply resilience and reduced exposure to transoceanic shipping disruptions.

End users have had to adapt as well. Purchasing teams are increasingly factoring duty-related surcharges into total cost of ownership analyses, leading to longer procurement cycles and heightened scrutiny of long-term service agreements. Some organizations have opted to standardize on universal modules that can be easily sourced from multiple suppliers, thereby reducing the risk of single-source dependencies. As the tariff landscape continues to evolve, stakeholders are closely monitoring trade policy developments to anticipate further adjustments to cost structures and market dynamics.

Revealing Critical Insights from Segmenting the Electrochemical Instruments Market by Instrument Type Application End User and Product Form Factors

The electrochemical instrumentation sector exhibits a rich tapestry of product distinctions, beginning with core instrument categories such as conductivity meters, corrosion analyzers, dissolved oxygen meters, ion selective electrode analyzers, pH meters, potentiostat/galvanostats, and titrators. Within the conductivity segment, users can select between benchtop models for laboratory precision, in-line variants suited for process integration across laboratory and plant environments, and portable units designed for battery-operated and handheld convenience in the field. Corrosion analysis solutions span techniques from electrochemical impedance spectroscopy to linear polarization and Tafel extrapolation, catering to both research laboratories and maintenance teams seeking to quantify material degradation rates.

Dissolved oxygen measurements follow a similar pattern of segmentation, with benchtop systems for controlled experiments, online configurations that support continuous monitoring via in-line or on-line installations, and portable options that offer battery-operated or handheld flexibility. Ion selective electrode analyzers deliver targeted ion quantification through specialized calcium, chloride, potassium, and sodium electrodes, while pH measurement platforms encompass benchtop consoles, online probes, and portable meters with handheld or battery-powered designs. Potentiostat/galvanostat instruments address a diversity of research and industrial demands, including battery testing, corrosion studies, electrochemical research, industrial plating, and sensor development, whereas titrators employ coulometric, Karl Fischer, potentiometric, and voltammetric approaches to support advanced chemical analysis.

This detailed segmentation reveals where suppliers can align product roadmaps with application requirements. By understanding the nuances of each subsegment, from portable handheld convenience to in-line process adaptability, industry participants can tailor value propositions to meet the stringent demands of academia, environmental monitoring, food and beverage quality control, petrochemical processing, pharmaceutical formulation, and water treatment operations.

This comprehensive research report categorizes the Electrochemical Instruments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Instrument Type

- Product Type

- Application

- End User

Mapping the Diverse Regional Dynamics Influencing Electrochemical Instruments Adoption Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics play a pivotal role in shaping the adoption and development of electrochemical instrumentation. In the Americas, well-established laboratory infrastructure across North America and stringent environmental regulations have spurred demand for high-precision measurement systems. The United States and Canada continue to invest in advanced research and industrial applications, while emerging markets in Latin America are demonstrating growing interest in water treatment and food safety testing. Collaborative partnerships between local distributors and global manufacturers have facilitated technology transfer and training programs aimed at enhancing analytical capabilities.

Across Europe, Middle East, and Africa, diverse regulatory landscapes and economic conditions influence purchasing decisions. Western European nations maintain rigorous quality control standards, driving a preference for integrated, automated platforms with comprehensive support services. In the Middle East, increased spending on petrochemical and energy infrastructure has led to higher uptake of corrosion analyzers and potentiostat/galvanostat systems. African markets, while more nascent, are gradually embracing portable and battery-operated solutions to address field-based environmental monitoring and agricultural applications, with international aid organizations often spearheading initial deployments.

The Asia-Pacific region offers a blend of mature and fast-growing markets. Established hubs in Japan and South Korea prioritize cutting-edge research applications and precision instrumentation, whereas China and India represent high-volume opportunities driven by expanding pharmaceutical manufacturing, water treatment, and environmental compliance mandates. Investment in domestic manufacturing capabilities and state-funded research projects has intensified competition, leading global vendors to adapt pricing strategies, localize service networks, and form joint ventures with regional players to secure long-term growth.

This comprehensive research report examines key regions that drive the evolution of the Electrochemical Instruments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Moves and Innovation Portfolios of Leading Players Driving Competition and Collaboration in Electrochemical Instruments Industry

Innovation leadership and strategic collaboration define the competitive landscape of electrochemical instrumentation. Thermo Fisher Scientific has fortified its position by integrating software-driven workflows and expanding its service footprint, ensuring rapid instrument deployment and ongoing support. Metrohm AG continues to differentiate through modular titration systems and virtual burette technologies, appealing to laboratories that demand both flexibility and precision. Meanwhile, Mettler-Toledo leverages its expertise in analytical balances and sensors to deliver bundled solutions that streamline sample preparation and measurement in regulated environments.

Hach Company has sustained strong market presence in water quality testing by offering turnkey packages that combine online monitoring stations with digital reporting platforms, addressing municipal and industrial treatment requirements. HORIBA advances the field through specialized corrosion analyzers and electrochemical research instruments, often collaborating with academic institutions to pioneer new methodology standards. Ametek’s Princeton Applied Research division further enhances the ecosystem with high-performance potentiostat/galvanostat platforms, catering to battery research, sensor development, and fundamental electrochemistry studies.

Smaller innovators such as Gamry Instruments and BioLogic emphasize niche capabilities by focusing on user-friendly interfaces, customizable methods, and transparent data analytics. These companies have capitalized on emerging trends in sensor miniaturization and wireless connectivity to create tailored offerings for research laboratories and on-site process monitoring. Through strategic partnerships, acquisitions, and co-development agreements, these leading players continue to expand their technological portfolios and geographic reach, reinforcing their competitive advantage in a rapidly evolving marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Electrochemical Instruments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Anton Paar GmbH

- Bio-Rad Laboratories, Inc.

- Bioanalytical Systems, Inc.

- Cytiva

- Danaher Corporation

- DKK TOA Corporation

- Endress+Hauser AG

- Environmental & Scientific Instruments Co.

- Fluke Corporation

- Gamry Instruments

- GlobalSpec, LLC

- Hanna Instruments, Inc.

- Hioki E.E. CORPORATION

- HORIBA, Ltd

- Kaifeng Qingtianweiye Flow Instrument Co., Ltd.

- MAHESH ELECTRICAL INSTRUMENTS

- Metrohm AG

- Mettler-Toledo International, Inc.

- PerkinElmer, Inc.

- PG Instruments Lmited

- Shimadzu Corporation

- ST Instruments B.V

- Thermo Fisher Scientific, Inc.

- White Bear Photonics, LLC

- Xylem, Inc.

- Yokogawa Electric Corporation

Outlining High Impact Strategies for Industry Leaders to Enhance Product Development Streamline Operations and Capitalize on Emerging Opportunities

Industry leaders seeking to maintain or strengthen their market position must focus on several high-impact strategies that align with evolving customer expectations and technological possibilities. First, advancing digital ecosystems around electrochemical platforms can unlock new service revenue streams and deepen customer engagement. By embedding advanced analytics, predictive maintenance algorithms, and remote diagnostics into instrument software, companies can offer subscription-based support models and reduce onsite downtime for end users.

Second, fostering cross-industry partnerships will accelerate innovation and broaden application scope. Collaborating with materials science experts, software developers, and regulatory bodies can lead to the co-creation of next-generation sensors, AI-driven analysis tools, and standardized testing protocols. These alliances not only distribute development risk but also enable faster time to market for feature enhancements that address emerging industry needs.

Third, prioritizing sustainability and regulatory compliance can differentiate offerings in highly regulated sectors such as pharmaceuticals, environmental monitoring, and food safety. Incorporating eco-friendly materials, energy-saving operation modes, and end-of-life recycling programs into product design can strengthen brand reputation and meet corporate responsibility goals.

Lastly, diversifying regional manufacturing footprints and reinforcing local service networks will mitigate the impact of geopolitical uncertainties and trade policy shifts. Establishing assembly centers closer to key customer clusters reduces lead times, lowers transportation costs, and enhances responsiveness to regional market dynamics. Together, these actionable recommendations provide a roadmap for industry leaders to capitalize on growth opportunities while navigating competitive and regulatory challenges.

Detailing the Comprehensive Research Framework Employing Primary Interviews Secondary Data Triangulation and Robust Validation Processes

This research framework integrates a multi-tiered approach combining primary and secondary methodologies to ensure comprehensive coverage and data validity. Initially, expert interviews were conducted with laboratory managers, process engineers, and senior R&D scientists across multiple industries to gather firsthand insights into instrumentation performance criteria, purchasing drivers, and future requirements. These qualitative discussions were complemented by a systematic review of technical publications, patent filings, and white papers to identify emerging trends in sensor technology, connectivity solutions, and regulatory guidelines.

Secondary research involved sourcing data from proprietary academic databases, public financial reports, and industry association materials. Emphasis was placed on cross-referencing information to triangulate findings and reduce potential bias. Vendor profiling exercises assessed corporate strategies, product portfolios, and partnership activities to map the competitive landscape effectively. Data synthesis techniques such as thematic analysis and gap identification helped shape the key segmentation framework and regional insights.

Throughout the process, rigorous validation steps were employed, including peer reviews by subject matter experts and follow-up surveys to confirm preliminary conclusions. Quality control measures such as consistency checks, outlier analysis, and methodological audits further reinforced the reliability of the research outcomes. This robust methodology underpins the strategic recommendations and ensures that the report delivers actionable intelligence to stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Electrochemical Instruments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Electrochemical Instruments Market, by Instrument Type

- Electrochemical Instruments Market, by Product Type

- Electrochemical Instruments Market, by Application

- Electrochemical Instruments Market, by End User

- Electrochemical Instruments Market, by Region

- Electrochemical Instruments Market, by Group

- Electrochemical Instruments Market, by Country

- United States Electrochemical Instruments Market

- China Electrochemical Instruments Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 5247 ]

Summarizing Key Takeaways and Future Outlook for the Evolution of Electrochemical Instruments Market Amidst Technological and Regulatory Shifts

In summary, the electrochemical instrumentation sector stands at the intersection of technological innovation, regulatory evolution, and shifting supply chain paradigms. The proliferation of modular, digitally integrated platforms has democratized access to high-accuracy measurements, enabling end users in academia, environmental monitoring, and industrial operations to derive deeper insights from their data. Concurrently, the 2025 tariff adjustments in the United States have prompted a reconfiguration of sourcing strategies, with stakeholders accelerating investments in domestic capabilities and alternative supply networks to preserve margin stability and system availability.

Segmentation analysis underscores the importance of tailoring solutions across instrument type, application, end-user, and product form factor dimensions. By aligning product roadmaps with the nuanced requirements of laboratories, process engineers, and field technicians, vendors can secure competitive differentiation and foster long-term customer loyalty. Regional dynamics from the mature markets of North America and Western Europe to the high-growth opportunities in Asia-Pacific and Latin America highlight the strategic imperative for localized market approaches and robust service infrastructures.

Looking ahead, ongoing advancements in sensor materials, AI-driven analytics, and sustainable design practices will continue to expand the value proposition of electrochemical instruments. Industry participants that integrate these innovations while maintaining regulatory alignment and supply chain resilience are well poised to shape the next era of precision measurement and control.

Engage Directly with Ketan Rohom Associate Director Sales Marketing to Access Comprehensive Insights and Elevate Position in Electrochemical Instruments Market

To gain an in-depth understanding of the trends, challenges, and opportunities discussed in this executive summary, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the detailed analysis, product comparisons, and strategic insights that this complete report provides. By engaging directly, you will unlock expert perspectives on instrumentation performance, regulatory considerations, and competitive positioning that can inform your next steps in procurement, development, or market expansion. Don’t miss the chance to leverage comprehensive data and actionable recommendations tailored to your organization’s needs. Connect with Ketan to purchase the full report and equip your team with the most current intelligence on electrochemical instruments.

- How big is the Electrochemical Instruments Market?

- What is the Electrochemical Instruments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?